IRIS GST TIMES

October, 2020

This issue

Top GST News of the Month ————————-P.1

E-invoicing and SEZ Recipient of an E-invoice ————- P.2

IRIS Peridot – 4.0 ——————- P.3

GST Compliance Calendar ———– P.4

Chief Editor

Vaishali Dedhia

The arrival of November brings in a lot of light and positivity as it the month of the biggest festival of the year – Diwali. It is a great time for Indian businesses because customers are all in for a ‘spending spree’. The convenience to shop and sell online has proven to be a boon for many during the pandemic.

We at IRIS continue to WFH and serve all our clients with the best of our abilities just like before!

In this issue, we’ll be covering E-invoicing and SEZ, also we share steps to take for recipients of e-invoices.

And, we share the Top GST News of October 2020, and all about ITC – Claiming GST ITC. Here, we also cover our feature highlight IRIS Peridot 4.0 version. Lastly, we share the link to our compliance calendar for November 2020 to help you stay compliant.

Regards,

Team IRIS GST

How to claim Input Tax Credit?

What is Input Tax Credit?

Input Tax Credit or ITC under GST is the credit back of the tax a registered GST taxpayer pays on inputs i.e. purchases. This tax he is liable to get back from the government.

Who is eligible for Input Tax Credit (ITC)?

As per Sec.16 of CGST Act, 2017, every registered taxpayer can avail input tax credit (ITC) under GST if he fulfils the criteria.

NOTE: It is possible to have unclaimed input credit due to tax on purchases being higher than tax on sale. In such a case, the taxpayer is allowed to carry forward/claim a refund. The government does NOT pay interest on input tax balance.

Key Rules and Conditions governing ITC Computation and Reporting:

Taxpayer should be in possession of the tax invoice or debit note or relevant tax paying documents.

He should have received the goods and services.

Payment of such tax is made to the government by the vendor.

Taxpayer has furnished return under section 39 i.e. GSTR 3B.

All about Provisional Input Tax Credit (ITC) | CGST Rule 36(4)

Provisional input tax credit (ITC) refers to the Input Tax Credit which can be claimed even if ITC is not available in GSTR-2A.

For availing Input tax credit, the invoices need to be uploaded by suppliers in their GSTR 1. If not uploaded, ITC with respect to such missing invoices will be restricted to 10% of ITC (20% – if before Jan 2020) eligible from invoices which are uploaded by suppliers and hence are part of GSTR 2A. The concept of provisional ITC was brought into effect vide CGST notification no. 49/2019 central tax dated 09/10/2019.

Updates:

- 20% ITC Rule | Notif No.: 49/2019 Central Tax | Rule 36 (4) | 20% Provisional ITC

- Amendment to Rule 36(4) | 10% ITC Rule

- Circular 123/2019 GST – Clarification to Notification 49/2019

- Latest Update on Provisional ITC Rule

- 3rd April 2020: Notification No: 30/2020-Central Tax, dt. 03-04-2020

- 9th October 2020: Circular 142/12/2020 GST

While government has issued several clarifications regarding applicability of Provisional ITC, there still are several open issues that need to be addressed.

EasyWay Bill App:

EasyWayBill, an application that lets transporters easily manage their activities related to E-way bills from the comfort of mobile.

Visit: EasyWayBill.in to get more information.

*****

IRIS Credixo – a cloud software that empowers financial institutions with data-based lending using GSTN Ecosystem:

IRIS Credixo, our credit assessment and monitoring tool, helps lending institutions to move from traditional and manual-credit assessment process to automated and data driven lending. The likes of Banks, NBFC’s and Fintechs can simplify their credit assessments with consented GST data.

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST

Top GST News of the Month – October 2020

October month has just gone in a jiffy with so many updates happening in the GST arena. E-invoicing mandate going LIVE has been the most important news for this month.The GST Council Meeting held at the start of the month also brought in a lot of new changes.

Here is a round-up of all the Top GST News updates for the month of October 2020:

1. Important GST Notifications released in October 2020:

- GST Notification 73/2020- Regarding 30 days extension for e-invoice generation

- GST Notification 74/2020- Due dates of GSTR 1 Quarterly returns due dates for Oct ‘20 – Mar’21 notified to be 13th of month following the quarter.

- GST Notification 75/2020- Due dates of GSTR 1 Monthly returns is notified for tax period Oct’20 to Mar’21.

- GST Notification 76/2020- Due date of filing GSTR 3B for tax period Oct’20 to Mar’21 notified to be 20th, 22nd, 24th of following month based on turnover and States / UT’s.

Some more notifications released:

- GST Notification 77/2020

- GST Notification 78/2020

- GST Notification 79/2020

- GST Notification 80/2020

2. 42nd GST Council Meeting – Expectations and Highlights:

Held on October 5th, 2020, Read the highlights here: 42nd GST Council Meeting

Other Important Updates of the Month:

- Temporary Relief on QR Codes: QR Codes have been deferred on consumer invoices by 2 months i.e. till December 1, 2020.

- Extension of Annual Return Due-Date FY19: The government extended the due-date for filing the Annual Return in GSTR-9 and GSTR 9C for 2018-19 by 1 month. Now the extended timeline is from 30.09.2020 to 31.12.2020.

- Government announces 4% Growth in GST: After witnessing 6 months of steady decline the economy saw an upward trend. In September, the GST collections rose 4% to Rs 95,000 cr. So, the government is hopeful that the markets will slowly returning to the pre-COVID levels.

- GSTN clarified that carrying physical invoice copies is not required: Again a big relief to companies while movement of goods, the physical invoice copy is not mandatory but an electronic copy with the QR Code is needed for verification.

- Small businesses can file their GST returns on quarterly basis: Government simplified filing returns for small businesses by allowing them to only file their returns quarterly with monthly payments from January 1, 2021.Read the full article here:

GST Updates

Received an E-Invoice? 9 Questions to Consider:

E-invoicing has finally seen the light of the day. While the Government has provided relaxation to e-invoice mandate subject to certain conditions, e-invoicing is now officially here, and the taxpayers have started generating IRN compliant invoices.

E-invoicing as much as it impacts the suppliers, it has a ripple effect on the purchase cycle too. And the consequences of non-compliance by supplier can cost recipient their ITC.

Here are some important questions which as recipients of e-invoices, you need to be aware of and wherever needed, be prepared for.

- How will I know if my supplier is covered under e-invoicing mandate and hence the invoices received should have IRN?

- Should all documents received from supplier have an IRN?

- How to verify if IRN is valid?

- As a recipient, can I get the full invoice data from NIC portal?

- Can invoice data change after the IRN is generated?

- If IRN is cancelled, will I come to know from the QR Code?

- The document I received does not have IRN printed, but there is a QR code? Does this violate any of the e-invoicing rules?

- My purchases from supplier are not direct but through e-commerce operator and invoices are generated by e-commerceoperator on behalf of supplier. Would such invoices also have IRN?

- Will all my suppliers who have aggregate turnover above ₹500 CR be covered under e-invoice and hence will share QR code embedded invoice henceforth?

The questions need to be pondered before accepting an e-invoice. Read the full article here:Recipient of an e-invoiceto know how to tackle these questions before accepting an e-invoice.

E-invoicing & SEZ

While it is important to understand questions related to receipt of an e-invoice, an equally important area to be aware of is generating e-invoices for SEZ transactions. There have been few clarifications issued around the subject that segregates applicability criteria for SEZ Developers and SEZ Units. Let us get into the basics of E-invoicing & SEZ in detail:

E-invoicing and SEZ Units/Developers

- Supplies made by a SEZ unit/developer as a Supplier:

According to the GST Notification (Central Tax) 61/2020 dated 30-7-2020 only SEZ Units are exempted from issuing e-invoices for their outward supplies. For SEZ Developers e-invoicing is applicable if they have specified turnover and fulfilling other conditions for e-invoicing mandate. - Supplies made to SEZ unit/developer:

If your GSTIN fall under the e-invoicing mandate then all supplies to registered persons (B2B), Supplies to SEZs (with or without payment), Exports (with or without payment), and Deemed Exports are covered under the mandate. Thus, for a regular taxpayer supplier, even supplies made to SEZ units or developers will have an IRN and QR code generated.

It is important to note that the type of transaction is to be reported as SEZWP (SEZ with payment) or SEZWOP (SEZ without payment). Also, Supplies to SEZ Unit/Developer are always treated as Interstate transactions, even if the supplier location is same as the place of supply. Same needs to be taken care of while reporting such transactions.

For supplies made to SEZ unit/developer, the suppliers can claim GST refund through refund application for both with payment as well as without payment. So now for such GST refunds also the e-invoicing mandate will become very important. If you are eligible for e-invoicing then you will not be able to claim refund unless IRN is generated.

Read the full article here:

FEATURE HIGHLIGHT

IRIS Peridot – 4.0

We are delighted to share the Launch Plan of IRIS Peridot 4.0 envisaged to Go-LIVE in November 2020!

The 4.0 Version which is right now in Beta Launch will soon be released on Play store for user download.

The Peridot app is a free app that lets you scan any GSTIN to know their taxpayer type, filing history and eligibility to collect tax. The current version – 3.2 has 5 Lakh+ successful downloads with an active user base of 2.63 Lakhs. So, what more will you be able to achieve with IRIS Peridot 4.0?

Here is a list of what’s in store for you…

- Search GSTIN by Name: The app that currently lets you scan GSTIN will now let you even search GSTINs by Name. Search text can be either in trade or legal name. For simplicity sake right now we are showing only the trade name. So if you see a result which doesn’t contain your search text, it would be in the legal name.

- Search GSTIN by PAN: Not only this, but now you can even search by PAN and get all GSTINs belonging to the PAN. Both PAN and Name search results are from our Peridot Database, which has about 92 lakh GSTINs by now.

- Create Watchlist: GSTINs which you search frequently can be added as yourfavourite and will be available as your watchlist. And what’s more, you can do bulk refresh for all your watch listed GSTINs and know if they have filed any return and if it was on time. If the Return filing is not on time, same is indicated with

- Bookmark Notifications: Version 3.2 offered multiple notifications regarding due dates and release of GST Notifications and Circulars. With 4.0, now you will be able to bookmark these notifications for future reference.

- Complete GST Returns Summary: All the GST returns apart from main/regular returns filed by the taxpayer will be displayed under the ‘More Returns’ section.

- QR Scanner: With e-invoicing gone live, how could we not include QR scanner! Only for Production QR codes and E-Way Bill QR Codes, well, just click on the GSTIN and see the magic!

All these above features are available once you sign up using your Google ID.

Another change to notice in version 4.0 is that the search history will now show Trade name instead of Legal Name. Overall as a principle, we have gone ahead with displaying trade name wherever available.

One feature of the current version that you won’t find in the new version is the option to report issues. Instead of that option, now we have included a feedback form where you can provide us other feedback as well.

Technical updates like in-app version update, detailed help guide, disclaimer, terms and conditions and about us is also being updated. Please go through the same.

For more details visit:

IRIS Peridot Product Page

UPDATES

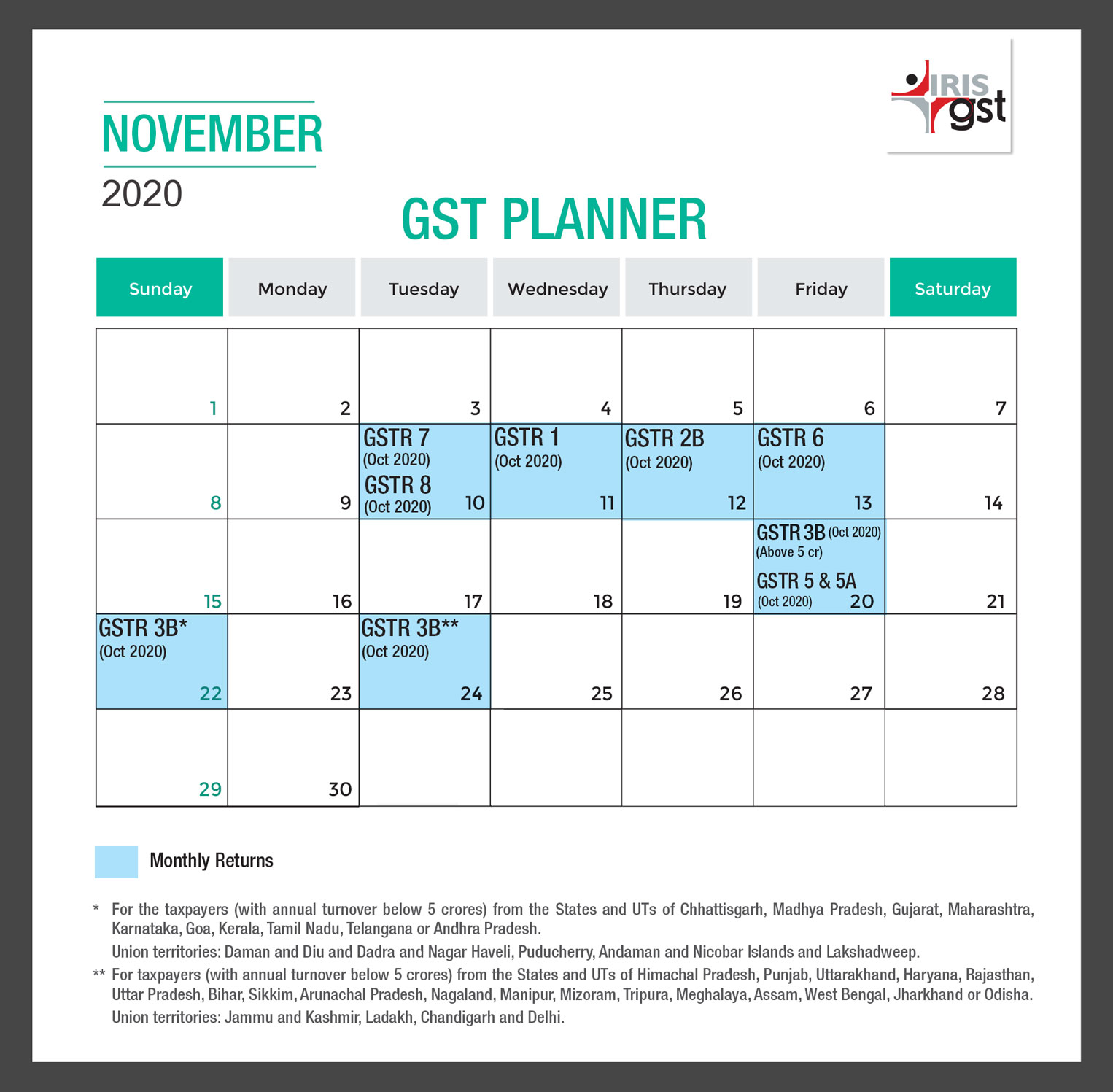

November Compliance Calendar 2020

Let us look at the GST Compliance Calendar; here is a comprehensive image of our November Compliance Calendar. You can Download and pin it for your quick reference.

All about Form GST REG-03:

Form REG-03 is a notice where additional information/clarification/documents is asked from the applicant. This information/clarification/document could relate to various applications like registration, amendment or cancellation.Just like other forms, basic information about applicants needs to be provided in this form too.

This basic information includes:

- Name of the applicant

- Address

- GSTIN

- Application Reference No. (ARN)

- Date

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment