IRIS GST TIMES

April, 2021

This issue

Why small businesses should look forward to e-invoicing | Practical Challenges at Different stages in

E-invoicing —————————————————- P.1

Latest EWB Updates ———————— P.2

IRIS Onyx ———————————————————————— P.3

GST Compliance Calendar- May and Top GST News of the month ——– P.4

–

Chief Editor

Vaishali Dedhia

The month of May is here!

April 2021, the month of new financial year went by in a jiffy. Also, many states in the country witnessed partial/ complete lockdown due to the prolonged COVID-19 pandemic. However, the vaccines have brought in some hope!

On the GST front, there has been a few new updates and changes that businesses have to look out for. We have covered all the major details for your reference in this Newsletter.

In this issue, we’ll be covering two important articles 1) Practical challenges at Latest Updates in the E-way Bill System – April 202.

And, we share Why Small Businesses should look forward to e-invoicing and Updates in B2C and QR Code. Here, we also cover our feature highlight IRIS Onyx.

Lastly, we share the link to our compliance calendar for May 2021 to help you stay compliant along sharing Top GST News of April 2021.

Regards,

Team IRIS GST

Inverted Tax Structure:

What is INVERTED TAX STRUCTURE?

As the name suggests, Inverted Tax Structure is a condition where the rate of tax on inputs purchased i.e. the ‘GST Rate paid on inputs received’ is more than the rate of tax i.e. ‘GST Rate Payable on outward supplies’ on outward supplies (finished goods).

In simple terms, the GST rate paid on purchases is more than the GST rate paid on sales.

For Example: The tax on raw materials for a business is more than the tax rate on the supplies i.e. the goods that are finally being sold.

- Refund in case of Inverted Duty Structure under GST

According to Section 54(3) of the CGST Act, 2017, a registered taxpayer can claim refund of unused Input Tax Credit at the end of any tax period.

The taxpayer has to claim his refund of unused ITC on account of Inverted Duty Structure at the end of any tax period. He/she can do so only if the credit has accumulated due to rate of tax on inputs being higher than the rate of tax on output supplies which is the Inverted Tax Structure condition. - Claiming unused ITC refund

- Filing Form RFD-01A

- Basic Steps

- Tracking the GST Refund Application

- Issues / Contentions w.r.t. Inverted Tax Structure

- FAQS

Read the full article here: Inverted Tax Structure

QR Code and B2C Invoices:

What are B2C Transactions?

Transactions involving supplies made to unregistered persons or consumers are generally referred to as Business to Customer (B2C) transactions. B2C Invoices are those invoices where the end-user will not be claiming Input Tax Credit (ITC) from GSTN. QR Code and B2C invoices became a topic of discussion after the e-invoicing revolution in India.

IRN FOR B2C INVOICES

Although the notification on e-invoicing schema has included B2C transactions as Invoice Type, as per e-invoicing mandate and actual API released, IRN generation is not applicable for B2C.

Hence taxpayers should not send the B2C invoices to the Government (i.e. IRP). This has been further clarified by NIC that the requests sent with B2C invoices will be rejected by them and if sent multiple times, then the IRN generation can be also be blocked.

- Thus for B2C invoices, IRN generation is not required.

- Specifications for B2C QR Code

- How to generate a QR Code?

- Contents of a B2C QR Code

- B2C QR Code is not applicable to:

- Notifications and Clarifications around B2C QR Code

Read the full article here: QR Code and B2C Invoices

Cloud Software in times of COVID-19

The lockdown situation due to COVID-19 has forced companies in all sectors to work from home as much as possible. For multiple resources to work from remote locations to achieve a common goal, it requires strong technology backing. And the answers lie in cloud computing or cloud technology.

What is cloud computing?

In layman’s terms, cloud computing is nothing but computing based on the internet. Just how people can run software programs, applications and documents on their physical computer or servers in their set office premises, cloud computing offers the same with the help of the internet.

This means it does not require any physical equipment or established office premises but can be used from anywhere anytime by the people involved. There are multiple cloud platforms and cloud computing providers who help companies set up their base.

Read more: Cloud Computing

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST.com

Practical challenges at different stages in e-invoicing

E-invoice implementation requires integration with external systems i.e. solution providers and Government systems. It also includes educating all stakeholders and departments within the organization. While these could be one-time processes, you need to ensure that there is a system in place to keep everyone updated about the new developments and changes within the organization. Being aware of the challenges, it is required to take necessary steps to overcome them and find relevant solutions promptly. This will also help in avoiding any upcoming problems before hand.

