1. Once you have uploaded your GSTR1, ITC 04, EWB-others data.

Click on EWB Reconciliation on the top right-hand side. This option is available at the GSTIN level.

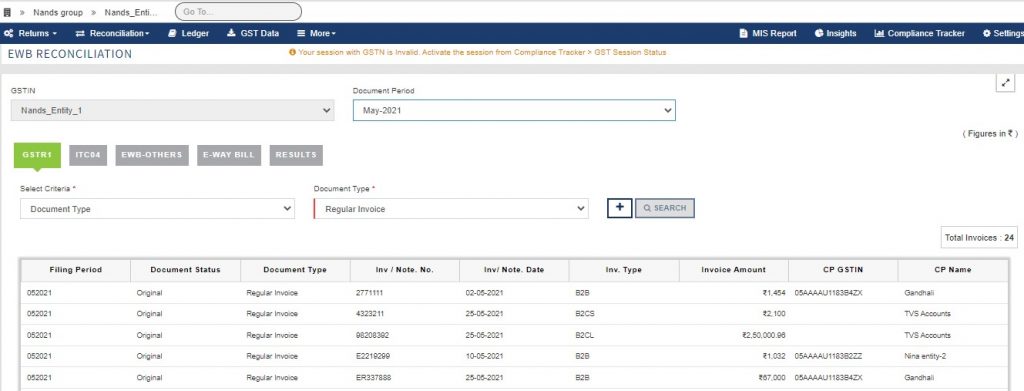

2. In GSTR 1 tab, here you will see the uploaded data for selected GSTIN and selected period

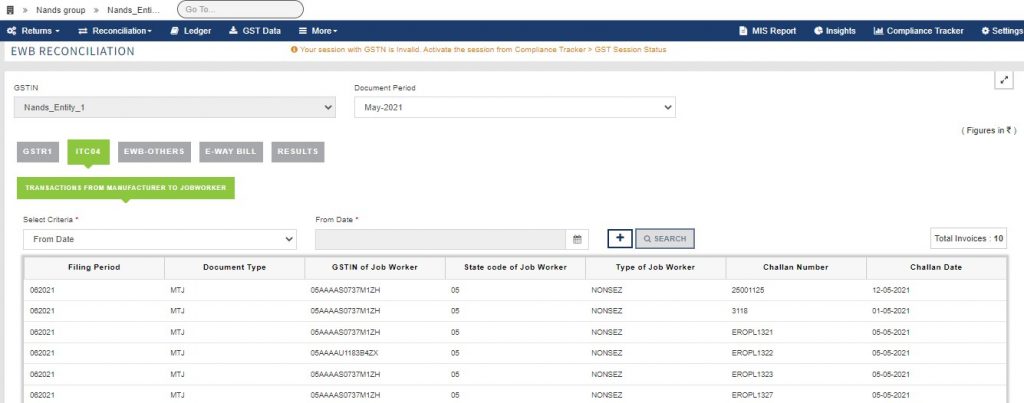

In ITC 04 tab, here you will see the uploaded data for selected GSTIN and selected period

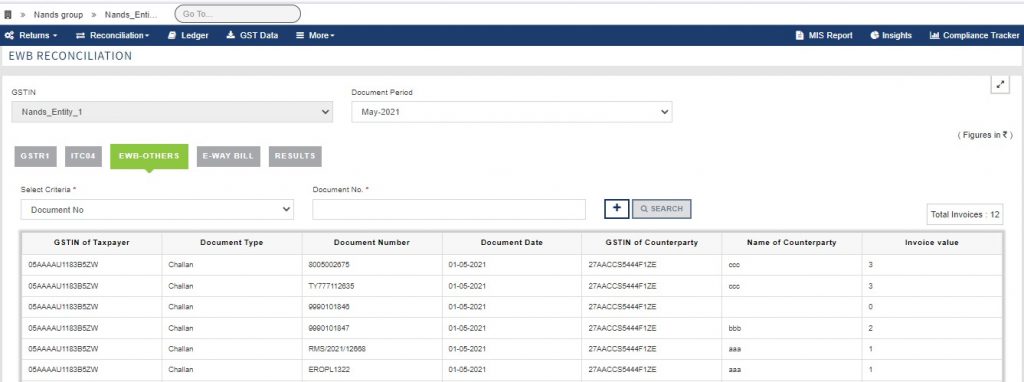

In the EWB-OTHERS tab, here you will see the uploaded data for selected GSTIN and selected period

Please note in all 3 sections the data is getting reflected based on document month and year logic which is derived based on document date.

Example: Sale invoice no A1001 which is dated 01-11-2021 is reported in Dec-2021 GSTR1 return but in EWB Reconciliation it will reflect under Document Period Nov-2021 as the month and year of the invoice belongs to Nov-2021.

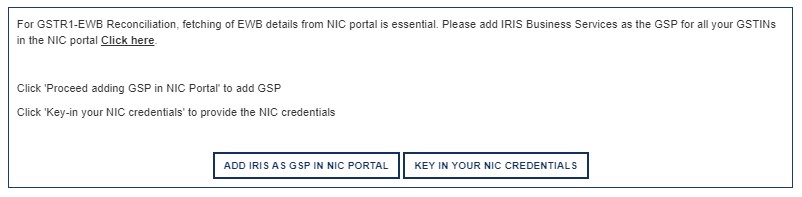

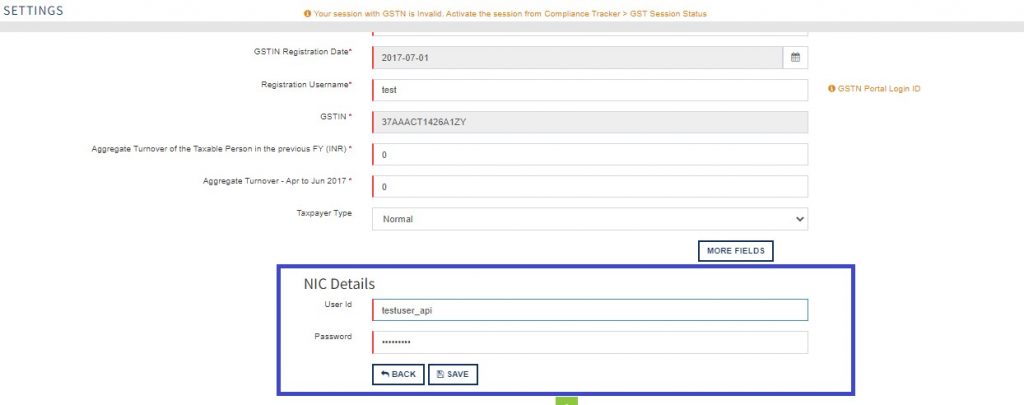

3. In the E-way Bill tab, you will get E-way bills. So here first you need to do some setup activity i.e. Adding IRIS as GSP on the NIC portal and providing your NIC credential on IRIS Sapphire. So for the first time when you click on the E-way bill tab, the below window will get opened.

A helping document is provided to know how to add IRIS as GSP on NIC Portal. Also once you click on “Key in Your NIC Credentials” it will take you to the setting page where you need to provide your NIC credentials.

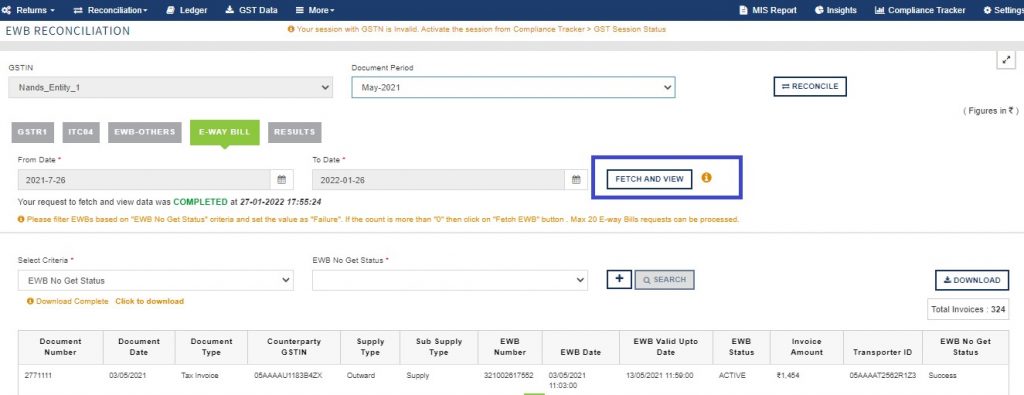

4. Once this setup is done, here you can see an option to fetch E-way bills details. By default, for the selected filing period, you can fetch details. For a maximum of 6 months of data from the current date, you can fetch E-way bills in one go. Once the fetch request is completed on UI, you can see details of E-way bills. Here we are fetching complete details of E-way bill example: Type of supply (Outward/ Inward), Document Type (Tax Invoice, Delivery Challan, Others, etc.) (Sub Supply type (Supply, Export, Job work, Import, etc.), Invoice Value, etc.

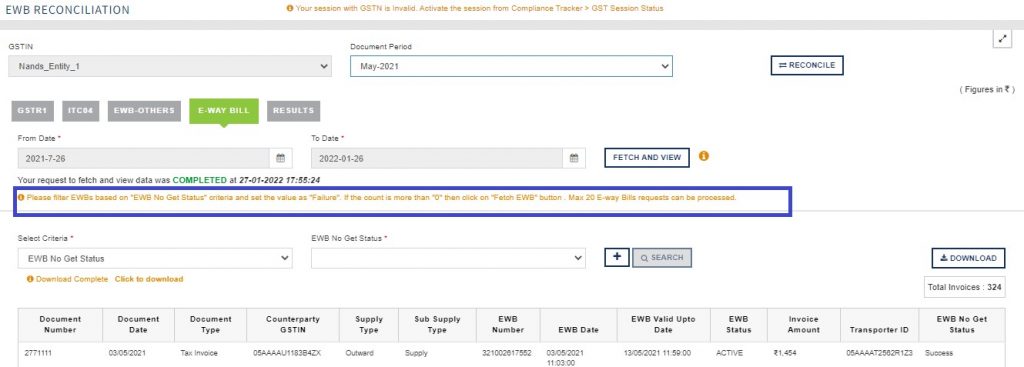

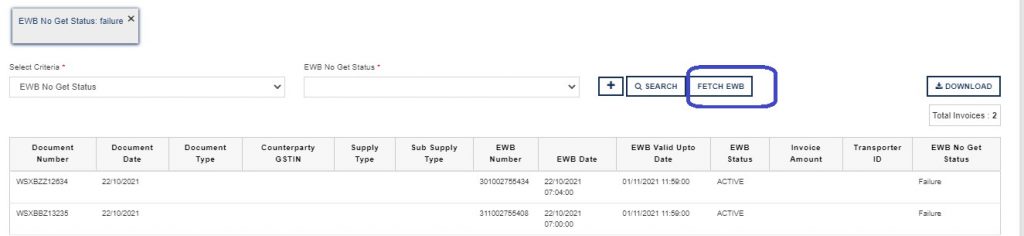

Before clicking on “RECONCILE”, please check if for any e-way bill complete details has not got fetched.

Filter EWBs based on “EWB No Get Status” and select status as “Failure” and then on the right-hand side “FETCH EWB” button pop-ups. Kindly click on that to get complete details for such e-way bills.

Now after fetching details click on the “Reconcile” button to perform reconciliation.

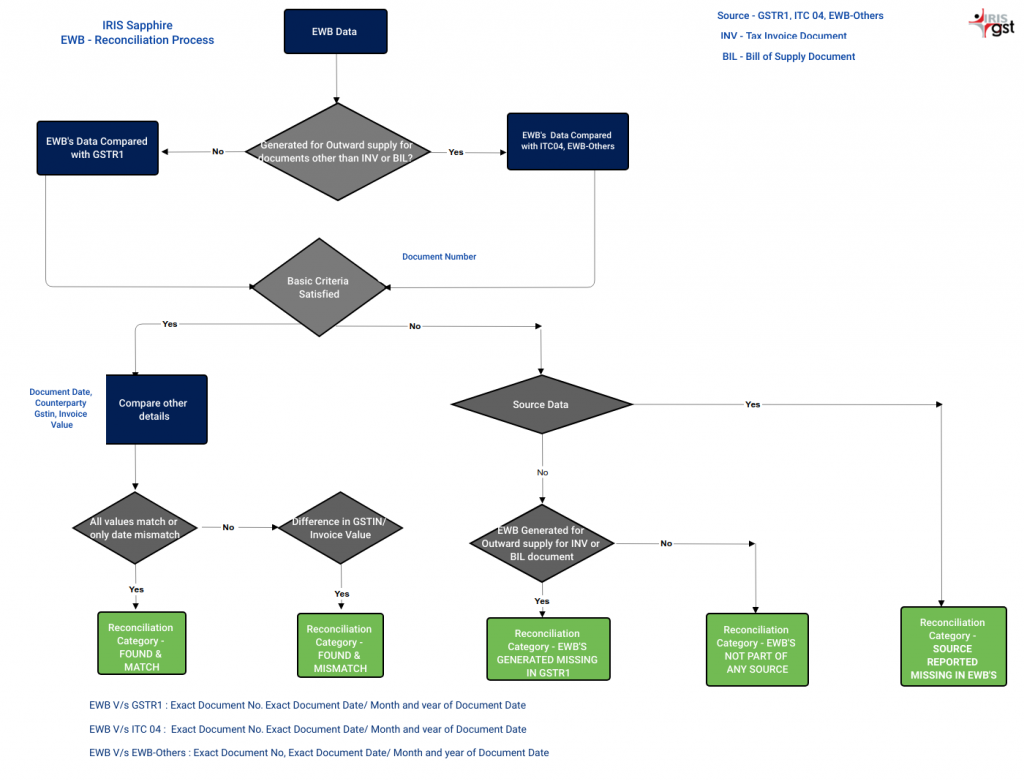

Reconciliation flow diagram to understand the logic.

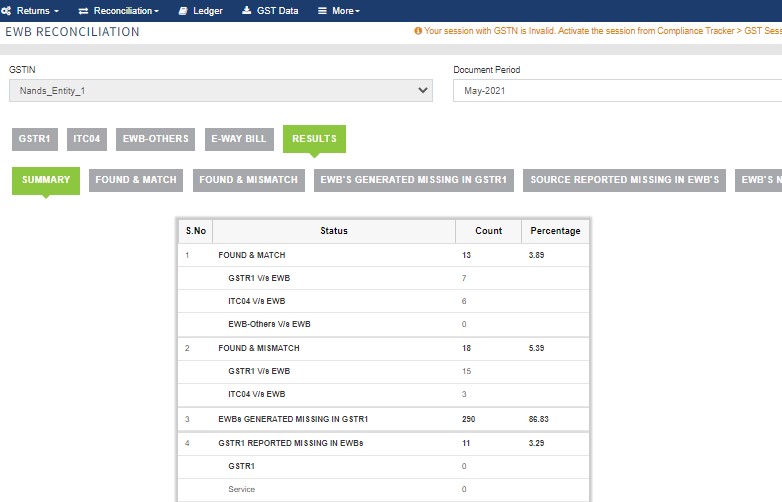

Once the reconciliation request is completed go to the Results tab.

In the Results tab, firstly you can see the “Summary” of reconciled documents.