IRIS GST TIMES

September, 2020

This issue

E-invoicing- Latest Updates ————————-P.1

42nd GST Council Meeting Highlights ————- P.2

IRIS Onyx – E-invoicing Solution ——————- P.3

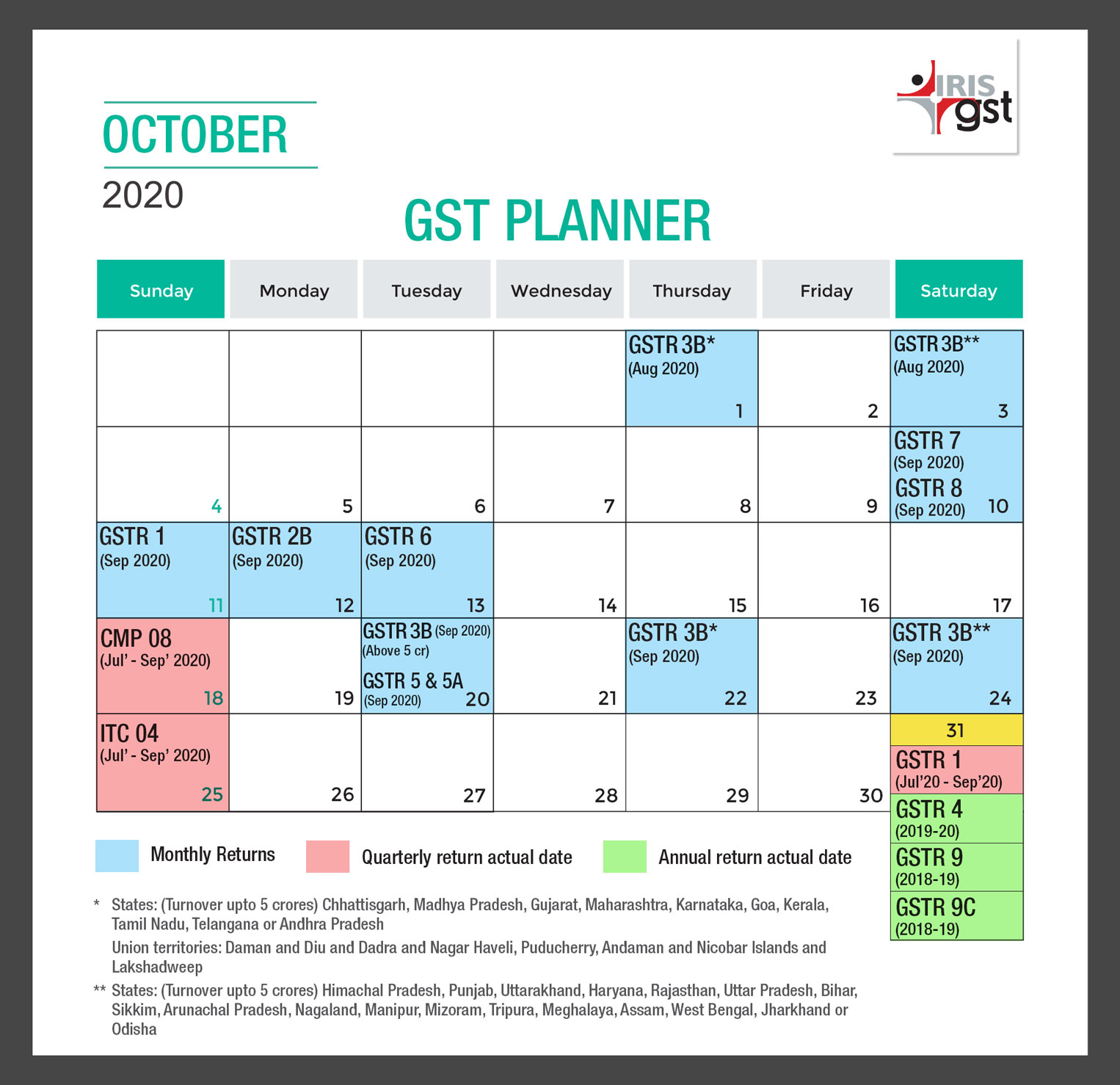

GST Compliance Calendar October 2020 ———– P.4

Chief Editor

Vaishali Dedhia

September went by in a jiffy and October is already here! The month of implementing e-invoicing under GST and the commotion that will follow. People all over the country are wrapping up September and gearing up for the last quarter of the year, hoping for a better tomorrow while the finance folks gear up to implement big GST Changes.

We at IRIS continue to WFH and serve all our clients with the best of our abilities just like before!

In this issue, we’ll be the latest notifications and updates released by the government. Here, we also share details about e-invoicing for e-commerce operators. Along with articles – E-invoicing for E-commerce operators, Compensation cess and more. Our feature highlight is IRIS Onyx. And we share the link to our compliance calendar for October to make your compliance easy!

Regards,

Team IRIS GST

GSTR 5: Eligibility, Due-date, Tables & Format

Form GSTR 5 is a return which is to be filed by every registered non-resident taxable person. GSTR 5 contains all the information related to purchases and sales of the filer i.e. for the non-resident (NR)’s business. It has to be filed online on the official GST Portal as there is no offline facility available.

It is a return containing information related to sales and purchases of a non-resident’s business.

GSTR 10: Eligibility, Due-date, & Format

What is Form GSTR-10?

If a taxpayer’s GST registration is cancelled or surrendered, then he/she needs to file a return in Form GSTR 10. It is known as the Final Return.

This return has to be filed within three months of the date of cancellation or the date of order of cancellation (whichever is later). Form GSTR 10 also shows details of the ITC involved in closing stock (inputs and capital goods) to be reversed or paid by the taxpayer. The taxpayer can file NIL GSTR 10 also.

Compensation Cess under GST

GST – Goods and Service Tax was launched in India in July 2017 replacing the old taxation system that existed in the country. Compensation cess is charged on goods at their consumption destination and not where they are manufactured. So manufacturing states like Maharashtra, Gujarat, Haryana, Tamil Nadu etc. feared revenue losses and to cover this issue, the government introduced Compensation Cess under GST. It was pre-decided that compensation cess will be levied only for the first 5 years of the GST regime i.e. from July 1st, 2017 to July 1st, 2022.

What is Compensation Cess under GST?

Compensation Cess under GST is levied by GST – Compensation to States Act 2017. As per this act, the centre has to compensate the states for loss of their revenue due to the implementation of GST since GST is a consumption-based taxation system.

- Who collects the GST compensation cess?

- Goods covered for GST Compensation Cess

- Using ITC of Compensation Cess under GST

- Calculating Compensation Cess under GST

Read our full article on Compensation Cess under GST here!

System computed values of GSTR 1 (Monthly filers) will be available in Form GSTR 3B as PDF Statement by GST Portal

The latest update on the GST portal is that the system will compute values for Table 3 of Form GSTR-3B using information reported in GSTR-1 Statement (monthly) and it will be made available as PDF statement.

It is good to note that this PDF will be available on the taxpayer’s GSTR-3B dashboard, from the tax period of August 2020 onwards. It will contain the information of GSTR-1 filed by them on or after 4th September 2020.

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST

Latest E-invoicing Updates

At the stroke of midnight, India woke up to a new era of connected future – E-invoicing became effective from 1st Oct 2020!

However, considering initial hiccups companies may face, Government gave some relaxation for taxpayers for them to get fully prepared for the new IRN system and process.

- For the month of Oct, no penalty shall be levied in case of non-compliance under e-invoicing rules provided IRN is obtained within 30 days of invoice issued.

- After 30 days, the penalty which could go up to ₹25,000 per default could be levied.

- From 1st Nov’20, there would be no relaxation and non-adherence will attract a penalty under section 122 of the CGST Act.

Here are some important updates:

- Notification 70/2020 introduced to update Notification 13/2020 and thereby cover “Export” transactions and also taxpayers who crossed ₹ 500 CR in any FY after 2017 for e-invoicing mandate

- Implementation of dynamic QR Code on B2C invoices deferred to 1st December 2020. Notification 71/2020-Central Tax dated 30.09.2020 issued. If you are looking to provide a seamless payment experience for your customers, this may be the time to check with your banks and payment gateways.

- HSN Master is also updated to include all the codes, which were earlier missing and were reported to NIC.

E-invoicing and E-commerce

From October 1, 2020, all the companies with over ₹ 500 CR turnover in any of the preceding financial year from 2017-2018 onwards have implemented e-invoicing. We have covered E-Invoicing and B2C transactions, Reverse Charge Mechanism, E-Way Bill in our August Edition. This month, we are talking about E-Invoicing and E-Com Operators.

E-invoicing for E-commerce Operators

E-commerce operators are allowed to generate IRN on behalf of a supplier.

However, it is important that the e-commerce platform should mandatorily be registered as e-commerce operator under GST.

The latest update on the GST Portal is that E-Commerce Operators have been enabled to register and test the APIs on the sandbox system. Services provided by E-commerce come under RCM i.e. Reverse Charge Mechanism. In order to know whether these service invoices require IRN or not turnover of the commerce operator is important.

The transactions made through ecommerce platform are normal supplies made by suppliers and hence in order to know whether e-invoicing is required for these or not supplier’s turnover is important. The overall principle of generating an IRN still remains the same i.e. for B2C transactions IRN generation is not applicable.

GST Updates

42nd GST Council Meeting Highlights

The 42nd GST Council Meeting was held on October 5th, 2020 chaired by Union Finance Minister Nirmala Sitharaman, via video conferencing.

The meeting was attended by Shri. Anurag Thakur, Union Minister of State for Finance & Corporate Affairs besides Finance Ministers of States & UTs and Senior officers from Union Government & States.

Highlights of 42nd GST Council Meeting:

- Compensation Cess:

In the last meeting i.e. the 41st GST council meeting, Centre had given two borrowing options to States to meet GST compensation requirement for the current financial year.

In the 42nd GST Council Meeting, the Council decides to extend Compensation Cess levy beyond June 2022.

The Compensation of ₹ 20,000 crores will be released to States towards loss of revenue during 2020-21.

Additionally, an amount of approx ₹ 25,000 crores towards IGST of 2017-18 to be released in the coming week.

The GST Council will meet on October 12 to further deliberate on compensating states for GST cess shortfall.

- GST Returns Filing – Enhancements and Process Streamlining:

The 39th GST Council Meeting acknowledged the necessity for simpler GST reporting, especially for small taxpayers.

It was decided to incrementally fix the current filing system, introduce enhancements wherever necessary and streamline for an efficient reporting system.

Various enhancements have since been made available on the GST Common Portal including filing NIL GSTR 3B via SMS and form GSTR 2B etc.

- Nil CMP-08

Provision for furnishing Nil CMP-08 through SMS has been introduced.

- GST Return Filing Roadmap

The Council today has approved a future roadmap for efficient GST Return filing. Following are the key highlights from the roadmap:

- Due date of furnishing quarterly GSTR-1 by quarterly taxpayers to be revised to 13th of the month succeeding the quarter w.e.f. 01.1.2021

- Roadmap for auto-generation of GSTR-3B from GSTR-1 by:

- Auto-population of liability from own GSTR-1 w.e.f. 01.01.2021; and

- Auto-population of the input tax credit from suppliers’ GSTR-1 through the newly developed facility in FORM GSTR-2B for monthly filers w.e.f. 01.01.2021 and for quarterly filers w.e.f. 01.04.2021;

- In order to ensure auto-population of ITC and liability in GSTR 3B as detailed above, FORM GSTR 1 mandatorily required to be filed before FORM GSTR 3B from 01.04.2021 onwards.

- The present GSTR 1 and GSTR 3B return filing system to be extended till 31.03.2021 and the GST laws to be amended to make the GSTR-1/3B return filing system as the default return filing system.

- Small Taxpayers GST Compliance

To reduce the compliance burden of small taxpayers having an aggregate annual turnover of less than ₹ 5 crores, GST Council had earlier suggested quarterly return filing with monthly tax payment. Same has been accepted today. It will be implemented from 01 Jan 2021.

The number of returns comes down from 24 monthly returns to 8 returns, from January 2021.

- HSN/SAC Declaration

A revised requirement of declaring HSN/SAC for Goods and Services (4/6/8 digits) in invoices and GSTR1 to be introduced from 01-04-2021 based on turnover limit of taxpayers.

FEATURE HIGHLIGHT

IRIS Onyx: A Complete E-invoicing Solution

When India was waking to the new era of digital oneness, our team was busy fine-tuning the last-minute touch-ups for our client’s implementation! Yes, we have also gone live with our e-invoicing solution –IRIS Onyx.

More than 250 GSTINs generated IRNs through Onyx on 1st October.

Apart from fine-tuning following changes have been made to the portal:

Updates made in Generate EWB by IRN:

In case of export invoices, if taxpayers want to generate EWB while generating IRN then they have to provide port address details (final destination within India) in Ship to Details section. In case if while generating IRN, the port details are not available, then the taxpayers can generate EWB later using Generate EWB by IRN feature and by providing the Port details. The fields that are added in Generate EWB by IRN under Export Ship/Port details are as below:

- Port Address 1, Location, State Code and Pincode. (All mandatory in case of export and only if not provided while IRN generation)

- Port Address 2 (Optional).

Here are some of the prominent features of IRIS Onyx:

- Real-time E-invoice with E-way Bill Generation

- Business and User Management Module

- Standard and Advanced Validations

- Upload Invoice at PAN and GSTIN level

- POB level operations

- Invoice Sharing and Archiving

- Alerts and Reminders – MIS and reports

- Customized Invoice Template with Bulk Print

For more details on E-invoicing Solution i.e. IRIS Onyx, you can check out our e-invoicing Solution (IRIS Onyx).

Update in IRIS Sapphire:

Delinking of Credit debit notes with Invoice:

Now in GSTR1 and GSTR 6 while providing data for credit and debit notes, there is no requirement of sending the reference invoice no and date. GSTN has removed these fields from GSTR 1 and GSTR 6 and hence you can also skip providing these in IRIS formats

UPDATES

GST Compliance Calendar – October 2020

October – the last quarter of 2020 is here already!

While this year has seen a lot of roadblocks with a pandemic hitting the world followed by a lockdown and economic crises, it sure has kept our minds occupied and has made us solution-oriented.

The GST collection for June stood at Rs 90,917 crore and the collection for July was at Rs 87,422 crore. In the month of August, the GST collection further dropped and stood at Rs 86,449 crore. From this aggregate amount, Rs 15,906 crore is CGST, Rs 21,064 crore is SGST, IGST of Rs 42,264 crore including Rs 19,179 crore collected on import of goods and a cess collection of Rs 7, 215 crores including Rs 673 crore collected on import of goods.

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment