IRIS GST TIMES

November, 2018

Issue 2

We hope you had a safe and prosperous Diwali and also that you filed your GSTR-1 return on time with Diwali being around the corner and the due- date falling on a Sunday.

In this issue, we will discuss the complete comparative analysis of Taxable outward Supply in Form GSTR-9. How you can file your GSTR-9 return using information from returns filed during the current financial year. A convenient way of carrying all the tasks related to E-way bill using a MS-Excel based desktop utility, new notification regarding TCS provision, the scope of principal and agent relationship under CGST Act 2017 and more.

With GSTR-9 being the talk of the town, find out how IRIS GST will make your GSTR-9 filing seamless.

Regards,

Team IRIS GST

TCS provision for Supply of goods from a Public Sector Undertaking to another Public Sector Undertaking

As per the new notification, Tax Colelcted at Source (TCS) will not be applicable to supply of goods and services from a Public Sector Undertaking (PSU) to another PSU.

Do you know

GST Collection for the month of October

October’s GST revenue crossed ?1 lakh crore after a gap of 5 months. Of the ?1 lakh crore, CGST stood at ? 16,464 crore, SGST at ?22,826, IGST ?53,419 crore and cess at ?8,000 crore.

The Total revenue earned by the government and state government after regular and provisional settlement in the month of October, is ?48,954 crore for CGST and ?53,934 crore for SGST.

Update

Collection of Tax by Tea Board of India

Tea Board of India being the operator of the electronic auction system for trading of tea across the country including for collection and settlement of payments, admittedly falls under the category of electronic commerce operator liable to collect Tax at Source

Henceforth, in terms of section 52 of the CGST Act, tax shall be collected by Tea Board respectively from the :

1. sellers (i.e. tea producers) on the net value of supply of goods i.e. tea; and

2. Auctioneers on the net value of supply of services (i.e. brokerage).

Scope of Principal and agent relationship under Schedule 1 of CGST Act, 2017

The new circular Circular clarifies scope of principal and agent relationship under Schedule I of CGST Act, 2017 in the context of del-credre agent.

Do Not Forget!

Make a note that the dates notified by the government were upto 31st October 2018. From November onwards, regular filing date will apply. So file your GSTR-3 for October on or before November 20 2018

CONTACT US

Have feedback for us?

Want to request for our product demos?

Please reach out to us at

Analysis of Outward Supply in GSTR-9

In our previous issue, we have covered a detailed summary of the 6 parts that comprises your GSTR-9 Form. Table 4 GSTR 9 requires reporting of details related to taxable outward (except Sl No G which relates to inward supplies which attracts GST)

Sl. No. 4A. Supplies Made to Unregistered persons (B2C)

detailes of supplies made through E-commerce operators and are to be declared as net of credit notes or debit notes issued in this regard.

| Category of Supply | Nature of Supply | Relevant table of GSTR-1 |

|---|---|---|

| taxable outward inter-State supplies to unregistered persons where the invoice value > ?2.5 lakh | Inter-State | Table 5 |

| taxable supplies (Net of debit notes and credit notes) to unregistered persons where the invoice value is up to ? 2.5lakh | Inter-State & intra-State | Table 7 |

| Amendments to taxable outward supply details furnished in returns for earlier tax periods in Table 5 & Table 7 | Inter-State and Intra-State | Table 9 & Table 10 respectively. |

Sl.No.4B. Supplies Made to Registered Person

This group includes supplies made through E- commerce operators but shall not include supplies on which tax is to be paid by the recipient on reverse charge basis. See the table on the side.

| Category of Supply | Nature of Supply | Relevant Table of GSTR 1 |

| Taxable outward supplies to registered persons (including supplies made to UINs) other than those attracting reverse charge and supplies through ecommerce operators | Both inter and intra-State | Table 4A |

| Taxable outward supplies to registered person through e-commerce operators | Both inter and intra-State | Table 4C |

IMPACT ANALYSIS

Sl.No.4C. Zero rated supply in payment of tax

4C of GSTR-9 contains ifnormation relating to a sub-set of all zero-rated supplies comprising of exports of goods and exports of services out of India.

| Category of Supply | Nature of Supply | Relevant table of GSTR-1 |

|---|---|---|

| Agg. Value of Exports | Intra-State | Table 6A |

Sl.No. 4D. Supply to SEZs on payment of tax

This contains information relating to a sub-set of all zero-rated supplies comprising of supplies to SEZ being a Developer of the SEZ or a Unit in the SEZ.

| Category of Supply | Nature of Supply | Relevant table of GSTR-1 |

|---|---|---|

| Agg. Value of supplies to SEZs | Inter- State | Table 6B |

Sl.No.4E. Deemed Export

4E of GSTR 9 contains information regarding ‘deemed export’. Section 147 allows the Government to notify certain supply of goods to be deemed exports where the goods supplied do not leave India and the payment for such supplies is received either in Indian rupees or in convertible foreign exchange if such goods are manufactured in India.

| Category of Supply | Nature of Supply | Relevant table of GSTR-1 |

|---|---|---|

| Agg.value of supplies in the nature of deemed exports | Inter- State | Table 6C |

Sl.No. 4F. Advances on which tax has been paid but invoice not issued

Tax is payable on advance even though supply is pending. 4F contains details of advances received and tax Invoice that is yet to be issued.

| Category of Supply | Nature of Supply | Relevant table of GSTR-1 |

|---|---|---|

| Advance received, and tax has been paid but invoices has not been issued in the current year | Both inter- state and intra-state | Table 11A |

Sl.No.4G. Inward supplies on which tax is to be paid on reverse charge basis

4G in GSTR 9 contains details of inward supplies in respect of which registered person is liable to pay tax on reverse charge basis. Reverse charge provisions are guided through section 9(3) and 9(4) of the CGST Act in case of intra state supplies. In case of inter-state supplies, the corresponding sections of 5(3) and 5(4) of the IGST Act would be applicable.

To read the complete detailed analysis, please click here.

FEATURE HIGHLIGHT

Generate E-way Bills Easily Using MS-Excel based Desktop Utility

If you are a vendor who has to transport goods often and subsequently generate E-way bills, IRIS Topaz’s Desktop utility will make your job simpler.

IRIS Topaz’s desktop utility is a MS-Excel based utility tool for all the processes involved in E-way bill cycle. It allows you to generate E-way bills, Update, Cancel and reject E-way bills and an user to whom access is provided at POB level can generate E-way bills in bulk by place of location from drop down

Additionally, you can update transporter details and consolidate E-way bills i.e group all the individual E- way bill numbers to create a consolidated E-way number. You can do all this comfortably without even opening your web browser.

Now let’s take a look into the features that will make your task of generating E-way bill easier:

The tool provides you specific sheets for every E- way bill action i.e Generate, Update, Cancel and Reject. You just have to select the work type from the “Select Work Item tab”.

After you have mapped your task, you will have to import data for the respective actions. You can import data either in an excel file or a .csv file.

Once you have imported the data, you simply have to validate your data for respective action based on our validation rules which are built in compliance with the latest NIC rules.

The tool also prompts an error if there is any validation rule that is not met. Allowing you to track and rectify the error. So that there is no error in your E-way bill once it is generated.

Other than the mentioned features, IRIS Topaz’s desktop utility also offers additional value added features such as the option to:

- Calculate distance – distance is calculated using third party services based on “From” and “To” PIN codes provided by the user.

- Calculate invoice level values – the total tax amount at invoice level is computed by taking the sum of all tax amounts at line item level for each invoice. We compute Total Invoice Value by taking the sum of Invoice level Taxable Amount, CGST, SGST, IGST, Cess amount, Cess NonAdvol Amount and Other Charges. Even after calculation this field is editable.

- Print E-way bill – You can initiate single/bulk print request for both summary and detailed print.

- Check HSN code – In single click, you validate all the HSN code which identifies valid and invalid HSN.

IRIS Topaz, is an end-to-end E-way Bill solution. Try our MS Excel® based desktop utility to manage all your E-way Bill tasks easily. To know more, contact us at support@irisgst.com

UPDATES

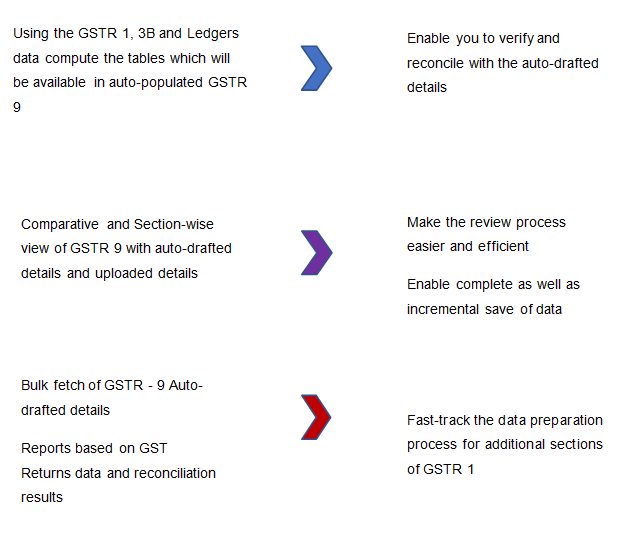

How IRIS Will Help You in Filing Your GSTR-9

IRIS GST untiringly endeavours to provide our users a seamless and efficient solution for any GST return. Likewise, we have come up with a solution to file your GSTR-9 form. Users will be able to file their GSTR-9 returns using IRIS Sapphire.

Since most of the information can be auto-populated, find out below how IRIS Sapphire will assist you in filing your return stress-free.

How IRIS GST Will Make It Simpler

To know more about ourr efficient GSTR-9 solution, please contact us at support@irisgst.com

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment