As defined in Section 2(44) of the CGST Act, 2017, e-commerce is the supply of goods or services through an electronic network. An Electronic Commerce Operator (ECO), as defined in Section 2(45) of the CGST Act, 2017, is any person who directly or indirectly owns or operates an electronic device, platform or GST for electronic commerce.

The Indian e-commerce market has witnessed steady growth and by 2024, its market value is anticipated to reach USD 99 billion, making it the second-largest e-commerce industry in the world, only after the US. Global giants like Google and Facebook have made major investments in the Indian e-commerce market. The Central Board of Excise & Customs (CBEC) has recognized the huge growth potential of this sector and its associated tax complications. Resultantly, the CBEC has introduced special arrangements for GST Registration for E-commerce sellers.

Goods and Services Tax (GST)

Goods and services are subject to GST, an indirect tax based on destination, at the place of final consumption. Moreover, it is a multi-stage, comprehensive destination tax as it is levied at every stage of sale or purchase.

Goods and Services Tax (GST) registration is mandatory for all e-commerce sellers/ /traders/aggregators selling goods/services online, except for exempted categories, under Section 24(ix) and (x) of the Central Goods and Services Tax Act, 2017. On every transaction, such e-commerce dealers must actively collect and deposit 1% of the total tax, which consists of 0.5 % CGST and 0.5 % SGST.

Who Will Collect TCS Under GST?

Under Section 52 of the CGST Act, e-commerce aggregators are required under the GST Act to collect and deposit a tax of 1% on each transaction. Before paying merchants or merchants who sell products or services online, e-commerce companies deduct 1% of the sales price for taxes. To claim the tax levied by aggregators, all merchants or dealers involved in online sales, regardless of whether their turnover is below the required threshold limit, must register for GST.

Note –

- The need to apply for GST registration does not apply to service providers with an income of less than Rs. 20 lakhs who do not use an e-commerce operator liable to collect tax at source.

- E-commerce businesses covered by Section 52 of the CGST Act cannot opt for a composition plan.

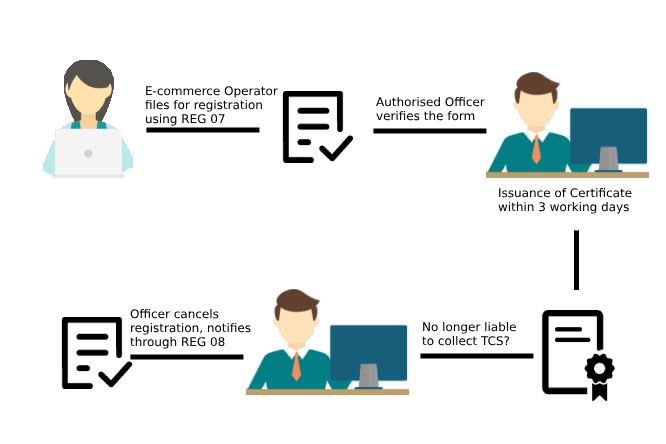

GST Registration Rules for those liable to TCS

All e-commerce businesses subject to TCS must register for GST per Section 24 of the CGST Act. Anyone liable to collect TCS must use Form GST REG-07 to electronically submit the registration application that is signed or verified using an Electronic Verification Code (EVC). For this, either the clearing house designated by the Commissioner, or the GST portal can be used.

As per CGST Rule 12(1A), the online seller has to mention the name of the state in Part A of Form REG-07 if they are not physically present in the state or Union territory where they carry out their operations. In addition, Part B needs to be updated if the principal place of business is in a state other than the state listed in Part A.

Within three working days from the date of submission of the application, the officer concerned will review it, allow the registration and issue a certificate of registration in Form GST REG-06.

Cancellation of GST Registration for E-Commerce Operators

If the proper officer investigates or determines through a proceeding that a person is no longer obligated to collect TCS, the officer will initiate the cancellation of registration. The officer will communicate the cancellation electronically to the concerned person using Form GST REG-08. The cancellation process specified under CGST Rule 22 will be adhered to, and the officer will follow the same procedure applicable to normal taxpayers.

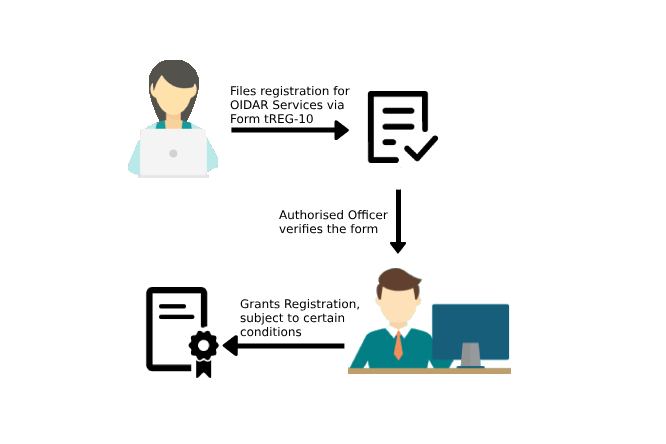

GST Registration for people supplying online information from outside India

Services falling under the category of Online Information and Database Access or Retrieval (OIDAR) are those in which delivery occurs through the internet. These services are essentially automated, requiring minimal human intervention and are impossible without the use of information technology.

Update

As of February 1, 2023, the Budget 2023 update brings a modification to the definition of OIDAR. The reference to “services essentially automated and involving minimal human intervention” is removed. Consequently, online information and database access or retrieval services now refer to services whose delivery is facilitated by information technology over the internet or an electronic network.

Examples of such services include

- Advertising on the internet

- Providing cloud services (e.g., Google Drive)

- Provision of e-books, movies, music, software, and other intangibles via the internet (e.g., Hotstar, Amazon Prime Video)

- Providing data or information, retrievable or otherwise, to any person in electronic form through a computer network

- Online gaming (e.g., Steam)

- Web-based services provide trade statistics, legal and financial data, matrimonial services, social networking sites, etc.

- The update also clarifies that using the internet merely for communication or to facilitate the outcome of service needs does not always imply that a business is providing OIDAR services.

Additionally, the following services are considered non-OIDAR services:

- Supplies of goods processed electronically

- Supplies of physical books newsletters, newspapers, journals, legal and financial consultation through email,

- Booking services for entertainment events, hotel accommodation, or car hire,

- Educational or professional courses delivered by a teacher over the internet.

- Offline physical repair services of computer equipment and repair of software or hardware through the internet from a remote location

- Advertising services in newspapers, on posters, and television, as well as internet backbone services and internet access services (e.g., BSNL broadband)

GST Registration Process for OIDAR Service Providers

To register for GST, dealers with an annual turnover exceeding Rs.20 lakh (Rs.40 lakh or Rs.10 lakh, as may vary depending upon the state and kind of supplies) must complete the registration process online on the government website gst.gov.in.

Here is a step-by-step guide on how to register for GST online on the GST Portal:

Step 1: Navigate to the GST portal and click on the ‘Services’ tab. Then, select the ‘Registration’ tab and choose ‘New Registration.’

Step 2: In Part A, provide the following details:

- Select the ‘New Registration’ radio button.

- Under ‘I am a’ dropdown, choose ‘Taxpayer.’

- Select the State and District from the dropdown.

- Enter the Name of Business and PAN of the business.

- Input the Email Address and Mobile Number. If your contact details are linked with PAN, you may skip this step.

- Receive OTPs on the registered email id and mobile number or PAN-linked contact details.

- Click on ‘Proceed.’

Step 3: Enter the two OTPs received on the email and mobile or the PAN-linked contact details. Click on ‘Continue.’ If OTPs are not received, click on ‘Resend OTP.’

Step 4: Receive the 15-digit Temporary Reference Number (TRN). This will be sent to your email and mobile or PAN-linked contact details. Note down the TRN. Complete filling in the Part-B details within the next 15 days.

Step 5: Visit the GST portal again and select the ‘New Registration’ tab.

Step 6: Choose ‘Temporary Reference Number (TRN).’ Enter the TRN and the CAPTCHA code. Click on ‘Proceed.’

Step 7: Receive an OTP on the registered mobile and email or PAN-linked contact details. Enter the OTP and click on ‘Proceed.’

Step 8: The application status will be shown as drafts. Click on the ‘Edit’ icon to make the necessary changes.

Steps to fill Part-B of GST registration application

Step 9: Complete all the details in Part B of the GST registration application, which comprises 10 sections. Provide the required information and submit the necessary documents. Note that as of 2020, the Aadhaar authentication section was introduced, and the bank account section was made non-mandatory.

- Ensure you have the following documents ready while applying for GST registration: Photographs, Constitution of the taxpayer, Proof for the place of business, Bank account details*, Verification and Aadhaar authentication, if chosen.

Bank account details have been non-mandatory for GST registration since December 27, 2018.

Step 10: In the Business Details section, provide the trade name, business constitution, and district. It’s important to note that the trade name is distinct from the legal name of the business.

- Proceed to select ‘Yes/No’ to either opt in or opt out of the composition scheme under the field “Option for Composition.” Additionally, specify the type of registered person, such as manufacturers or service providers of work contracts, or any other person eligible for the composition scheme.

- Next, input the date of business commencement and the date from which liability arises. If registering as a casual taxable person, choose ‘Yes/No.’ If ‘Yes’ is selected, generate the challan by entering the details for advance tax payment per the GST law for casual taxable persons.

- Under the ‘Reason to obtain registration’ section, select the reason, such as ‘Input service distributor.’ Alternatively, choose from various other options available. Depending on the selection, enter details in the corresponding fields. For instance, if ‘SEZ unit’ is chosen, input information such as the name of the SEZ, designation of the approving authority, approval order number, etc., and upload the supporting documents.

- In the ‘Indicate Existing Registrations’ section, choose the type of existing registration, such as Central Sales Tax, Excise, or Service Tax. Enter the registration number and date of registration, then click the ‘Add’ button.

Step 11: Complete the details under the Promoters/Partners tab by entering information for up to 10 Promoters or Partners.

- Provide personal details, such as name, address, mobile number, date of birth, email address, gender, and identity details like designation/status and Director Identification Number (if applicable).

- Also, specify whether or not the individual is an Indian citizen, and provide PAN and Aadhaar numbers.

- Include residential address details and upload a photograph of the stakeholder in PDF or JPEG format with a maximum file size of 1 MB.

- If the promoter is also the primary authorized signatory, make the necessary selection and click on ‘SAVE & CONTINUE’ to proceed.

Step 12: Enter details of the Authorized Signatory similar to those entered for promoters/partners in Step 10.

- If applicable, provide the enrollment ID for a GST practitioner or basic details for an authorized representative.

Step 13: Input details for the Principal Place of Business. Report the address, district, sector/circle/ward/charge/unit, commissionerate code, division code, and range code.

- Include the official contact number of the taxpayer, the nature of possession of premises (rented, owned, shared, etc.), and upload supporting documents.

- Check the nature of business activities on the premises, add any additional places of business, and click on the ‘SAVE & CONTINUE’ button.

Step 14: Submit details of goods and services in the next tab along with the HSN codes or SAC for up to a maximum of 5 goods and 5 services on the top of your list.

Step 15: Enter the Bank details of the taxpayer for up to 10 bank accounts. Submission of bank account details has been made optional from December 27, 2018. If not reported during GST registration, you will be prompted to file a non-core amendment application after GSTIN is granted.

Step 16: Under the State Specific Information tab, enter the professional tax employee code number, PT registration certificate number, and State Excise License number with the name holding the license. Click on ‘SAVE & CONTINUE.’

Step 17: Choose whether or not you are willing to do Aadhaar authentication.

Step 18: Proceed to the Verification page, tick on the declaration, and submit the application using any of the following methods:

- Companies and LLPs must submit the application using DSC or use e-Sign where an OTP will be sent to the Aadhaar registered number or use EVC where an OTP will be sent to the registered mobile.

Step 19: Upon successful submission, a message is displayed, and the Application Reference Number (ARN) is sent to the registered email and mobile. Check the ARN status for your registration by entering the ARN on the GST Portal.

For queries related to GST, please get in touch with us. IRIS GST is looking forward to helping you.

IRIS is now a government-authorized IRP along with being an ASP+GSP.

If you are looking for an invoice payment solution, IRIS Peridot Plus is the best answer. From effortless e-invoicing, automated collections, instant payouts, and easy reconciliations, IRIS Peridot Plus is your best call.

Thanks for finally writing about >How to Register as an E-Commerce Operator <Loved it!