Peridot Help

Introduction

IRIS Peridot is a handy and easy to use mobile app for verifying GSTIN, getting the filing history, verifying QR code and bundled with a lot other features. Some features are accessible only for signed in users.

| Features | Unregistered / Signed Out | Signed In |

| Scan and verify GSTIN | ✔ | ✔ |

| Compliance Status for all taxpayer types | ✔ | ✔ |

| View Returns Filed | Main Returns | Main and Additional Returns |

| Search by Name | ✔ | |

| Search by PAN | ✔ | |

| Compliance Report of any Business | ✔ | |

| Scan and verify QR Code | ✔ | |

| Create Watchlist | ✔ | |

| Manage Notifications | ✔ |

Compliance Module

The first step to view insights and reports using your GST Data in IRIS Peridot is to enable APIs so that we can connect to the GST System for you. Once access is enabled you can start session with OTP anytime. And for better security reasons Peridot requests Consent to Get your GST Data.

Verify and Search a GSTINSearch

GST Identification number or GSTIN is a 15-character unique number provided by GSTN to every registered taxpayer. IRIS Peridot verifies GSTIN with GST System and on successful verification, the details and filing status are displayed. In case GSTIN is not a valid GSTIN as per GST Records “Invalid GSTIN” error message is shown.

GSTIN search can be done in three different ways with IRIS Peridot

a. Scan/Type GSTIN

b. By Name

c. By PAN

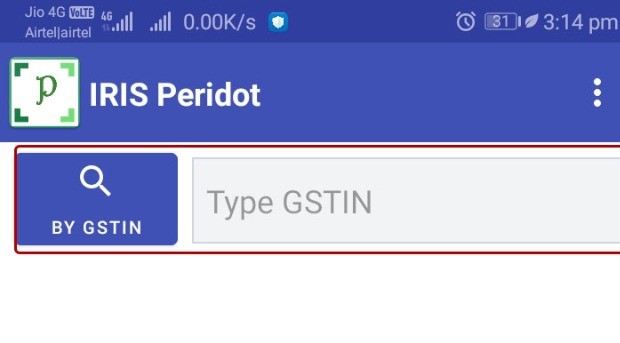

a.Scan/Type GSTIN

User can either type or scan any GSTIN

Find me here:

Type GSTIN

Scan GSTIN –

Access: All users irrespective of Signed In or not can use this functionality

Scan the surface which could have the GSTIN printed. IRIS Peridot analyses the text to identify the GSTINs and once identified, the same gets checked with GST system. Additionally, you can also type a GSTIN and get the details in the app.

In case of unsuccessful scan it gives message “Unable to Scan” and user accordingly can continue or exit

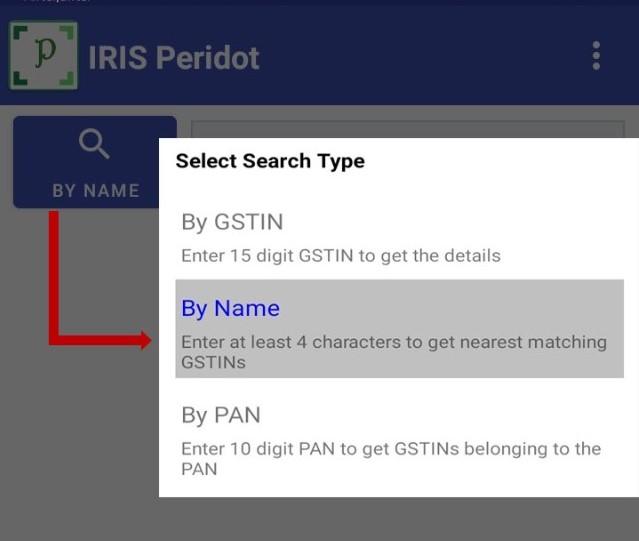

b.By Name

Find me here: Click of Search icon on the Home screen

Select Search By Name

Access: Only Signed In Users will be able to search GSTIN by Name

Explore Search by Name:

-

- At least 4 characters required to initiate Name Search

- Names having only these special characters .&() will be searched

- Names with other than restricted special characters will not be searched

- Numericals are accepted in Name

- Search will occur on Trade and/or Legal Name

- Result will include GSTIN, Trade name and State. If trade name is not available in the records then legal name to be displayed.

- Click on the record view GSTIN details and return back to name search result view

- Search results can be filtered on the basis of state

- In case Name mentioned in search criteria is not found and error message is displayed

Note: Both PAN and Name search results are restricted to IRIS Peridot DB

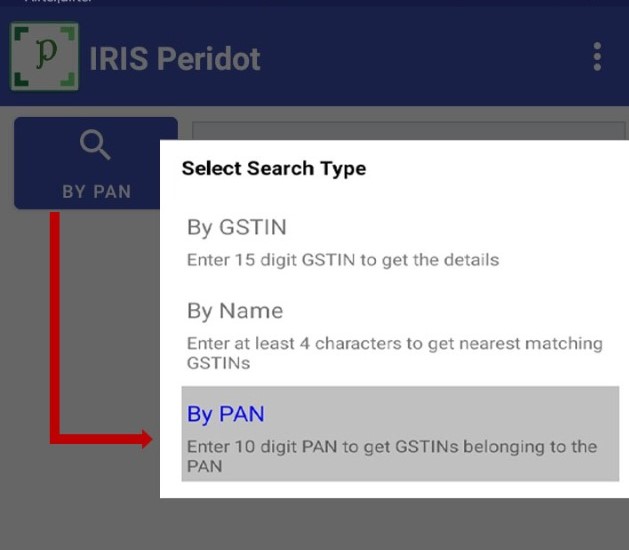

c. By PAN

Find me here:

Click on Search icon on the Home screen

Select Search by PAN

Access: Only Signed In Users will be able to search GSTIN by PAN

Explore Search by Name:

-

- Search will initiate once a 10 digit PAN with valid Regex is added

- Result will include GSTIN, Trade name and State. If trade name is not available in the records then legal name to be displayed.

- Click on the record view GSTIN details and return back to name search result view

- Search results can be filtered on the basis of State

- In case of no records found. It states “No records found”

- In case of Invalid PAN it gives error message is given

Note: Both PAN and Name search results are from our Peridot DB

GSTIN Details

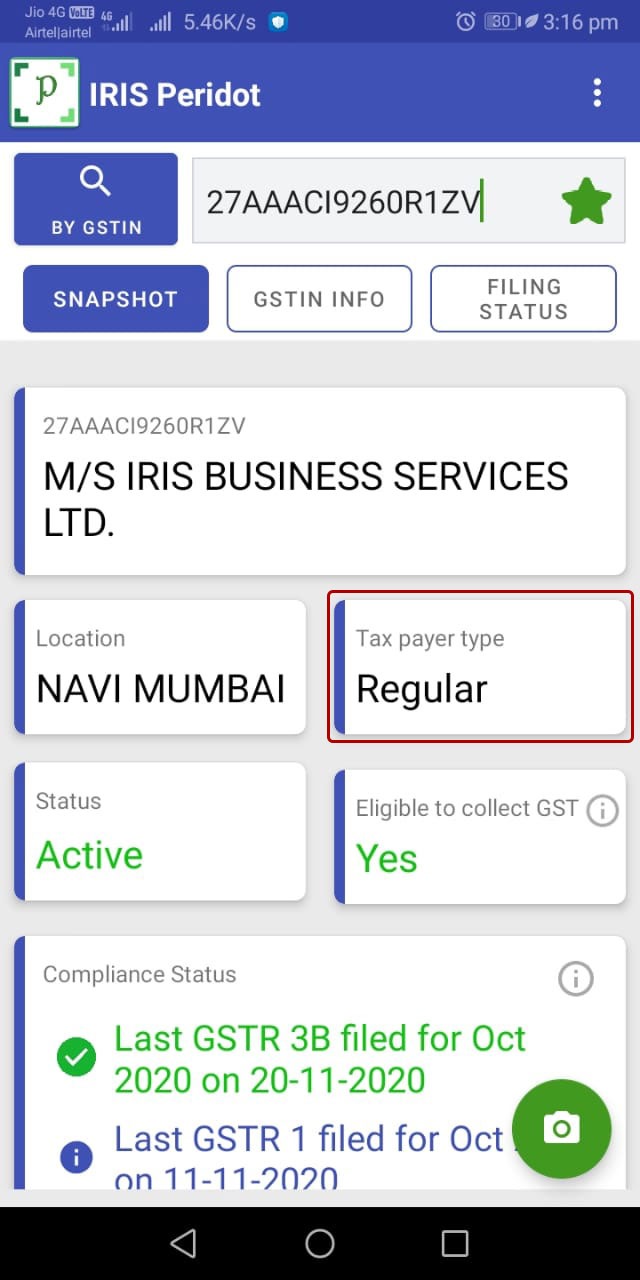

a. GSTIN Snapshot

Taxpayer type and Eligible to collect GST

Where do you find me: Snapshot page of any GSTIN Search Result

Access: This information is available irrespective of user being Signed In or not

Kindly note where Eligibility to collect GST is determined using two parameters

- Registration Status

- Taxpayer type

In case where registration status is cancelled in that case eligibility to collect GST will always be “No” but where registration status is active in that case eligibility will be based on Taxpayer type

| Taxpayer type | Description |

|

i) Regular Eligible to collect GST – Yes

|

Businesses who are supplying goods and services, are registered with GSTN. A regular taxpayer is liable to collect GST on supplies and deposit the same with Government after claiming input tax credit on purchase of goods and services |

|

ii)Composition Eligible to collect GST – No |

This scheme is for businesses having revenue below a threshold (currently set as ₹ 1.5 cr.) Taxpayers who have opted for this scheme are not allowed to collect taxes from consumers on any supplies made by them However, Composition taxpayer has to pay GST at specific rate on outward supplies and cannot claim Input tax credit on purchase of goods and services |

|

iii) SEZ Developer Eligible to collect GST – Yes |

As per the SPECIAL ECONOMIC ZONES ACT, 2005, SEZ Developer means a person who, or a State Government which, has been granted by the Central Government a letter of approval under sub-section (10) of section 3 and includes an Authority and a Co-Developer (the Developer or Co-Developer shall have at least twenty-six percent of the equity in the entity) to create business, residential or recreational facilities in a Special Economic Zone in case such development is proposed to be carried out through a separate entity or a special purpose vehicle being a company formed and registered under the Companies Act, 1956 (1 of 1956). A SEZ Developer is liable to collect only IGST on supplies. Further, Purchases by SEZ are considered as zero-rated supply. |

|

iv) SEZ Unit Eligible to collect GST – Yes |

Special Economic Units are dedicated geographical regions present in a country, providing businesses with simpler tax and legal compliance. In a manner of saying,SEZ Unit can be considered as a Trade Capacity Development tool, which has been established bring in the economic growth in the nation. The SEZ Units are deemed as foreign territory for trading operations and taxation purposes, i.e. any goods or services supplied to the SEZ Units shall be treated as Zero-Rated supply Conversely, any supply made from the SEZ Units shall be treated as a normal supply and normal GST rates, as applicable, may apply on such transactions. A SEZ Unit is liable to collect only IGST on supplies. Further, purchases by SEZ are considered as zero-rated supply. |

|

v) Casual Eligible to collect GST – Yes |

Casual taxable person means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business. A casual taxable person (other than those making supply of specified handicraft goods) making taxable supply in India has to compulsorily take registration. There is no threshold limit for registration A casual tax person is not required to file an annual return as required by a normally registered taxpayer. However, has to file GSTR 1 and 3B. And is eligible to collect GST and claim ITC |

|

vi) ISD Eligible to collect GST – N/A |

An Input service distributor is a business which receives invoices for goods or/ and services used by its branches. Also it distributes the tax paid, to such branches on a proportional basis by issuing an ISD invoice ISD cannot collect GST and can only distribute ITC |

|

vii) TDS Eligible to collect GST – N/A |

As per the GST law, certain categories of registered persons will be required to deduct taxes while making payments to suppliers and deposit it with the government. These taxpayers called as TDS Deductor The Government may order the following persons as the deductor to deduct tax at source: |

|

viii) TCS Eligible to collect GST – N/A |

Under GST, E Commerce Operator shall include every person who directly or indirectly owns, operates or manages an electronic platform that is engaged in facilitating the supply of any goods and/or servicesE-commerce operators are responsible to collect and deposit GST @ 1% for any transaction by any dealers/traders selling goods/services through E-Commerce platform |

|

ix) Non Resident Taxable Person Eligible to collect GST – Yes

|

Non Resident Taxable Person is a taxable person who resides outside India But is coming to India occasionally to undertake transaction however has no fixed place of business in India Non Resident Taxable Person is eligible to collect tax and claim credit of ITC.However, is required to make an advance deposit of tax in an amount equivalent to the estimated tax liability of such person for the period for which registration is sought |

|

x) OIDAR Eligible to collect GST – Yes |

The IGST Act defines OIDAR to mean services whose delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention and impossible to ensure in the absence of information technology and includes electronic services such as, –– (i) advertising on the internet; (ii) providing cloud services; (iii) provision of e-books, movie, music, software and other intangibles through telecommunication networks or internet; (iv) providing data or information, retrievable or otherwise, to any person in electronic form through a computer network; (v) online supplies of digital content (movies, television shows, music and the like); (vi) digital data storage; and (vii) online gaming; |

|

xi) Consulate /Embassy Eligible to collect GST – No |

|

|

xii) UN Body Eligible to collect GST – NA |

|

|

xiii) Other Notified Eligible to collect GST – NA |

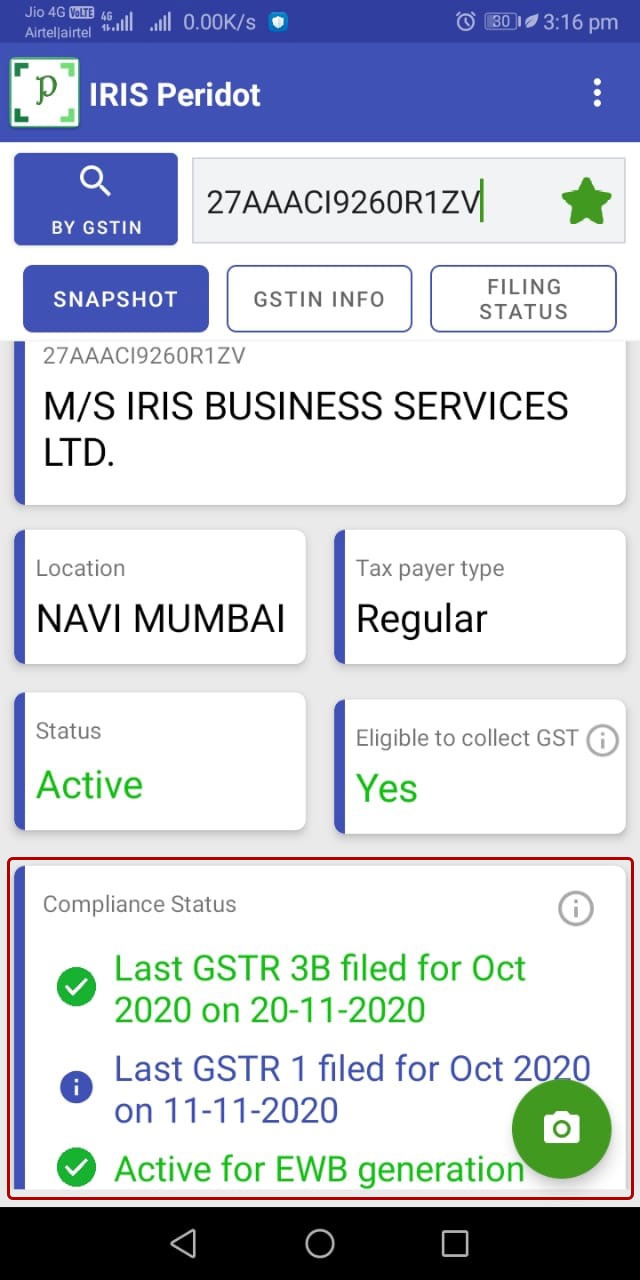

b. Compliance Status

Displays the last returns filed and Status for e-way bill generation

Where do you find me: Snapshot page of any GSTIN Search Result

Access: This utility is provided both the user types irrespective of Sign In status

- Last returns filed

For regular taxpayers, last filing done for GSTR 1, GSTR 3B and status of E Way Bill is displayed. GSTR 3B being a monthly return which is to be sequentially filed, the colour coding indicates the gap in filing tax periods as on the day.

For Composition taxpayers, last filing done for GSTR 4 (upto tax period March 2019) or CMP 08, whichever available is displayed

For other taxpayer types Main returns are displayed

Note: In order to compute the last filing period, due date is assumed to be 25th of following month for GSTR 3B. Since, computation of actual due date requires some user specific details

2. E-way Bill Generation Status

As per Rule 138E, E-Way Bill generation is blocked if the taxpayer has not filed GST returns for two consecutive months. The due date for GST returns is based on turnover and this information is not publicly available. Under exceptional circumstances the due dates get extended for particular states and for a specific category of taxpayers. The waiver of late fees at times given to taxpayers could also result in late filing by the taxpayer and need not be intentional Non compliance by the taxpayer. Considering the dynamic and interpretational cases and lack of complete availability of information IRIS Peridot displays EWB Block status on certain assumptions.

Note: GSTIN Search is dependent on our caching policy. To know more ..

c. GSTIN Info

Displays the tax payer details registered / available with GSTN System. Theses details are obtained using Taxpayer search API

| Description | Example |

| GSTN status | Active |

| Trade Name of Business | ABC Ltd. |

| Legal Name of Business | ABC Private Limited |

| Constitution of Business | Company |

| Date of Registration | 01-07-2017 |

| Taxpayer type | Regular |

| Nature of Business Activity | Examples – [“Bonded Warehouse”, “Factory / Manufacturing”, “Input Service Distributor (ISD)”, “Office / Sale Office” ] |

| State Jurisdiction | Panaji |

| Center Jurisdiction | Range-V |

| Date Of Cancellation | (will be provided where GST registration is cancelled) |

| Last Updated Date | 01-06-2018 |

Information on Principal and Additional place of businesses

| Description | Example |

| Building Name | Infotech Park |

| Street | Mahavir Road |

| Location | Talegao |

| Door Number | T131 |

| State Name | Goa |

| Floor | 3rd Floor |

| Pin Code | 400705 |

| Nature of Place of business (Additional/Principal) | Wholesale Business |

Note: GSTIN Info is dependent on our caching policy. To Know more …

Return filing Status

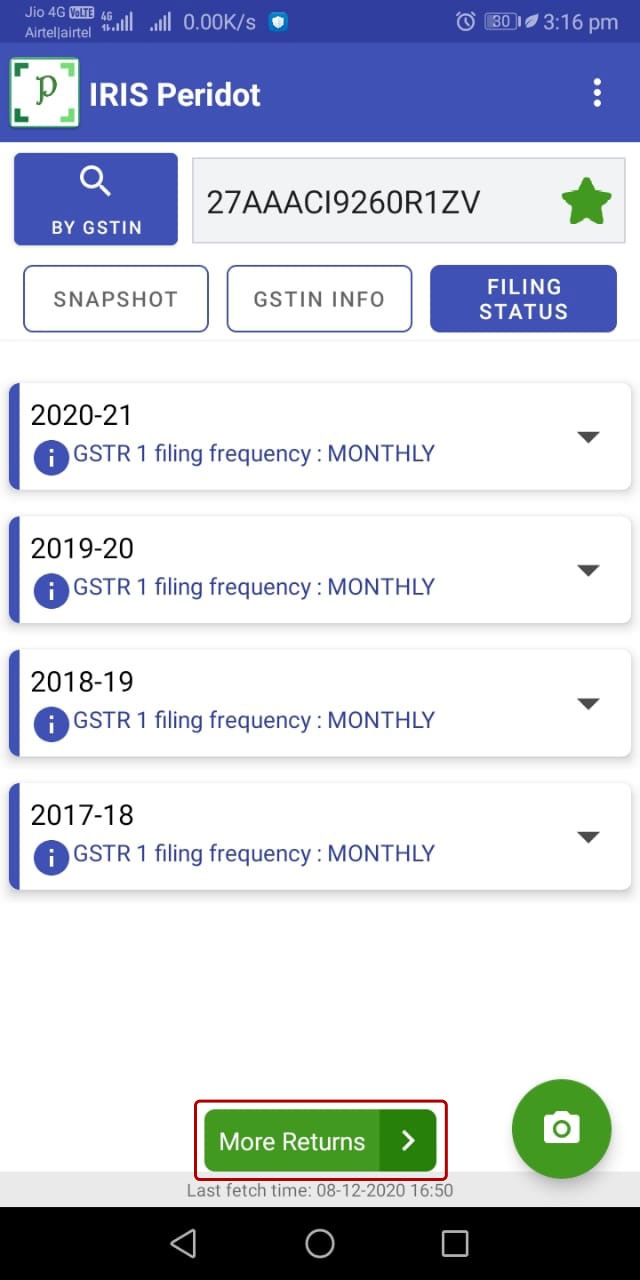

3. Return filing Status

Return filing status provides list of all the returns filed by the Valid GSTIN from the date of Registration.Return filing details of all the taxpayer types is displayed here .

So for all the returns filed are classified into Main and More Returns

Main Returns pertains to returns which are filed at fixed frequency on regular basis And More returns, are returns that are required to be filed either on account of transactions undertaken or are annual returns

Access: Main returns view is available to all the users irrespective of Signing Status However, Only Signed users can view More Returns

Below is the list of Main and More Returns

Returns are based on taxpayer type

For every taxpayer there will be Main returns, upto 2. All returns other than Main returns will be More returns

i) Main Returns

| Taxpayer type | Description |

|

i) Regular / SEZ / Casual taxable Person Return type: GSTR-1 Frequency: Monthly/Quarterly |

Return of outward supplies for Regular, SEZ Unit, SEZ Developer and Casual Taxable Person Taxpayers with turnover upto ₹ 1.5 Cr. Have an option to file GSTR 1 on quarterly basis. Taxpayers with turnover above ₹ 1.5 Cr. Have to file GSTR 1 on monthly basis. |

|

ii) Regular / SEZ / Casual taxable Person Return type: GSTR-3b Frequency: Monthly |

The GSTR-3B is a monthly consolidated statement for return of inward and outward supplies to be filed by Regular, SEZ Unit, SEZ Developer and Casual Taxable Person Due date for taxpayers having turnover above ₹ 5 Cr. is set to be to 20th of following month However, due date for taxpayers having turnover upto ₹ 5 Cr. is set to be 22nd of following months where taxpayer has principal place of business in Category A states/UT”s and 24th of following month in case classified in Category B (Quarterly Return Monthly Payment scheme is yet to be implemented by GSTN. Post implementation the aforementioned scenerio may undergo change) |

|

iii)Composition Return type: GSTR-4 Frequency: Quarterly /Annual |

From 1st April 2019, GSTR-4 is an annual return that is to be filed by a composition dealer Upto March 2019, GSTR-4 was a quarterly return that was to be filed by a composition dealer GSTR 4 filed for tax period upto March 2019 will be shown in Main returns and filed from tax period April 2019 will be shown in More returns |

|

iv)Composition Return type: CMP-08 Frequency: Quarterly |

From 1st April 2019, CMP 08 is the quarterly return that is to be filed by a composition dealer Filing due date is set to be 18th of the month following the Quarter Composite tax payers are required to file only CMP 08 on quarterly basis and GSTR 4 on annual basis from April 2019 |

|

v) Online Information and Database access Return type: GSTR-5A Frequency: Monthly |

GST return for person located outside India and supplying online information and database access to non taxable persons in India, to be filed on monthly basisFiling due date is 20th of next month |

|

iv)Non Resident Return type: GSTR-5 Frequency: Monthly |

GST return for Non-resident taxable person needs to be filed on monthly basis GSTR-5 provides details of inward and outward supplies and transaction details of a particular business of a non-resident foreign taxpayer.Filing due date is 20th of next month |

|

vii)For ISD Return type: GSTR-6 Frequency: Monthly |

GSTR 6 is a GST return for input service distributors to be filed on monthly basis Due date is set to be 13th of next month |

|

viii)TDS Return type: GSTR-7 Frequency: Monthly |

GST return for TDS deductor need to be filed on monthly basis Filing due date is 10th of next monthFrom 1st October 2018 TDS provisions have come into force and GSTR 7 is to be filed from October 2018 onwards |

|

ix)TCS Return type: GSTR-8 Frequency: Monthly |

GST return for E-commerce operator needs to be filed on monthly basis Filing due date is 10th of next monthFrom 1st October 2018 TDS provisions have come into force and GSTR 7 is to be filed from October 2018 onwards |

|

x)UIN Return type: GSTR-11 Frequency: Quarterly |

GSTR 11 is a monthly return that must be filed by a UIN holder latest by 28th of the month following the tax period in which the purchase is made by the UIN holders. Here he claims refund for taxes paid by him on said purchases |

ii) More returns

This view will be available only for signed in users.

Any returns other than the Main returns in the table above will be considered as More return

Where do you find me

There is an option to view more returns on Filing History Page

Only the returns which are present in API Response will be displayed. However below is a inclusive list of returns for which filing status may be displayed

| Return | Description | Frequency |

| GSTR 10 | Cancellation of GST Registration | Ad-hoc |

| GSTR 9 | Annual Return | Annual |

| GSTR 9C | Reconciliation Statement and Certification | Annual |

| ITC 04 | Details of goods sent to job worker and received back | Quarterly |

| GSTR 9A | Annual return for Composition Scheme holders | Annual |

| Tran1 | Transition Return | Ad hoc |

| Tran2 | Transitional ITC w.r.t rule 117(4) | Ad hoc |

| Tran3 | Transition Return | Ad hoc |

| ITC 01 | Declaration for claim of ITC u/s 18(1) | Ad hoc |

| ITC 02 | Declaration for transfer of ITC in case of sale, merger, or transfer of a business | Ad hoc |

| ITC 02A | Declaration for transfer of ITC pursuant to registration u/s 25 (2) | Ad hoc |

| ITC 03 | Declaration for intimation of ITC reversal/payment of tax on inputs held in stock | Ad hoc |

| GSTR 2 | Return on inward supplies | Ad hoc |

| GSTR 1E | Return to get refund on export transactions | Ad hoc |

| GSTR 2X | Returns to claim for TDS and TCS credit received | Ad hoc |

| ITC03-4A | Declaration of ITC reversal on inputs by taxpayers who are opting in for composition scheme | Ad hoc |

| ITC03-4B | Declaration of ITC reversal on inputs by taxpayers whose goods or services/ both supplied by them become exempt | Ad hoc |

| ITC01-18c | Declaration of ITC Claim on inputs by taxpayers who are opting out of composition scheme | Ad hoc |

| ITC01-18d | Declaration of ITC Claim on inputs by taxpayers whose goods or services/ both supplied by them become taxable from exempt | Ad hoc |

Note: Details of returns filed is dependent on our caching policy.. To Know more …

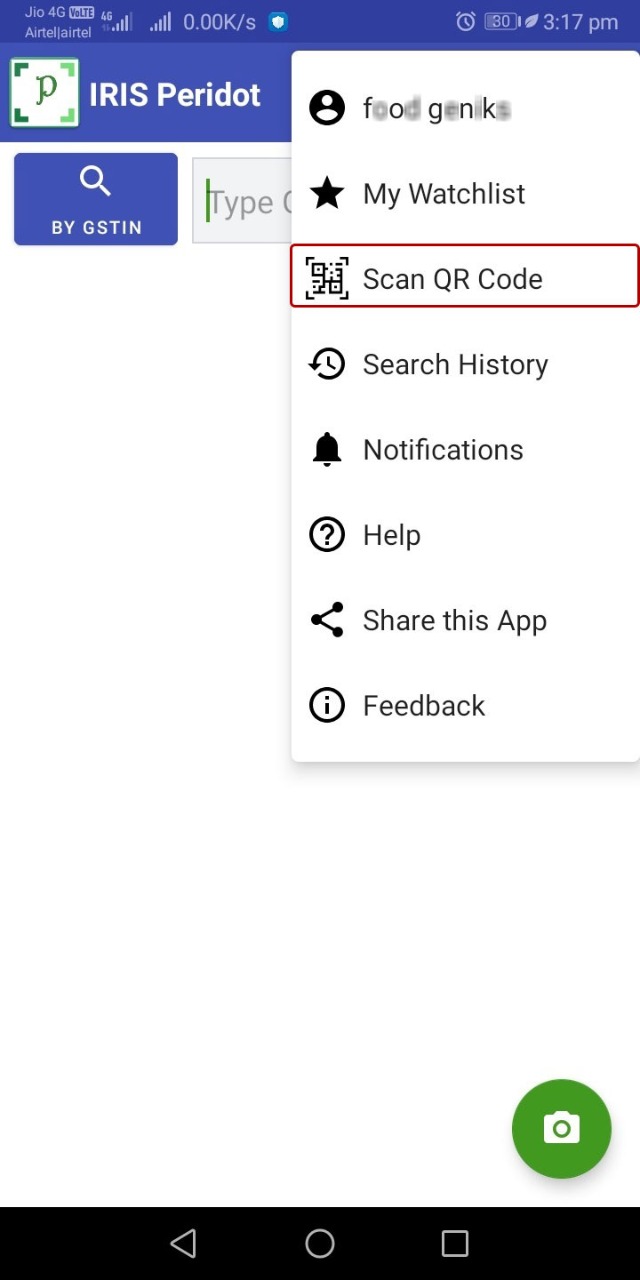

Scan QR Code

Placement: Menu option at Home Page

Access: Signed In users only can use this functionality

Scan QR Code functionality only provides results for E-Invoice and EWB QR codes

i) E-Invoice QR Code

E-Invoice QR Code will be used to provide information about a invoice in a quick manner, without the need to retrieve such information from an external source

ii) EWB QR Code

Eway bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered person

During transport QR Code of EWB is considered valid proof of EWB compliance

Note:

- Valid E-Invoice and EWB code can be scanned and decoded using Scan QR Code functionality

- Where QR Code pertains to E-Invoice portal it states verified by NIC IRP

- Where QR Code pertains to Stage platform of E-Invoice portal (i.e. generated on trial portal of GSTIN) it states not verified by NIC IRP, although content decoded is similar verified QR Code

- And following details are provided

IRP QR Code

| Label | Value |

| Supplier GSTIN | GSTIN |

| Recipient GSTIN | GSTIN or URP in case of Exports or supplies to unregistered parties |

| Document Type | Invoice, Debit Note and Credit Note respectively |

| Document Number | Alphanumeric value maximum 16 length |

| Document Date | dd-mm-yyyy |

| Invoice Value | The final value of invoice |

| No. of items | No of line items that are included in the invoice |

| Main HSN Code | Minimum 4 & Maximum 8 |

| IRN Date | Date and time stamp of IRN generation |

| IRN | 64 digit long text |

On clicking supplier/recipient GSTIN, user can land to snapshot i.e. GSTN Info and filing status page

Content of EWB QR Code

Eway Bill QR Code includes only following content:

| Label | Value |

| E-way Bill Number | 12 digit number |

| GSTIN | |

| Generated Date and Time |

On clicking supplier GSTIN user can land to snapshot i.e. GSTN Info and filing status page Option to go back or scan new

In case QR Code does not pertains to E-Invoice or EWB an error message is displayed – “Invalid E-Invoice or EWB QR Code”

Kindly note scope of QR code scanning is currently limited to QR code generated on E-Invoice by Invoice Registration Portal (IRP) and E-Way Bill QR code

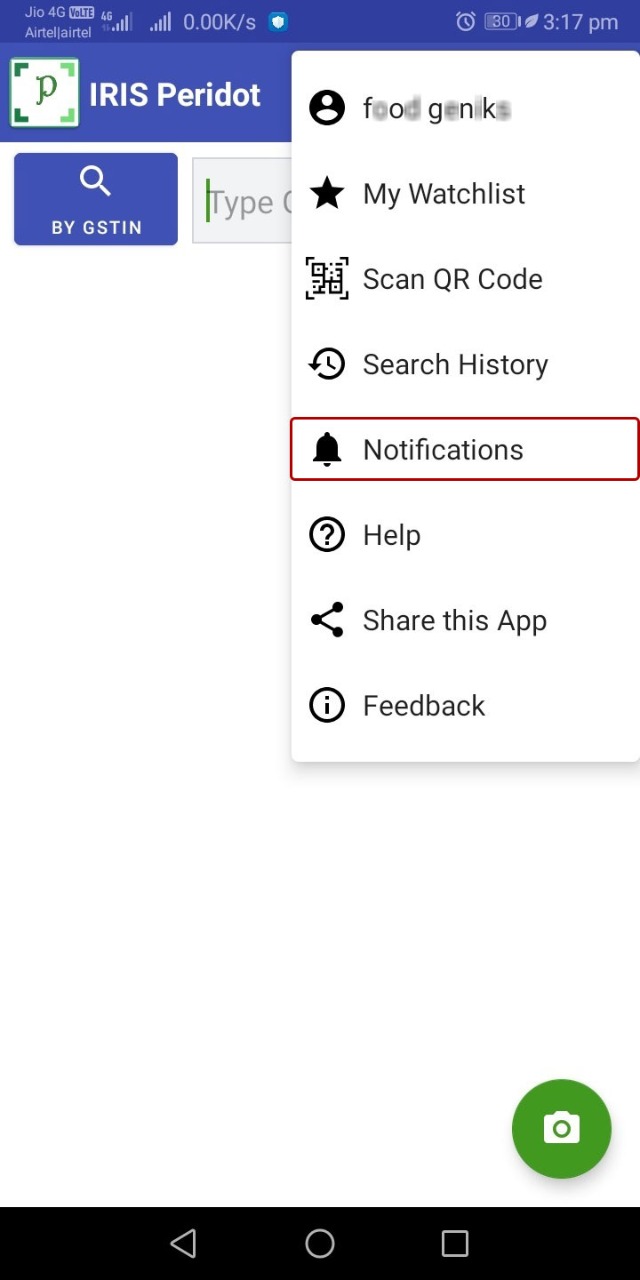

My Notifications

You can now stay informed about all the GST updates, due dates and IRIS offerings. As a signed in user you get option to manage your notifications and also store them for future reference

Where will you find me: Menu option at Home Page

Access: All users irrespective of signed in or not will receive notifications. However only signed in users will be able to unsubscribe from notifications

Each user type will receive notifications in following manner:

Apart from updates and service offerings from IRIS, you can receive notifications of the following types

| Category | Description |

| GST Updates | Relevant GST Notifications, Circulars, Press release |

| IRIS Knowledge Base | Relevant Blogs, Ebooks, Newsletters |

| Due Date Reminder |

Monthly Calendars, Due Date reminders |

All notifications will be saved and available for quick read for signed in user. User can bookmark any of the notifications and share the same. User can remove any notification from your bookmark list or remove from My notification

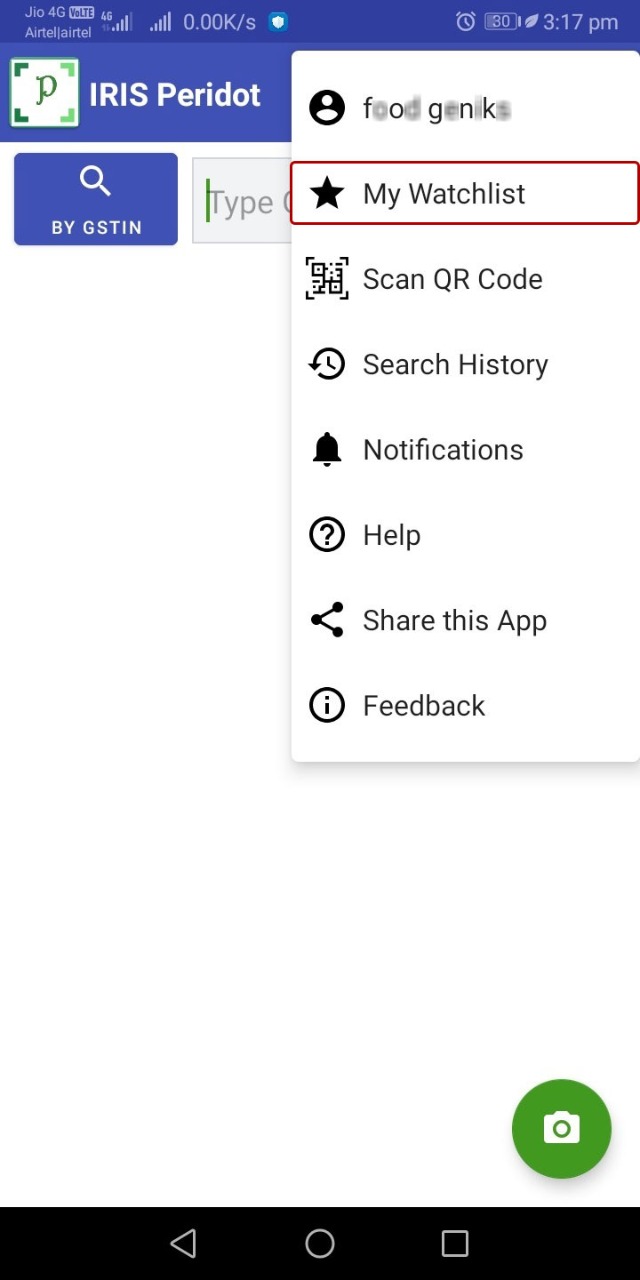

Watchlist

Where do you find me:

Menu option at Home Page

Access: Only Signed In users can use this functionality

Watchlist view is segregated into two

-

-

- Counterparties: It includes GSTIN of counterparties like vendors, customer, transporter, other

- Own: It includes Self GSTIN

-

Any GSTIN can be added in watchlist

And following details shall be requested at the time of addition of GSTIN to watchlist

| Field | Required | Values | Comments |

| Category | Optional | Self Vendor Customer Transporter Job Worker Other |

Default Value: Vendor Based on category GSTIN to be segregated : |

| Industry Type | Optional | Yes | |

| Turnover | Optional | 0 to 40 Lacs 40 Lacs to 1.5Cr. 1.5 Cr to 5 Cr. 5 Cr. to 100 Cr. 100 Cr. to 500 Cr. Above 500 Cr. |

|

| Optional | Valid email id | ||

| Mobile | Optional | 10 digit mobile number | |

| User Notes | Optional | Provision to add some notes for reference. |

Once added all these details can be edited by user

Count of GSTINs added to My Watchlist shall be within prescribed limits

And can be removed from watchlist anytime

Refresh status date

-

-

- Return status dates of each GSTIN shown in watchlist is subject to caching policy followed by IRIS Peridot

- Last bulk refresh date and time is of last manual refresh done by the user

-

Watchlist View

Watchlist view gets updated only when manual refresh is triggered by the user Information to be displayed

-

-

- GSTIN

- Trade Name, if not available then Legal name

- Taxpayer status, if other than active is shown

- Notification text

- Return Type

- Return Month

- Date of Filing

- Visual indicator to show return is filed within due date or after due date

-

Note:

Visual indicators are provided for all the taxpayer types

Here, date of filing is compared with actual due date using due date calendar

Turnover, if provided by the user while adding GSTIN to watchlist is taken as base for computing due dates

However, where taxpayer does not provide turnover details default due dates are assumed for such GSTIN

Hence, due dates may defer in case you add turnover details while adding GSTIN

a. For GSTINs watchlisted only standard returns will be considered

b. Visual indicators are shown for all the taxpayer types

c. Taxpayers are allowed to opt in for composition scheme at the beginning of financial year and can opt out any time during the financial year. On account of this, there are exceptional cases where there has been a transition in the taxpayer type from regular to composition and vice versa. During the transition period, taxpayers are expected to file all the returns. So the filing history can show GSTR 1 as well as CMP 08 filed for the same month. Further, when such taxpayers are not regular in filing, there is no adequate information to ascertain which returns should be expected and since which return period. In such cases, the compliance status will show the latest returns that are filed and this may not match with their current taxpayer type. Users need to check the filing history and some other details to determine the compliance pattern of GSTIN. IRIS takes no liability whatsoever.

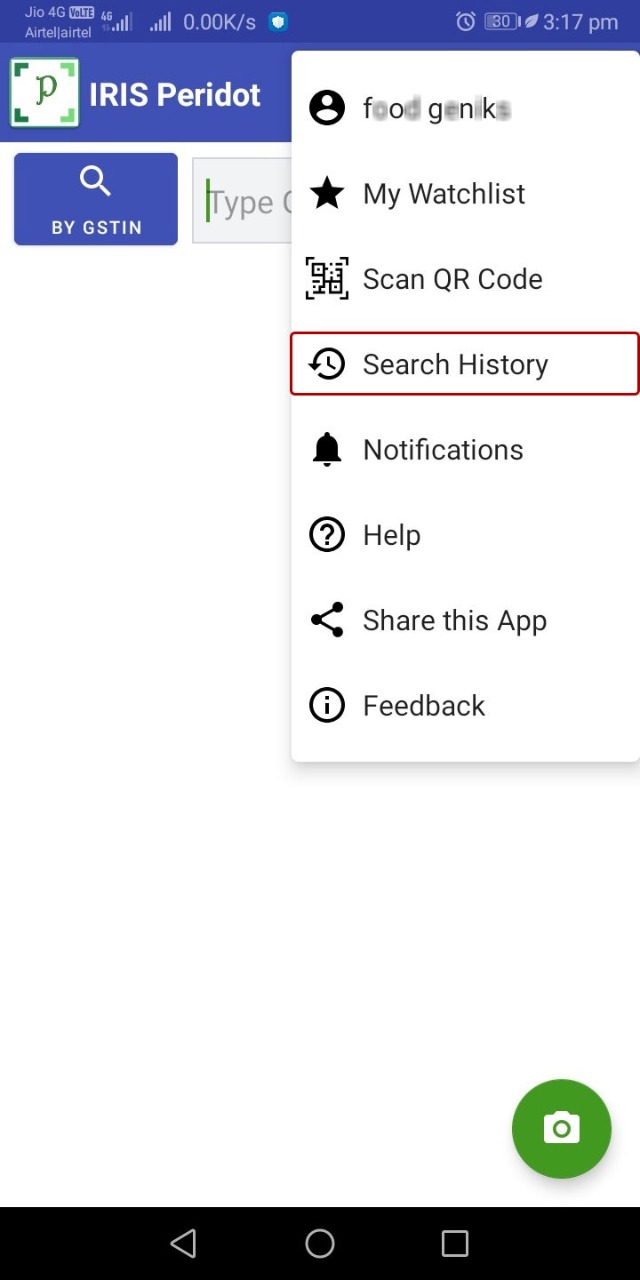

Search History

Placement: Menu option at Home Page

Access: All users can use this functionality

Search History basically saves history of all the valid GSTINs searched by the user, using search by GSTIN, Name or PAN

Each record in search history can be marked with search date and time. User can search GSTIN again from search history.

Sign Up

Any user can Sign Up using Sign Up option in the application

User has to provide following details to Sign Up

| SN | Details required | Mandatory / Not | Particulars |

| 1 | Gmail Id | Mandatory | Only active and valid Gmail Id to be added here |

| 2 | Mobile Number | Optional | 10 digit valid mobile number to be added |

| 3 | What describes you best | Mandatory |

Choose the business structure being currently followed Individual |

| 4 | Your GSTIN | Optional | Own GSTIN to be added here and same will also be reflected as favorite GSTIN in watchlist under OWN category |

| 5 | Industry type | Optional | Select industry type |

| 6 | Turnover | Optional | Turnover details to be added on optional basis |

If user intends to add optional details later, can select “Remind me later” or complete profile by saying “Thats it”

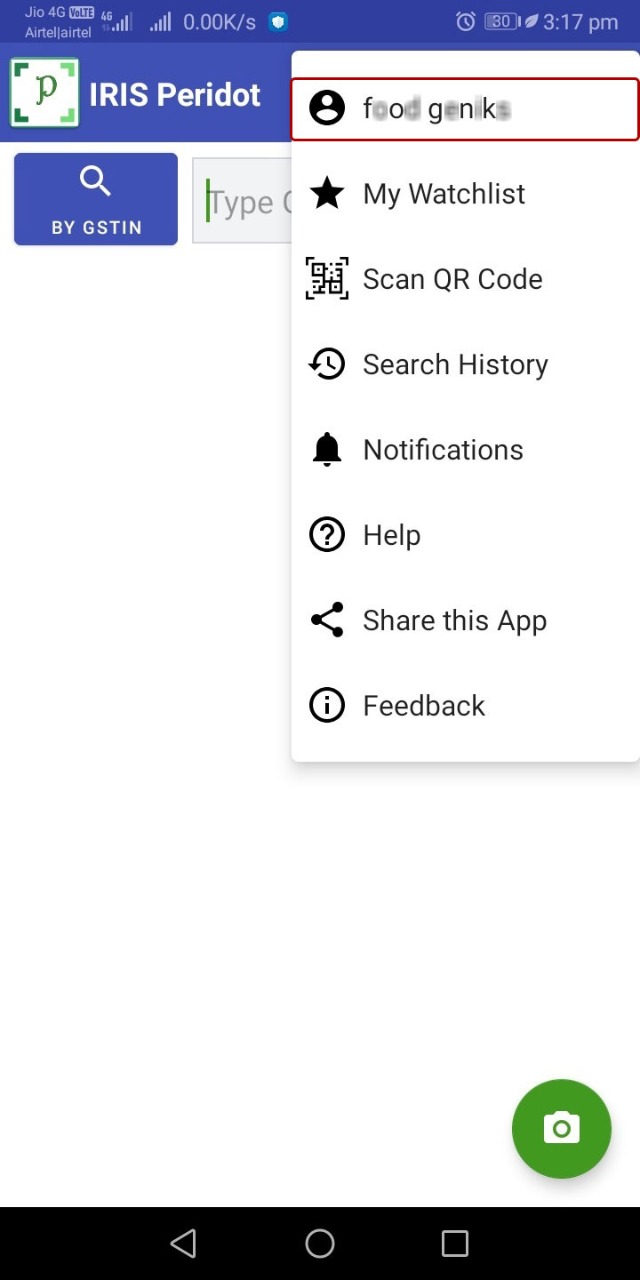

My Profile

Placement: Menu option at Home Page

Access: Signed In users only can use this functionality

Signed In user can view and edit following details in My profile

a) Mobile Number

b) Business Profile

c) Notification Settings

User can also sign out from My Accounts page

Pan Level Compliance Report

Where do you find me: PAN/Name search response page

Access: Signed in users only can use this functionality

Compliance report is generated for all the active and regular GSTIN registered under same PAN

It is generated for the latest month and is sent to registered email id of user with IRIS Peridot

Taxpayers registered with GST could be required to file different returns based on the transactions undertaken or type of business.

This report provides information of key returns which determine the overall compliance of the taxpayer and are linked to tax liability determination and payment

Due to restriction on number of times a GSP can connect to GST system for getting public information i.e. taxpayer details and filing history, IRIS Peridot follows a caching policy. This caching could also vary and be increased when the GST system is down for maintenance and upgrades. Any returns filed after the last update date and the date on which this report is generated are not included in this report

IRIS Peridot takes no liability whatsoever for any loss incurred. This report is for information purposes and is not to be construed as financial or investment advice

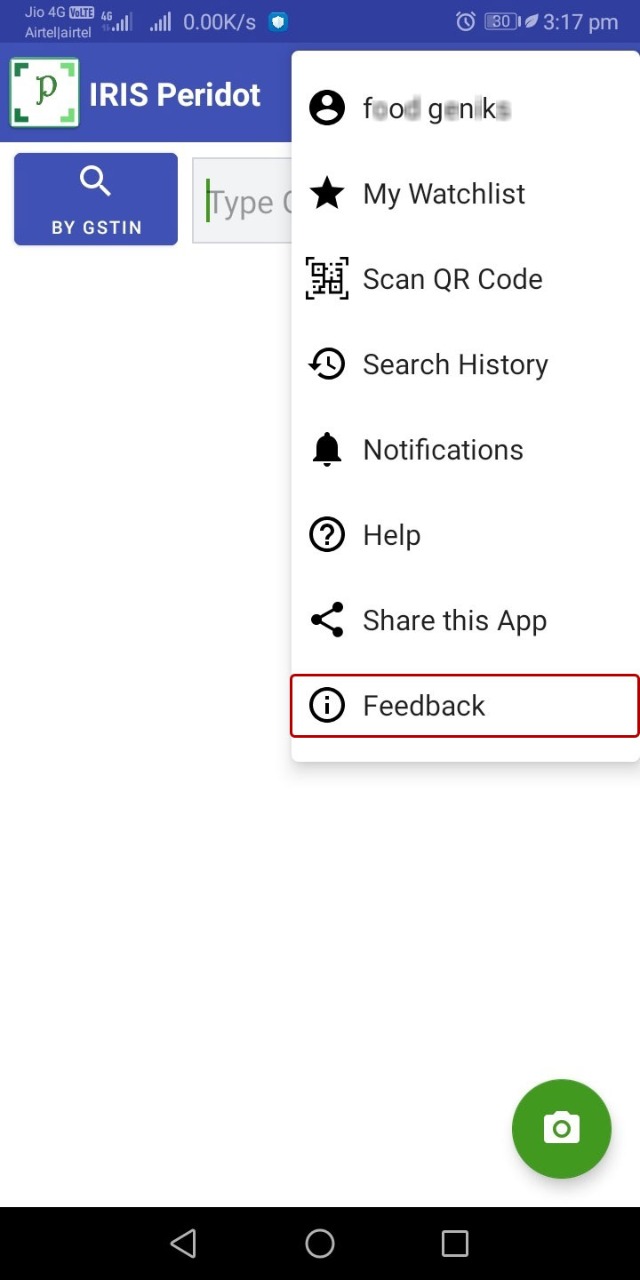

Write to Us

We always welcome suggestions and feedback from our users as this helps us to serve better. Should you want to share your thoughts and experiences with us, please get in touch with us by filing Feedback Form Or you can also write us support@irisgst.com