IRIS GST TIMES

November, 2020

Chief Editor

Vaishali Dedhia

The last month of the year 2020 is almost here – it’s the holiday season for most partof the world. While this year,along with the festivities, we

are also waiting for the vaccine to arrive ASAP! Onthe GST front, there has beena lot of new updates and

changes that businesses have to look out for. We have covered all the major details for your reference in this Newsletter.Also, we at IRIS continue to WFH and are serving all our clients with the best of our abilities like always!

In this issue, we’ll be covering E-invoicing and QR Code for both B2B and B2C Transactions.And, we share the NIC Specifications, and the new QRMP Scheme. Here, we also cover our feature highlight IRIS ONYX and share Top GST News of November 2020.Lastly, we share the link to our compliance calendar for December 2020 to help you stay compliant along with two other interesting articles on TCS under finance act and Delinking CDN.

Regards,

Team IRIS GST

Quarterly Returns and Monthly Payment (QRMP) Scheme:

Quarterly Return Monthly Payment Scheme or QRMP as it is called is a recently introduced initiative by the Government in its initiative to simplify compliance for taxpayers.

The CBDT issued notification 82/2020, 83/2020, 84,2020 and 85/2020 Central Tax dated 10-11-2020 and Circular 143/2020 on 10th November, whereby the registered persons having aggregate turnover up to Rs 5 Cr to be allowed to furnish their GST returns on a quarterly basis along with monthly payment of tax under QRMP w.e.f. Jan 01, 2021, i.e. from last quarter of FY 2020-21.

Here is a summary of all the changes introduced:

- Eligibility to QRMP Scheme

- When can You Avail the QRMP scheme

- Validity of scheme

- Details of outward supplies

- Impact of using IFF on other returns

- Payment Process of QRMP scheme

- Revised time limits

- Automatic Migration to scheme

Read the article in detail here: QRMP Scheme

*****

Click to read the Top GST News of the month – November 2020

All the imp updates at one place!

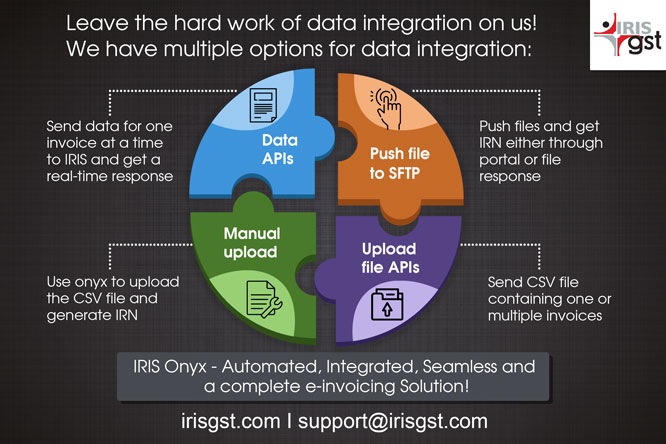

How can IRIS Onyx help you streamline your e-invoicing process & make it seamless?

Prominent Features:

- Real time E-invoice and E-way Bill Generation

- Upload invoice at PAN and GSTIN Level

- Multiple Integration Options

- Business and User Management Module

- Invoice Sharing and Archiving

- Customized Invoice Template with Bulk Print

- Standard and Advanced Validations

- Alerts and Reminders – MIS and Reports

Choose Hassle-Free Data Integration with IRIS Onyx!

Ready to get started?

Request a demo to learn more about how we can help you in e-invoicing implementation!

Get in touch for more details:

We have also released the Vol II of our ebook on e-invoicing – ‘E-Invoicing in India – Vol II’You can download the E-book here!

ALSO READ:

TCS under Finance Act & impact on E-invoicing:

Recently the Finance Act, 2020 has expanded the provision to include sale of goods also under the purview of TCS. The new provision was earlier made applicable from 1st April 2020, but due to the unfortunate pandemic, it was deferred and now it is applicable with effect from 1st Oct 2020.

