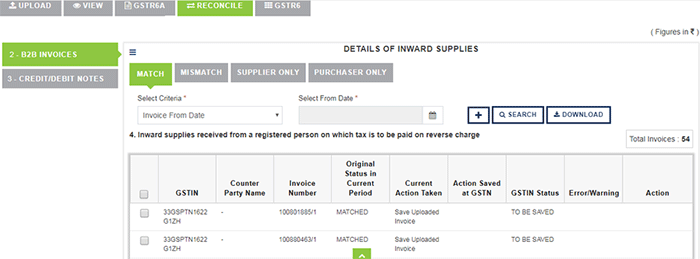

Matched invoices

An invoice is considered as matched when all the details of the GSTR 6A invoice are same as the details of the uploaded invoices.

For matched invoices, the actions will be auto-set by the system as “Save Uploaded Invoice”.

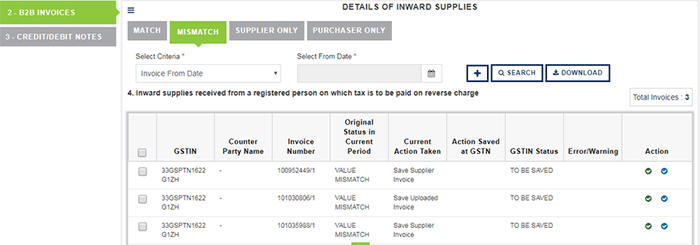

Mismatched invoices

An invoice is considered as not matched when the details apart for the basic criteria are notsame. Difference in any one field will result in mismatch.

An invoice is considered as ‘mismatched’ when the details related to invoice value or tax amounts (CGST, SGST, IGST, CESS) are not same. Also in scenario when the invoice level details such as POS, Date of invoice, Reverse charge mechanism, invoice type are not matching considered as mismatched.

In case of mismatch, the actions allowed and its impact is as follows

- Save Supplier Invoice – In this case, the GSTR 6A invoice details will be included in GSTR 6. And you will be able to distribute ITC for this invoice. You are allowed to take this action only if CFS = Y (i.e. counterparty filing status if filed).

- Save Uploaded Invoice – In this case, the invoice uploaded by you will be considered for GSTR 6. And you will be able to distribute ITC for this uploaded invoice. You are allowed to take this action in both cases i.e.CFS = Y or N (i.e. counterparty filing status if filed or not filed).

Any actions taken by you can be changed till the time return is not submitted.