Supercharge your lending capabilities using real-time GST data

with IRIS Credixo.

Ready to transform

the way you lend?

Our Clients

Who is IRIS Credixo for?

IRIS Credixo helps financial institutions to extend lending opportunities to the SME and MSME sectors,

breaking barriers that traditional lending models struggled to overcome.

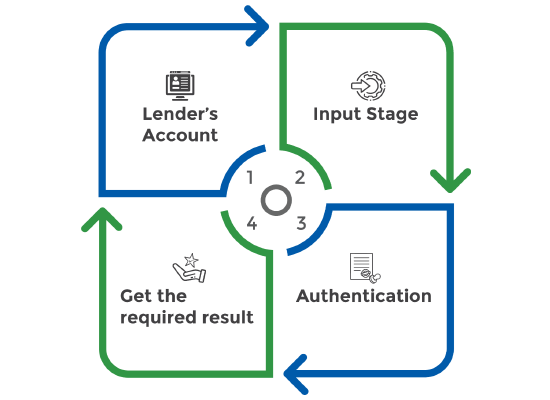

IRIS Credixo Process Flow

- Lender’s Account Creation on IRIS Credixo

- Input StageAdd which data/module is to be fetched

- AuthenticationFetch GST/E-invoicing/E-way Bill data with consent

- Get the required result

.

Use Cases

Loan Processing Journey

Business details like legal name, constitution (whether proprietor, firm, company etc.), main location and additional Place of Business (PoB) and the full filing history.

Real-time sales and profit margins through consent-based GST data

Analyse bank statement credits and debits using AI

Comprehensive analysis of GST data in combination with bank information

Supply Chain Finance and Trade Finance

Verifying invoice data before invoice verification discounting or financing using GST data and EWB data

Performing Invoice Audit to verify invoices after financing to ensure accuracy and compliance.

Client Testimonials

When it comes to MSME Lending, GST data can be an accurate source of business’s financial health. And to obtain accurate GST Data, I know I can rely on IRIS. I am amazed by the way they focus on deriving useful insights by compiling and analyzing the vast GST Data. We are also quite pleased with the product and the team’s flexibility and ability to work closely with partners. The support provided by the team is prompt, reliable and 24×7. Cheers!

Our vision at Xtracap is to simplify channel financing for Bharat and IRIS Credixo has been a great companion that helped us in this goal. We are using IRIS Credixo since last 3 years and we are pleased with the in-depth domain knowledge and experience of the team. IRIS Credixo has really helped us with better profiling of customers using their GST Data and has made this journey smoother.

Why Choose IRIS?