Read the full article to learn more about:

Section 206C(1H) of Finance Act for TCS states as below

- Threshold Limit for Seller

- Applicability for buyer and transactions

- Calculation of TCS

- Effective Dates and calculation for current Fin Year

- TCS and E-invoicing

Read here: TCS & impact on E-invoicing

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST.com

NIC Specified Changes for E-invoice Implementation

The Sandbox system of NIC has some changes But worry not, as most of these have already been part of IRIS Input format and process since the beginning. Also, some of these updates may not be relevant if your data extraction has been as per the guidelines.

To summarize the key changes and its impact

1. Blocking of E-way Bill System for IRN

Generated invoices –

– In our earlier

communications, we had informed about the Governments roadmap to block the generation of e-way bills from the current e-way bill system where IRN is already generated from the IRP system. We believe you have already taken steps to align your e-way bill generation from IRN system where applicable. In case not, better to get that under control now.

2. Availability of IRN generated invoices –

Along with fetching the invoice details using IRN number, you can get the details of your invoices based on the document number & its document. Be it via IRN or using document number, it can be fetched only if generated in the last 3 days. Invoices where IRN is generated before 3 days cannot be fetched from IRN system. This being your own invoice data may not impact your processes.However, should you still need to get the data

IRIS Onyx will have the invoice data uploaded by you as well as the complete response from IRP.

3. More focus on data quality –

Only numbers will be allowed in phone numbers,address if entered should be of at least 1 character and so on. These are the pattern- related validations as highlighted in NIC email. From our initial analysis, our estimate is that most of these additional checks should not impact your data extraction as should have been addressed while integrating with IRIS

4. Some necessary process improvement –

With feedback coming from industry and solution providers, certain scenarios and needs due to merging of IRN and E-way Bill in same IRP system have surfaced and hence had to be incorporated. Again, not all of these changes may impact you, however good to check out the rules.

5. A few technical and backend updates –

JSON schema and error codes have been updated in tune to the above-mentioned improvements. Also, additional API is released to check the status /availability of IRP system. Should help track downtime and response delays.

6. Updates in E-way Bill Print – The summary and detailed E-way Print will now also have IRN, Acknowledgement number and date. Given that IRN already has full invoice details and that IRN will be included on E-way Bill, in the detailed print of E-way Bill the line item details will not be included.

If you have any queries, do reach out to our support team at gst.support@irisbusiness.com

GST Updates

E-invoicing and QR Code for B2B Transactions

The e-invoice mandate in India requires the specified entities to get their invoices registered with the Government designated system i.e. Invoice Registration Portal (IRP). Not all documents or all transactions are covered under e-invoicing. The current scope includes invoices, debit notes and credit notes issued to other registered parties i.e. B2B transactions and also export invoices.

On successful registration of B2B

invoices, the IRP provides:

A unique invoice reference

number (IRN): The IRN is derived using the GSTIN of supplier, Document number, its type (invoice, debit or credit note) and the financial year.

A digitally signed QR code: This digitally signed QR code can be generated only by IRP and hence adds authenticity to the document. The QR code contains select information of invoice, IRN and its generation date

Digitally signed full invoice data:Digitally signed full invoice data as uploaded by the supplier while registering the invoice with IRP.

Other Information: Some other reference information such as acknowledgement number, date and status of the IRN.

Read the full article to learn more about:

– Potential Uses and Details of the Digitally

Signed QR Code

– Components of a Signed QR Code in case

of IRN generated invoices

– QR Code on Invoices

– Sample images of a B2B invoice with QR code

E-invoicing and QR Code for B2C Transactions

Transactions involving supplies made to unregistered persons or consumers are generally referred to as Business to Customer (B2C) transactions. B2C Invoices are those invoices where the end-user will not be claiming Input Tax Credit (ITC) from GSTN.

For B2C invoices, IRN generation is not required however; a digitally signed QR Code is required to be printed on B2C invoices as well.

As per Notification No.14/2020, the government has made it mandatory for notified taxpayers (turnover over 500 crores) to display QR Code on their B2C invoices too. This is nowhere related to e-invoicing mandate; rather it is a step to promote digitization and digital payments. The main purpose of the introduction of dynamic QR code in the GST system is to enable payment using any UPI.

B2C QR code has to be self-generated by the taxpayers. They are not supposed to send the B2C invoices on government portal to generate QR code.

This requirement has no relevance or connection with e-invoicing mandated for B2B Supplies and Exports.

Read the full article to learn more about:

- Specifications of a QR Code

- How to Generate QR Code for B2C

invoices? - UPI based QR Code v/s Bharat QR

Code - Key Notifications and Clarifications

around B2C QR Code

At IRIS, we have built-in features for verifying

the Signed QR code received from IRP and also

self-generating the QR code for B2C invoices

sent by the taxpayers under UPI mode.

Check out our E-invoicing Solution today!

FEATURE HIGHLIGHT

IRIS Onyx – The Ultimate E-invoicing Solution

IRIS Onyx – our all in one e-invoicing solution is a seamless tool that can cater to all your E-invoicing needs. The government is rolling out new changes and notifications everyday for some update or the other and businesses are expected to abide by all the rules. Along with Rs. 500+ Cr. companies, Rs. 100+ Cr. companies have also been included in the e-invoicing mandate which may extend to smaller companies as well. Companies surely need a helping hand from experts who can easily get them going without causing any disturbances in their business. We at IRISGST have developed this product to meet all the requirements of the present e-invoicing mandate and are constantly upgrading with the new requirements that keep dropping in! Having helped multiple businesses already with their e-invoicing implementation, we invite you to try a demo of IRIS Onyx and fully understand how it can help integrate all the data easily. We have a support team to vouch for and we truly care about our customers! Being an authorized GSP and a trusted name in the Industry, we assure you that IRIS Onyx’s offerings can truly make your e-invoicing journey a smooth ride! (Visit: IRIS Onyx – e-invoicing solution) For more information.

Why choose IRIS Onyx?

Recognized Name: An IRIS offering, a brand in GST compliance trusted by large business houses

Multiple Integration options: Our e-invoicing solution offers a range of integration options to choose from which helps you to align e-invoice as per your business process

Integrated Offering: Integrate e-invoicing, e-way bill and GST compliance for smoother business operations via our IRIS ONYX

Easy Monitoring: Operate at PAN or place of business levels under GSTIN, flexibility to operate at micro level and monitor at macro

Hassle-Free Data Integration: You send us the data, the technical complexities of encrypt, decrypt and manage sessions for all you GSTINs we’ll do

Future- proof: Facilitating audit by storing/archiving all the historically signed data

IRIS Onyx will have the invoice data uploaded by you as well as the complete response from IRP. It can integrate with your billing systems seamlessly in multiple ways & generate IRN even if there are multiple invoices of different volumes and frequencies.

Watch video: https://bit.ly/2XXjnzs

Details:https://irisgst.com/iris-onyx/

UPDATES

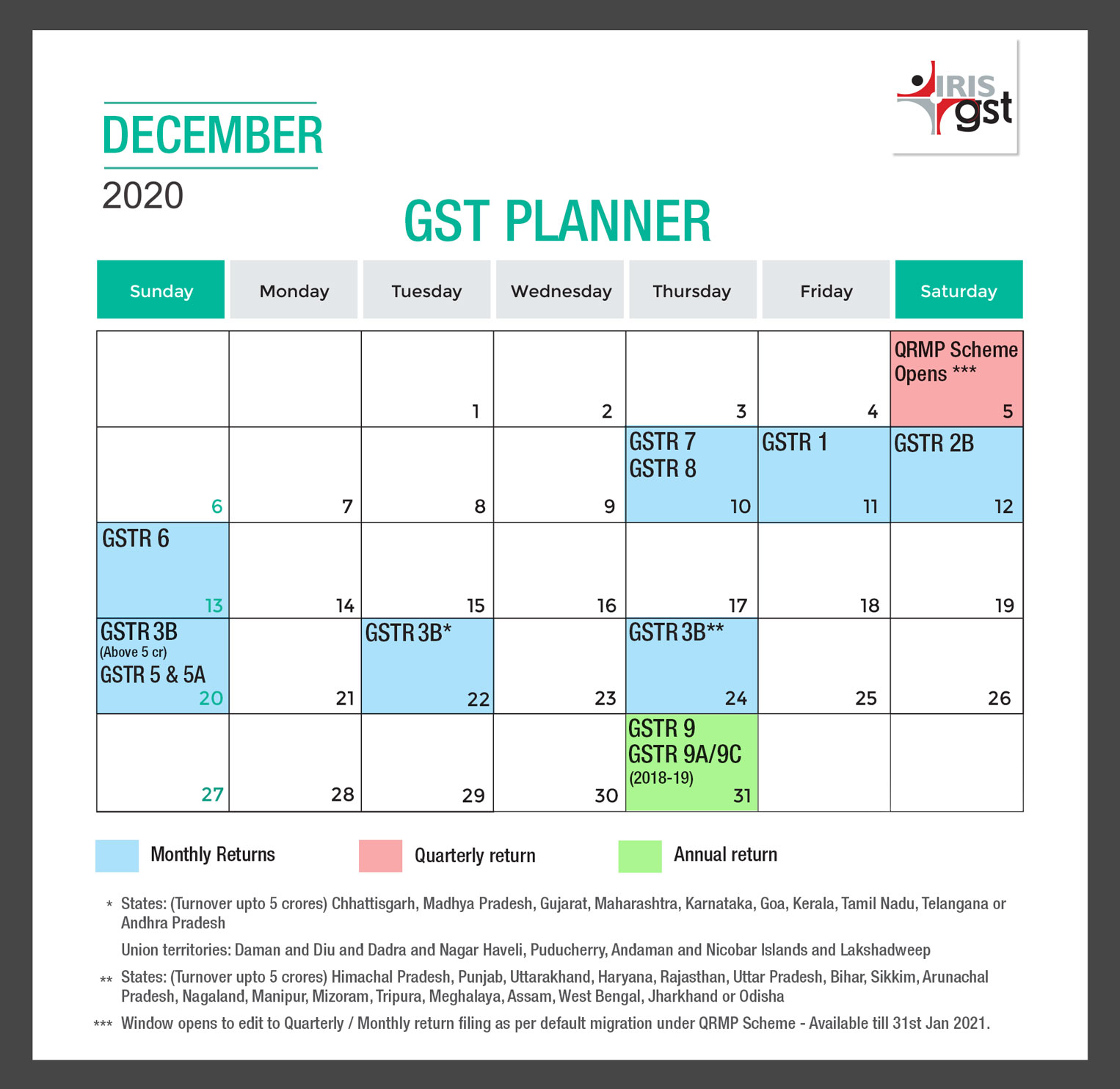

November Compliance Calendar 2020

Let us look at the GST Compliance Calendar December. Here is a comprehensive image of our Compliance Calendar December 2020.

You can Download and pin it for your quick reference

Delinking – Debit and Credit Note

Till now, the original invoice number was mandatory to be quoted by the taxpayers, while reporting a Credit Note or Debit Note in GST Form GSTR-1 or Form GSTR-6.

However, with the latest de-linking update, the taxpayer will have some relief and leisure as it will be time-saving and also very cost-effective. The process will become hassle-free and a little smoother. Credit and Debit note de-linking is one of the steps towards bettering GST

processes.

Read the full article to understand what does this change mean, here:

Delinking of Credit Note/Debit Note from invoice, while reporting them in Form GSTR 1/GSTR 6 or filing Refund

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment