IRIS GST TIMES

May ,2020

This issue

6 Reports to Maximize Your ITC Claim ……………………………………… P.1

COVID-19: New relief measures issued amidst Lockdown 3.0 ……. P.2

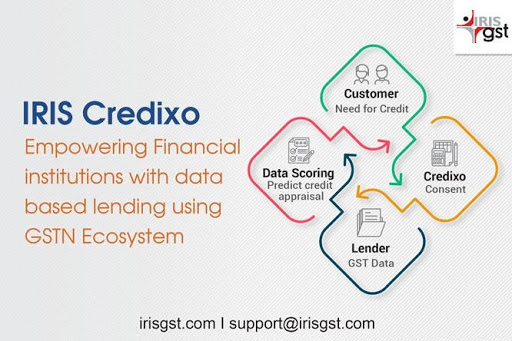

Feature Highlight: IRIS Credixo ………………………………………………… P.3

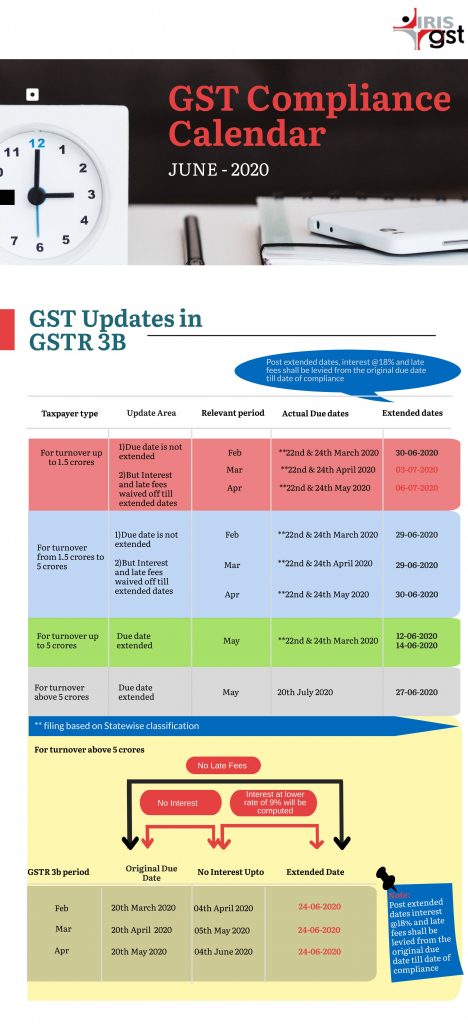

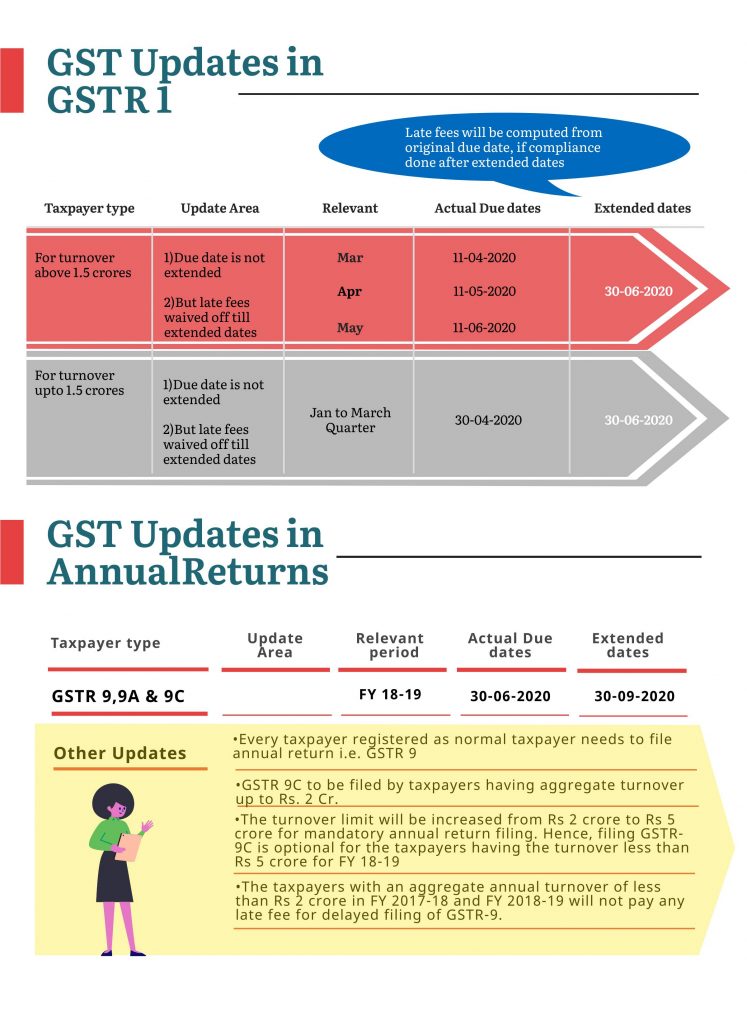

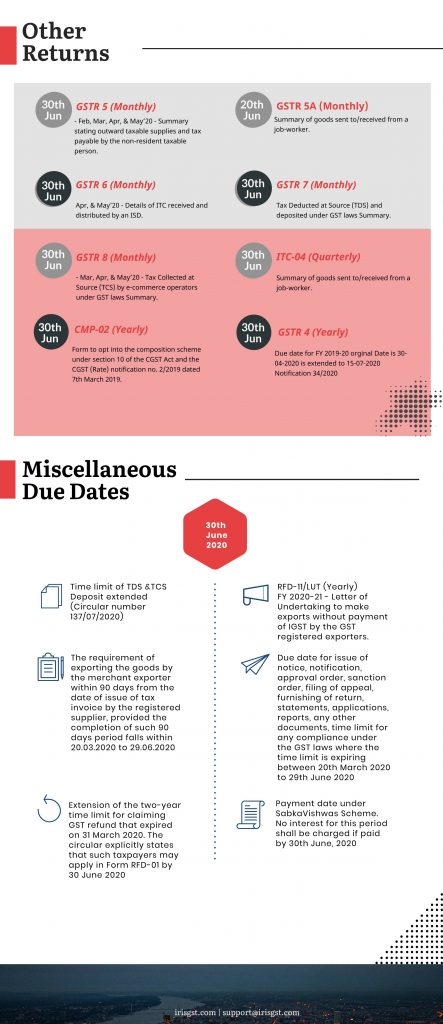

June Compliance Calendar ………………………………………………………… P.4

Chief Editor

Vaishali Dedhia

COVID -19 SPECIAL ISSUE

The country is under lockdown 4.0 – it is one of a kind phase that we are all going through amidst the global pandemic. Now that we are settling in the WFH routine, the Finance Ministry is also releasing several relief measures to tackle this situation and support businesses because the show must go on! Since this is expected to continue for a few more months, all of us must adapt to the new scenario and work towards a better tomorrow.

In this issue, we’ll be covering Six Reports that can help you maximize your ITC Claim, we also cover New Relief measures – COVID-19. Feature Highlight: IRIS Credixo and June Compliance Calendar which comes with multiple due dates.

Regards,

Team IRIS GST

GST & Excise Related Hearings Made Virtual Via WhatsApp!

Authorities in Thane, Mumbai tax zone stated in a notice dated May 18 that virtual hearings will now be conducted for personal hearings of all demand notices. Since the government has released strict social distancing norms due to COVID-19, a decision has been taken to conduct hearings via WhatsApp.

Considering WhatsApp has ‘end to end encryption’ and has a huge reach, it is convenient for people to use. As per the notice, the hearings will be conducted via video conferencing. It will be used till any other better and secure facility is made available.

The video conference will be held after the consent of the appellant/ respondent. The field officers will follow the guidelines of the CBIC. The authorities will confirm the date & time a day in advance. The authorities will also send PDF memos of the personal hearings to the respondents after the hearing session. This has to be signed by the notice/ noticees concerned; they also ensure to revert back by the same WhatsApp number within 15 mins with the signed documents.

Dicey Suppliers & Exporters will be held accountable by GST Analytics

There were several cases of fraudulent GST Refund claim last year for Integrated Goods and Services Tax on exports of goods. Since then CBIC has taken strict measures to lessen the risk by applying stringent risk parameters based checks.

The consignments of such exporters who appear dicey are subject to 100% Customs examinations. Reports suggest that their refunds will be kept in abeyance.

The Central Board of Indirect Taxes and Customs had issued a SOP – Standard Operating Procedure that needs to be followed by such exporters.

By June 5, the CBIC has asked the GST and Customs Zonal principal chief commissioners to advance all pending verification reports and send to Directorate General of Analytics & Risk Management (DGARM) by speeding up the process.

***

IRIS Topaz offers you a 360° solution for all your E-way Bill Needs. A cloud-based tool, IRIS Topaz, provides you with the ability to manage all your tasks related to E-way Bill in an easy and automated way, on the go.

Alert to taxpayers on fake messages on GST Refund

It has come to notice that fake messages on GST Refund have been circulating across social media asking for personal information citing new updates amidst COVID-19. IRIS GST would like to make all our readers aware of the fraud websites and fake messages with links promising GST Refund. We would like to extend a request to all our readers that they should not fall prey to such fraudulent messages and not click on any links on WhatsApp messages, Email or on social media.

Visit only gst.gov.in or irisgst.com for authentic GST updates and any GST related information.

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST

Master these 6 Reports to Maximize Your Input Tax Credit (ITC) Claim

Amidst the lockdown, the government has been constantly trying to provide relief both by announcing stimulus and even by announcing relaxations for compliance under both direct and indirect taxes. In GST, there has been release of new notifications and Relief Measures in the past month in respect of various returns to be filed for the months of Feb 2020 to May 2020 providing some relief if filed within the extended dates.

One more very important relaxation that was provided via inserting a provision under rule 36(4) of GST Rules as under:

“Provided that the said condition shall apply cumulatively for the period February, March, April, May, June, July and August, 2020 and the return in FORM GSTR-3B for the tax period September, 2020 shall be furnished with the cumulative adjustment of input tax credit for the said months in accordance with the condition above.”

This implies that the condition of 10% provisional ITC rule will apply cumulatively for Feb to Aug 2020. And any cumulative adjustment for input tax credit for these months can be reported in 3B of Sept 2020. For details of this rule which was earlier 20% and now 10%, refer our blog on 10% ITC Rule. The usual flow of claiming Input Tax Credit in 3B is based on the amount of ITC available in GSTR 2A of the taxpayer and also based on the purchase register of the taxpayer.

Similarly there are a few preconditions that need to be met while claiming ITC. Let us understand in detail these preconditions that you need to take care while claiming ITC:

- Taxpayer should be in possession of the tax invoice or debit note or relevant tax paying documents.

- He should have received the goods and services.

- Payment of such tax is made to the government by the vendor.

- Taxpayer has furnished return under section 39.

- Payment of invoice to the supplier should be done within 180 days from the date of issue of invoice. If payment is not done within 180 days then the ITC so availed by the recipient. (taxpayer) shall be added to his output tax liability, along with interest thereon, in such manner as may be prescribed.

- No ITC will be allowed if depreciation has been claimed on tax component of a capital goods.

- There is a time limit for claiming ITC which is earlier of Return filing due date of September of next financial year OR Actual annual return filing for current financial year.

- Where the goods or services both are used partly for business and non-business purposes, credit attributable to business purpose only can be claimed as ITC.

Based upon the reconciliation results, there are several reports to maximize your ITC claim.

Economy Health

COVID-19: New relief measures issued amidst Lockdown

The country is under lockdown 4.0 citing the Corona Virus outbreak. Lockdown 3.0 was announced and implemented from 3rd May onwards and continued until 17th May 2020. Considering the rapid spread of COVID-19, the government took measures in all areas for the well-being of the citizens. The finance ministry has been updating the new norms in multiple areas including GST. In the 39th Council Meeting, several rules had been laid down and further the Finance Ministry made new announcements and notifications amidst COVID-19.

Here are the new relief measures released by CBIC via latest notifications and circulars. These recent updates with regards to COVID-19 serve as relief measures and will prove to be beneficial for the taxpayers:

| SN | Source | Notification Description |

| 1 | Notification: 42/2020- Central Tax ,dt. 05-05-2020 | GSTR 3B due date extended to 24th March 2020 for periods November 2019 to February 2020 for the taxpayers of Union Territory of Jammu & Kashmir. GSTR 3B due date extended to 24th March 2020 for periods November 2019 to December 2019 for the taxpayers of Union Territory of Ladakh. Extended GSTR 3B due date to 20th May 2020 for periods January 2020 to March 2020 for the taxpayers of Union Territory of Ladakh. |

| 2 | Notification: 41/2020- Central Tax ,dt. 05-05-2020 | Due date to file GSTR-9 & GSTR-9C for the FY 2018-19 further extended up to 30th September 2020. |

| 3 | Notification: 40/2020- Central Tax ,dt. 05-05-2020 | E-way bill generated upto 24th March 2020 and if its validity period expires anytime between 20th March 2020 and 15th April 2020, shall remain valid until 31st May 2020, |

| 4 | Notification: 39/2020- Central Tax ,dt. 05-05-2020 |

The Interim Resolution Professional (IRP) must obtain separate GST registration in every state/Union Territory, where the corporate debtor was earlier registered. The time limit allowed is later of thirty days of his appointment or by 30th June 2020. The special procedure under GST notified via CGST notification number 11/2020 dated 21st March 2020 shall not apply to those corporate debtors who have filed GSTR-1 and GSTR-3B returns for all the tax periods prior to the appointment of the IRP. |

| 5 | Notification: 38/2020- Central Tax ,dt. 05-05-2020 |

|

| 6 | Circular – 138/08/2020 | The requirement of exporting the goods by the merchant exporter within 90 days from the date of issue of tax invoice by the registered supplier gets extended to 30th June, 2020, provided the completion of such 90 days period falls within 20.03.2020 to 29.06.2020 |

| 7 | Circular – 138/08/2020 | The due date of furnishing of FORM GST ITC-04 for the quarter ending March, 2020 stands extended up to 30.06.2020 |

FEATURE HIGHLIGHT

IRIS Credixo

India is expected to have huge credit growth across sectors and more lending to MSMEs is in the offing. This provides us a unique opportunity to re-imagine credit products like never before.

IRIS Credixo, our credit assessment and monitoring tool, helps lending institutions to move from traditional asset-based lending to data-based lending. The likes of Banks, NBFC’s and Fintechs can simplify their credit assessments with consented GST data. This helps to bring down their cost of processing and arresting increase in NPAs. Use of GST data transforms turnover and cash flow based financing to one based on first hand, real time information.

Credixo stands at the intersection of Data and Lending Experience. It allows lenders to grow volumes, stand out from the competition and gather meaningful customer data to provide seamless “lending in the box” credit experience and design tailored customer journeys.

Why GST Based Lending?

- Granular Data

- Invoice Verified

- 6 M+ GST Returns

- Digitally Signed

- Easily Accessed

- Real time data

How does IRIS Credixo work?

Sign-in IRIS Credixo

- In Credixo, Lender signs in and shares either GSTIN or pan number of customer (or API sharing is enabled through an integration with the ASP & lender)

Get access to GST data

- In a few clicks, the Lender is able to access specific GST data as per your credit model

Build credit score and make credit offer

- With consent, the lender uses this data for underwriting, build a credit score and makes a credit offer to the MSMEs

Complete the KYC

- The MSME provides his bank account details for real-time loan disbursement and based on the type of the business you can complete KYC

Take mandate either digitally or physically

- Take mandate either digitally or physically based on the customer for repayments

IRIS Credixo is at the intersection of Digital Data and Lending Demand. It allows technology-driven credit scoring.

UPDATES

June Compliance Calendar

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment