Dynamic QR code gained popularity since the e-invoicing system went live in October 2020.

As per GST Notification 14/2020-Central Tax date. 23-03-2020, the government made it mandatory for notified taxpayers (turnover over Rs. 500 Cr.) to display dynamic QR codes on their B2C invoices. While e-invoicing mandates static QR Codes on the B2B invoices, industry had its own doubts about dynamic QR codes in the initial days.

The mandate of requirement of Dynamic QR Code on B2C invoices which was to go Live from 1st October 2020 was deferred to 1st December 2020 vide GST Notification 71/2020-Central Tax dated 30-09-2020. However, as per the GST notification 89/2020-Central Tax,dt. 29-11-2020, penalty for non-compliance with dynamic QR Code on B2C transactions was waived from 1st December 2020 till 31st March 2021 provided compliance with the said provision was adhered from 1st April 2021. However, this was further waived till 30th June 2021, subject to compliance from 1st July 2021 as per the GST Notification 06/2021 released on 30-03-2021.

Deferment of Dynamic QR Code on B2C Invoices

The Notification for deferment of Dynamic QR Code on B2C invoices was not applicable to-

• Supplies made for exports as e-invoices are required to be issued in respect of supplies for exports, in terms of

Notification no. 13/2020-Central Tax, dated 21st March 2020 treating them as Business to Business (B2B) supplies

• An insurer or a banking company or a financial institution, including a non-banking financial company

• A goods transport agency supplying services in relation to transportation of goods by road in a goods carriage

• Supplying passenger transportation service

• Supplying services by way of admission to exhibition of cinematograph in films in multiplex screens

• OIDAR suppliers registered under section 14 of the IGST Act 2017

Transactions involving supplies made to unregistered persons or consumers are generally referred to as Business to Customer (B2C) transactions. B2C Invoices are those invoices where the end-user will not be claiming Input Tax Credit (ITC) from GSTN. QR Code and B2C invoices became a topic of discussion after the e-invoicing revolution in India.

Read about E-Invoicing and E-Way Bill here.

Notifications and Circulars related to Dynamic QR Codes on B2C Invoices

| Notification No/Circular No | Content of Notification |

| Notification No. 14/2020-Central Tax, dated 21st March 2020 (as amended) | Mandates Dynamic QR Code on B2C invoice issued by taxpayers having aggregate turnover more than 500 crore rupees, w.e.f. 01.12.2020 |

| Notification No. 89/2020- Central Tax, dated 29th November 2020 | Penalty has been waived for non-compliance of the provisions of Notification No.14/2020 – Central Tax for the period from 01st December, 2020 to 31st March, 2021, subject to the condition that the said person complies with the provisions of the said Notification from 01st April, 2021. |

| Notification No. 06/2021- Central Tax, dated 30th March 2021 | Penalty payable for non-compliance of QR Code on B2C transactions waived further till 30th June 2021, subject to compliance from 1st July 2021. |

| Circular no. 146/02/2021-GST, dated 23rd February, 2021 | Clarification in respect of applicability of Dynamic Quick Response (QR) Code on B2C invoices and compliance of notification 14/2020- Central Tax dated 21st March, 2020. Along with some clarifications in specific issues raised by trade and industry |

IRN for B2C Invoices under GST

While B2B transactions i.e. invoices raised to a registered counterparty are explicitly covered under the current e-invoicing mandate as per GST Notification No.13/2020, it is equally important to understand the effect of e-invoicing under GST on various other business transactions like Exports, Deemed Exports, B2C, etc.

A schema for e-invoicing was released via GST Notification 60/2020-Central Tax dated 30th July 2020 followed by the release of version 1.03 of E-invoicing API specifications. Even though the mandate covers only B2B transactions, the e-invoicing schema notified includes all Invoice Types like Exports, Deemed Exports, and B2C transactions as well.

Although the notification on e-invoicing schema has included B2C transactions as Invoice Type, as per e-invoicing mandate and actual API released, IRN generation is not applicable for B2C. Hence taxpayers should not send the B2C invoices to the Government (i.e. IRP). This has been further clarified by NIC that the requests sent with B2C invoices will be rejected by them and if sent multiple times, then the IRN generation can be also be blocked.

Thus for B2C invoices, IRN generation is not required.

Specifications for Dynamic B2C QR Code

Dynamic QR Code on B2C invoice is self-generated by the business and there are no standard specifications prescribed by the Government for this. The purpose of having a B2C QR Code is to facilitate digital payments and the RBI recommendations related to streamlining payments also need to be factored in while deciding the approach to define the QR Code for B2C transactions.

Dynamic QR Code and Static QR Code

A QR Code based on the content included in it can be either static or dynamic.

A dynamic QR code is editable, as opposed to a static QR code which cannot be edited. Dynamic QR codes allow for additional features like scan analytics, password protection, device-based redirection, and access management. Dynamic QR codes also result in a less dense QR code image that is more reliable to scan.

How to generate a Dynamic QR Code?

Inferring the various notifications and clarifications issued for QR code on B2C transactions, the following is the gist:

- Enable Scan and Pay Currently many stores like D-Mart, Westside, etc have static QR codes at payment counters. The payee needs to scan the code, enter the amount and make payments. However, with dynamic QR codes, details like invoice amount, merchant’s id, merchant’s name, payment details, etc can be stored in the QR code itself. So, when the payee scans the QR Code, he/she will be able to directly make the payment through UPI.

- Adopt Interoperable QR Code

The RBI recommendation is to follow either of UPI or Bharat QR codes as these are inter-operable and standard QR codes. Businesses that have adopted proprietary QR Codes, will need to migrate to either of the standard codes by March 2022. Between the UPI and Bharat QR codes, the entity needs to decide about their approach. While UPI may be quick to implement, it may not support very high-value transactions. Bharat QR Code has the flexibility to include more content, however, the number of banks who have already implemented the option to issue QR Code is less than the banks that have UPI capabilities.

A brief comparative matrix is given below:

UPI based QR Code vs Bharat QR Code

| UPI based QR Code | Bharat QR Code |

| Merchant has to have account in the banks live on Bharat QR code (about 190) | Can be issued by member banks (about 32). Merchant has to have account in the banks live on Bharat QR code (about 28) |

| Includes merchant details, bank account etc. | Includes details of merchant, bank account and also transaction details such as amount. |

| Can be static or dynamic | Can be static or dynamic |

| Preferably used for P2P* or P2M* dynamic Transaction using Virtual Payment Address. | Specifically used for P2M* transaction wherein payment is done via cards |

| Necessary to have a mobile number linked |

Contents of a Dynamic B2C QR Code

Dynamic QR Code, in terms of GST Notification No. 14/2020-Central Taxis required, to contain the following information:

- Supplier GSTIN number

- Supplier UPI ID

- Payee’s Bank A/C number and IFSC

- Invoice number & invoice date,

- Total Invoice Value

- GST amount along with breakup i.e. CGST, SGST, IGST, CESS, etc.

Further, a dynamic QR Code should be such that it can be scanned to make a digital payment. IRIS is already live with the changes to include these fields in their B2C QR code.

Also, this QR code must be displayed on print and PDF invoices. The size of the printed signed QR code can be 2 X 2 inches. However, it depends on the available size on the invoice. But it should be readable from the QR code scanners.

In addition to the above point, there are four more points that are clarified in the circular. Here are the points:

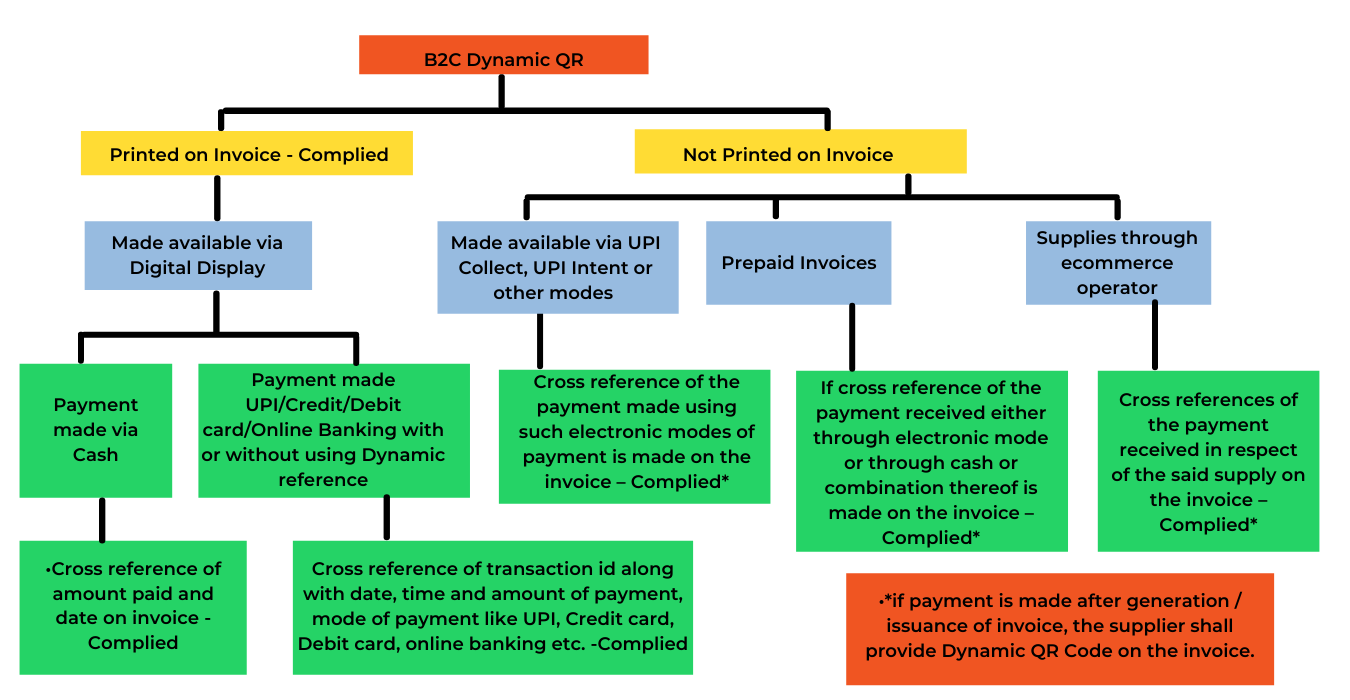

1.Digitally Displayed Dynamic QR code

A dynamic QR code that the taxpayers are already making available to the recipient through a digital display, usually also includes a payment link. Thus, on scanning the dynamic QR code, the recipient can directly make payments through such payment links. So, in case the taxpayers do not already have such a dynamic QR code, then the payment link can also be included in the self-generated QR code. If the taxpayers are already generating dynamic QR code with payment information and making it available to the recipient through a digital display, such dynamic QR code will be deemed to be QR code in accordance with the notification.

As per this latest circular, they additionally provided one more clarification around this digital displayed QR code. If the taxpayer is providing digitally displayed QR code then on invoice copy as they are not printing QR code hence they need to provide cross-reference of these payments so that invoice shall be deemed to comply with the requirement of Dynamic QR Code

2. Prepaid Invoices

If payment is done before generation of invoice then taxpayer shall provide cross reference of these payments on invoice copy then invoice shall be deemed to comply with the requirement of Dynamic QR Code.

In cases other than pre-paid supply where payment is made after invoice generation then, in that case, it is mandatory to print the dynamic QR code on the invoice copy

3. Electronic mode of payment

If the taxpayer makes available to customers an electronic mode of payment like UPI Collect, UPI Intent, or similar other modes of payment, through mobile applications or computer-based applications, where though Dynamic QR Code is not displayed, but the details of the merchant as well as the transactions are displayed then on invoice if taxpayers provide the cross-reference of these electronic payments then the invoice shall be deemed to comply with the requirement of Dynamic QR Code.

However, if payment is made after invoice generation then it is mandatory to print a dynamic QR code on the invoice copy.

4. Supply through E-commerce operator

As per the notification, it shall apply to each supplier/registered person separately, if such person is liable to issue invoices with Dynamic QR Code for B2C supplies as per the said notification. In case, the supplier is making supply through the e-commerce portal or application, and the said supplier gives cross-references of the payment received in respect of the said supply on the invoice, then such invoices would be deemed to have complied with the requirements of the Dynamic QR Code.

In cases other than pre-paid supply i.e. where payment is made after generation/issuance of the invoice, the supplier shall provide a Dynamic QR Code on the invoice.

Let’s understand it on basis of the flow chart:

B2C Dynamic QR code is not applicable for the below cases:

B2C Dynamic QR code is not applicable for the below cases:

B2C QR Code is not applicable to:

- Export Transactions – as covered under e-invoicing

- Turnover below 500 Cr rupees in all financial years from 2017-18 onwards

- Where the supplier of taxable service is:

- An insurer or a banking company or a financial institution, including a non-banking financial company

- A goods transport agency supplying services in relation to transportation of goods by road in a goods carriage

- Supplying passenger transportation service

- Supplying services by way of admission to an exhibition of cinematograph in films in multiplex screens

- OIDAR supplies made by any registered person, who has obtained registration under section 14 of the IGST Act 2017, to an unregistered person.

Notifications and Clarifications around B2C QR Code

| Particulars | Mandate | Clarification | Deferment | Related Mandate |

| Authority /Law | Central Govt, CGST Act | NIC, Developed E-invoice system | Central Govt, CGST Act | RBI |

| Notification /Reference Document | Notification No. 14/2020 | FAQ clarifying queries on B2C QR code | Notification No. 71/2020 | Notification RBI/2020-21/59 |

| Issued On | 21-Mar-20 | 14-Sep-20 | 30-Sep-20 | 22-Oct-20 |

| Scope | •Turnover > ₹ 500 cr in previous FY | •QR code is self-generated. Not by IRN system | •Turnover > ₹ 500 cr in any of previous FY from 2017 | •Streamlining QR Code infrastructure |

| •Dynamic QR code on their B2C invoices | •Many business have static QR code displayed in their outlets. IN static QR code, customer has to key in amount | •Effective 1st Oct 2020 is changed to 1st Dec 2020 | •Either of the two interoperable QR codes to be followed – UPI QR and Bharat QR | |

| •Purpose is to enable digital payments | •Dynamic will make the payments easier as customer just needs to scan, review details and pay. | •Proprietary QR codes shall shift to one or more interoperable QR codes by 31-Mar-2022 |

QR Code requirement had been notified under Income Tax Act and to be followed as per the conditions prescribed. Further with de-monetization, QR code has found its place even in the smallest of tea stalls to large retail outlets.

Notification of B2C under GST rules and the clarifications indicating dynamic QR codes has created quite a stir. Businesses need to weigh the options and keeping the timelines in view, maybe device a short-term and longer-term strategy.

FAQs

In the case of digital display, is it compulsory to provide cross-reference even if the payment is made using a Dynamic QR code?

- Yes. As per point 3 mentioned in the circular.

If Dynamic QR is printed in case of prepaid B2C invoices will it suffice?

- No cross-reference would be required if Dynamic QR is printed on the invoice.

If Partial Payment is prepaid and partial is after issuance of the invoice, then what should be done?

- There is no clarity as of now on this, however, two things are possible –

- Cross-reference for payment already made and Dynamic QR with balance amount both to be printed on invoice.

- Invoice Value field is required in the Dynamic QR and no mention of the Net due amount is made in specification, hence Dynamic QR for full amount printed on invoice may be allowed.

Payment app restrictions for amount, how it has to be handled?

- There is no clarity as of now on this. If Dynamic QR is printed on the invoice then you have complied and need not worry about all these cases as of now unless there is more clarity.

****

If you are looking for Automated, Integrated, and Seamless E-invoicing Software, Try IRIS Onyx!

IRIS Onyx – has multiple options for Integration. It is a complete tool for a seamless e-invoicing process.

- Data APIs – Send one invoice to IRIS Onyx at a time and get a real-time response.

- Push File to SFTP – Push file to SFTP location and get IRN in a response file on the same SFTP location.

- Upload File APIs – Send CSV file containing one or multiple invoices through APIs. Integrate status and other API to also get the IRN response back into the system

- Manual Upload – Use Onyx to upload the CSV file and generate IRN

IRNs generated through any of the above approaches will be present on IRIS Onyx web portal also.

Onyx has proven to be a blessing for all our clients who managed to carry out the entire process of IRN generation smoothly. Our team has been dedicatedly helping clients with all their queries and has been conducting free webinars to spread awareness about the latest changes and extend support in the implementation of the e-invoice mandate.

We M/s DCM Shriram Ltd. are registered as manufacturing company under GST Act 2017 , having turnover of more than 5000 crores. At our works in Kota – Rajasthan we are running workers canteen and also having an employee shop for providing household goods to our workers / staff as a part of HR / IR welfare activities.

For all B2B transactions we are following standard procedures and all invoices are being generated with QR Codes . Do we need QR code on all the bills / invoices issued to our customers ( B2C) who are procuring household goods ( Pulses , Rice , , FMCG items ) from our employee shop . ( This E.shop is not separately registered under GST . )

Kindly suggest … is it actually feasible

Rizwan

rizwanullah@dcmshriram.com

Yes, QR code is required for B2C transactions. Please note CBIC has exempted this QR Code on B2C transactions till 31st March 2021 provided you comply with the same from 1st April 2021

In case you fail to comply from 1st April 2021 penalty will be levied from 1st December

Refer: Notification 89/2020

https://irisgst.com/gst-notifications-and-circulars/

Is QR Code necessary for Non Taxable Items.

QR code has to be added to all the B2C invoices. It has no correlation with the taxability of items, provided entity is covered under e-invoicing

Would E invoicing be applicable if our turnover is more than Rs 100 cr wherein 99% of the invoice is raised to a unregistereted customer and 1% to a registered customer.

Will my company be need to be registered and have e invoicing norms ahdhered to for all invoices ?

Turnover includes sales to both registered and unregistered person, so company has to registered and adhered E-invoice norms for B2B transactions.