PMT-09 is a form (i.e. a challan) used to transfer wrongly paid Input Tax Credit from one head to another.

What is Form PMT-09 in GST

The Central Board of Indirect Taxes and Customs (CBIC) enabled Form PMT-09 on the GST Portal in April 2020. It is a challan which can be used to shift the amount of tax, interest, penalty, etc. that is available in the electronic cash ledger to any other tax head, cess, interest, penalty, etc.

It was launched by CBIC via GST Notification no. 31/2019 CT on 28th June 2019, and was announced in the 35th GST Council Meeting. However, it was made live on 21 April, 2020.

Who is eligible to File Form PMT-09 Online?

All the registered taxpayers are eligible to file PMT-09 for shifting the balance available in Electronic Cash Ledger to any other appropriate tax head or cess head or interest or penalty etc.

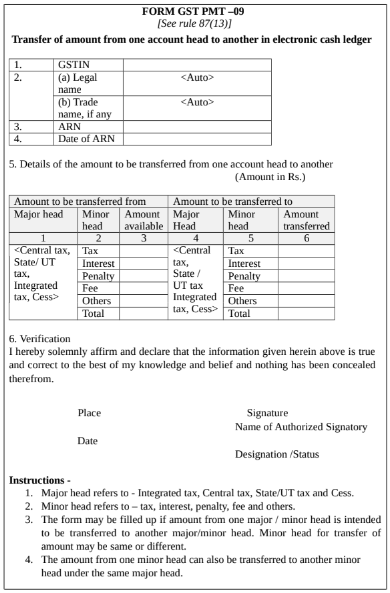

Form PMT-09 Format

Form PMT 09 consists of major and minor heads. Major head are Integrated tax, Central tax, State/UT Tax, and Cess. Minor head are Tax, Interest, Penalty, Fee and others.

In the Form PMT-09, the taxpayers need to provide GSTIN number and fill the data in Table No. 5. It is important to note that the amount can be transferred from one head to another only if there is enough balance available during the transfer.

The GST PMT-09 form is useful if a taxpayer wants to transfer an amount from one minor head to a major head or vice versa. The amount can also be transferred from one minor head to another minor head under the same major head.

Example:

Supposing the taxpayer has erroneously paid Rs. 20,000 under Cess instead of SGST. So, now by filing PMT-09 the taxpayer can transfer the Cess balance in Electronic Cash Ledger to SGST and utilize the same for settlement of SGST Liability.

Filing PMT-09 in GST

- This challan only allows shifting of the amounts that are available in the electronic cash ledger.

- If the wrong tax has already been utilized for making any payment, then this challan is not useful. In other words, it will be able to handle only one situation and that is when payment is done in the wrong head and not utilized.

- The amount once utilized and removed from cash ledger cannot be reallocated.

******

IRIS Sapphire – a product of IRIS GST, an authorised GSP (GST Suvidha Provider of the government).

A GST Return Filing Software which is trusted by top Indian companies for their GST Compliance.

It is a premium cloud based GST software that helps your team to collaborate on GST Return filing, GST Reconciliation and ITC maximization. It is 100% Secure and Scalable.