The IRISGST Times

Volume 53 | May, 2022

Inside

THE ISSUE

When dealing with an ever evolving law like GST, being up to date is essential!

IRIS GST Times, our monthly newsletter, is here to provide you with all of the crucial GST updates. Here are some insightful changes covered for you: ‘Reporting 6% Rate in GSTR 1’, ‘Requirement of Table 4 n GSTR 4 | Negative Liability in GSTR4’, ‘Clarification regarding incomplete GSTR 2B for April 2022’.

In this newsletter, we are introducing our new product – IRIS LMS – India’s finest Tax Litigation Management Software. It is sure to ease your strenuous litigation processes and keep you on track with due-dates, notices, facing audits and managing cases effectively. In this issue, also learn more about – ‘Direct and Indirect Tax Litigation in India’.

And, yes, your favourite part of the newsletter, the GST Compliance Calendar for June 2022 is also covered so that you never miss a GST due date. Happy Reading!

Regards,

Meghana Pawar,

Editor, IRISGST Times

Latest GST News Updates

Late fee has been waived on GSTR-4 for FY 2021-22 from the 1st May, 2022 till 30th June, 2022. Read all the new GST updates and changes here: Top GST News of the month

Reader’s Choice of the Month

Our most popular article for the month is – Clarification regarding incomplete GSTR 2B for April 2022. There was an issue with GSTR 2B for April, which CBIC later resolved. Read the full update in the article.

Top Finance News of the Month

In order to meet the goals of monetary policy, financial stability, and efficient currency and payment system operations, the Reserve Bank of India proposes a graded approach to the implementation of Central Bank Digital Currency (CBDC).

GST Updates

Product Updates

Make way for IRIS LMS – India’s finest Tax Litigation Management Software!

Companies all over India are struggling with pending pre-GST cases, GST Audits and the overall tax litigation management. Considering the need to streamline tax audits, litigation, and assessment for businesses, IRIS GST in collaboration with DAA Consulting has launched a new product – IRIS LMS that will surely ease your strenuous process of keeping track of litigation and facing audits.

How can IRIS LMS help you?

IRIS LMS is a Litigation Management Solution (LMS) developed by IRIS in association with DAA Consulting, a specialized Indirect Tax Consulting Organization with in-depth experience in litigation, knowledge of the subject and understanding of the practical difficulties faced by various industries.

IRIS-DAA have combined their individual strengths of Technology and Subject Matter Experiences & Expertise to develop a robust product anticipating the needs of the industry in light of the faceless assessments under GST which is in pipeline.

IRIS LMS is a cloud-based litigation management software with Artificial Intelligence, a proactive alert mechanism, extensive reporting and analytics dashboard for enterprises.

It is here to assist you in facing GST departmental audits and efficiently manage GST litigations. Further, Integration through API with GSTN Portal is under request with GSTN to enable better tracking.

What can you do with IRIS LMS?

- Store: Complete trail of Litigation from 1st Letter to Replies, Hearing Proceedings to Final Order

- Retrieve: Data through friendly UI with custom categorizations

- Archive: Gst Returns Data and Various Reconciliations to handle Departmental Audit in the future

- Track: Status of Litigations on real-time basis at GSTIN Level

- Alerts: For various Due Dates for Pending Replies, Appeals, Personal Hearings, Written Submissions

Testimonial

“The solution is well-rounded & up-to-date with GST norms.”

“When it comes to GST Filing, I know I can rely on IRIS GST. Filing monthly GST Returns- GSTR 1,3B, specific returns like ITC 04 and annual return – GSTR 9 including the entire reconciliation process, wouldn’t have been easier without IRISGST. We are quite pleased with the product and the support provided. While the solution in itself is well-rounded and up-to-date with GST norms, the support provided by the team is prompt, reliable and 24×7. The support team has deservingly earned gratitude. Cheers !”

– Prakash Kinage – Indirect Taxation Head, Forbes Marshall Group

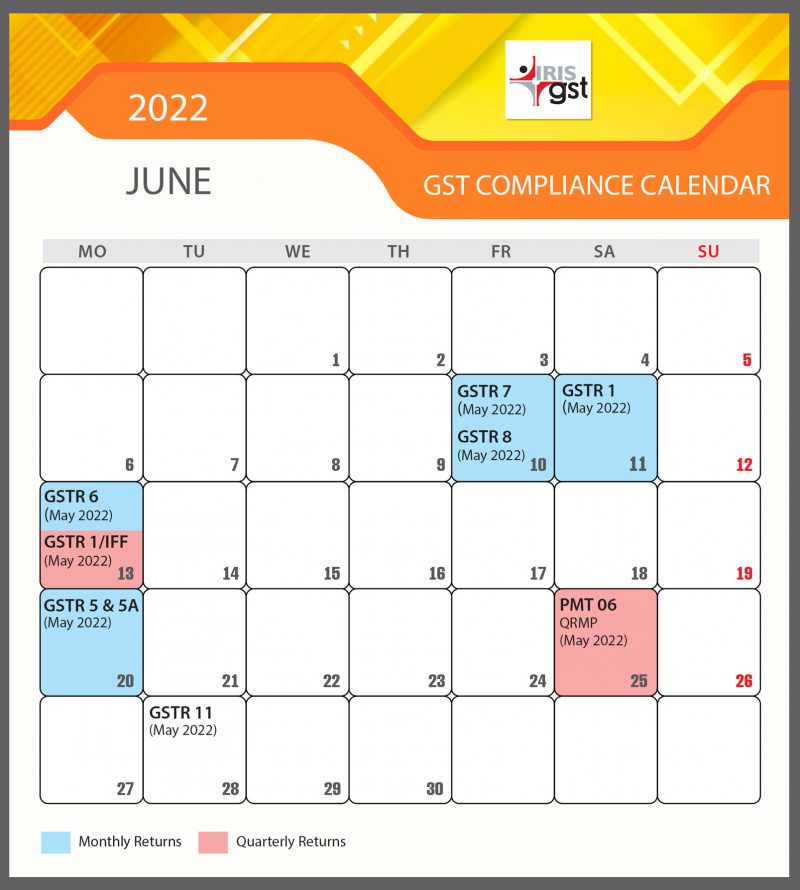

GST Compliance Calendar

We are always finding ways to help our readers, product users and customers via our free resources, articles, ebooks and other digital assets. And we love that our GST Compliance Calendar is a big hit amongst the readers of IRIS GST.

Here is a comprehensive image of the GST Compliance Calendar that we have created for you. It has all the GST Compliance Due dates for June 2022 so that you never miss a GST due date!

Click here to read: GST Due Dates – June 2022 Calendar

By C.A. Samaira Tolani

Every feedback, be it via comments, replies on Social platforms or emails is always welcome. Thank you for appreciating our efforts and staying connected.

CONTACT US

Have feedback for us? Want to request for our product demos? Please reach out to us at

Leave a comment