Reconciliation

In IRIS Sapphire, reconciliation is auto-triggered. Thus whenever GSTR 6A is downloaded from GSTN or GSTR 6 data is uploaded in IRIS application, invoices get compared and the results of comparison are displayed.

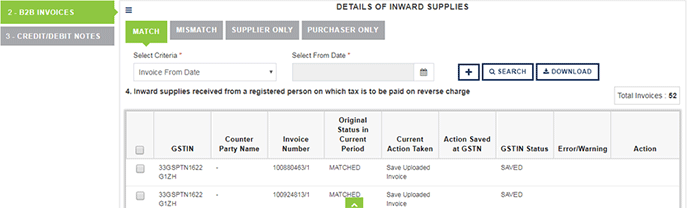

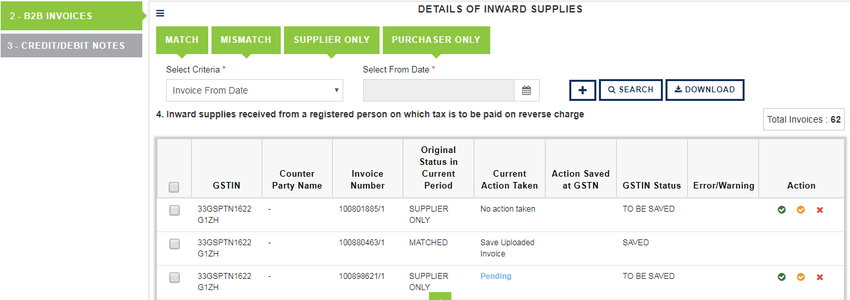

The reconciled invoices will be shown in different sections. To see further details, user needs to click on respective sections. Also, user can select multiple sections to get the consolidated view of reconciliation. For each section and for consolidation views, download option is available.

- Sectionwise View

- Consolidated View

For comparing invoices, the following fields are considered

- GSTIN of counter-parties

- Invoice number (Not case sensitive)

If the fields match, then the invoices will be compared.