IRIS GST TIMES

January, 2021

This issue

Business Scenarios & Validations ———————— P.1

Auto-population of e-invoice details Into GSTR 1 ————— P.2

IRIS Onyx – Success Stories ————— P.3

GST Compliance Calendar- Feb 2021 TOP GST News of the month —– P.4

Chief Editor

Vaishali Dedhia

The month of new year resolutions , January, went by in a jiffy and February 2021 is here already!

On the GST front, there have been a few new updates and changes that businesses have to look out for. We have covered all the major details for your reference in this Newsletter.

In this issue, we’ll be covering specific business scenarios and validations + an article on registering your GSP for e-invoicing.

And, we share a detailed article about Auto-population of e-invoice details in GSTR 1. Here, we also cover how IRIS Onyx helped multiple business on successful e-invoicing.

Lastly, we share the link to our compliance calendar for February 2021 to help you stay compliant along with the Top GST News of the month.

Regards,

Team IRIS GST

Registering Your GSP for E-invoicing

To communicate with the E-invoice system for registering your invoices, it is important to have API access.

Companies having turnover more than 500 cr. have two options – one is “Direct API Access” and second is “API access through GSP”.

But companies having turnover between 100 cr. to 500 cr. have only one option i.e., “API access through GSP”.

So, registering your GSP for e-invoicing on the GSTN portal before you start the process through them is essential.

Let’s see how to establish connection with E-invoice system by selecting GSP

Registration on E-invoice portal

Firstly, to open or log in to the e-invoice system (https://einvoice1-trial.nic.in/), the user should have registered in the e-invoice system or e-Way Bill system.

There can be two possibilities when it comes to registration:

a) You are a user of E-way Bill System

b) You are not a user of the E-way Bill System.

NOTE: Kindly note that if a registered user GSTIN attempts to register again, then the system will show a popup message stating the GSTIN is already registered.

Read the full article here to understand the process in detail (Explained with step by step images):

Prominent features of IRIS Onyx:

- Real-time E-invoice with E-way Bill Generation

- Business and User Management Module

- Standard and Advanced Validations

- Upload Invoice at PAN and GSTIN level

- POB level operations

- Invoice Sharing and Archiving

- Alerts and Reminders – MIS and reports

- Customized Invoice Template with Bulk Print

For more details on E-invoicing Solution i.e. IRIS Onyx, you can check out our e-invoicing Solution (IRIS Onyx)

*******

IRIS GST is now on WhatApp!!

We are happy to announce that we are now on Whatsapp! You can get all the actionable communications right on time and right where the world is!

Subscribe to WhatsApp Communication! Click here

Please note, if you are checking this in your web browser from laptop /desktop, you need to be active on WhatsApp Web. The link would open in WhatsApp Web and you can complete the opt-in process.

If you face any issues while subscribing, do reach out to us at support@irisgst.com

Note: You can read all the latest GST updates on our IRIS GST BLOG. Get detailed articles, latest updates about GST circulars & notifications along with free E-books!

Sneak peek into IRIS Peridot’s latest features

E-Invoicing being a new GST compliance era, it’s time to equip yourself with IRIS Peridot’s latest version which is not just E-Invoicing ready but also offers diverse ways to search and save GST Info of any vendor /customer/counterparties etc.

Here is a list of what’s in store for you:

- Search GSTIN by Name & PAN

- Get Compliance Report of any business

- Create Watchlist

- Bookmark Notifications

- Complete GST Returns Summary

- QR Scanner

Upcoming Features:

- Voice Search any GSTIN

- Check if your vendors are generating

- e-invoices

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST.com

Validation Rules for E-invoicing

With the e-invoicing mandate going live on 1st January 2021 onwards, businesses have been occupied in automating their e-invoicing processes. Businesses with a turnover above Rs. 500 Cr. have been successfully generating IRN since October 2020 and now businesses with Rs. 100 Cr. and above have joined their league and are trying to go with the prescribed flow and rules for e-invoicing stated by the government.

However, the process of generating e-invoices is not a smooth ride for many. There have been several roadblocks and hurdles in generating IRN successfully – be it through the portal or via GSPs. The reason can be many; however one which is under your control is taking care of certain reporting aspects at business level and at the ERP system level for correct e-invoice generation. The data that is to be sent to NIC (Invoice Registration portal) is in a JSON (JavaScript Object Notation) format.

In layman terms, in JSON file the data is structured in such a way that each data point has a parameter name and a value for that data point is reported against such parameter name. Two data points are separated with a comma .For E.g.: a simple JSON for your understanding: {“DocDtls”: {“DocNo”: “1090”, “DocType”: “INV”}}

The actual e-invoicing json is more detailed than this and can have multiple structures. Each parameter can have different type of validation rules. The validations are categorized in 4 major buckets for better understanding.

(1) Schema Errors: A schema is usually defined to take care of basic errors in the Json as below:

- Mandatory Fields

- Field Specification Error

- Json Schema invalid

- Specific Values only allowed

(2) Master Code Errors: NIC has a list of master codes for various data points. In order to avoid these errors, you need to clean your masters in the ERP too so that while IRN generation no such error comes.

- HSN Code

- Pin Codes and Pin code State Mapping Pattern

- State Codes, UQC and Tax Rate

- Other Codes

- GSTIN of counterparty /Transporter

- Distance

(3) Validations with respect to Values reported: In e-invoicing schema as notified by the government there are many values that are to be reported and for some of those values there are validations added.

(4) Other Specific Errors: There are various other validations too.

GST Updates

Auto-population of e-invoice details into GSTR 1

The e-invoice mandate that went LIVE for certain class of taxpayers from 1st October 2020 paved way for this automation.

The first advisory about auto-population of e-invoice into GSTR 1 was issued on 13th November followed by second advisory issued on 30th November suggesting Government’s plan towards the same.

The auto-population for the month of October and November 2020 was expected to go LIVE from Nov 2020, however same got delayed due to some technical issues.

The first auto-population happened for December 2020 on 3rd December 2020 followed by October and November auto-population.

Auto-population of details from e-invoices into GSTR-1 is only a facility for the taxpayers and not final numbers from legal point of view.

After viewing the auto-populated data, the taxpayers need to verify the propriety and accuracy of the amounts and other data in each field, especially from the perspective of GSTR-1 and file the same, in the light of relevant legal provisions.

Auto-population of E-Invoice Data summarized in 7 questions:

- When will e-invoice data auto-populate?

- Which sections of GSTR1 will be auto-populated

- What is the reference date for auto-population?

- Can I edit/modify/update invoices once it has been auto-populated?

- What happens to the auto-populated details if I cancel the IRN?

- Can I add invoices in GSTR 1 even if it is not auto-populated?

- Which other forms will get auto-populated with e-invoice details?

Reasons why E-Invoice Data does not get auto-populated in GSTR 1

- Document Date

- Wrong Supplier Type

- Supplier is a Composition Taxpayer

- Document date is prior to Supplier’s/Recipient’s effective date of registration

- Document date is after Supplier’s/Recipient’s effective date of cancellation of registration

- Invoices reported as attracting “IGST on Intra-state supply” but without reverse charge

- Buyer GSTIN and Invoice Type not in Sync

- Export Without Payment and SEZ without Payment reported with Tax amounts

- Serial No is 0

- White Space in places where a specific master code list is to be followed

Download of all E-invoices

GST System is maintaining a complete set of e-invoices (in GSTR1 format) even if you discard the auto-populated data and save own data again. You can either download these e-invoices from GST Portal or you can get these auto-populated invoices from your GST compliance software.

IRIS offers an e-invoice platform-IRIS Onyx which is seamless, integrated and one-stop solution for all GST compliance. While from the portal, you need to login to every GSTIN for getting these details, IRIS Onyx gives option for bulk fetch of these e-invoices data for multiple GSTINs and multiple months.

Read the full article in detail with all the information in each of the sections:

HIGHLIGHT

IRIS Onyx- Success Stories

E-invoicing went live for taxpayers with a turnover of Rs. 100 crores from January 2021 onwards while it has been live for businesses with turnover of Rs. 500 crores since October 2020. We at IRIS GST have had the privilege to help multiple businesses and lead them on a journey to successful e-invoicing. Our e-invoicing solution – IRIS Onyx has proven to be a blessing for all our clients who managed to carry out the entire process of IRN generation smoothly. Our team has been dedicatedly helping clients with all their queries and has been conducting free webinars to spread awareness about the latest changes and extend support in the implementation of the e-invoice mandate.

Here are some testimonials by our clients:

“Thanks to IRIS Onyx, we were able to generate invoices with proper IRN and QR codes as per the GST E-invoicing guidelines right from our SAP production servers before our stipulated time. And it wouldn’t have been possible without the round-the-clock support provided by the IRIS team, thank you very much. We would also like to extend our special thanks to Beena and Milind, for making the process so swift and seamless. “

– Tejaswara Rao, L&T Valves

“I would like to thank team IRIS GST for their fantastic support in taking E-Invoicing live for us. It was all because of their efforts and hard work, we could generate IRN for all our sales invoices, seamlessly. And we are sure the team will be there for us for any issues we face, as I can already see the support we are getting for the ongoing issues. “

– Asish Thakur, Asst. Director – IT, Samsonite South Asia Pvt. Ltd.

Watch the video to understand how IRIS Onyx can help you with e-invoicing and a hassle-free integration without disrupting any of your business processes: IRIS Onyx Video

IRIS Onyx – has multiple options for Integration. It is a complete tool for a seamless e-invoicing process.

