The monthly return (in some cases quarterly) containing the details of outward supplies made during the period.

New revised edition of HSN 2022 | HSN 2022 is the new revised edition of HSN published by the World Customs Organization (WCO) has into force from 1st Jan 2022…

2021 went by in a jiffy and 2022 is waiting for us around the corner patiently! From all the changes that indirect taxation has undergone this year, it seems like the GST rules are getting tighter in 2022. We have collated all the important GST changes being applicable from 1st January 2022 that you need to be aware of! Let us look at the changes in major brackets one by one...

From all the changes that indirect taxation has undergone this year, it seems like the GST rules are getting tighter in 2022. We have collated all the important GST changes being applicable from 1st January 2022 that you need to be aware of! Let us look at the changes in major brackets one by one

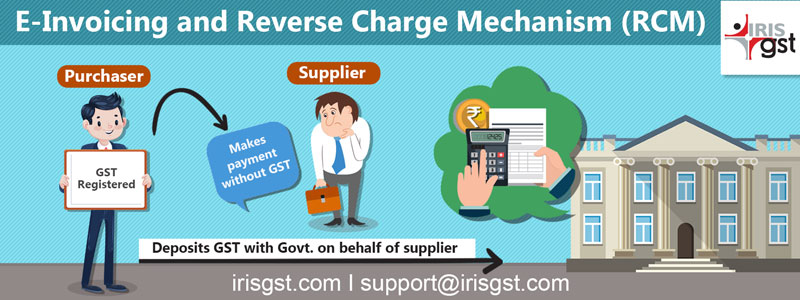

E-invoicing starts in a month and the onus of creating invoices and getting them registered on the Invoice Registration Portal (IRP) lies on the Supplier.

Falling Under The E-invoice Criteria? Here Are Mistakes To Avoid | E-invoice Preparation | E-invoicing in India | E-invoicing under GST

Summary of GST Circular 161 talks about clarification relating to the export of services-condition (v) of section 2(6) of the IGST Act 2017. Read here…

GST Circular 160 explained: It talks about the clarification with respect to certain GST related issues. Read here…

Summary of GST Circular 159: This circular talks about the clarification on doubts related to Scope of “Intermediary”. Read here…

Unblocking a GSTIN for EWay Bill Generation in case of non-filing of GST Returns is going to be a major concern of the MSME sector in coming days as the rule of EWay Bill Generation blocking is now supposed to come into effect from 21st November 2019 as per Notification No. 36/2019 – Central Tax dated 20.08.2019.

India, is a big economy with wider geographical anomalies. Here people live in terrains, deserts, land and mountains connected by roads, rail, air and even water at some places.

IRIS GST Software, from the house of IRIS GST, a leading GST Suvidha Provider, offers this tool to ease your GST return filing processes , compliance processes, GST reconciliation and so on.