A) Preparing for IRN

- Updating ERP

- Connecting to IRP (Invoice Registration Portal) via APIs and Data Mapping

B) Generating IRN

- Handling errors, Exceptions etc.

- E-way Bill

- Handling Specific Business Scenarios

C) Post IRN

- Cancellation

- GSTR 1 Reporting

Latest Updates in the E-way Bill System – April 2021

The Government is releasing a bunch of new updates every other day for businesses. Practices like E-invoicing and E-way Bill have transformed the entire scenario and are on their way to rooting out the old way of doing business. Digitization is the way to go as it not only eases the entire process but brings in a lot more transparency. After all the e-invoicing updates, now the government has released some major updates in the E-way Bill system as well.

Here are all the Updates in the E-way Bill System from April 2021

E-way Bill and HSN Code: E-way Bill cannot be generated with only SAC codes(99) for Services, a minimum of one HSN code belonging to Goods is mandatory. Earlier e-way bill generation was allowed with only SAC codes (99) for service.

Vehicle type ODC is provisioned for transport mode ‘Ship’: For Transport Mode “Ship”, a provision is added to set the vehicle type as “ODC” (Over dimensional cargo). Prior to this change, there was no provision to set the vehicle type for the transport mode “Ship”.

GST Updates

Why Small Businesses Should Look Forward to E-invoicing?

Smaller companies may soon come under the e-invoicing threshold and thus need to be ready. However, this does not give small businesses a reason to worry. There are numerous benefits of e-invoicing and SMEs must accept the e-invoice revolution with open arms. At outset e-invoicing under gst can appear to be a big overhaul and humongous task but if handled it well, it can serve you well. It does not require heavy investment to start e-invoicing or it is not necessary for your company to have a huge IT department to handle it. Just partnering with the right GSP and getting an e-invoicing software is enough!

What are the advantages of e-invoicing for MSMEs?

An opportunity to digitize: E-invoicing will not just give MSMEs an opportunity to digitize but also make the processes transparent. Usually, small or mid-size companies are juggling between multiple aspects of business and a proper billing and administrative system is a dream far-fetched which leads to chaos. With e-invoicing, streamlining administrative work can really become convenient with the help of a reliable e-invoicing software like IRIS Onyx. Onyx is a one-stop e-invoicing solution that can integrate with billing systems seamlessly in multiple ways and generate IRN with zero disruption to the businesses.

Reduced Compliance Burden: The GST compliance gets lightened because of auto-population and streamlined processes. There will be a reduced effort for GST compliance as e-invoicing details will be auto-populated to prepare GST Returns and other e-way bill actions. As the scope of e-invoicing is limited to certain transaction types, there could be cases where the businesses will need to take care of the balance compliance needs.

Easier Integration with Supply Chain: When all the parties slowly and steadily were getting covered under e-invoicing, everyone eventually will be following the same standard, the same process, and the same data fields in their invoices. Hence, it offers an opportunity to better integrate with your large customers who want their purchase data /ask you to fill in the information on some vendor platform.

Opens up doors for cash flow financing: Due to its standardized nature and availability of data in a real-time and technologically consumable fashion, e-invoicing also has caught the interest of banks and financial institutions. What erstwhile might have taken days to obtain and verify, now can be done in a matter of minutes, thus making cash flow and trade financing the next big wave? To the underserved MSME market, opening up financing options based on e-invoices is a direct blessing with apparently no disguise.

Read more to understand how to small businesses can get started with e-invoicing.

FEATURE HIGHLIGHT

IRIS Onyx – E-invoicing Solution

After the recent GST Notification that made e-invoicing mandatory for companies with an annual turnover more than Rs. 50 + crores, there are high chances that the e-invoicing threshold will further be reduced. Smaller companies may soon come under the e-invoicing threshold and thus need to be ready. E-Invoicing integration process is a detailed one and requires sufficient time for testing and final output. As the process does not just include IRN generation but businesses also need to carry out e-invoicing for different types of transactions -B2B and B2C transactions, Exports, SEZ and RCM etc. Also, E-Invoicing impacts rules and compliance on internal systems and processes as well.

We recommend you to start it if not done already. Our E-invoicing software is proving to be a blessing for all our clients who managed to carry out the entire process of IRN generation smoothly. Onyx is an automated, integrated and seamless solution which can be accessed from a single platform that offers GST compliance as well as E-Way Bill management – all at one place.

Along with all its basic functionalities, we have recently added the following features to our e-invoicing solution:

PAN Level Buk Download: IRIS Onyx is enhanced to provide a filtered view of PAN level data. Apply date filters or additional filters like active IRNs or cancelled and get specific PAN level data that you are looking for.

- B2C QR code revamped The B2C QR Code generation from IRIS Onyx is now in line with Circular no. 146/02/2021-GST, dated 23rd February 2021 published by the government specifying the contents of the B2C QR code.

- GSTIN Sync Now with IRIS Onyx, you can search for a GSTIN on the NIC portal and if the details found for the GSTIN are not updated on the NIC portal, the same is synced from the GSTN common portal.

GST Suvidha Providers (GSP) are conduits through which taxpayers can connect to IRP. It is important to note that invoice generation will continue to be done by taxpayers. For generating IRN, taxpayers can opt for solutions that can be embedded in their current invoicing processes or use manual generation options. However, there are many tasks post-IRN generation i.e. getting invoices printed with QR code, checking its auto-population in GSTR 1, etc., and hence it is recommended to choose a solution that can provide for all needs around e-invoicing and GST compliance.

To understand how IRIS Onyx can help your business, book a free demo today!

UPDATES

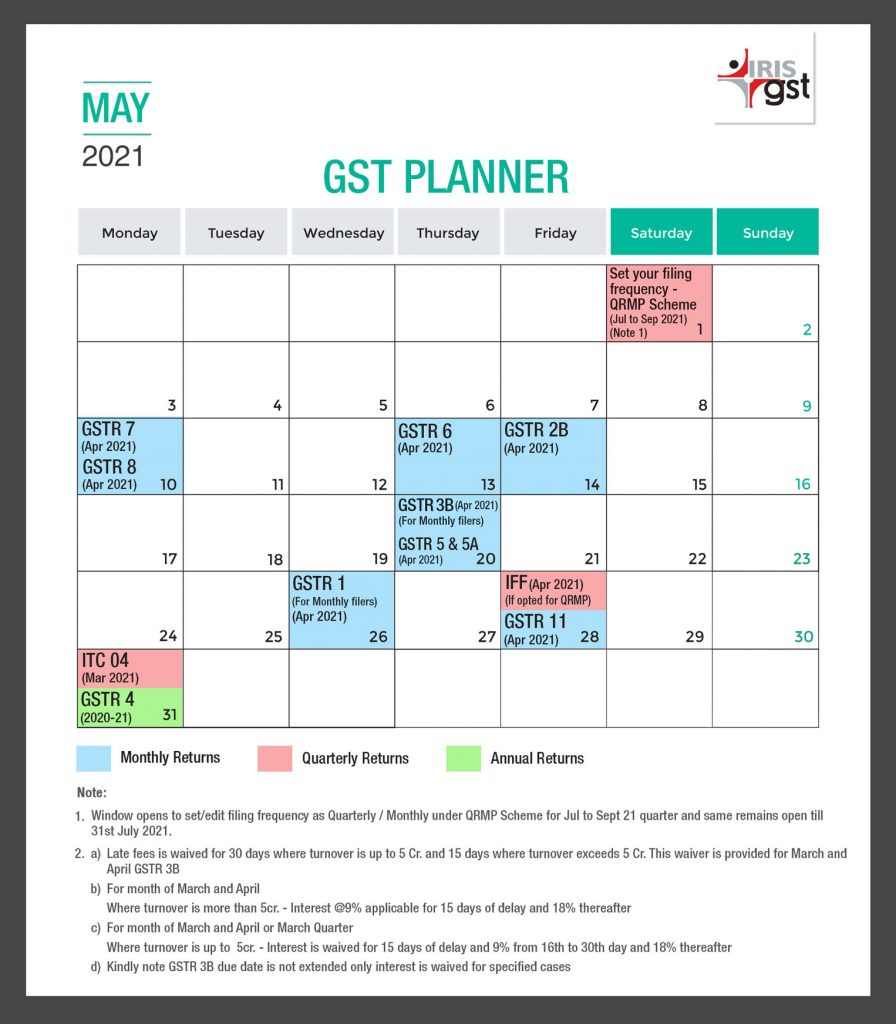

May Compliance Calendar 2021

Let us look at the GST Compliance Calendar May. Here is a comprehensive image of our May Compliance Calendar 2021. It has all the GST Compliance Due-dates for May 2021 so that you never miss a due-date! You can Download and pin it for your quick reference.GST Compliance Calendar April 2021

Top GST NEWS of the month!

There have been a few new changes, additions, and GST updates in the month of April 2021.

In the article we have covered the following categories:

- Important notifications released in the month

- GST Collection of the month

- GST Compliance Updates

- Latest GST Changes and News

Read the full article here: Top GST News of the month – April 2021

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment