The Goods and Service Tax (GST) Act has brought significant reform in the Indian taxation system. It is definitely a move closer to Digital India. And if you have recently come under the GST mandate by crossing the GST threshold limit (Taxable Person under GST) we think it’s about time you start learning more about the topic so that you can be ready for GST compliance well in time.

While the effects of GST on the economy are seen explicitly, its impact on the taxpayer’s day-to-day operations are equally far-reaching. We believe that the implementation of GST is a game changer for organizations in easing operations going forward. The aim should be to get maximum alignment with the current processes and absorb any impact with minimum disruption to the business.

And to do this, there are several areas that need to be thought through before diving in – Understanding the GST’s applicability, coverage of the bill, impact on profitability and ways to handle this, among others.

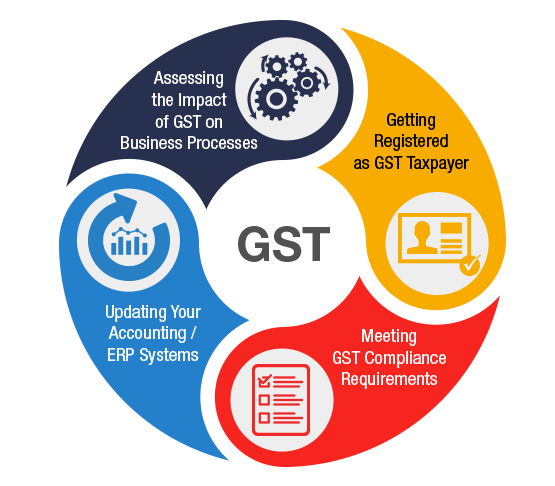

Goods and Services Tax: A 4 point Action Plan

Here is a 4 point action plan to help you take a holistic view of your GST compliance process and plan for the implementation:

1. Assessing the Impact of GST on Business Processes

GST has brought significant policy-level changes when compared to erstwhile tax laws. For instance, GST is applicable to supply; the place of supply determines the incidence of tax, rules and process of claiming Input Tax Credit etc. Entities, therefore, need to align their processes and policies related to pricing, supply chain, cash flow management, legal contracts, business locations etc.

Moreover, with GST, information needs to be submitted at the invoice level and with a monthly frequency. This directly impacts the functioning of current IT systems that might be programmed for quarterly or half-yearly frequencies and capture aggregated data.

We recommend that you immediately get started on the impact analysis of GST on your business processes. The objective of the exercise should be to understand the gaps between current processes and the expectations under the GST implementation and initiate steps for bridging them. Engaging all the stakeholders such as accountants, indirect tax experts, and internal teams, is a must, right at the outset, for coming up with an effective strategy.

2. Getting Registered as GST Taxpayer

2. Getting Registered as GST Taxpayer

Another important aspect of complying with GST is to register the entity as a GST taxpayer.

Some note-worthy points:

1. Existing VAT and service taxpayers need not register afresh for GST. Their existing details can be migrated to the GST portal by following due process to enable a single transactional relationship with the government. These entities need to get provisional IDs for the GST portal from their existing registrations with State VAT or Service. This provisional ID can then be used to login to the GST portal and fill the requisite details for GST registration.

2. As GST is a supply location-based tax regime, organizations may have to get multiple IDs registered depending on their locations.

3. The GST Registration form is a lengthy one with several fields and also requires you to upload business documents. So ensure that you have the relevant documents handy as soft copies, before initiating the registration process as each section needs to be completed in one go for your data to be saved.

3. Updating your ERP / Accounting Systems

GST has subsumed most of the indirect taxes. The rate of tax is now based on the destination of supply of goods instead of the erstwhile value added tax at various levels along the supply chain. Tax invoices now need to include the GST registration number (GSTIN) of the counterparty, HSN (Harmonised System of Nomenclature) code for goods or Service Accounting Codes (SAC) for service etc. Also, when filing returns, companies need to provide further details such as eligibility for claiming input tax credit, details of original invoice in case revised invoices are issued etc.

Many of these requirements will require revisiting the existing billing system, the standard chart of accounts and underlying accounting aspects. The ERP/ accounting systems therefore need an upgrade to enable capturing and smooth processing of all the additional information.

4. Meeting the GST compliance requirement

Once the initial GSTIN registration process is complete, for most entities, compliance with GST will be a monthly affair. The GST reconciliation of supply and purchase data on a monthly basis will improve efficiency when it comes to tax payment and availing of credit, amongst other things.

GST transition may look like a humongous exercise, but with the right tools and support, it can be done easily, quickly and with minimum disruption to business. While the GST portal allows you to file returns directly, for companies with many records this might not prove to be easy.

Given the volume of data and frequency of filing, a seamless and automated process for the regular compliance requirement will be necessary. With a proficient GST solution, this can be streamlined to a great extent.

The Good and Services Tax Network (GSTN) has therefore appointed GST Suvidha Providers (GSP) to provide services for the ease and convenience of taxpayers. IRIS Business Services Limited is one of only 34 companies selected as a GSP, after a comprehensive and stringent evaluation process.

IRIS has been in the compliance space for 2 decades, having worked with regulators and filing entities alike. On one hand, our solutions power the likes of the Reserve Bank of India and ACRA, Singapore on the regulatory side, and on the other, we support over 700 Indian corporates to meet their MCA filing requirements.

IRIS GST is the Tax technology business line of IRIS. There is this notion that GST compliance is monotonous, boring and tiring. But, we know that there is a better way to tax! We believe GST Compliance is no longer a tick in the CFO’s task list. It is fast transforming into a core business process. Hence, at IRISGST, we have crafted multiple products with the use of technology to simplify GST compliance for taxpayers with automation and AI.

Nice information about GST thanks you. It is really useful Articles .