IRIS GST TIMES

December, 2020

This issue

Latest GST Updates ———————— P.1

Updates in the EWB System ————— P.2

Year End Recap – IRIS GST ————— P.3

GST Compliance Calendar- Jan 2021 —– P.4

Chief Editor

Vaishali Dedhia

The new year has arrived with a ray of hope for a better and brighter 2021.

On the GST front, there has been a lot of new updates and changes that businesses have to look out for. We have covered all the major details for your reference in this Newsletter.

In this issue, we’ll be covering Latest GST Updates and Latest EWB Updates that you need to be aware of!

And, we share a detailed article about Auto-population of GSTR 3B. Here, we also cover all the updates of our GST products witnessed throughout 2020.

Lastly, we share the link to our compliance calendar for January 2021 to help you stay compliant along with two other interesting articles on TOP GST News of Dec 2020 and Composition Scheme for Restaurant and Hotel owners.

Regards,

Team IRIS GST

Key Amendments from 1st January 2021 – Impact Analysis for Businesses

Onset of 2021 not just brings E-invoice mandate for taxpayers having aggregate turnover above Rs. 100 Cr. but also a huddle of CBIC notifications on ITC Claim, QRMP Scheme, GSTR-3B auto population, EWB Validity, cancellation of GSTIN and a lot more amendments duly wired with one another having an overall impact on the business processes.

Here in this article, we have compiled a list of changes that have come into effect from 1st January 2021 that you need to be aware of so as to plan and carry out the implementation effectively.

- E–invoicing goes live for 100 CR Club

- QRMP goes LIVE for Small Taxpayers

- GSTR 3B Auto-Population

- ITC Claim Process from 1st January 2021

- Rules to Refer for ITC Computation from 1st Jan 2021

- Rule changes regarding Suspension of GST Registration

- Updates related to E-Way Bill Generation and Validity

Read the full article here:

Auto-population of GSTR 3B from GSTR 1 and GSTR 2B

Government is continually striving to ease compliance stress of taxpayers. And here is another attempt to ease compliance burden – Auto-population of GSTR 3B from GSTR 1 and 2B. Now, every registered person filing returns on monthly basis will receive a system generated summary of GSTR 3B duly auto populated using details reported in GSTR 1 and generated in GSTR 2B.

A detailed table-wise computation of the values auto-populated in GSTR-3B is also made available in PDF on GSTR-3B dashboard which can be downloaded for reference by clicking on the “System Generated GSTR-3B” tab.This facility will be enabled for quarterly filers also in due course.

Flow:The values are auto-populated and PDF is generated. GSTR-2B is generated on a specific date on the basis of the GSTR 1, GSTR 5, GSTR 6 and from the data pertaining to Import of Goods as received from ICEGATE portal. However, filing GSTR 1 is at discretion of taxpayer. Consequently, system will prepare the PDF partially & populate the respective tables of GSTR-3B partially on the filing of GSTR-1 or generation of GSTR-2B, whichever is earlier.Subsequently, the PDF will be re-generated & remaining tables will be auto-populated in GSTR-3B after the other FORM is filed/generated, as the case may be.

Read More

Composition Scheme for Restaurant and Hotel owners:

For the benefit of small taxpayers, the GST Department brought out the composition scheme initiative. Composition Scheme under GST is also available for Restaurant and Hotel Services that come with certain conditions.

- Registration Process

- Restaurants that cannot register

- Conditions for Restaurants opting Composition Scheme under GST:

- GST Rate for Restaurant Services

- Difference between the Regular Scheme and Composition Scheme for Restaurant Services

- Return Filing & Identification

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST.com

Latest GST Updates You Need To Be Aware Of!

As the remarkable year 2020 ends, we see another set of amendments in GST Act and Rules. While amendments are more in the direction of keeping a check on malpractices, the genuine taxpayers will have more process to follow and need to be extra vigilant regarding their counterparts.

With the backdrop of 12000 ITC fraud cases, cancellation of 1.63 Lakh GST Registrations and 365 arrests due to non-compliances, Government has issued GST notification 92/2020, GST notification 93/2020 and GST Notification 94/2020 dated 22nd Dec 2020 to curb tax evasion.

These notifications introduce radical change and stringent controls in the process of GST cancellation, ITC claim, EWB validity and GSTR 1 filing, to curtail practice of issuing fake invoices or excessive ITC Claims

Here is a list of the recent GST amendments and notifications:

1. Limit on ITC Claim and Utilization

- Upper limit for provisional ITC pegged at 5%

- Restriction on full utilization of Input Tax Credit – Newly inserted Rule 86B

2. Blocking of GSTR 1 if GSTR 3B is not filed

3. Dtricter rules for Suspension of Registrations

4. More verifications to New Registrations

5. Reduced Validity Period for E-way Bill

6. Late Fee Waiver for GSTR 4

7. CGST Act Amendments comes into effect

Read the changes and updates in detail here: Latest GST Updates

These announcements which will be in effect from Jan 2021 need to be analysed by businesses to determine the changes that they need to do in their current processes and systems so that they are not caught in these stringent checks, which primarily have been defined to keep frauds in check. In addition to these, the parallel compliances such as e-invoicing and blocking of e-way bill system for IRN generated invoices are other things to be ready with for the New Year 2021.

E-Invoicing has gone LIVE from 1st Jan 2021 for companies with turnover more than Rs. 100 CR. And E-Way Bill generation is inter-twined with E-Invoicing for these companies where E-Invoicing is mandatory. Hence, companies not only need to be prepared for the mandate themselves, but also set-up a mechanism to identify the applicability of the mandate on their vendor network.

Also, from January 1st, 2021 onwards, taxpayers having aggregate turnover up to Rs 5 CR can choose to furnish their GST returns under the QRMP Scheme. Rule 138E now states that where a supplier fails to file GSTR 3B or CMP-08 for two subsequent tax periods, not just his E-Way Bill but also his GSTR 1 will get blocked.

Hence, one needs to be prepared for all the latest GST Updates and prepare businesses accordingly. Here is an impact analysis of recent GST amendments for businesses.

GST Updates

New Updates in the E-way Bill System

The Government is releasing a bunch of new updates every other day for businesses. Practices like E-invoicing and E-way Bill have transformed the entire scenario and are on their way to rooting out the old way of doing business. Digitization is the way to go as it not only eases the entire process but brings in a lot more transparency.

Here are the latest updates in the E-way Bill System:

- Validity of E-way bill: The validity of e-way bills for cases other than over-dimensional cargo will be calculated based on a distance of 200 km and not 100 km from 1st January 2021 onwards.

- GSTIN Status: The recipient’s GSTIN should be registered and active, on the date of preparation of the document by the supplier.

- Documentation for E-way Bill System: Document numbers are case sensitive for E-way bill generation.

- Distance Validation: If the Pin-to-Pin distance is known then allowed distance for transportation is between +/- 10 % of auto-calculated PIN-PIN distance. If the auto-calculated distance is less than 100 KMs, then the allowed distance for transportation should be between 1 and +10 % of auto-calculated PIN-PIN distance.

- Pin-to-Pin distance: In the case of Bulk Upload, if the Pin-to-Pin distance is not known, the distance may be passed as zero. If available, the E-way bill system will automatically populate the distance. However, if the distance is not available then the error is returned. For such cases, the user has to pass the distance.

- Pin code: If the required Pin code does not exist in the E-way Bill system then atleast the first 3 digits of the pin code must match with the selected state.

- E-way Bill from E-invoice System: If the E-way Bill is generated from the E-invoice System, then IRN is displayed on the E-way Bill print.

- Bulk Upload: In Bulk upload, 96 can also be passed as state code for ‘Other Country’.

- Update on Blocking of E-Way Bill generation facility after 1st December 2020: Rule 138E (a) and (b) of the CGST Rules – 2017 states: The E-Way Bill (EWB) generation facility of a taxpayer can be restricted if the taxpayer fails to file their GSTR-3B returns or Statement in GST CMP-08, for two or more tax periods.

The blocking of the EWB generation facility in E-way bill system would be made applicable to all the taxpayers (irrespective of their Aggregate Annual Turnover (AATO)

- EWB blocking for transporters in light of E-invoicing: IRN can be generated only by the Supplier or e-commerce operator on behalf of the supplier. Hence access to the IRP system is only for suppliers or e-commerce operators and not transporters.

Read the full article here: New Updates in EWB system you need to be aware of!

Important GST Notifications released in December 2020

HIGHLIGHT

Year 2020 in recap for IRIS GST

This year 2020 has been an action-packed year for IRIS GST too. Key highlights of what we did in 2020:

1. One-stop-shop for all GST compliances: In the beginning it was GST, then, came e-way bill and now e-invoicing. The compliances have not just increased but also converged. Hence, it is quite natural for the products to also evolve in a similar manner. All compliances under one roof and accessible using single sign-in have been the core theme for us this year. Considering the inter-dependencies between various compliances and enabling a smooth transition for our users, the integrated modules were released in a staggered manner. We started with combining e-invoicing and e-way bill operations as these are more closely related and are transactional and now we are moving to integrating the GST Returns.

2. Complete solution for e-invoicing: IRIS Onyx, as we have named it, can be used to manage the complete lifecycle for e-invoice. The integrated offering further helps to accomplish the subsequent tasks of e-way bill management and GST compliances. Preparing an E-invoice is the starting point of compliance. Once an invoice (or now an e-invoice) is generated, the goods can be shipped and the invoice can be reported in GST returns.

So, while the Government has defined about 140 data points to be collected for e-invoicing, we did not limit ourselves just to it. We have defined our input format (format for collecting data points from ERPs) to collect data for e-invoice, e-way bill and GST return simultaneously.

3. More utilities to make your ITC computations easier: Towards the end of Nov 2019 cap on ITC reduced from 20% to 10 % and this December we saw the limit being further reduced to 5%. Last year, we added options to keep month-wise track of ITC taken on a provisional basis and a summarized view of ITC eligible based on conditions such as filing status of the vendor, reverse charge etc.

4. Assisting transporters for uninterrupted movement even during Covid times: For Topaz users-our e-way bill solution for taxpayers (primarily consigners), the main activity was integrating the workflow along with e-invoicing generation.

5. A giant leap for Peridot: It’s been a super exciting year for Peridot, one of the most popular apps for verifying GSTIN. And now, the latest version of Peridot, can do a lot more. The latest version Peridot 4, is available on Google Playstore.

Read the full article in detail here: Year 2020 in recap for IRIS GST

UPDATES

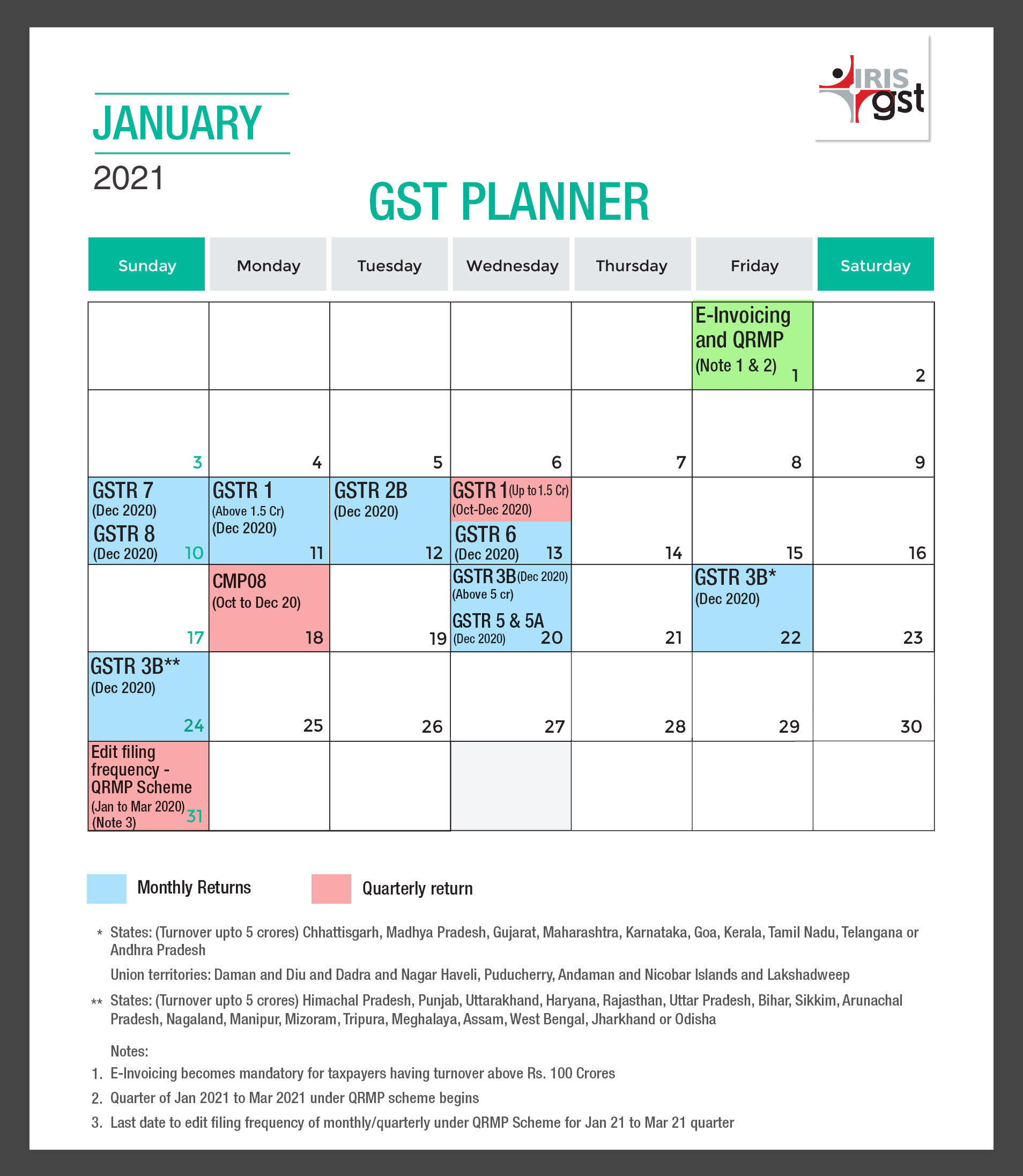

January Compliance Calendar 2020

Here is a comprehensive image of our Compliance Calendar January 2021 with all the dates and important information regarding GST compliance of January 2021.This will help you stay compliant and never miss a due-date. You can Download and pin it for your quick reference.

Read the full blog to get a detailed info here: Compliance Calendar January 2021

What can you do against tax frauds, stealing away your hard-earned money?

- Download the Peridot app

- Scan the GSTIN provided on the Invoice

- Check the Compliance status and Filing History.

- Report any Non-Compliance

Scan today and Download!

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Good

Good