IRIS GST TIMES

June, 2021

This issue

44th GST Council Meeting Highlights ——————————————————– P.1

GST Amnesty Scheme ————— ———————— P.2

IRIS Sapphire —————————————————– P.3

GST Compliance Calendar- July and Top GST News of the month —— P.4

–

Chief Editor

Vaishali Dedhia

Completing the half yearly mark, let’s welcome July! Seems surreal that we have completed half of this year and 2022 is just 6 months away!!

July 1, 2021 is a very special day as GST came into effect on 1st July 2017. Thus, this day is not just celebrated as GST Day but also CA Day.

There were a lot of GST Changes and new updates in June. We have covered them all in this newsletter for your quick reference.

In this issue, we’ll be covering 44th GST Council Meeting Highlights and GST Amnesty Scheme updates in detail.

Along with that we also have two important articles about GSTR 9 and GSTR 9C.

And, we share details about the impact of e-invoicing on Nil-rated supplies reporting in GSTR 1. Here, we also cover our feature highlight – IRIS Sapphire and a supporting article stating how can a GST Software help you in your compliance journey.

Lastly, we share the link to our compliance calendar for July 2021 to help you stay compliant along sharing Top GST News of June 2021.

Regards,

Team IRIS GST

All about ITC | How to claim Input Tax Credit?

What is Input Tax Credit?

Input Tax Credit or ITC under GST is the credit back of the tax a registered GST taxpayer pays on inputs i.e. purchases. This tax he is liable to get back from the government.

For Example, A registered taxpayer has generated a sales invoice which has Rs. 500 as tax for the final product and collected the same from his final customer. Let us assume he has already paid a tax of Rs. 200 while purchasing the raw material. Now the supplier from whom he may have bought raw material will deposit Rs 200 to the government. Thus, this Rs 200 is the tax paid on the inputs which he can deduct from his liability on the final product. So, the taxpayer needs to pay tax only of Rs. 300 (i.e. Rs.500 – 200).

Who is eligible for Input Tax Credit (ITC)? As per Sec.16 of CGST Act, 2017, every registered taxpayer can avail input tax credit (ITC) under GST if he fulfils the criteria.

Read the full article to learn more about the following:

- Key Rules and Conditions governing ITC Computation and Reporting

- Rule 36 of CGST Rules 2017

- Input Tax Credit (ITC) on Reverse Charge

- Reversal of Input Tax Credit (ITC)

- How to claim ITC? – Availing of maximum ITC

- Advent of GSTR 2B

Read the full article here:

44th GST Council Meeting Highlights

The 44th GST Council Meeting was held on June 12th, 2021 via video conference by our finance minister Nirmala Sitharaman in New Delhi. The meeting was also attended by union minister of state (MoS) for finance Anurag Thakur and other finance ministers of states and Union territories (UTs). This meeting was held shortly after the 43rd GST council meeting to finalise the points proposed in it regarding GST rates reduction on medical and Covid-19 related equipments.

Now, let us understand the updates and highlights of the 44th GST Council Meeting here:

- The GST rates on COVID-19 related equipments has been reduced from 12% to 5%

- The GST rates on sanitizers and temperature checking instruments have been reduced to 5% from 18%

- The GST on vaccines will remain at 5%

- GST on ambulances reduced to 12 percent.

- The Centre will buy 75 percent of the vaccine as announced and will pay its GST. However, 70 percent of income will be shared with States.

GST Amnesty Scheme – Relaxations

The word ‘Amnesty’ means – grant an official pardon to. In the 43rd GST Council Meeting, the finance ministry brought out the GST Amnesty Scheme to provide relief to taxpayers regarding late fees for pending returns. It basically reduces the tax burden off taxpayers during the pandemic. This scheme is valid from June 1, 2021 to August 31, 2021.

In this scheme, the government has offered relief to the taxpayers in the following sections. Please have a look at them here:

Relief Information via GST Notification 19/2021: To provide relief to the taxpayers for not filing GSTR-3B, the late fee for the tax periods from July 2017 to April 2021 has been capped.

Relaxation Applicable from 1st June, 2021 onwards:

1. Relaxation in Late fees for Return Filings of GSTR 3B and GSTR 1

2. Relaxation in Late fees for filing GSTR 4

3. Relaxation for availing Input Tax Credit under GST

4. Relaxation in Late fees for filing GSTR 7

GST Updates

GSTR 9 Annual Return Form: Parts and Sub-sections Explained

Simplification of Annual Return for Financial Year 2020-21

Following changes to apply for the filing of annual return GSTR 9 for the FY 20-21 stated in 43rd GST Council Meeting.

- Optional GSTR 9 Filing for Micro Taxpayers – Filing of annual return in GSTR-9 / 9A for FY 2020-21 to be made optional for taxpayers having aggregate annual turnover up to Rs 2 Crore

- The reconciliation statement in GSTR- 9C for FY 2020-21 will be required to be filed by taxpayers with annual aggregate turnover above Rs 5 Crore

- Taxpayers would be able to self- certify the reconciliation statement in GSTR 9C, instead of getting it certified by chartered accountants. This change will apply for Annual Return for FY 2020-21. Amendments in sections 35 and 44 of CGST Act made through Finance Act, 2021 to be notified soon. This would ease the compliance requirement in furnishing reconciliation statements in GSTR-9C.

In our previous article, we have covered all about annual returns and their different form types that need to be filed by different entities. Now let us focus on GSTR-9 Annual Return Form.

GSTR 9 Annual Return Form Filing: GSTR-9 is an annual return form that needs to be filed once a year by registered taxpayers under GST disclosing a detailed summary of outward supply and taxes paid thereon, input tax credits claimed, taxes paid, and refund claimed in the financial year in respect of which such annual return is filed. Read more.

Also read all our other articles about GSTR 9 – here:

10 Step Guide to Outward Supply: Table 4 and 5 of Form GSTR-9 Explained

Inward Supplies and ITC in GSTR 9: Table 6 Explained

How to Fill ITC Reversal details in GSTR 9: Table 7 Explained

Credit Availed and IGST paid in GSTR 9 – Table 8 Explained

A Complete Guide to Preparing GSTR 9C: Explained Table- wise

GSTR 9C is an annual audit form for all the taxpayers having the turnover above 2 crores in a particular financial year. GSTR 9C form has a reconciliation statement for reconciling turnover, input tax credits and tax payments. Let’s understand its scope:

- It is GST annual audit Form

- And it also includes reconciliation statement for reconciling turnover, input tax credits and tax payments.

- It should be Certified by CA/CMA

- Auditor will report all discrepancies or liabilities found in any of the GST returns

- Auditor will also mention the reasons of discrepancies found

- And it must be digitally signed by the GST Auditor

Note: In a situation where a registered person files only GSTR 9, but fails to file GSTR 9C, the filing of GSTR 9C is not considered to have been defaulted. However, For GSTR 9C there may be consequences of default in complying with the provisions of Section 44(2).

Sections of GSTR 9C:

Part A divided into 5 sections:

- Part I : Basic details

- Part-II : Reconciliation of turnover declared in the Audited Annual Financial Statement with turnover declared in Annual Return (GSTR-9)

- Part-III : Reconciliation of tax paid

- Part-IV : Reconciliation of Input Tax Credit (ITC)

- Part-V : Auditor’s recommendation on additional Liability due to non- reconciliation

Part B Details:

It is about GST auditor need to provide certification based on audits.

How can a GST Software simplify your compliance needs:

GST compliance requires reporting multiple invoices, reconciliation of invoices for maximizing ITC claim, e- invoicing, and various other things that taxpayers need to take care of. For large and mid- size businesses, there are hundreds and even thousands of invoices that are generated every month. Considering these complexities, managing the GST Compliance process manually could be inefficient, time- consuming, and error-prone. At the same time, taxpayers also need to cope with constant changes in GST law and compliances.

However, the GST implementation in India has also opened up possibilities for use of technology that can streamline process for all the tasks involved in GST compliance.

Thus a secure and comprehensive GST filing software is necessary to ease the course not just for filing the return but also to acquire data, reconcile, and for ITC claim among other things.

Here’s how a GST software can simplify your GST Compliance:

- Ensure correctness and enable automation for recording invoices

- Make Reconciliation and ITC computation Process Efficient

- Seamlessly interact with GST Portal

- Integrate with one or many source systems

- Manage and monitor GST compliance all under one roof

- Cloud-based GST Compliance Software

FEATURE HIGHLIGHT

IRIS Sapphire – A Complete GST Solution

The ever changing nature of GST often leads to creating challenges for businesses and taxpayers who find themselves amidst a fix with every law change and every new GST update.

Manually filing GST Return or using a half-baked GST Software can only add to the chaos. Businesses need a complete GST Solution that not just files their GST Return but also help in matching ITC, faster reconciliation, vendor management, bulk download and so on!

IRIS GST has been successfully helping the businesses with its most trusted product – IRIS Sapphire! It is a Cloud based GST software that helps your team to collaborate on GST Return filing, GST Reconciliation and ITC maximization.

At IRIS, our GST Experts have been helping taxpayers to understand the latest GST Changes and get ITC maximization via free webinars. Also, our team has been supporting our clients with their GST Compliance, making it a smooth and time-saving affair. Have a look at what our clients have to say about our support team…

“We have been using IRIS Sapphire for a while now. Quite happy with the ease it brings in our ITC reconciliations and monthly compliances, it helps us focus on other crucial aspects of our business. Chellamuthu, our Customer Service Manager, is prompt and available 24*7! Cheers to the team IRIS.”

– Mr. Ashish Kulkarni, Manager (Finance), Kirloskar Chillers Private Limited

“When we first started with GSTR 9 preparation, it seemed a herculean task. The monthly 3Bs did not match with 2As and vendor communication was tough to handle. Yet, with IRIS Sapphire and the team’s support, things started to fall into place. With features like bulk download, PAN view of invoices, advanced reconciliation logic like match across financial years, fuzzy logic etc, GSTR 9 preparation became as easy as it could be. My recommendation goes with IRISGST for anything GST!”

– Ms. Sudha Parthasarathi, Director & Co-Founder, Cytopro Consumer Goods Pvt Ltd

In times like these when the pandemic has taken over the world affecting businesses across all spectrums, achieving maximum and accurate ITC is the need of the hour. Though challenging, a 100% ITC claim is manageable with the use of correct strategies and solutions. Knowing your vendor network is important for 100% ITC claim, one cannot deny the importance of technology when it comes to GST reconciliation.

With IRIS Sapphire, the preferred GST Solution of top organizations across the country, GST Reconciliation can be easier than you think.

Try us! Book a free demo here: http://bit.ly/ISapphire

A Fun Quiz for GST Day!

To commemorate the 4th anniversary of GST Law, team IRIS GST has organized a fun GST Quiz. The quiz consists of 10 simple yet insightful GST questions. Top 3 participants will be selected and will be given Amazon Vouchers worth Rs. 500/- each!

Contest Rules:

– Follow IRISGST on following social media:

– Share the quiz with your friends and family

– Tag IRISGST on social media with each share

We are getting an overwhelming response to the quiz

You can participate here:

https://bit.ly/2Uec6LU

Don’t forget to Follow, Tag and Share IRISGST on social media –

Search IRISGST on Twitter,

F.B. and Linkedin, Follow,Tag, share

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

UPDATES

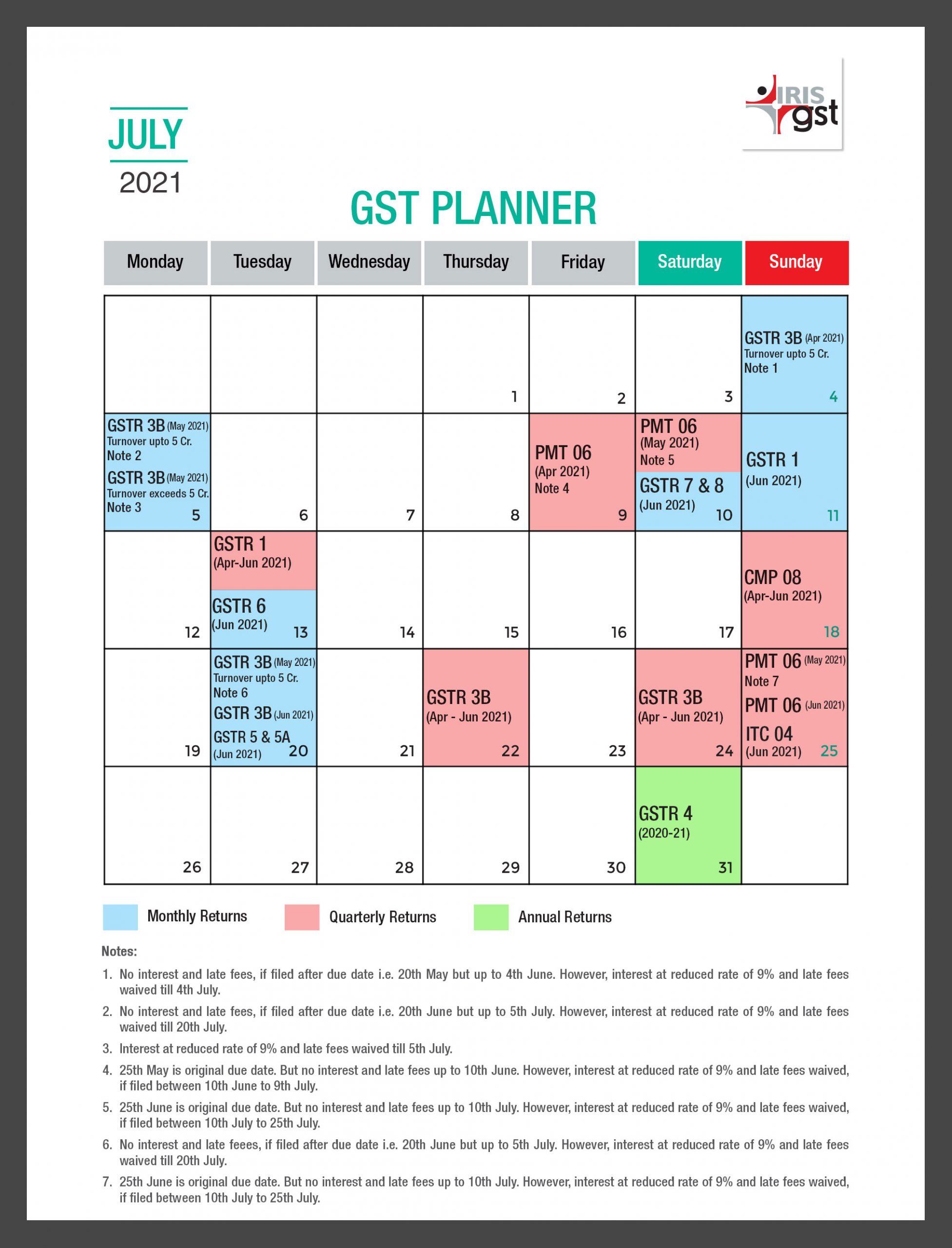

July Compliance Calendar 2021

Let us look at the GST Compliance Calendar July 2021. Here is a comprehensive image of our July Compliance Calendar 2021, also read our detailed blog about the same. You can Download and pin it for your quick reference.

Top GST NEWS of the month!

There have been a few new changes, additions, and GST updates in the month of June 2021. Here we have compiled them together for your quick reference.

In the article we have covered the following categories:

- Important notifications released in the month

- Important circulars released in the month

- GST Collection of the month

- GST Rate Changes Announced in 44th GST Council Meeting

- GST Compliance Updates and Latest GST Changes and News

Read the full article here: Top GST News of the month – june 2021

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment