Cross ITC Utilization

Based on new APIs released by GSTN that are about calculate ITC and save cross ITC utilization details, changes are made on IRIS Sapphire.

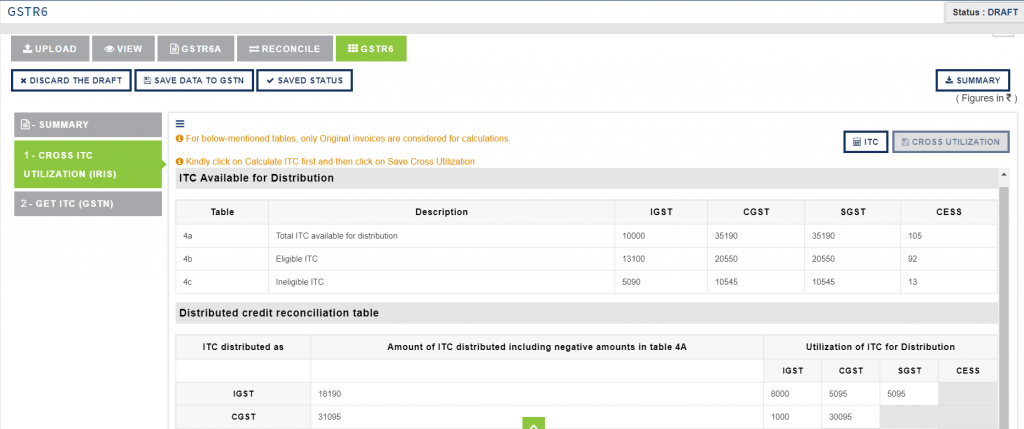

So here on Sapphire, once you saved your regular transactions and ISD invoices then you need to go to cross ITC utilization tab.

Based on your saved invoices, ITC available, and cross ITC utilization table gets calculated by IRIS.

Let’s see what details come in ITC Available for Distribution:

4a – This shows total ITC available for distribution based on regular transaction and ISD credit notes

4b – It shows the eligible ITC calculated based on ISD invoices with the description as eligible

4c – It shows the ineligible ITC calculated based on ISD invoices with the description as ineligible

Details come in Distributed credit reconciliation table as follows:

Here IRIS will calculate aggregated level cross-utilization ITC details based on invoice level ITC utilization details provided by you for ISD invoices.

Now after reviewing calculations, click on calculate ITC and then click on save cross-utilization button.

These actions will save your ITC data on the GSTN portal. Also if any error comes while saving these details, then on UI itself, you will get the error message. The error you need to rectify and save the invoice again. Then try to save cross-utilization again.

Kindly note below points :

- Invoices having errors or mark as deletion will not get considered here in calculation

- Amended invoices are not considered in this calculation. If you have amended invoices then kindly go to GSTN portal and add cross-utilization details and save it on GSTN portal

- Also if there are only negative ITC available, then for distribution kindly go to GSTN portal.

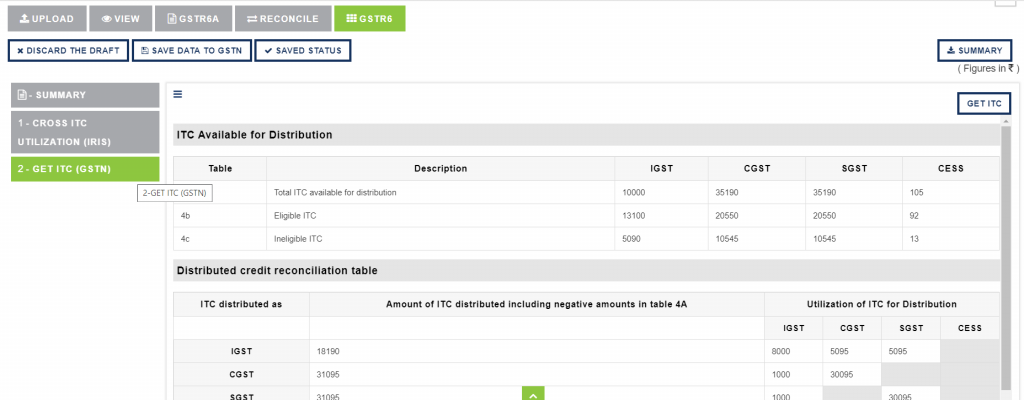

Once cross ITC utilization saved then go to Get ITC tab.

Here in Get ITC tab, click on Get ITC button, which will provide ITC details that get saved on the GSTN portal. So by using this get ITC functionality, you can cross verify the ITC details.

For the Submission and to file the return, you need to go to the GSTN portal.