A minimum 6-digit HSN code is compulsory for taxpayers with an AATO of Rs. 5 crores and above from December 15, 2023

A One-Stop e-Invoicing Solution that can integrate with your billing systems seamlessly in multiple ways and generate IRN with zero disruption to your business.

The latest GST Notification 10/2023 makes it compulsory for companies with an AATO of Rs. 5 Cr. and above to generate e-invoices from 1st August 2023. Schedule a free demo to understand how IRIS E-Invoicing can help!

Customers Speak

Need of the Hour

Generate e-Invoice

Get IRN Seamlessly

Bridge Data Gaps

Prepare for Future

IRIS E-Invoicing Solution

All in one- E-invoicing Software for your entire team

Multiple Data Integration Options offered by our E-invoicing Solution

Why IRIS E-Invoicing Solution

Recognized Name

Multiple Integration options

Integrated Offering

Easy Monitoring

Hassle-Free Data Integration

Future- proof

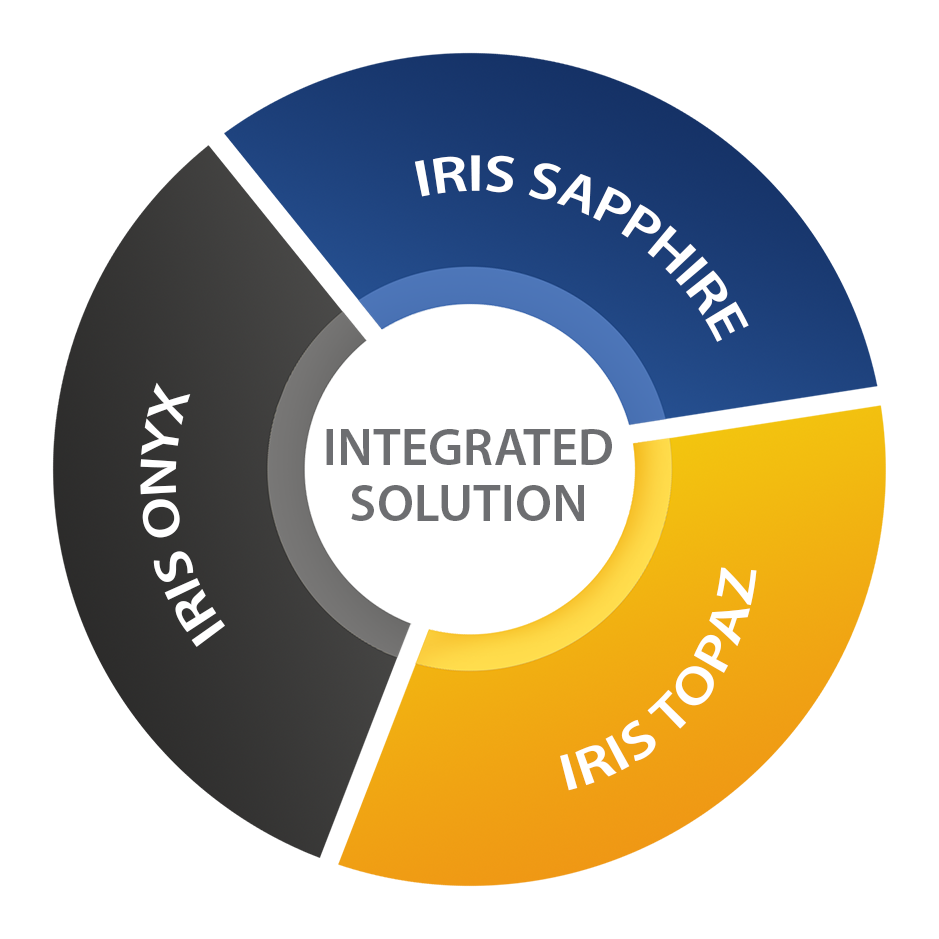

IRISGST’s E-invoicing Solution, GST Software and E-way Bill tool are powerful alone – but they are even better together.

GST Software | IRIS Sapphire

E-way Bill System | IRIS Topaz

E-Invoicing Software

E-Invoicing in India

E-Invoicing aka Electronic Invoicing is an electronic authentication mechanism under GST. Under the mechanism, all the B2B invoices generated by a business (agg. turnover > ₹50 CR in a F.Y.) will have to be authenticated on the GSTN portal, electronically. Furthermore, to manage these invoices, the Invoice Registration Portal (IRP) will issue a unique identification number – Invoice Registration Number (IRN) for every invoice.

The mandate, that is introduced in phases, came into effect from 1st October 2020 for companies with turnover > ₹500 CR and from 1st January 2020 for companies with turnover > ₹100 CR. And now, the mandate gets extended to companies with > ₹50 CR turnover from 1st April 2021.

The businesses need to be prepared for e-invoicing implementation. While mainly perceived as technical change and low impact for business users, the organisations need to take some key decisions for integrating e-invoicing in their routine business operations without major disruptions.

We have prepared a comprehensive e-book that aims to cover the contours of e-invoicing in India, impact on businesses and IT systems, the key decisions to be taken and some recommendations for being future-ready.

Read more on E-invoicing

Two-Factor Authentication (2FA) mechanism is soon going to be a part of the login to GST Portal to enhance security.

Invoice Reference Number or IRN as it is usually called is a registration number provided by the government under the e-invoicing mandate to prove the authenticity of any B2B invoice generated by the businesses. It is one of the main components of an e-invoice. You can read all about IRN in the article and understand its intricacies in detail.

Clearing the fog about a major misconception surrounding the E-invoice generation, it is not mandatory for a taxpayer to generate E-invoice through the government’s tax portal.

To start generating e-invoices, there are certain preparatory activities. Organizations can get started with these in parallel to getting their internal system and processes ready for e-invoices. In this article, we share all the important tasks that one needs to undertake before starting their e-invoicing journey.

Read all the latest E-invoicing notifications and updates here. All the notifications from the implementation of e-invoicing are covered in this article.