GST Returns, as we are aware, are filed on a monthly or quarterly basis. GSTR 2B is a return generated on a specific date, while GSTR 2A is a dynamic statement that gets updated as and when a supplier uploads invoices or files their GSTR1.

In Compliance Report, we consider 6 months based on the latest filed returns. As new returns are filed or available on the specified date, there may be a need to get reports updated based on new data. This can be achieved in two ways

Refresh Reports

This option is available on every page of the compliance reports. With Refresh, reports are updated to include the data from newly filed returns. Please note, at any point in time, a maximum of 6 months is considered to generate the reports. So if a new month is available, then 6 months duration gets adjusted accordingly.

For example, when reports were generated the first time, the 6 months were from Jan to June 2021. After July 2021 is filed, the new 6 months will be Feb 2021 to July 2021.

When you refresh, new reports are computed for the newly filed returns. Reports which included aggregated data such as Averages or trends are freshly computed.

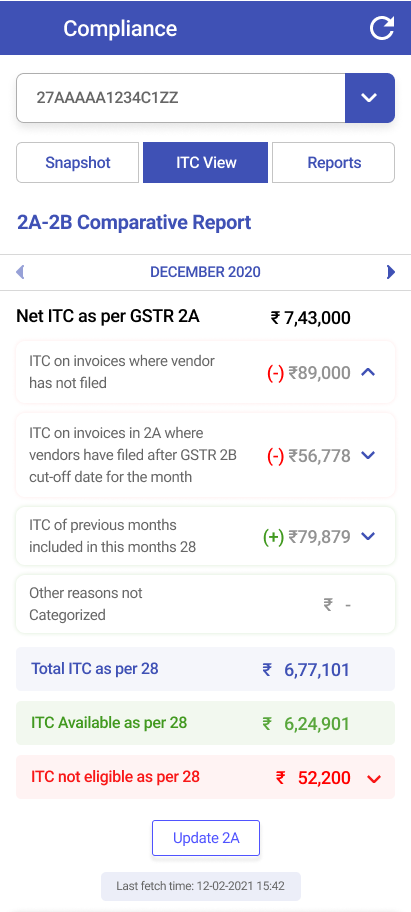

Update GSTR 2A

GSTR 2A is dynamic. For any particular month, fresh data for GSTR 2A is needed, then there is an option available to update data for that particular month. This option is available only in ITC reports.

Update 2A can be done one time per day. All ITC related reports for the specific month and 2A aggregated reports get freshly computed with updated GSTR 2A data.

For getting data from GST system, the GSTN session needs to be active