IRIS GST TIMES

May, 2021

This issue

43rd GST Council Meeting ——————————————————– P.1

COVID Relief Measures Issued – 2021 ————— ———————— P.2

IRIS Sapphire & IRIS Peridot —————————————————– P.3

GST Compliance Calendar- June and Top GST News of the month —— P.4

–

Chief Editor

Vaishali Dedhia

The entire month of May 2021 went under lockdown and several businesses witnessed a huge blow. The lockdown continues now in June (complete/partial) in most parts of the country. However, the vaccination drive has started.

In this issue, we’ll be covering two important articles 1) 43rd GST Council Meeting – Key Highlights, COVID relief measures announced in last month and GST registration requirement for E-commerce Vendors.

Here, we also cover our feature highlight IRIS Sapphire.

Lastly, we share the link to our compliance calendar for June 2021 to help you stay compliant along sharing Top GST News of May 2021 plus the upcoming new ITC related feature of IRIS Peridot 5.0.

Regards,

Team IRIS GST

GST Registration Requirement for E-commerce Vendors

In this COVID world, work from home has become the new norm. Thus, more and more businesses are choosing to go digital for a wider reach. If you are someone who wants to start selling through e-commerce platforms and wondering if you need to register for GST then this article can help. But before that It is important to understand the seller categories in order to avoid the confusion.

E-commerce Seller/Vendor Categories

E-commerce sellers can be classified into three categories for the purpose of applicability of GST provisions. Here are the following categories:

- Selling Goods

- Selling Services [other than mentioned in Section 9(5)]

- Selling services mentioned in Section 9(5)

- Selling Goods:

If a person is selling goods on the e-commerce websites then he/she will have to get registered under GST even if their turnover is less than the required threshold limit which is Rs. 40/20/10 lakh. The people who want to sell goods via e-commerce need to register before starting to sell on the platform.Example: Sellers who want to set-up their digital stores on platforms like Amazon, Flipkart etc. are required to have GSTIN at time of registration as a seller on their platform.

- Selling Services [other than mentioned in Section 9(5)]:

A person selling services other than the ones mentioned in Section 9(5) is required to get registered under GST only if his turnover is more than the given threshold which is Rs. 20/10 lakh. And if a person is not registered then GST is not applicable for the transactions made by his e-commerce sales.

43rd GST Council Meeting – Key Highlights

The much-awaited ‘43rd GST Council Meeting’ was held on the 28th of May 2021. Finance Minister NirmalaSitharaman chaired the GST Council Meeting from New Delhi via video conferencing. The meeting was attended by MOS Anurag Thakur along with Finance Ministers of States and UTs and Sr. Officers from Union Government and States. Following recommendations were announced in the meeting (same will be brought into effect via relevant circulars and notifications, the recommendations have no legal binding).

- GST Amnesty Scheme reducing late fee:

To provide relief to the taxpayers, the late fee for not filing GSTR-3B for the tax periods from July, 2017 to April, 2021 has been reduced as follows

| GSTR 3B | Maximum late fees per return | Criteria |

| Nil return | Rs. 500(Rs. 250 each for CGST and SGST) | If filed GSTR 3B between 1st June to 31st August 2021 |

| Having tax liability | Rs. 1000(Rs. 500 each for CGST and SGST) | If filed GSTR 3B between 1st June to 31st August 2021 |

- Rationalization of late fees for all upcoming tax periods

To reduce burden of late fee on small taxpayers, the upper cap of late fee for all prospective tax periods is being rationalized to align late fee with tax liability/ turnover of the taxpayers. The benefit is provided for returns – GSTR 1, 3B, GSTR 4 and GSTR 7. See here for more details.

- Simplification of Annual Return for Financial Year 2020-21

Following changes to apply for the filing of annual return GSTR 9 for the FY 20-21.

- Optional GSTR 9 for taxpayers having aggregate annual turnover uptoRs 2 Crore

- The reconciliation statement in GSTR-9C for FY 2020-21 to be filed by taxpayers with annual aggregate turnover above Rs 5 Crore

- Taxpayers would be able to self-certify the reconciliation statement in GSTR 9C, instead of getting it certified by chartered accountants.

- Other changes and relief measures are in the areas as mentioned below:

- Several Extensions of due dates and lower interest rate and waiver of late fee announced as COVID 19 Relief measures for the taxpayers.

- Other Covid 19 related relief measures announced such as Rule 36(4) of claiming provisional ITC is recommended to be applicable cumulatively to April, May and June 21.etc.

GST Updates

COVID-19: New Relief Measures Issued – 2021

The country is once again under lockdown citing the rising COVID-19 cases. Considering the prolonged pandemic, the government is taking measures in all areas for the well-being of the citizens. The finance ministry has been updating the new norms in multiple areas including GST. The Finance Ministry made new announcements and notifications in the month of May, followed by an update to the same in 43rd Council meeting.

Following is a note on relief measures announced:

- Extension of due dates:

Several due dates were extended at the start of the month vide notifications issued on 1st May 2021. The council has recommended further extension on the previous notification.

| Return type | Tax Period | Original due date | Recommended due date |

| GSTR 1* | May ‘21 | 11 June ‘21 | 26 June ‘21 |

| IFF* | May ‘21 | 13 June ‘21 | 28 June ‘21 |

| GSTR 4 | FY 20-21 | 30 Apr ‘21 | 31st July ‘21 |

| GSTR 5 & 5A | Mar ‘21 | 20 Apr ‘21 | 30 June ‘21 |

| Apr ‘21 | 20 May ‘21 | 30 June ‘21 | |

| May ‘21 | 20 June ‘21 | 30 June ‘21 | |

| GSTR 6 | Apr ‘21 | 13 May ‘21 | 30 June ‘21 |

| May ‘21 | 13 June ‘21 | 30 June ‘21 | |

| GSTR 7 & 8 | Apr ‘21 | 10 May ‘21 | 30 June ‘21 |

| May ‘21 | 10 June ‘21 | 30 June ‘21 | |

| ITC 04 | Qtr – Mar ‘21 | 25 Apr ‘21 | 30 June ‘21 |

*Due Date is extended by 15 days

- Lower Interest Rate and waiver of Late Fees:

Several benefits of lower interest rate and waiver of late fees were announced in the month of May. The Council meeting further extended those benefits, notifications to affect the same to be issued soon. Following table summarises the same:

- PMT 06 and CMP 08

| Return type | Tax period | Original due date | Benefit available till | Benefit available |

| PMT 06 | April ‘21 | 25 May ‘21 | 9 June ‘21 | Nil interest |

| 10 June ‘21 – 9 July ‘21 | Interest at reduced rate of 9% | |||

| PMT 06 | May ‘21 | 25 June ‘21 | 10 June ‘21 | Nil interest |

| 11 June ‘21 – 25 July ‘21 | Interest at reduced rate of 9% | |||

| CMP 08 | Qtr – Mar ‘21 | 18 Apr ‘21 | 3rd May ‘21 | Nil interest |

| 4 May – 17 June ‘21 |

Interest at reduced rate of 9% No late fees till 17 July ‘21 |

- GSTR 3B

Several benefits have been announced for GSTR 3B filers in various categories based on their turnover and filing frequency for the month of Mar, April and May . If filed within 15 days from due date, nil interest to be charged, interest to be charged at reduced rate of 9% for next 15 days . No late fees to be charged if filed within these 30 days.

IRIS GST has released a free E-book on effectively using GSTR-2A and GSTR-2B for ITC maximization

A complete guide to mastering ITC maximization using GSTR 2A and 2B along with other essential factors and advanced reconciliation secrets!

The e-book is written by our top GST Experts – Shilpa Dhobale, VaishaliChheda and Ashwini Gorhe wherein they discussed everything about ITC maximization and Advanced User-Defined Reconciliation using 2A and 2B along with related factors

FEATURE HIGHLIGHT

IRIS Sapphire – Complete GST Filing Solution

The companies are struggling for cash flow in these pandemic times and hence achieving maximum and accurate ITC is the need of the hour. Though challenging, a 100% ITC claim is manageable with the use of correct strategies and solutions.

While knowing your vendor network is important for 100% ITC claim, one cannot deny the importance of technology when it comes to GST reconciliation. Hence, businesses should choose a GST Solution Provider who can help them to claim ITC effectively and efficiently. Because well defined internal processes and solutions can help you reconcile purchase data and a deft technology provider can assist you in narrowing down the discrepancies and help you to maximize your ITC claim.

With IRIS Sapphire, the preferred GST Solution of top organizations across the country, GST Reconciliation can be easier than you think. Built with advanced algorithms and fuzzy logic, IRIS Sapphire helps you to reconcile all your data, with no-hassles guaranteed. It swiftly scans through your purchase and the suppliers’ sales data and points out the discrepancies. Furthermore, its smart assistance can help you to rectify the discrepancies (if any), on the go.

With strong built-in analytics, Sapphire offers CFOs ITC maximization, vendor management, and faster GST reconciliation. Well, hassle free return preparation and timely GST Return filing is a given! From the latest GST updates to system upgrades, we are always on top of things, literally!

Why IRIS Sapphire?

- Your data is handled ‘your way’ via ERP data/API Integration or manually prepared data

- Hassle-free GST Reconciliation and ITC Maximization

- API Gateway to GSTN Systems

- Strong Customer Support and Guidance

Along with offering basic features like GST Compliance Tracker, Bulk Operations, Vendor Management, etc. IRIS Sapphire also offers value-added services like:

- Know Your Monthly ITC

- Smart and Advanced Reconciliation

- Download data for all your GSTINs in one go

- GSTR 6, GSTR7, GSTR 8, and GSTR 2X enabled

- Partially Auto drafted GSTR 9

- GSTR 3B auto-population from GSTR 1 and GSTR 2 uploaded data

- GSTR1 and E-invoicing Reconciliation

IRIS Peridot – More Than A GSTIN Search App!

IRIS Peridot – New ITC Feature

When it comes to ITC claim, reconciliation of purchase invoices and arriving at ITC amount considering ‘actual’ and ‘provisional’ claims is key. Invoices in forms GSTR 2A and GSTR 2B will be the same. However, the only reason for the discrepancy is invoices being reflected in different months.

We are bringing in a new feature in the upcoming launch of IRIS Peridot 5.0 !!

The latest version offers a reconciliation between form GSTR 2A and GSTR 2B at any given point of time once GSTR 2B is generated. The said statement provides reconciliation at counterparty level and invoice level too.

Here are all the other features the App has: IRISPeridot’s Features

Download / Upgrade to Peridot now: https://bit.ly/2IFNdTN

5 Key Areas You Need To Plan For An Effective E-voicing Implementation

With e-invoicing implementation, both the Government as well as entities, stand to benefit. However for the benefits to reap in the future, efforts and investment is needed now to get the systems and processes ready. As E-invoicing and E-way Bill generation can be done simultaneously, entities need to revisit and consider if any changes are required in their business processes.

Here are 5 Key Areas You Need to Plan for an Effective E-Invoicing Implementation…

1. Aligning internal systems to the e-invoicing implementation standard

2. Revisiting billing system and processes for e-invoicing implementation

3. Meeting the B2C E-invoicing Implementation Requirements:

4. It’s not only IRN but also E-way bill

5. Invoice Printing

Read: 5 Key Areas You Need To Plan For An Effective E-voicing Implementation

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST.com

UPDATES

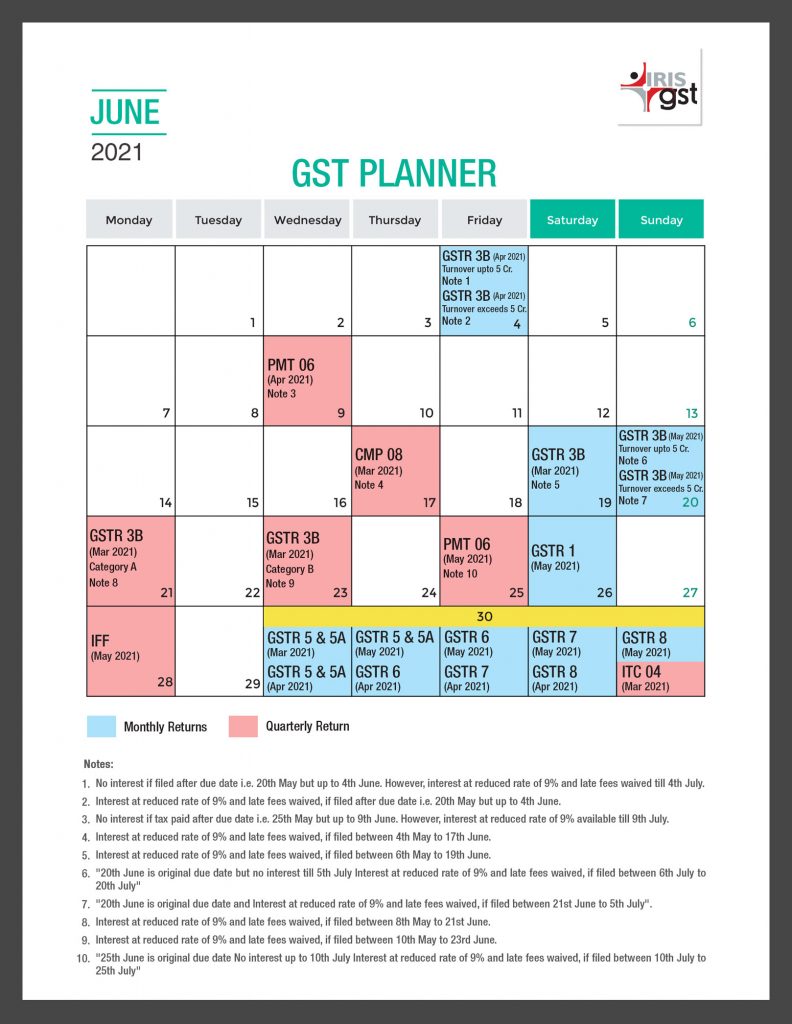

June Compliance Calendar 2021

Let us look at the GST Compliance Calendar of June 2021. Here is a comprehensive image of our June Compliance Calendar 2021. It has all the GST Compliance Due-dates for June 2021 so that you never miss a due-date! You can Download and pin it for your quick reference.

Top GST NEWS of the month!

There have been a few new changes, additions, and GST updates in the month of May 2021.

In the article we have covered the following categories:

- Important notifications released in the month

- GST Collection of the month

- GST Compliance Updates

- Latest GST Changes and News

Read the full article here: Top GST News of the month – May 2021

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment