Create GSTR 6

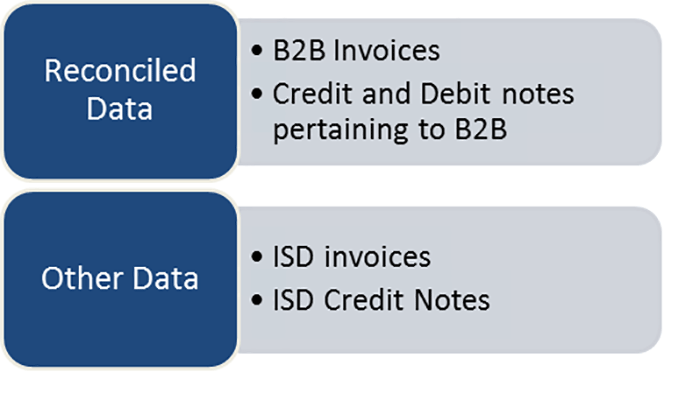

GSTR 6 comprises of sections which are to be reconciled and some which are direct inclusion

The GSTR 6 return will be created

- For reconciled data – Where actions are taken

- For other data – As uploaded by the user

The invoices will be categorized into the various sections of GSTR 6 return. The summary of GSTR 6 will be presented to the user for verification before saving the data to GSTN.

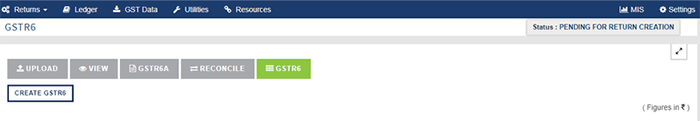

So Firstly go to GSTR 6 tab and then Click on GSTR 6.

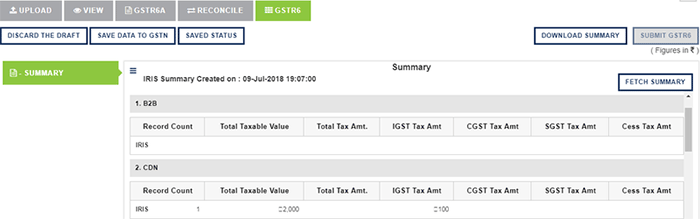

After this, your return will get created and will be able to view GSTR 6 Summary prepared by IRIS.

GSTR 6 Summary

This is a summary of the data that is prepared for sending to GSTN. In IRIS Sapphire, we are preparing the Summary which as per the GST portal logic. This should help the user to verify the data in IRIS Sapphire and once it gets saved at GST system. It should be noted that

- Invoices on which action is taken are included

- Invoices having errors are not considered

- In case of credit and debit notes, the values are added and not netted off.

The mapping of GSTR 6 sections and the logic for defining summary is summarized below

| Section Head | Corresponding Table | Scope – As per IRIS input format |

| Regular transactions excluding amendments | ||

| 1. B2B | 3 | It includes B2B regular invoices. These are invoices on which action is taken. |

| 2. CDN | 6B | It includes CDN onregular transaction. These are invoices on which action is taken. |

| Regular transactions including amendments | ||

| 1. B2B | 6A | It includes amended B2B regular invoices. These are invoices on which action is taken. |

| 2. CDN | 6C | It includes amended CDN onregular transaction. These are invoices on which action is taken. |

| ISD – Excluding Amendments | ||

| 3. Eligible – Registered ISD Invoices | 5A | It includes registered ISDINV on which ITC is eligible. |

| 4. Eligible – Registered ISD Credit Notes | 8A | It includes registered ISDCN on which ITC is eligible. |

| 5. Eligible – Unregistered ISD Invoices | 5A | It includes unregistered ISDINV on which ITC is eligible. |

| 6. Eligible – Unregistered ISD Credit Notes | 8A | It includes unregistered ISDCN on which ITC is eligible. |

| 7. Ineligible – Registered ISD Invoices | 5B | It includes registered ISDINV on which ITC is ineligible. |

| 8. Ineligible – Registered ISD Credit Notes | 8B | It includes registered ISDCN on which ITC is ineligible. |

| 9. Ineligible – Unregistered ISD Invoices | 5B | It includes unregistered ISDINV on which ITC is ineligible. |

| 10. Ineligible – Unregistered ISD Credit Notes | 8B | It includes unregistered ISDCN on which ITC is ineligible. |

| ISD – Amendments | ||

| 11. Eligible – Registered ISD Invoices | 9A | It includes amended registeredISDINV on which ITC is eligible. |

| 12. Eligible – Registered ISD Credit Notes | 9A |

It includes amended registeredISDCN on which ITC is eligible. |

| 13. Eligible – Unregistered ISD Invoices | 9A | It includes amended unregisteredISDINV on which ITC is eligible. |

| 14. Eligible – Unregistered ISD Credit Notes | 9A | It includes amended unregisteredISDCN on which ITC is eligible. |

| 15. Ineligible – Registered ISD Invoices | 9B | It includes amended registeredISDINV on which ITC is ineligible. |

| 16. Ineligible – Registered ISD Credit Notes | 9B |

It includes amended registeredISDCN on which ITC is ineligible. |

| 17. Ineligible – Unregistered ISD Invoices | 9B | It includes amended unregisteredISDINV on which ITC is ineligible. |

| 18. Ineligible – Unregistered ISD Credit Notes | 9B | It includes amended unregisteredISDCN on which ITC is ineligible. |

This is all about creating GSTR 6. Now the next step is to save data at GST system