Appeals under GST and dispute resolution mechanisms are provided under the GST Act to resolve disputes and enforce compliance with the GST laws. In case of any legal disputes, wherein the person involved is not happy with the decision passed on by a lower court, the person can raise an application to the higher court for the cancellation or reversal of the same. The act of raising such applications is known as an Appeal under GST.

Legal Disputes under GST

Legal disputes under GST may arise due to various reasons such as non-compliance with the provisions of the GST Act, incorrect classification of goods and services, incorrect valuation of goods and services, non-payment of tax, and others.

Under GST, legal disputes can be rooted in two obligations as given below:

- Tax-related

- Procedure-related

These obligations are often verified by a proper GST officer during audits, anti-evasion, examining etc. However, in some scenarios, the obligation verified may be actual or perceived non-compliance and the difference in the perception leads to a dispute, which is then required to be resolved. The resolution of such dispute is done by a departmental officer, as per a quasi-judicial process, wherein the outcome of these issues of an initial order is often termed as an assessment order, adjudication order, order-in-original, etc.

Adjudicating Authority under GST

The Adjudicating Authority under GST is a designated official or body responsible for resolving disputes and enforcing the provisions of the GST Act. The Adjudicating Authority is empowered to take decisions, impose penalties and take other enforcement actions in case of non-compliance with the GST laws. The Commissioner of Central Tax or State Tax is the highest level of Adjudicating Authority under GST. The Commissioner is empowered to take enforcement actions, impose penalties and resolve disputes related to GST. Any order/decision passed under the act is called an act of Adjudication.

Appeal under GST

The GST Act provides an appeal mechanism for taxpayers who are dissatisfied with the decisions of the Adjudicating Authority. The appeal mechanism provides taxpayers with the opportunity to challenge the decisions of the Adjudicating Authority and to seek a review of the matter.

Appeal Hierarchy under GST

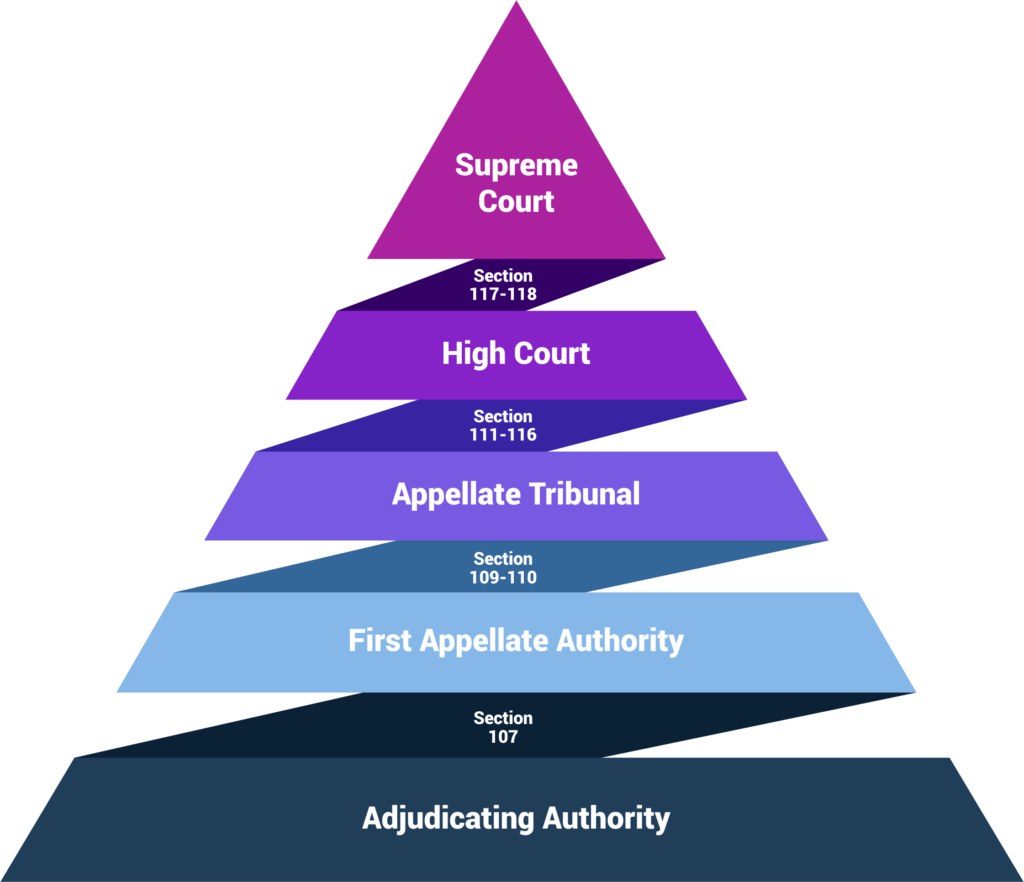

The hierarchy of an appeal can be understood with the following pyramid, wherein a person can raise an application to the higher authority, based on the section given. For instance, for a legal dispute against the First Appellate Authority, the person can raise an application to the Appellate tribunal under sections 109-110.

The CGST & the SGST authority

Under the GST Act, the CGST officers and the SGST/UTGST officers, both have the authority to pass an order. Furthermore, as per the act, if an order has been passed for a person under CGST, it shall be deemed to apply for SGST as well. However, it should be noted that, if a CGST officer passes an order, any appeal, review, revision/rectification against the order shall lie only with the CGST officers and likewise for the SGST officer.

Procedure for Appeal under GST

The procedure for appeal under GST involves the following steps:

- Filing of Appeal: An aggrieved person can file a GST appeal for any orders received from the government. It needs to be filed in Form GST APL-01, along with relevant documents. The provisional acknowledgment will be granted as soon as the appeal is submitted. However, only after manually submitting Form GST APL-01, a copy of the challenged order, and a declaration of the facts and grounds for the appeal within 7 days of the receipt of the provisional acknowledgment, will the final acknowledgment that has the appeal number, be issued.

- Notice to the Adjudicating Authority: The Appellate Authority serves a notice on the Adjudicating Authority, informing them of the appeal filed by the taxpayer.

- Personal Hearing: The taxpayer is given an opportunity to present their case and provide evidence in support of their case in a personal hearing.

- Decision: Based on the evidence presented, the Appellate Authority takes a decision on the matter.

- Further Appeal: If the taxpayer is not satisfied with the decision of the Appellate Authority, they can file a further appeal to the next higher authority, such as the High Court or the Supreme Court.

What is the appeal fee in GST?

- The appeals need to be made in prescribed forms along with the required fees. The fee will be – The full amount of tax, interest, fine, fee and penalty arising from the challenged order, as admitted by the appellant, AND –10% of the disputed amount.

- Fees won’t be charged in cases where an officer or the Commissioner of GST is appealing

Authorized representation

The person required to appear before a GST Officer, First Appellate Authority, or Appellate Tribunal can assign an authorized representative to appear on his behalf unless he is required by the Act to appear personally.

An authorized representative can be-

- a relative

- a regular employee

- a lawyer practising in any court in India

- any chartered accountant/cost accountant/company secretary, with a valid certificate of practice

- a retired officer of the Tax Department of any State Government or of the Excise Dept. whose rank was minimum Group-B gazetted officer.

- any tax return preparer

Retired officers cannot appear in place of the concerned person within 1 year from the date of their retirement.

What is the time limit for filing an appeal in GST?

The GST Act specifies time limits for filing appeals.

- Taxpayers are required to file an appeal within 30 days from the date of receipt of the decision of the Adjudicating Authority. In case of a further appeal to a higher authority, the time limit for filing the appeal may vary and will be specified by the relevant authority.

- In order to make an appeal to the First Appellate Authority, a person has to file form GST APL 1 within 3 months (extendable up to 1 month) of the issuance of the order.

- However, under the rule of condonation appeal filing delays, a maximum of one further month is permitted, and that is only after providing a valid justification for the delay and supporting documentation.

Restriction applicable on Appeals

A person cannot raise an appeal for following decisions taken by a GST officer-

- An order to transfer the proceedings from one officer to another officer

- An order to seize or retain books of account and other documents; or

- An order sanctioning prosecution under the Act; or

- An order allowing payment of tax and other amounts in installments

Furthermore, an appeal cannot be filed in certain cases, wherein on the recommendation of the council, the Board or the State Government may fix monetary limits for appeals by the GST officer in order to regulate the filing of appeals and avoid unnecessary litigation expenses

A person unhappy with any decision or order passed against him under GST by an adjudicating authority can appeal to the First Appellate Authority.

The appeal process under GST provides taxpayers with an opportunity to challenge the decisions of the Adjudicating Authority and to seek a review of the matter. It is important to understand the provisions of the appeal process and to stay up-to-date with the latest developments under GST.

*****

When litigations across multiple GSTINs in a legal entity or multiple entities in a group are handled, the following are the most common pain points of the Industry given the sensitivity attached to litigations:

- To keep a track of all the actionable,

- To monitor the preparedness & progress of the litigations on a regular basis

- To have all the information/documents required for facing such litigations right from its source.

Need help in being prepared for GST audits and litigations? IRIS GST can help!

IRIS LMS – Litigation Management Solution helps users keep a track of due dates, manage notices and cases, and store documents and precedences along with their legal positions at one location digitally. The solution is designed to assist you in facing the GST audits efficiently and managing GST litigations effectively.

We highly recommend you schedule a free demo of IRIS LMS to understand what it can do for you. Click the link below!

Schedule a Demo of IRIS LMS

IRIS is a listed reg-tech solution provider and an authorized GSP for the past 5 years. IRIS GST has helped businesses like L&T, Bajaj, Thermax and Forbes meet their GST compliance efficiently and effectively with no missed due dates and 100 % ITC claim.

Please feel free to revert with any queries regarding GST litigation and departmental audits. Our team of experts can certainly take on your specific questions, if any and look at resolving the issues efficiently. Email: support@irisgst.com.