1. Data APIs – Send one invoice to IRIS Onyx at a time and get real time response.

2. Push File to SFTP – Push file and get IRN either through portal or file response.

3. Upload File APIs – Send CSV file containing one or multiple invoices through APIs.

4. Manual Upload – Use Onyx to upload the CSV file and generate IRN

UPDATES

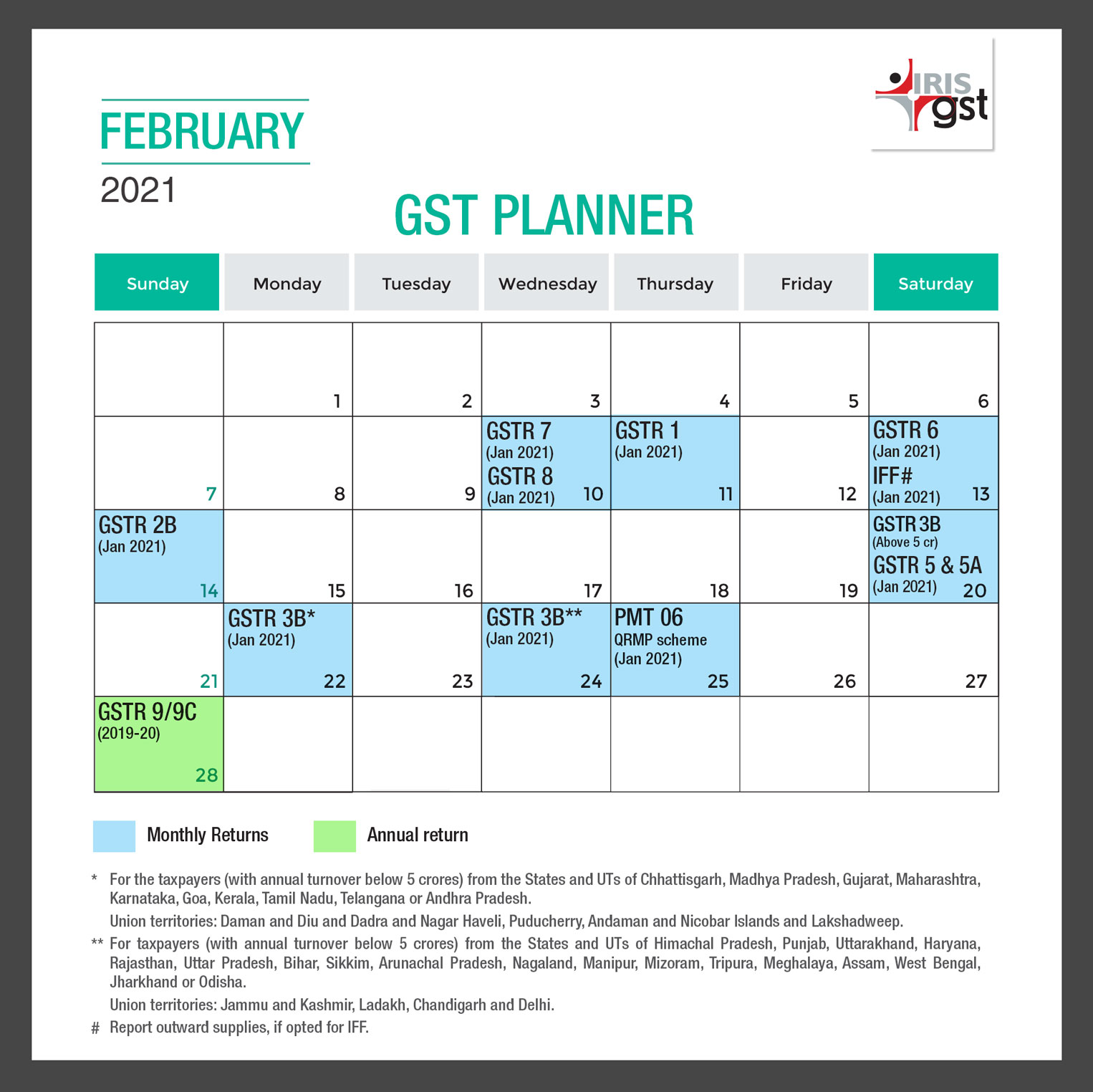

February 2021 – GST Compliance Calendar

Let us look at the GST Compliance Calendar for February 2021. Here is a comprehensive image of our GST Compliance Calendar for the upcoming month. It has all the GST Compliance Due-dates for February 2021.

Read the full blog to get a detailed info here: February Compliance Calendar

Top GST News of the month

GST laws are constantly being upgraded lately with new notifications and circulars.

After the successful implementation of e-invoicing mandate from 1st January 2021 onwards, there have been some major changes in the compliance arena too. We have compiled all the top GST news updates of January 2021 here for your reference.

To read the same, click here: Top GST News of the month

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment