GSTR 9 is annual GST return which needs to be filed by every taxpayer who has taken registration under GST Law. It is a mandatory return for all taxpayer and due date for GSTR 9 is 31st December 2018.

GSTR 9 consists of major 6 parts, bifurcated between 19 sub-sections. Out of these 19 sub-section, some of the sub-sections will be auto-populated based on GSTR 1 and GSTR 3B filed with GSTN.

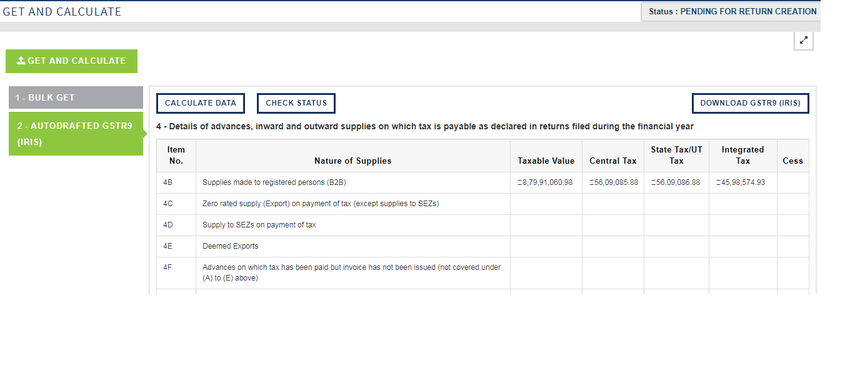

So here is our first part release of auto computed details for GSTR 9 and Bulk fetch of GSTR 1 and GSTR 3B for GSTR 9.

Below are the sections for which you will get the auto-computed details

| Table No. | Section No. | Description |

| 4 | 4B | Supplies made to registered persons (B2B) |

| 4C | Zero-rated supply (Export) on payment of tax (except supplies to SEZs) | |

| 4D | Supply to SEZs on payment of tax | |

| 4E | Deemed Exports | |

| 4F | Advances on which tax has been paid but invoice has not been issued (not covered under (A) to (E) above) | |

| 4G | Inward supplies on which tax is to be paid on reverse charge basis | |

| 5 | 5A | Zero rated supply (Export) without payment of tax |

| 5B | Supply to SEZs without payment of tax | |

| 5C | Supplies on which tax is to be paid by the recipient on reverse charge basis | |

| 5D | Exempted | |

| 5E | Nil Rated | |

| 5F | Non-GST Supply | |

| 6 | 6A | Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B) |

| 6F | Import of services (excluding inward supplies from SEZs) | |

| 6G | Input Tax credit received from ISD |

Also for getting above auto-computed details firstly, you need to do bulk fetch for GSTR 1 and GSTR 3B. So this bulk fetch facility is also available for GSTR 9 on IRIS Sapphire.

For detail process of GSTR 9 click here.1

For queries or a detailed demo, contact us or write to us at support@irisgst.com