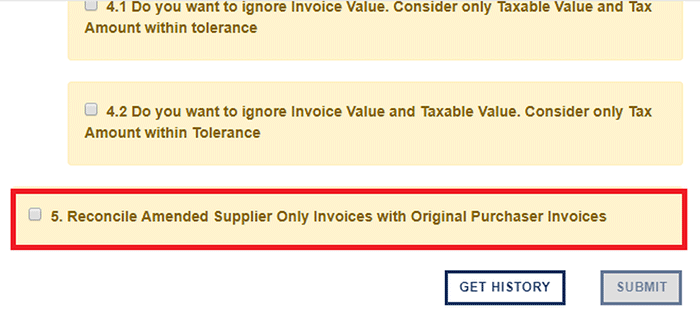

Rule 5. Reconcile Amended Supplier Only Invoices with Original Purchaser Invoices

For amendment sections like B2BA and CDNA, this rule will be applicable. If you want to be run across section reconciliation like B2B and B2BA then by using this rule it will be possible.

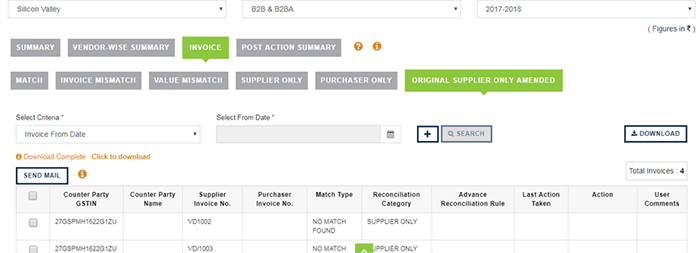

So invoices which are amended by your supplier and come under B2BA section in GSTR 2A data, now these invoices can be checked with your uploaded B2B data i.e. as original invoices. Because of this rule, invoices coming in GSTR 2A as original having amended invoices will get ignored.

In simple words, the original supplier invoice will be moved to the supplier only category and will be flagged as already amended.

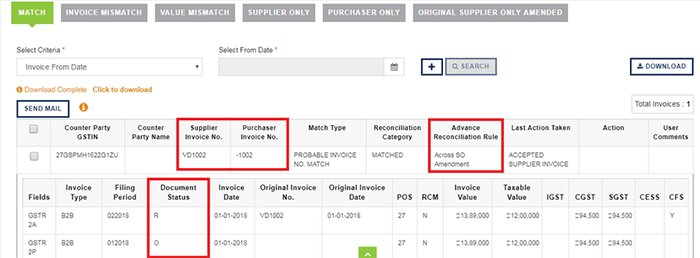

Also if the original invoice is already categorized as Match/Mismatch then it will get first delink and then amended invoice will get consider for reconciliation and original invoice get moved to supplier only category and will be flagged as already amended.

Also with this rule, if other rules are selected like across financial year, Invoice no. fuzzy logic etc then these other rules will get apply for across section reconciliation.

E.g. Purchase invoice no. -1002 dated 01/01/2018 uploaded in Jan 2018. This same invoice uploaded by a supplier in Jan 2018 and supplier amended this invoice in Feb 2018. So now this amended invoice uploaded in Feb 2018 will get reconciled with invoice uploaded by the purchaser in Jan 2018 and an original invoice of the supplier will get shown in a separate tab of “Original Supplier Only Amended”.