IRIS GST’s e-invoicing module (branded as IRIS Onyx) is an end-to-end solution. Apart from core e-invoice generation and cancellation, you can also define your own custom formats for invoice printing, e-sign and email them to the customers.

If you are using IRIS Onyx for managing your e-invoices, your GSTR 1 preparation becomes easier. You can push all your e-invoice data and populate the GSTR 1 input format. While not recommended, if any edits are needed to the invoice data, you can download the details, update and reupload the invoices.

Available for a GSTIN and multiple GSTINs

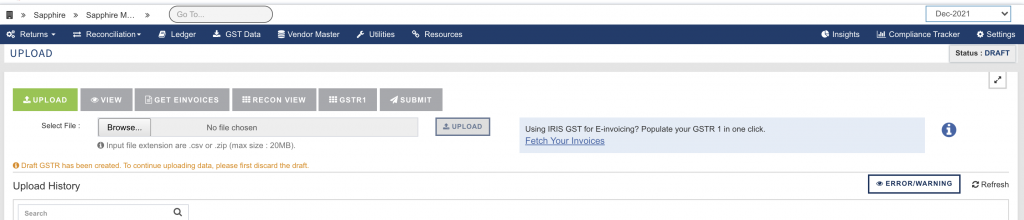

- For Single GSTIN, go to GSTR 1 Return and the option is available under Upload section

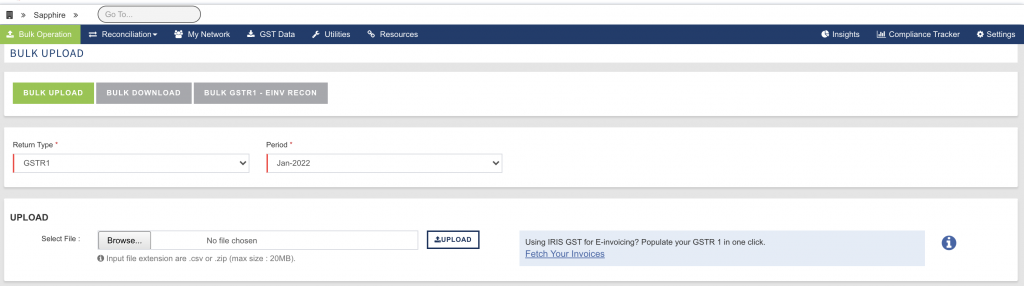

- For Multiple GSTINs, go to Bulk Operations. Here under Bulk Upload, for GSTR 1, the option to Get data from IRIS Onyx is available

Basis of populating e-invoices for GSTR 1

While the same invoice details used for e-invoice generation need to be reported in GSTR 1, the granularity level is different. Further, not all transactions are covered for e-invoice but are to be reported in GSTR 1.

In IRIS Onyx, we have given the option to upload all the data even though e-invoicing may not be applicable for the same. This enables businesses to extract all data from their systems in one-go. In IRIS platform we do the segregation.

Key points to note –

- All invoices of the type – Regular, Debit Note, Credit Note and Bill of Supply will be populated in IRIS Input format for GSTR 1

- Invoices with errors will not be populated

- Invoices that are eligible for IRN, but IRN is not generated will also be populated

- The GSTR 1 return period is decided by the document date and not the date on which the invoice was uploaded in IRIS Onyx for e-invoice. For example

| Document Date | Document Month | Uploaded in IRIS Onyx | Uploaded Month | Considered Month for GSTR 1 |

| 12-10-2021 | Oct 2021 | 15-10-2021 | Oct 2021 | Oct 2021 |

| 12-10-2021 | Oct 2021 | 01-11-2021 | Nov 2021 | Oct 2021 |

As the window for IRN cancellation is 24 hours, the Get data feature has a latency of one day. It means data uploaded up to yesterday will be reflected in GSTR 1 input format.

Important to note

- This option is available only for users who are using IRIS for generating e-invoices

- If GSTR 1 draft has been created, Option to fetch data from IRIS Onyx will be deactivated. You can discard the draft to get data

- For GSTR 1 already filed or submitted, this option will not be available

Once you have your GSTR 1 data ready, it is recommended to do reconciliation with GST system data as the e-invoices are populated in GST system as well.