IRIS GST TIMES

March, 2021

This issue

GST Rule Changes Applicable from April 1 —————————————————- P.1

Story Beyond Compliance – All About GST Data Factors to be considered while building credit models using GST Data ———————— P.2

IIRIS Credixo – Feature Highlight ———————————————————————— P.3

GST Compliance Calendar – April 2021; Top GST News of the Month ——– P.4

–

Chief Editor

Vaishali Dedhia

March – the month full of festivals is over and here begins April. It marks the beginning of the new financial year. The summer heat is all set to rise and businesses are gearing up to start afresh by winding up their old records.

On the GST front, there have been a few new updates and changes that businesses have to look out for. We have covered all the major details for your reference in this Newsletter.

In this issue, we’ll be covering GST Rule Changes Applicable from April 1, 202; An article on all about GST Data + Factors to be considered for building credit models using GST Data

And, we also share article about 2B or not 2B, 10 Checkpoints for ITC Claim. Here, we also our feature highlight of the month – IRIS Credixo- Data based lending solution.

Lastly, we share the link to our compliance calendar for April 2021 to help you stay compliant along with the Top GST News of the month.

Regards,

Team IRIS GST

E-invoicing for 50 CR. Club from April 1, 2021

The E-invoicing mandate is made applicable to all the companies having more than Rs. 50 Cr. turnover from 1st April, 2021 onwards. An invoice will be considered as a valid invoice for companies falling under the mandate only if it has IRN(Invoice Registration Number) on it. A summary of all the e-invoicing notifications released till date is as below:

08 March 2021: From 1st April 2021, entities having turnover above Rs. 50 Cr. are required to generate E-Invoice as per GST Notification 05/2021-Central Tax, dt. 08-03-2021. The sandbox testing for e-invoice portal was enabled for companies with turnover above Rs. 50 CR – Rs 100 Cr.

1st Jan 2021: E-Invoicing becomes mandatory for companies with Rs. 100 Cr and above turnover.

29 November 2020: Penalty for non compliance with QR Code on B2C transactions waived from 1st December 2021 till 31st March 2021 provided compliance with the said provision is adhered from 1st April 2021 – GST notification 89/2020-Central Tax,dt. 29-11-2020

10th Nov 2020: E-invoicing is mandatory for taxpayers having aggregate turnover above Rs. 100 Cr from 01st Jan 2021 | GST Notification 88/2020-Central Tax, dt.10-11-2020

2nd November 2020: E-Invoicing enabled on Sandbox environment for companies having turnover Rs 100 Cr and above.

1 October 2020: E-invoicing went LIVE for companies with Rs. 500 CR and above turnover. However, CBIC released another notification which gave some leverage to companies having teething issues. As per the notification, 30 days of time period was allowed to generate IRN for any invoice prepared between 01.10.2020 to 31.10.2020.

Read the full article here: E-invoicing for 50 CR. Club from April 1, 2021

2B or Not to 2B: 10 Check points to Maximize your ITC Claim

In Aug 2020, a new auto-drafted statement GSTR 2B was introduced with the objective of making ITC claim and computation easier.

GSTR 2B or GSTR 2A or Purchase Register: The Trinity of ITC Computation

ITC or Input Tax Credit is an important phenomenon for business as it gets set-off against the tax liability. The more ITC claim you have, the less cash you need to pay to settle your tax liability. Traditionally, ITC was computed on the basis of purchase register. However, same has changed ever since GST has been introduced.

- Role of GSTR 2A

- Role of GSTR 2B

- Role of Purchase Register

Checklist to maximize ITC claim:

- Check if the invoice is Valid

- Check if the QR Code is Valid

- Check if the Invoice appears in your GSTR 2A

- Check if the invoice also appears in GSTR 2B

- Check if you are following up for missing invoices

- Check whether ITC is eligible

- Check whether you can claim ITC

- Check if provisional ITC is within limits

- Check if ITC has already been claimed

- Check if vendor payment is done after 6 months

7 Benefits of e-invoicing in a post-pandemic world!

With the unfortunate advent of COVID-19, countries worldwide have felt the need and importance of paperless transactions- and India is no exception. It was fairly understood that going digital is the way to fast-track growth and invite success. And thus there couldn’t have been any other opportune time than this for the introduction of the e-invoice mandate.

Let us discuss the benefits of e-invoicing in this post COVID world.

- Reduce Tax Leakage and Fraud

- Save Time and Money

- Benefits to MSMEs

- Benefits to the Taxpayers

- E-way Bill and E-invoicing

- GST Data Based Lending

- Reduced Human Error and Enhanced Transparency

Read the full article here: 7 Benefits of e-invoicing in a post-pandemic world!

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST.com

GST Rule Changes Applicable from April 1, 2021

GST is a dynamic law. It has gone through several changes, alterations, and additions ever since its inception. It is a transformational change in the area of indirect taxation which has an overarching impact on the economy and all the businesses, irrespective of their size, turnover and operations. We as taxpayers, business owners, and tax consultants must be up-to-date with all the latest GST rule changes in order to make wise decisions for ourselves and our businesses.

Here is a list of GST rule changes that will be applicable from 1st April 2021

1. E-invoicing Mandate for 50 Cr.+ Turnover Companies: As per GST Notification 05/2021, e-invoicing is mandatory from 1st April 2021 for entities whose aggregate turnover exceeds Rs. 50 crore in any of the preceding financial years from 2017-18. Earlier, the e-invoicing mandate was made applicable to Rs. 500 crore+ turnover companies in October 2020 and later it was also made mandatory for Rs. 100 crore+ turnover companies from January 1, 2021.

Now, the government is also trying to bring in the smaller companies under the mandate considering the benefits of e-invoicing for MSMEs. The integration of E-invoicing system with the other existing regulatory systems viz. the GSTN and E-way Bill, overall the businesses will stand to benefit and the compliances should become an end-result of streamlined business processes.

2. HSN Code Mandatory: As per GST Notification 90/2020, taxpayers need to include the 8 digit HSN Code for specified products in their Tax Invoice. Earlier, the 8 digit HSN code was mandatory to be included in GST Invoice only for taxpayers with turnover above RS. 5 crore. However, as per the above-mentioned notification, the 8 digit HSN code is mandatory for all tax invoices (specified products) irrespective of the turnover. Notification 90/2020 amends Notification 12/2017 and correspondingly Notification 78/2020.

3. HSN Code in GSTR 1: From 1st April onwards, it will become mandatory to report minimum 4 digit or 6 digits of HSN Code in Table-12 of GSTR-1 and in Tax Invoice. From 1st April, 2021 the taxpayers need to provide HSN plus rate-wise taxable value and tax amounts in Table-12 of GSTR-1. All the tax invoices should consist of proper HSN Digits, detailed explanation of the products and correct tax rates for better transparency and to escape future litigations. Under section 125 of GST there is a fine for any mistakes related to GSTR-1. The no. of HSN Code to be reported will be on the basis of Aggregate Turnover on PAN in the preceding fiscal year. For companies with turnover Rs. 5 crore and above 6 digit HSN is mandatory while those below 5 cr need to have 4 digit HSN code.

GST Updates

The Story Beyond Compliance – All about GST Data

For a diverse country like India, introducing “One Tax” as a concept and as the law governing the entire nation hasn’t been a straight forward one.

Over the period, new compliances such as e-way bill and now e-invoicing under GST emerged. And every new compliance requires the industry to evaluate the current practices and upgrade their systems and processes. Having seen businesses having disparate and dated systems, heavily customized, and home-grown solutions, and not to forget the cost of overhauling; thus, migrating to new systems is often easier said than done.

Despite all the challenges faced by Government to develop a nationwide law and system, catering to taxpayers at various levels of preparedness; and by taxpayers to make their varied internal systems and practices work in sync, GST compliance had withstood the test of time.

Even if not 100% compliance, even if not always timely, GST as a data source is getting deeper, wider and richer.

- The length and breadth of GST Data

- Types of GST Data

- Publicly Available GST Data

- Proprietary i.e. GST Returns Data

- The Technology (API) effect

- Emerging Use Cases

- Some challenges to be addressed

- A bit of Crystal-gazing

Read the full article here: The story ‘beyond compliance’ – All about GST Data

IRIS Credixo (Data based Lending solution) stands at the intersection of Data and Lending Experience.

Factors to consider while building credit models using GST Data

Types of GST Data

Apart from the data filed in returns, which could be aggregate or even at the invoice level in certain taxpayers, select details of taxpayers such as their address, nature of operations etc. and their entire return filing history for all the taxpayers is available for public consumption. An overview of the data available in GST system

Publicly Available GST Data

The publicly available i.e. without taxpayers’ consent, a repository of GST data itself is quite rich. For any GST registered taxpayer, we can get basic taxpayer details such as its legal name, the constitution of business (whether proprietor, firm, company etc.), main location and additional locations from where the business operates and the full filing history of the taxpayers also is available.

An important point to note is that with GST, businesses had to opt for state-level registration. Thus a business entity (say having a PAN) could have more than one GSTINs registered in different states or even within the same state for different business verticals. The pattern of GSTIN has the PAN embedded and hence identifying GSTINs belonging to a PAN is no rocket science.

Read more:

FEATURE HIGHLIGHT

IRIS Credixo – GST Data-based Lending

GST as a data source has become deeper, wider and richer. Due to its real-time availability, authenticity and granularity, GST data is no longer considered as an alternate data source, but the main source for credit decision making and lending. GST Data is a reliable data source that we can bank upon.

Harnessing the benefits of GST data, IRIS Credixo, stands at the intersection of Data and Lending Experience. It allows lenders to grow volumes, stand out from the competition and gather meaningful customer data to provide seamless “lending in the box” credit experience and design tailored customer journeys.

Credixo offers a set of APIs covering publicly available GST data and consent based data filed in GST returns. Additionally pre-processed data sets, reports and insights are also available as enhanced data APIs which can quickly plug into any system. Banks, lending institutions and fin-techs can integrate these APIs in their credit models and provide faster and seamless lending experience to the MSMEs.

Why IRIS Credixo?

Credixo allows technology-driven credit scoring. The assessment models are driven by a massive volume of data from various disparate sources, compiled and analysed extensively with the help of algorithms to derive useful insights. The resulting credit score is then used by lenders to take decisions pertaining to the financing of loans such as assigning interest rates, quantum of loans, deciding on repayment terms, timelines, etc.

- Arrests increase in NPAs

- Creates robust credit appraisal process

- Monitors cash flows

- Measures borrower’s business

- Enhances ability to give loans

- Allows access to their suppliers

Create and define credit templates

- Annual filings with MCA

- Income Tax Return

Create and define credit templates

- Populate data in templates

- Early warning systems

Evaluate Vendors

- Check compliance

- Filing scorecard

UPDATES

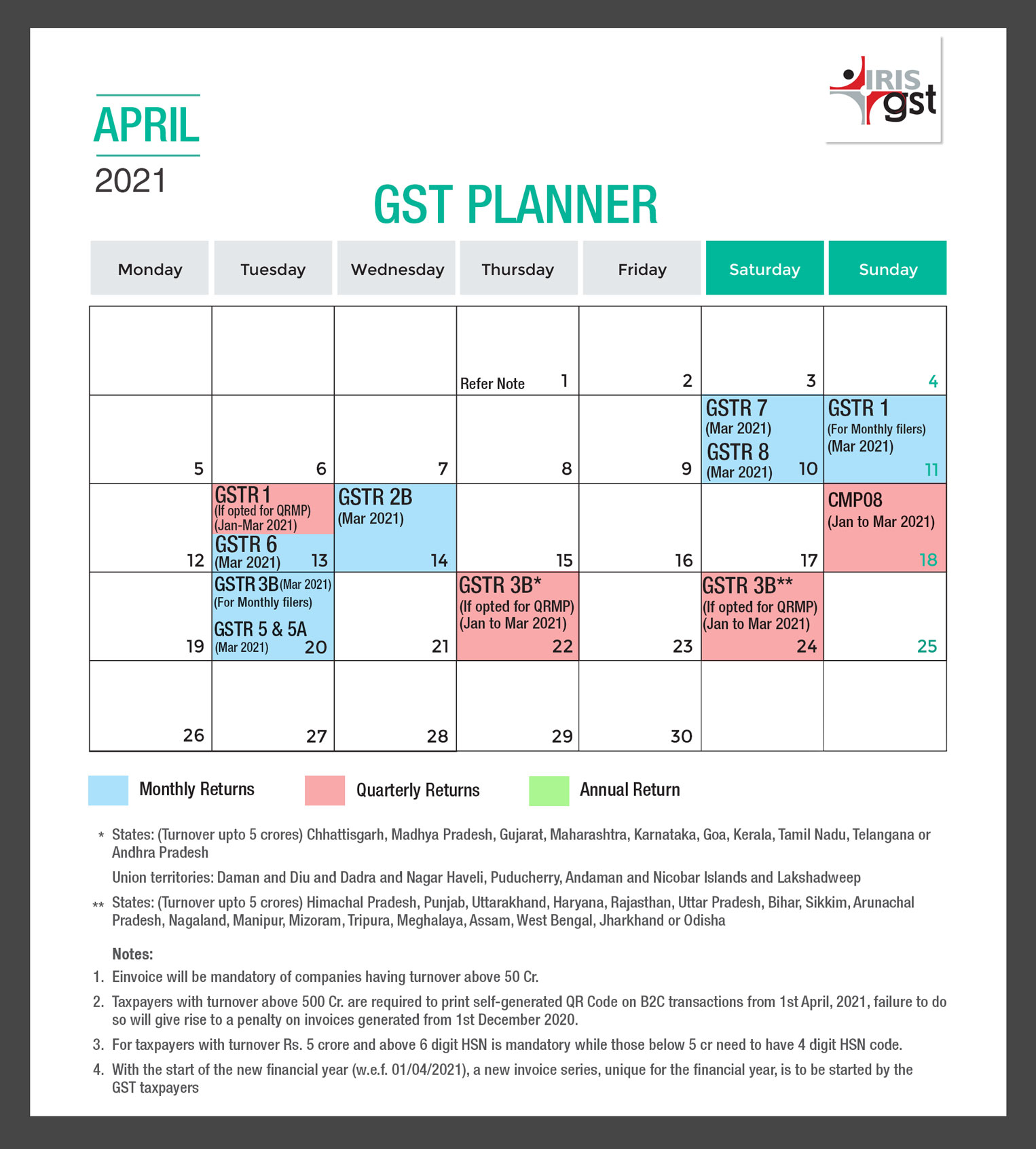

April 2021 – GST Compliance Calendar

Let us look at the GST Compliance Calendar for April 2021. Here is a comprehensive image of our GST Compliance Calendar for the upcoming month. It has all the GST Compliance Due-dates for April 2021 so that you never miss a due-date!

Read the full blog to get a detailed info here: GST Compliance Calendar April 2021

Top GST NEWS of the month!

GST laws are constantly being upgraded lately with new notifications and circulars.

New GST Rule Changes will be implemented from April 1, 2020. There have been a few changes in the compliance arena too. We have compiled all the top GST news updates of March 2021 here for your reference.

To read the same, click here: Top GST News of the month

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment