Chief Editor

Vaishali Dedhia

COVID -19 SPECIAL ISSUE

This April is different from any other in the history of accountants.

While in any other year, we would have been discussing about the work plan for new financial year, new regulations and updates for the new FY. This year, there are some of us trying to adjust with the new work from home schedule while some of us are stressed about the lockdown still continuing and the Pandemic numbers increasing everyday.

All we can do is take care of ourselves and our employees while hoping for the best.

Read: 9 Step Work from Home Productivity Guide for CxOs amidst Coronavirus lockdown

In this issue, we’ll be covering New Announcements by the Finance Minister, COVID-19 – What Government can do to Nurse the Economy Back to Health, we also cover our pro-bono initiative of e-pass for truck drivers. Feature Highlight:Updates in IRIS Onyx

E-Pass for Truck Drivers with AITWA

To offer support to the truck drivers whose trucks were stranded on the roads due to the sudden COVID-19 outbreak, IRIS GST collaborated with All India Transporters Welfare Association (AITWA) to develop an e-passapplication for truck-drivers.

This e-passwill help truck drivers to deal with the authorities, officials and policemen while they try to return to their trucks. This will give them confidence to carry out their everyday transportation activities with ease.

The app was launched on 24th April 2020. More than 275 transporters across the country are already using the app. Hyderabad Goods Transport Association (HGTA) and Karnataka Goods Transport Association (KGTA) have also joined this e-platform to help drivers. More than 1,500 e-passes have so far been issued to truck drivers after the app was launched.

A registered transporter can generate the e-pass and send it to the drivers through WhatsApp.

CBIC processes ₹5,575 Cr GST refund

The Central Board of Excise and Custom (CBIC) has settled GST (Goods and Services Tax) refund claims worth ₹5,575 crore providing relief to many business owners.

The Central Board of Excise and Custom (CBIC) has settled GST (Goods and Services Tax) refund claims worth ₹5,575 crore providing relief to many business owners.

This step has ensured early facilitation of the Input Tax Credit (ITC). This step will also ensure that the wrong Input Tax Credit (ITC) claims are not processed in the absence of appropriate information.

The Central Board of Excise and Custom (CBIC) stated that this measure was taken into effect with GST Council’s approval in its 39th Meeting held on March 14, 2020.

This is to moderate delays in ITC refunds faced by the honest taxpayers. It will also ensure that fake ITC claims are not processed..

****

IRIS Topaz offers you a 360° solution for all your E-way Bill Needs. A cloud-based tool, IRIS Topaz, provides you with the ability to manage all your tasks related to E-way Bill in an easy and automated way, on the go.

Updated Due Dates

(Impact of COVID-19)

GSTR 7 – 30th June

GSTR 8 – 30th June

GSTR 1–30th June

GSTR 6 – 30th June

GSTR 5/5A – 30th June GSTR 3B–30th June

GST Software | IRIS Sapphire

An industry-trusted GST compliance tool for seamless data transformation from your ERP to GST data, vendor reconciliation, GST form filing and annual return filing.

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST

New Announcements & Notifications by the FM

The Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman announced a few important changes which serve as relief measures in the view of the COVID-19 outbreak. Smt. Sitharaman made these announcements via video conferencing on 24th March, 2020.

Changes in the GST/Indirect Tax:

- Those having aggregate annual turnover less than Rs. 5 Crore can file GSTR-3B for the months of February, March and April 2020 by the last week of June, 2020. No interest, late fee, and penalty to be charged, if complied before extended date.

- Others can file GSTR-3B for the months of February, March and April and May 2020 by last week of June 2020 but the same would attract reduced rate of interest @9 % per annum from 15 days after old due date (current interest rate is 18 % per annum). No late fee and penalty to be charged, if complied beforeextended date.

- For May 2020, the due date isextended for those having turnover more than 5 crores to 27th For others the dates are extended and staggered based on state to 12th July and 14thJuly.

- Date for filing GST annual returns of FY 18-19, which is due on 31st March, 2020 is extended till the last week of June 2020.

- Date for opting for composition scheme is extended till the last week of June, 2020. Further, the last date for making payments for the quarter ending 31st March, 2020 and filing of return for 2019-20 by the composition dealers will be extended till the last week of June, 2020.

- Due date for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents, time limit for any compliance under the GST laws where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June 2020.

- Payment date under Sabka Vishwas Scheme shall be extended to 30th June, 2020. No interest for this period shall be charged if paid by 30th June, 2020.

Respective notification with regard to various announcements have been released by the GSTN on Friday – 3rd April 2020. Please refer below for details.

- Another important announcement had been around DFIA licenses. Pursuant to PN 67/2015-20 issued by @dgftindia 23,674 AA & DFIA licenses expiring in February to June 2020 have been automatically extended in ICES system by 6 months as a measure of relief to exporters amidst Corona Virus Pandemic. Same was announced on 25th April 2020.

Economy Health

COVID-19 – What Government can do to Nurse the Economy Back to Health

As the world fervently grapples with the Corona virus outbreak, the engine of the economy has sputtered to a halt and many a business is gasping for breath.These are extraordinary times. The hapless Indian MSME sector, already bedeviled by a credit crunch, is set for an unimaginably rough ride with the government clamping a nationwide lock-down that would grind the supply chains to a halt and drastically crunch demand. While obviously the first priority is health care and saving lives, if businesses shut down en-masse, the economy might take years to recover and the social costs would be prohibitively high.

We have been, hopefully, proactive in battling the virus, can we be equally so in taking care of the micro, small and medium businesses? In short, we need business ventilators in operation which will pump in funds to enhance staying power.

Here is a short prescription the government could consider:

- Defining MSME on the basis of turnover: Firstly, it would greatly help if the definition of an MSME changes to turnover based instead of the existing rather antediluvian fixed asset criteria. Our economy is predominantly service oriented and this definition just does not make much sense. There is already a bill which has been in the works for quite sometime. We should pass this in the parliament, pronto. Currently, a large number of enterprises fall outside this definition and are denied benefits of government-initiated programs.

- Organizing MSME into segments: Secondly, actionable data can emerge if we get the existing silos organized so as to meaningfully segment the MSME sector. One could look in terms of GST registered business and non-registered businesses. The second way is to classify B2B and B2C businesses. Then there are those enterprises served by the banking sector, those who are financed by NBFCs and those which rely on personal loans. Another way is to bucket enterprises which are predominantly exporting and those which are selling in the domestic market. A good triangulation of GSTN and the MSME Udyog Aadhar database could make all this happen.

- Prescription for Financial Boost: Now, this pandemic and associated economic havoc essentially calls for a financial reset. The RBI has mercifully pushed for a three-month loan moratorium. While this is necessary, it is hardly sufficient given the unfolding scenario and considerable uncertainty regarding when economic activities can resume full time. One educated guess would be when the virus is contained and a vaccine is visible in the horizon. Six months, one year – your guess is as good as anyone else including the government’s.Firms need funds to stay afloat. Most in the B2B and export sectors are suddenly saddled with a huge receivables problem. One way is for the government to come out with an instrument similar to a working capital term loan that can be offered by banks to those enterprises with whom they have an existing relationship.The government can fund the banks with an earmarked fund line suitably structured as to not disturb the CRAR. Some of the banks can be asked to co-lend with NBFCs in specific sectors as well. This kind of facility should alleviate the pain endured by a good number of B2B segment enterprises with banking and select NBFC relationships.Then there are a huge number of small firms in the B2B supply chain who fall under the reverse charge mechanism in the GST supply chain. They are not GST registered and the buyer pays the GST in bulk on behalf of these suppliers. Many of these suppliers depend on one or two big buyers for a bulk of their business.Would it make sense if the government pushes through a financing scheme which helps the micro B2B enterprises through the big, established buyers in the chain, of course, with an adequate KYC process? GSTN registration with an annual simple filing would be one option to nudge them towards formalization.

FEATURE HIGHLIGHT

IRIS Onyx

IRIS Onyx is an advanced e-invoicing solution that can integrate with your billing systems in multiple ways and help you generate IRN seamlessly without disrupting your current business processes.

Multiple additions and upgrades have been implemented; have a look at it here:

Dashboard in Onyx:

(A) In Quick Data there are two counts provided for those documents for which no IRN is present as on date.

(1) IRN to be generated: This count represents the documents uploaded in Onyx and which do not have error but still IRN is yet to be generated

(2) Error Documents: This count represents the documents uploaded in Onyx and which have errors hence they are not considered for IRN generation.

(B) In “IRN Active and cancelled section” the chart provides with the count of documents for which IRN is generated and is either active or cancelled in last seven days.

Both the above data is available in Dashboard at all three levels i.e. Root PAN, Legal PAN and GSTIN Level. Also the data is provided based on the access given to the user. If the user has access to only 2 out of 10 GSTINs then he will be able to see consolidated counts for only 2 GSTINs.

In the Utilities section, two features are added as follows:

(A) Get by IRN–

Here a user can fetch the document details for which the IRN is generated by user from the NIC by just providing the IRN No. This section also provides the Signed QR code image.

(b) Signed QR code verification–

Here the user can verify the signature of IRP for Signed QR code on an invoice by providing the signed QR code text in this section. This will enable users to verify the Signed QR code on purchase invoices too. We are also working towards building a similar feature in Peridot so that instead of putting the signed QR code text, user can scan the Signed QR code image and also verify whether an invoice is IRP registered or not.

For more details on e-Invoicing Solution i.e. IRIS Onyx, you can check out e-Invoicing Solution (IRIS Onyx).

Visit GST Blog to get more information about E-invoicing.

UPDATES

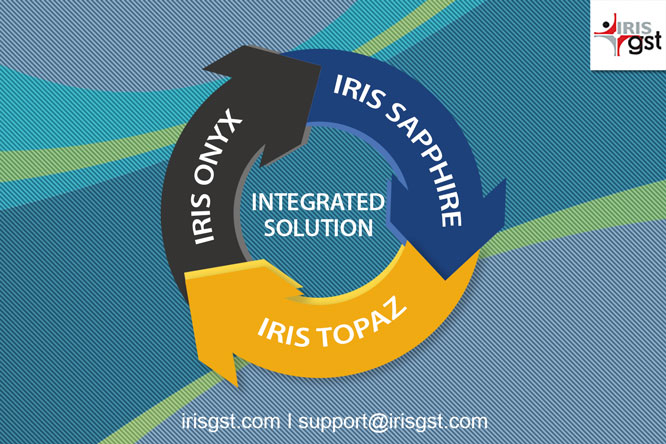

IRISGST’s E-Invoicing Solution, GST Software and EWay Bill tool are powerful alone but they are even better together!

Our integrated solution has the following products:

IRIS Sapphire: Collaborative GST Solution

- An industry-trusted GST compliance tool for seamless data transformation from your ERP to GST data, vendor reconciliation, GST form filing and annual return filing.

IRIS Topaz: Smart EWay Bill Management

- A simple and hassle-free solution for mid-and large sized businesses to generate, cancel, modify and update E-Way bills from single platform.

IRIS Onyx: Automated and Integrated E-invoicing Solution

- An advanced e-invoicing solution that can integrate with your billing systems in multiple ways and help you generate IRN seamlessly without disrupting your current business processes.

This integrated solution is made available on a unified platform with a single long-in for ease of use i.e. get all our offerings – IRIS Sapphire, Topaz and, Onyx from a single log-in and shared business hierarchy.

Our Integrated Solution with all in one ‘GST Suite’ will not just streamline the GST Filing, EWAY Bill Management and E-invoice processes but also will reduce the time involved with 100% accuracy!

IRIS GST Suite – Integrated Solution is everything you need to seamlessly:

- Reconcile your GST Returns with vendor data

- Maximize ITC

- Never miss a due date

- Create and manage every e-way bill

- Generate IRN and QR Code for every invoice, all in one place!

It’s Collaborative: For multiple teams spread across different locations

It’s 100% Secure: ISO-27001 Certified, built on Amazon AWS Cloud

From the House of IRIS: An authorised GSP since 2017.

Trusted: Vetted by more than 850+ business houses

Reliable: With excellent Customer Support

Cloud Based: For ease of operations

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment