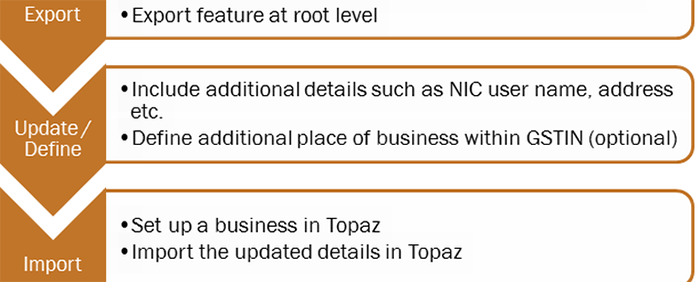

Adding Business hierarchy process for Existing IRIS Sapphire User:

If you are an IRIS Sapphire user, setting up business gets easier as you have an option to reuse the hierarchy here in Topaz.

Let us now go through these steps in detail

1. Export Business hierarchy from Sapphire

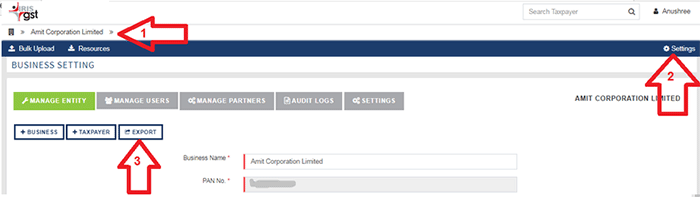

i. Once you login to IRIS Sapphire (https://asp.irisgst.com), you will need to navigate to the settings of the root level entity. Please note only users with Admin role can access the Settings option. At the root business, you will find an option as ‘EXPORT’

ii. Once the user exports the business hierarchy, a .CSV file will be downloaded as Export_Summary.CSV”. User can change the file name for the convenience.

iii. The downloaded template needs to be updated with some information for it to be imported in Topaz for defining business hierarchy.

2. Update Business Hierarchy Template

The following table summaries the information that needs to be provided in the business hierarchy template. When exported from Sapphire, some fields will be auto-populated and the remaining need to be filled

| Field | Description | Mandatory | Populated in Sapphire template | Expected Values | Comments |

| Entity Type | The type of entity (level of hierarchy) which is being added. There are four levels of hierarchy in Topaz | Y | Y |

BUSINESS LEGAL FILING POB |

i. Business is the root level business ii. Legal is the PAN added under a business or another sub-business iii. Filing is the GSTIN within a PAN iv. POB is the place of business within GSTIN. There can be more than one POB. |

| Entity Name | Display name for the entity being added | Y | Y | This name will be used for display purpose. It is recommended to define self-explanatory names so that it is easy to recognize the entity | |

| PAN | PAN of the entity | Y | Y | Valid PAN | |

| Gstin | GSTIN of the entity | Y, if the entity type is Filing or place of business | Y |

Valid GSTIN A validation with GST system database will be checked |

Will be blank if a Business or legal entity is being added |

| Immediate Parent PAN/GSTIN | The PAN or GSTIN under which the entity is being added | Y | Y | Valid PAN | |

| Immediate Parent PAN/GSTIN Name | Display name of the PAN or GSTIN under which the entity is being added | Y | Y | Valid GSTIN | |

| Taxpayer Type | The category under which registration is obtained with GST system | N | Y |

Normal SEZ ISD ECOM TDS NRTP OIDT UIN CD |

Default value is assumed as Normal Explanation of values

· Normal · SEZ · Input Service Distributor · E-commerce Operator · TDS Deductor · Non-resident taxable Person · Person supplying online information and database access · UIN-holders · Taxpayer opting for composition scheme |

| NIC Username | User name as provided for enabling API access at NIC portal | Y, if the entity type is Filing or place of business | N | Validation with NIC system | |

| NIC password | Password as set for enabling API access at NIC portal | Y, if the entity type is Filing or place of business | N | Validation with NIC system | Password in IRIS portal will be stored in encrypted format. Whenever the password is reset at NIC portal, the same needs to be updated here |

| Address | Address line 1 | N | Y, if entered in Sapphire | ||

| Address1 | Address line 2 | N | Y, if entered in Sapphire | ||

| City | City | N | |||

| Pin code | Pin code | Y | |||

| State | State code | Y | Two digit state code | ||

| Email address | N | ||||

| Phone | Phone | N | |||

| Fax | Fax | N | |||

| Website | Website | N |

While the address related fields are not mandatory, it is recommended that the details are provided so that the E-way Bill gets generated using the complete address. Refer to the annexure for further explanations on the business hierarchy template

3. Import Business Hierarchy in Topaz

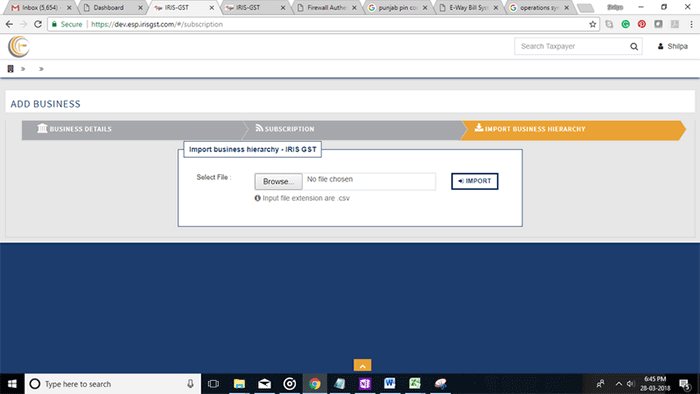

a. After updating the necessary details, the data is now ready to be uploaded in Topaz. The file must be a .csv (Comma Delimited) file.

b. Login to Topaz using your credentials and click on “+ BUSINESS”. Here, you will find an option to browse and upload a .CSV for import of business hierarchy after providing a valid subscription code.

c. PAN uniquely identifies every organization. If the CSV consists of any PAN which is already registered on the TOPAZ, then it is a conflicting scenario. The business hierarchy will not be created.

d. The uploaded data will be validated for structural rules. The business hierarchy will not be created if there are any errors in the uploaded file.

e. The GSTIN mentioned in the CSV file will be validated with the GST system. If invalid, The business hierarchy will not be created

4. Key points to note

i. Import of hierarchy can be done only once in Topaz. Subsequent additions, modifications and deletions need to be done on the Topaz portal.

ii. Users are required to be added separately on Topaz. These will not be getting imported from Sapphire.