Any interaction i.e. sending of data or fetching data from the GST system requires a secure session to be established between the application (IRIS Peridot) and the GST system. To set-up the session, taxpayers need to authenticate via an OTP, which is sent to the number registered with the GST system.

Starting a session with OTP

For Peridot, or any application, to fetch your GST Returns data, connecting to GST system is required. And for a connecting to be established, an authentication via One-time-password (OTP) needs to be done.

OTP is sent to the mobile number registered with the GST system. Generally, the mobile numbers of the business owners or authorised signatories are registered. OTP is valid only for 10 min. So ensure to have mobile handy or the coordinate with respective personnel who might receive the OTP

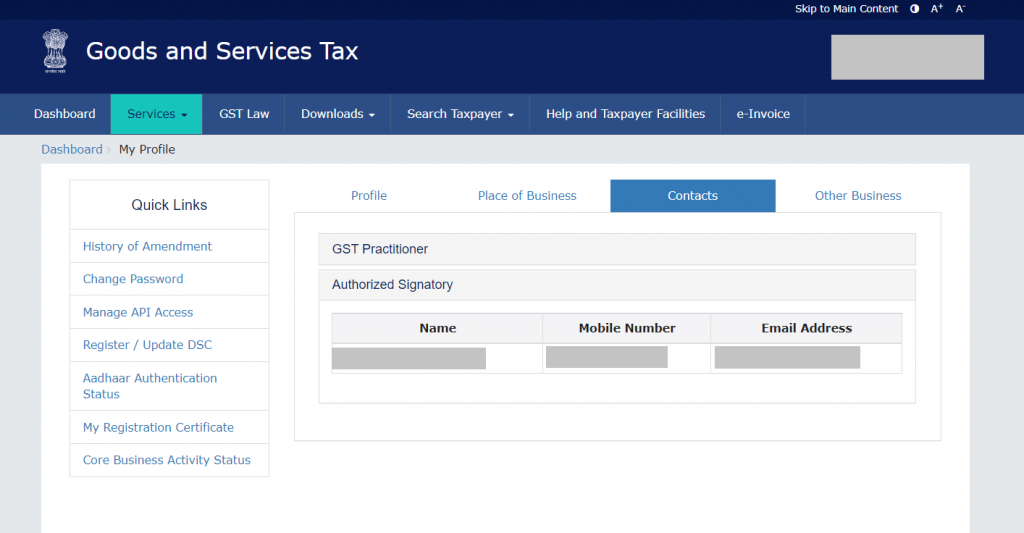

If you are unsure of the number, kindly login to GST Portal and under My Profiles section check the mobile number provided.

For getting OTP, you need to provide the user name of GST Portal. Please note, only user name is required. IRIS Peridot does not ask you to provide your GST portal password. All interaction with GST system is done via OTP authentication and only after you have given us the consent to fetch data. We do not do any background fetch of your data or login to the GST portal, without your knowledge and consent.

Here are some common issues which you may face while activating GST session using OTP and how you need to resolve the same

1. API connection is not enabled

This is a one-time process which authorises any application to set-up a session with the GST system for your GSTIN. If APIs are not-enabled, then OTP is not sent. To resolve this issue, login to the GST portal and enable API access. Read more on how to enable API access

2. Mobile number is not same as registered mobile

OTP is sent only to the mobile number and email address of the authorised signatory as registered on the GST system. If you are the authorised signatory, please login to the GST portal and check if your details are correctly registered.

3. Incorrect username

For getting OTP, you need to provide the username which is used to login to the GST system. If the user name is not correct, OTP is not sent. Kindly check the username entered in IRIS Peridot while generating OTP. Please note, if you have multiple GSTINs, ensure to provide OTP corresponding to the GSTIN for which you are activating the session.

4. Delay due to Mobile network

If there are any network issues from the mobile operator, then there could be a delay in receiving the OTP. An OTP is valid only for 10 min. So if you receive OTP after a delay of 10 min, that OTP may not be valid. You may need to regenerate OTP. Alternatively, if you don’t get OTP immediately, you check the registered email ID for OTP