In our previous article, we covered all about annual returns and their different form types that need to be filed by different entities. Now let us focus on GSTR-9 Annual Return Form.

GSTR 9 Annual Return Form Filing

GSTR-9 is an annual return form that needs to be filed once a year by registered taxpayers under GST disclosing a detailed summary of outward supply and taxes paid thereon, input tax credits claimed, taxes paid, and refund claimed in the financial year in respect of which such annual return is filed.

Who needs to file GSTR-9?

Registered Regular taxpayers under GST who file GSTR-1 and GSTR-3 are liable to file GSTR-9 Annual Return Form.

What does GSTR-9 Annual Return form consist of?

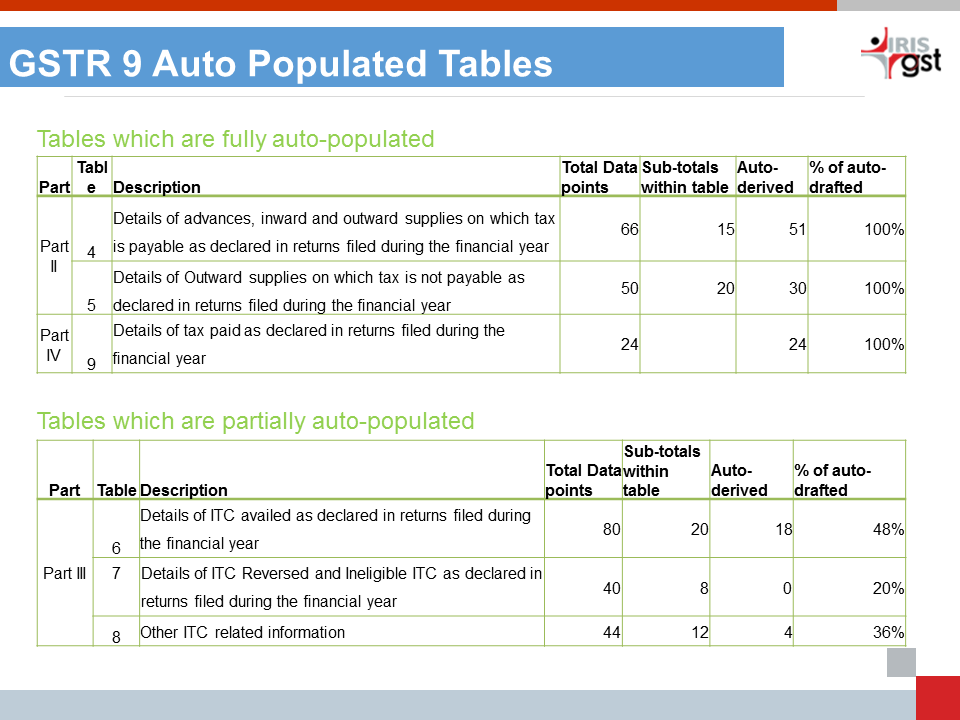

The GSTR-9 return form consists of 19 tables grouped into 6 parts. the 6 parts can be broken down as follows:

- Part 1:It covers the basic details such as financial year, GSTIN, legal name, and trade name (if any).

- Part 2: In this section, you need to provide consolidated details of all your outward supplies and advances received on which tax is applicable during the financial year for which the return is filed. You also need to fill details of outward supplies on which tax is not applicable as mentioned in the returns filed during the respective financial year.

- Part 3:The tables under Part 3 deal with the Input Tax Credit (ITC) details, which is divided further into 3 subsections as follows:

- 1st Sub-Section: In the first sub-section, you have to mention the details of ITC availed as declared in returns filed during the financial year. The mentioned details can be obtained from FORM GSTR-3B.

- 2nd Sub-Section: In the second sub-section, you have to provide details of ITC reversed and ineligible ITC as declared in return filed during the financial year.

- 3rd Sub-Section: The third sub-section asks for details of other ITC details, which is auto-populated.

- Part 4 of GSTR 9:It covers details of actual tax paid during the financial year.

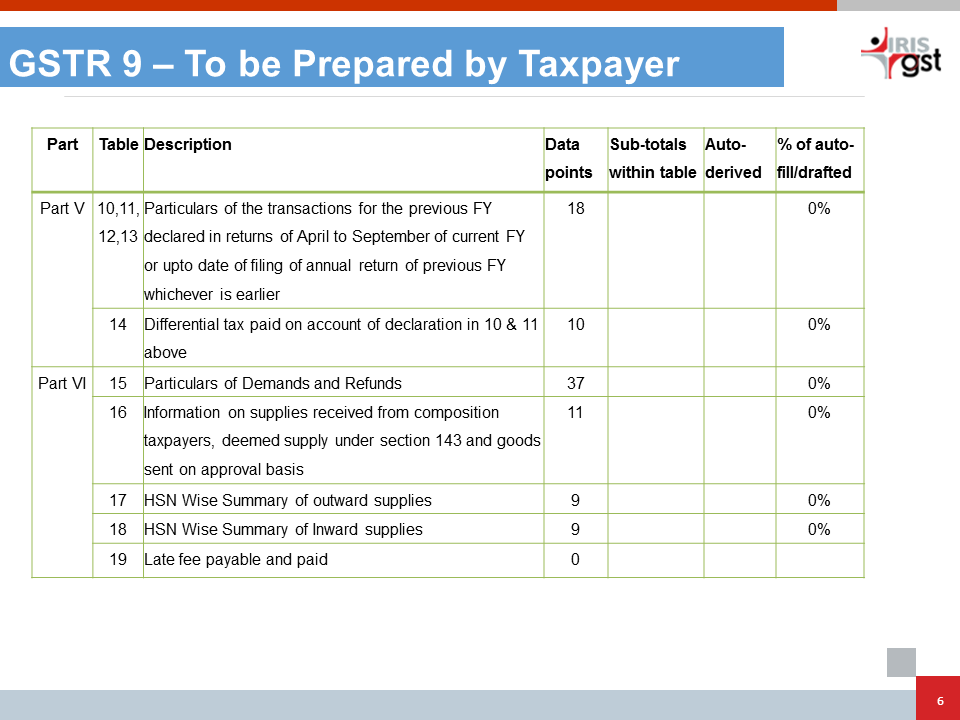

- Part 5 0f GSTR9: You have to disclose details of amendments made i.e. additions or deductions made for the supplies of the previous financial year in the returns of April to September of the current financial year or the date of filing of an annual return for the previous financial year, whichever is earlier.

- Part 6 of GSTR9:In this part, you have to provide information of any refund, demand, supplies received from composition taxpayer, deemed supply and good send of approval basis, HSN wise summary of outward and inward supplies and if any late fee payable or paid.

GST Annual Return GSTR 9 is quite an elaborate return and consolidates all the details and transactions of the financial year. As businesses have been filing monthly and quarterly GST returns, some of the sections of GSTR 9 hence can be directly derived from the previously filed GST returns.

Simplification of Annual Return since FY 2020-21

With the 43rd GST Council Meeting following changes were introduced to the annual return filing of Form GSTR 9:

- Optional GSTR 9 Filing for Micro Taxpayers: Filing of annual return in GSTR-9 / 9A for FY 2020-21 and henceforth was made optional for taxpayers having aggregate annual turnover up to Rs 2 Crore

- GSTR 9C for Taxpayers with AATO Rs 5 Cr+: The reconciliation statement in GSTR-9C for FY 2020-21 and henceforth are required to be filed by taxpayers with annual aggregate turnover above Rs 5 Crore.

- Self Certification of GSTR 9C: Taxpayers can now self-certify the reconciliation statement in GSTR 9C, instead of getting it certified by chartered accountants. This change applies for annual returns from FY 2020-21. Amendments in sections 35 and 44 of CGST Act were made through Finance Act, 2021. This eased the compliance requirement in furnishing reconciliation statements in GSTR-9C.

How IRIS GST Software can make GSTR 9 Filing Simpler?

IRIS GST Software helps you to automate your GSTR 9 preparation and simplify computation at various levels. It provides computation details auto-drafted in the GSTR 9 form. Using the GSTR 1, 3B and Ledgers data uploaded, it computes the tables that get available in auto-populated GSTR 9. This enables you to verify and reconcile with the auto-drafted details.

It gives a section-wise view of GSTR 9 with auto-drafted details and uploaded details. This makes the review process easier and more efficient. This enables complete as well as incremental saving of data.

IRIS GST Software helps you bulk fetch GSTR 9 auto-drafted details and also provides reports based on GST Returns data and reconciliation results. This puts your GSTR 9 preparation on fast-track mode and supplements the data preparation process for additional sections of the GSTR 9 Annual Return Form.

Ultimately, after spending many hours on the internet at last we’ve uncovered somebody that surely does know what they are. Thank you for sharing wonderful article. Great post. I will be your regular visitor.

OMITTED PURCHASE INVOICES FOR THE YEAR 2018-19 WERE ACCOUNTED IN 2019-20 AND SHOWED IN 2019-20 3B AND ITC ALSO TAKEN IN 2019-20. IN WHICH TABLE I WANT TO THE SAME IN 2019-20 ANNUAL RETURN?

Report the same in table 8C of GSTR 9