In a major step toward simplifying tax compliance, the introduction of Form DRC-03A on July 10, 2024, via GST Notification No. 12/2024, has added a new layer of convenience to the GST regime. This new form is designed to help taxpayers manage their tax liabilities more effectively, primarily through the appropriation of payments made via the original Form GST DRC-03. In this article, let’s discuss the purpose, filing process, and significance of Form DRC-03A, providing a comprehensive understanding of its benefits to taxpayers.

Purpose of Form DRC-03A

Form DRC-03A is an important tool that enables taxpayers to appropriate payments made under Form GST DRC-03 to specific demand liabilities reflected in their Electronic Liability Ledger. Taxpayers often make voluntary payments or settle amounts in response to notices, and Form DRC-03A ensures that these payments are accurately allocated against the corresponding tax demands.

This process is essential because it eliminates the risk of misallocated payments, which can create discrepancies in tax records. In essence, Form DRC-03A streamlines the payment process by bridging voluntary payments with the formal demand procedure, ensuring greater transparency and reducing administrative errors.

Appropriation of Payments

One of the key functions of Form DRC-03A is the appropriate allocation of payments to specific tax liabilities. Payments made through Form GST DRC-03, whether voluntarily or in response to notices, can now be accurately mapped to their respective liabilities using the new form. This allocation takes place within the Electronic Liability Ledger, which records all outstanding tax liabilities of a taxpayer.

This appropriation system enhances the management of tax payments and provides taxpayers with better control over how their funds are applied. It also minimizes the risk of payments being lost in administrative procedures or wrongly applied to other liabilities, ensuring that the settlement of tax demands is both accurate and timely.

Significance and Benefits

The introduction of Form DRC-03A brings several significant advantages to both taxpayers and the overall GST framework:

- Streamlining Payments

One of the most important benefits of Form DRC-03A is that it bridges the gap between voluntary payments and formal tax demands. By ensuring that payments are not lost in administrative limbo, the form enhances the transparency and accuracy of the payment process. - Pre-Deposit for Appeals

Another major advantage of Form DRC-03A is its role in handling pre-deposit requirements for appeals. Taxpayers who have made payments via DRC-03 can use DRC-03A to show that the payment was made against a particular demand. This is particularly useful when filing GST appeals before the GST Tribunal, as it provides clear evidence that the pre-deposit has been satisfied. - Simplification of the Compliance Process

The automation of the payment appropriation process reduces the manual effort required to match payments with demands. This simplification minimizes the risk of errors, streamlines compliance for taxpayers, and ensures that tax liabilities are settled efficiently. - GST Council’s Proactive Approach

The introduction of Form DRC-03A reflects the GST Council’s proactive approach to addressing practical challenges faced by taxpayers. By continuously refining the GST system, the Council aims to create a more taxpayer-friendly environment where procedural complexities are reduced, allowing genuine taxpayers to focus on their businesses rather than being burdened by compliance issues.

Filing Process: A Step-by-Step Guide

a. Login to the portal Click on Services User Services My Applications FORM GST DRC-03A

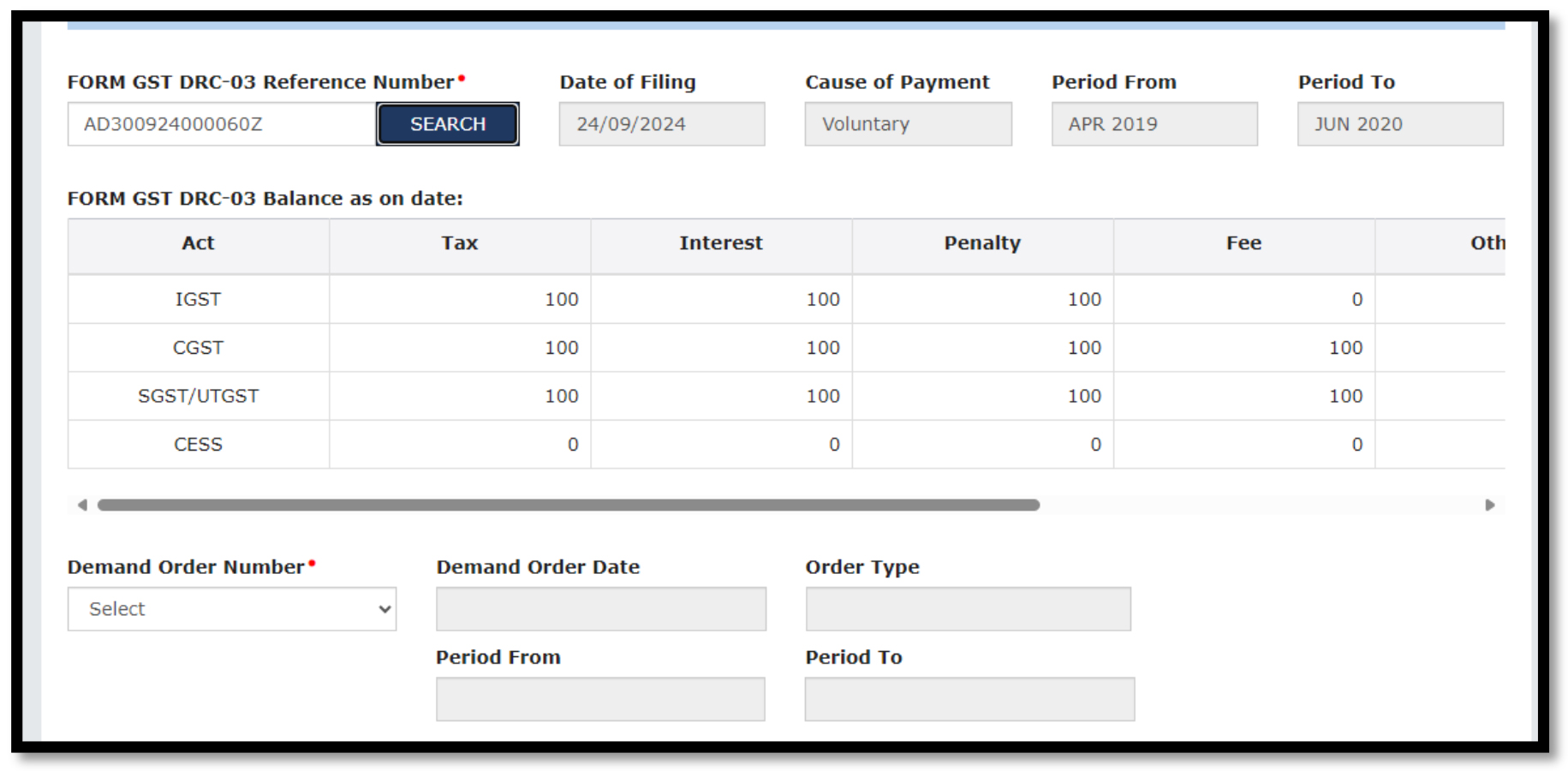

b. Enter FORM GST DRC-03 number and click on the Search button. The following details related to DRC-03 will be visible:

– Date of Filing

– Cause of Payment

– Period From & To

– FORM GST DRC-03 balance as on date

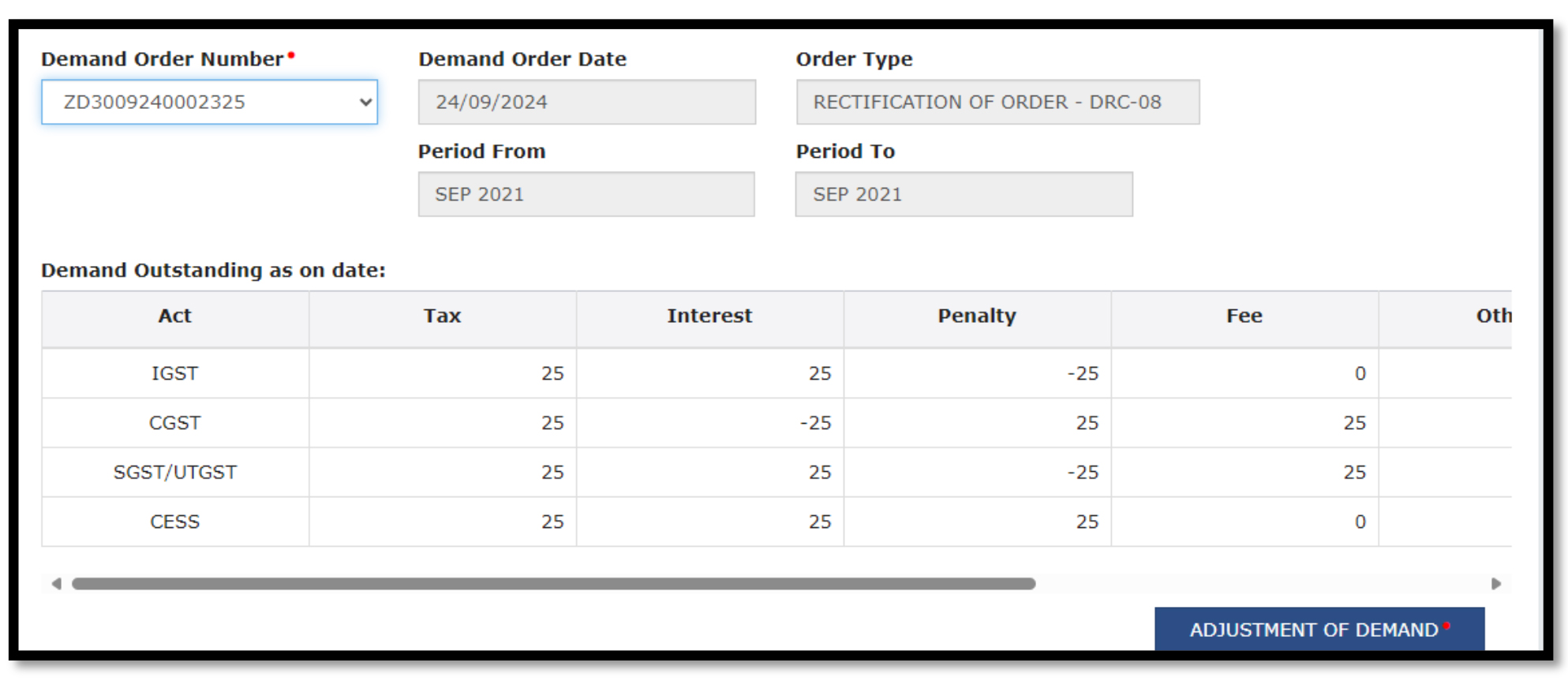

c. Select “ Demand Order No.” from the drop-down box. It will display all the outstanding demands against which payment has not been done. Select the relevant Demand Order no. from the drop-down box. On selection, following details will be displayed:

– Demand Order Date

– Order Type

– Period From & To

– Demand Outstanding as on date

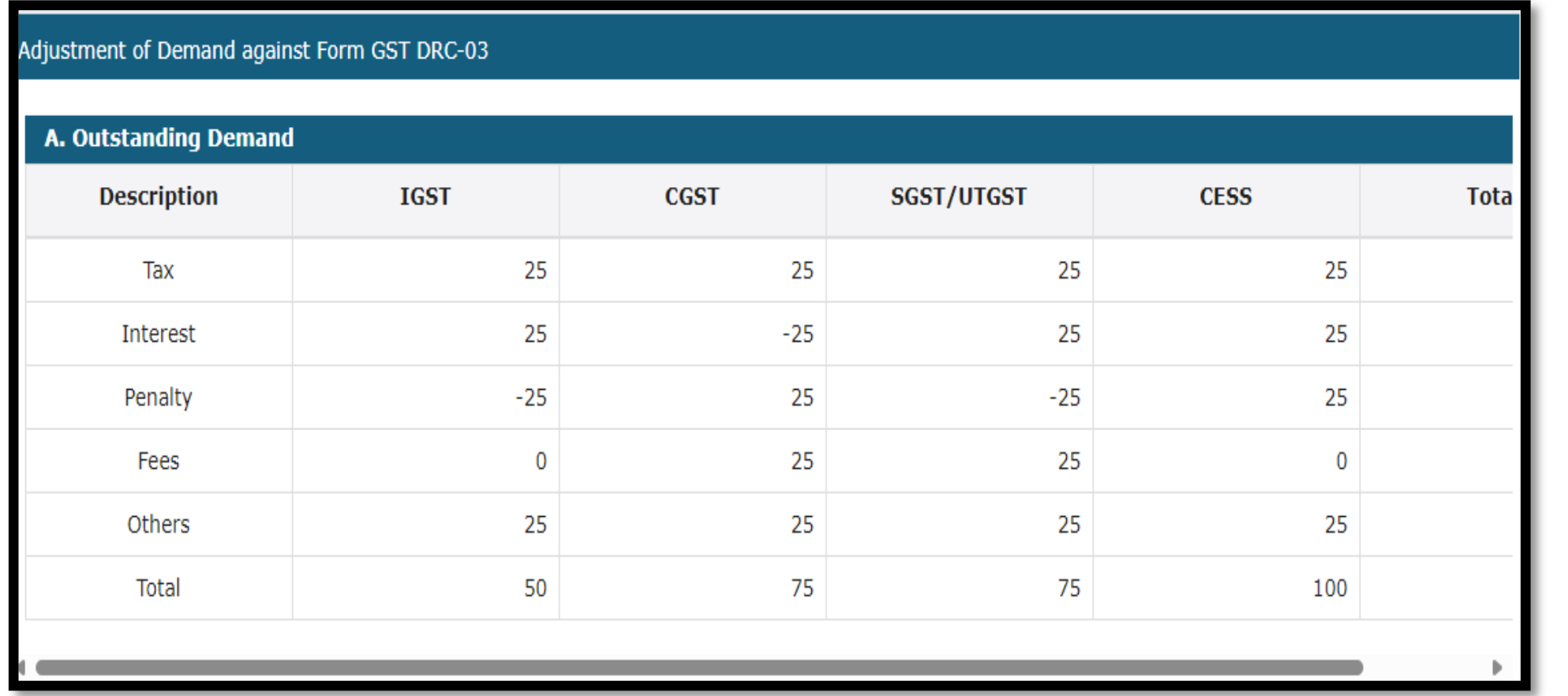

d. Taxpayer to click on the tab “Adjustment of Demand”. A new page will be opened and following tables will be displayed on the page. The taxpayer has to enter or edit the details shown in the tables below.

Table A : Outstanding Demand

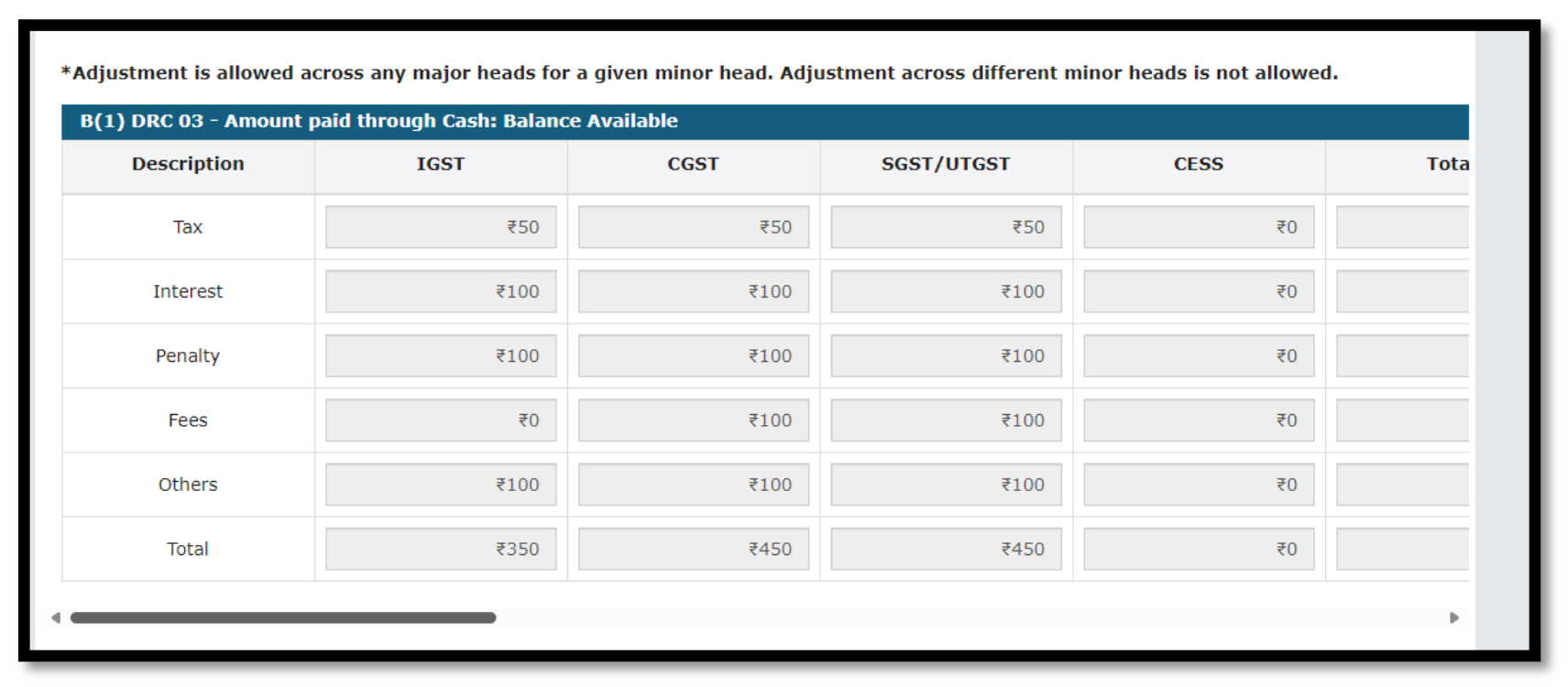

Table B1 (DRC 03 – Amount paid through Cash: Balance Available)

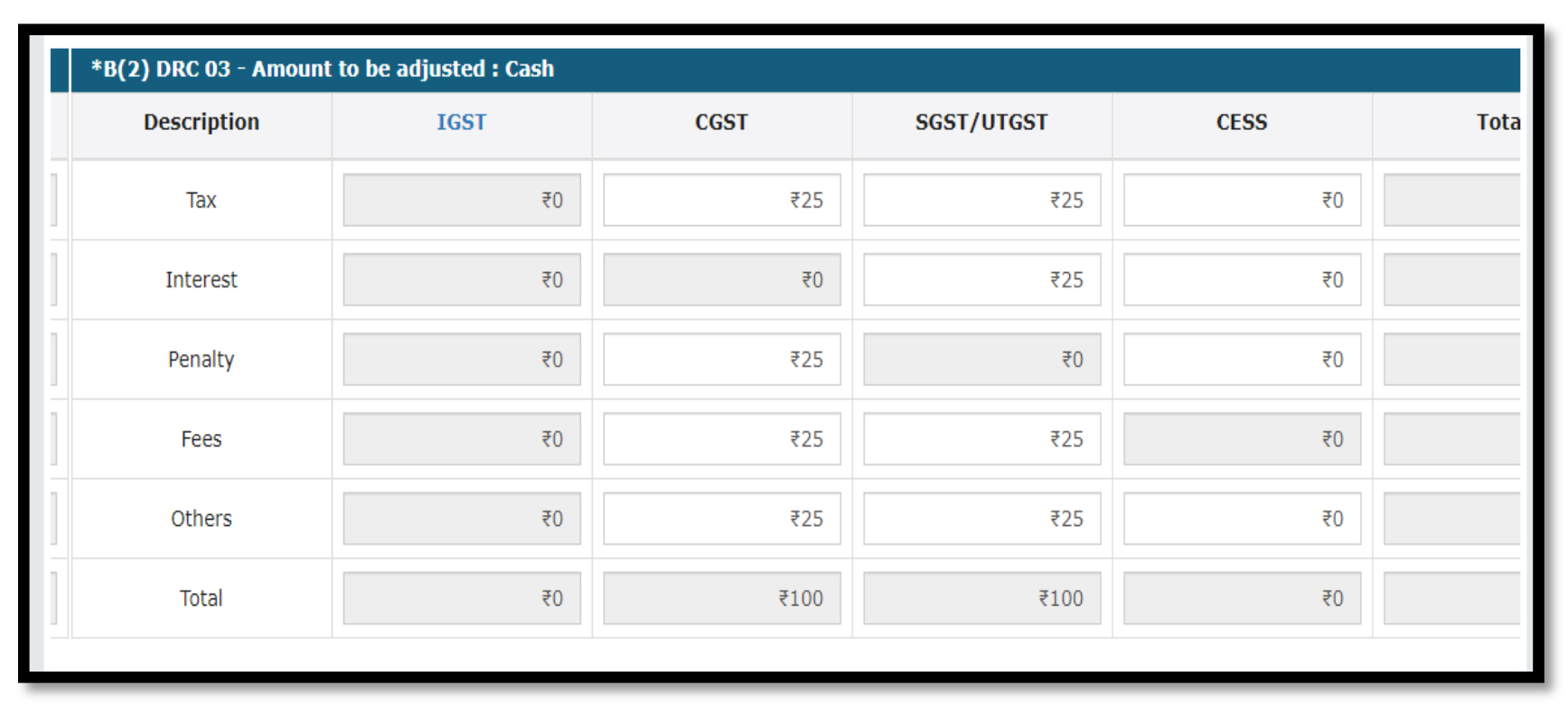

Table B2 (DRC 03 – Amount to be adjusted : Cash)

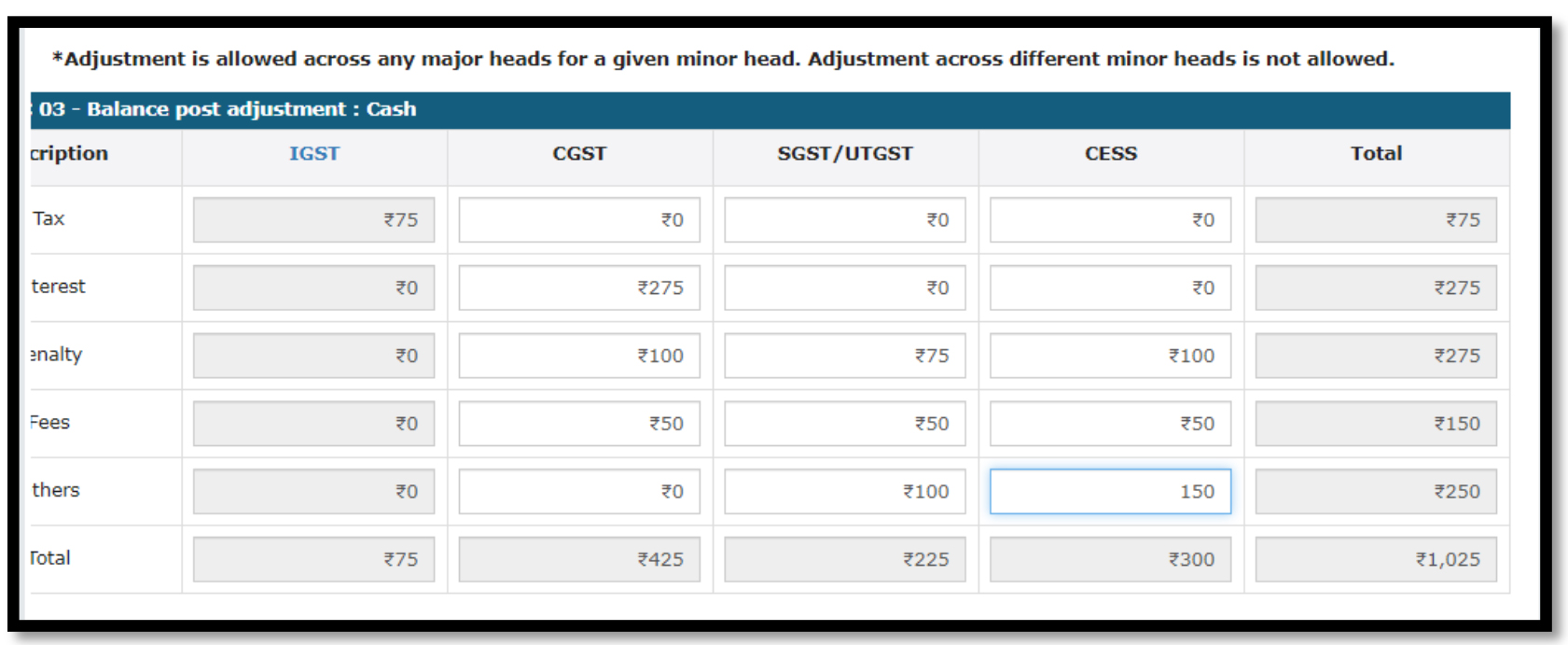

Table B3 (DRC-03: Balance post adjustment- Cash)

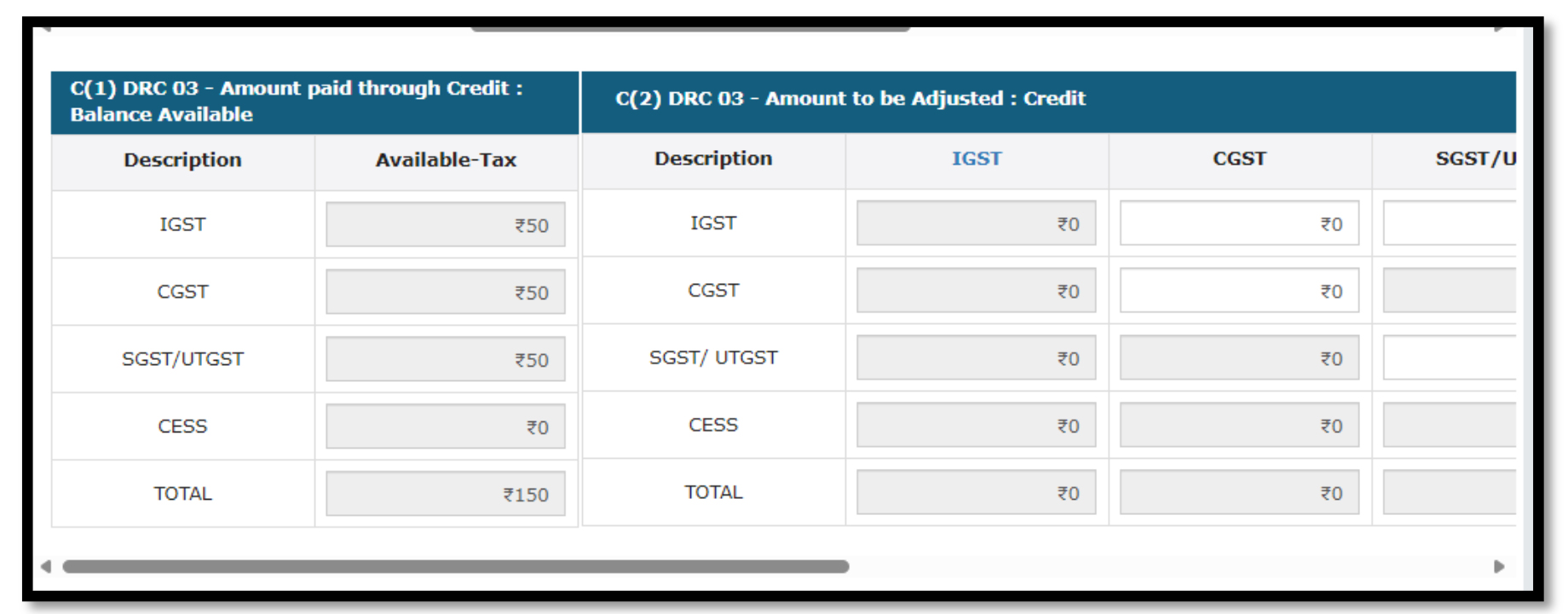

Table C(1) (DRC 03 – Amount paid through Credit : Balance Available)

& Table C(2) DRC 03 – Amount to be Adjusted : Credit

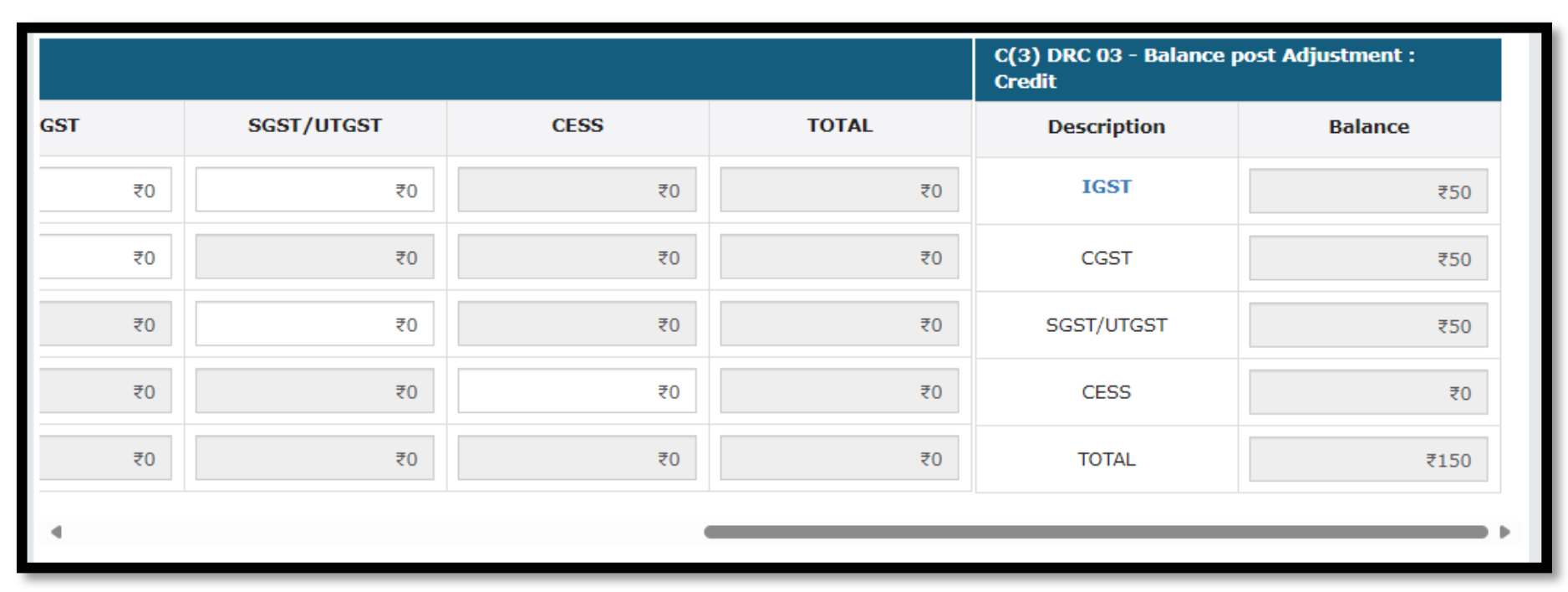

Table C(3) DRC-03 Balance post Adjustment: Credit

Table D. Outstanding Demand post Adjustment

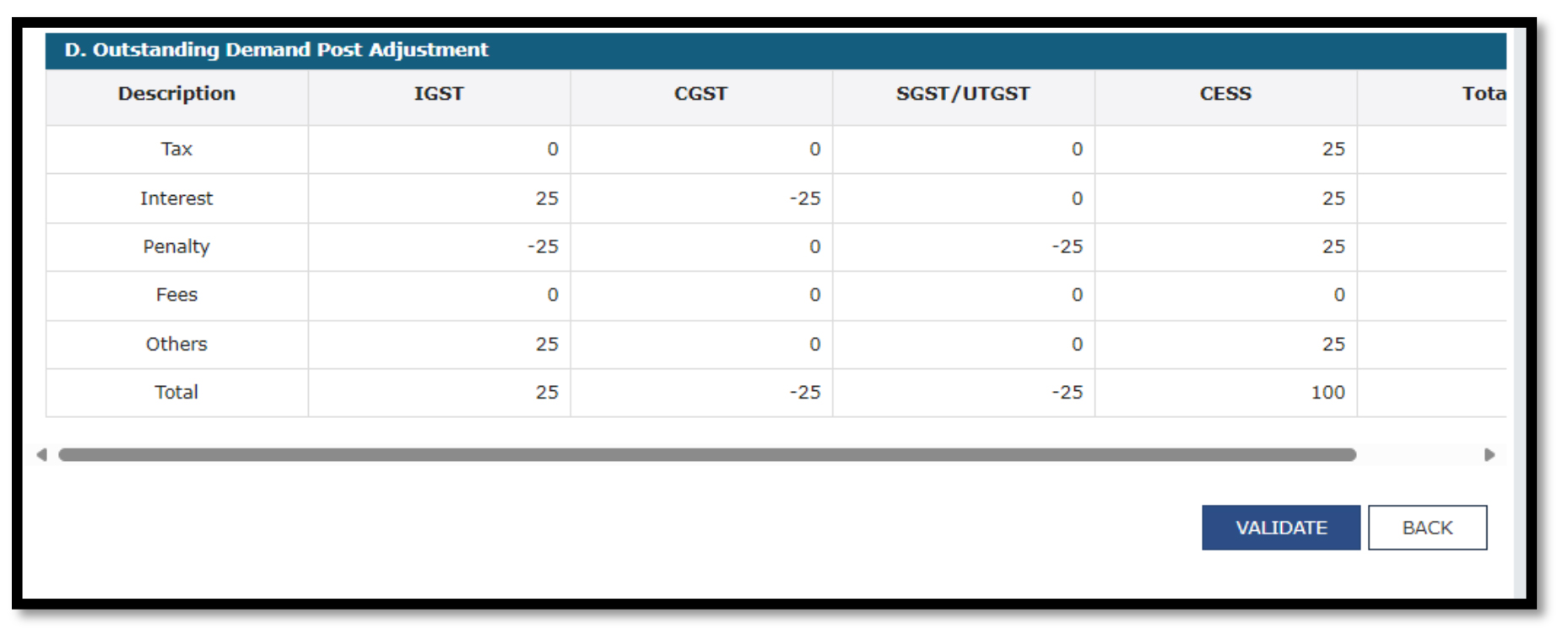

e. The details mentioned in Table A, B, C & D are to be verified by the taxpayer. After verification, click on the Validate button.

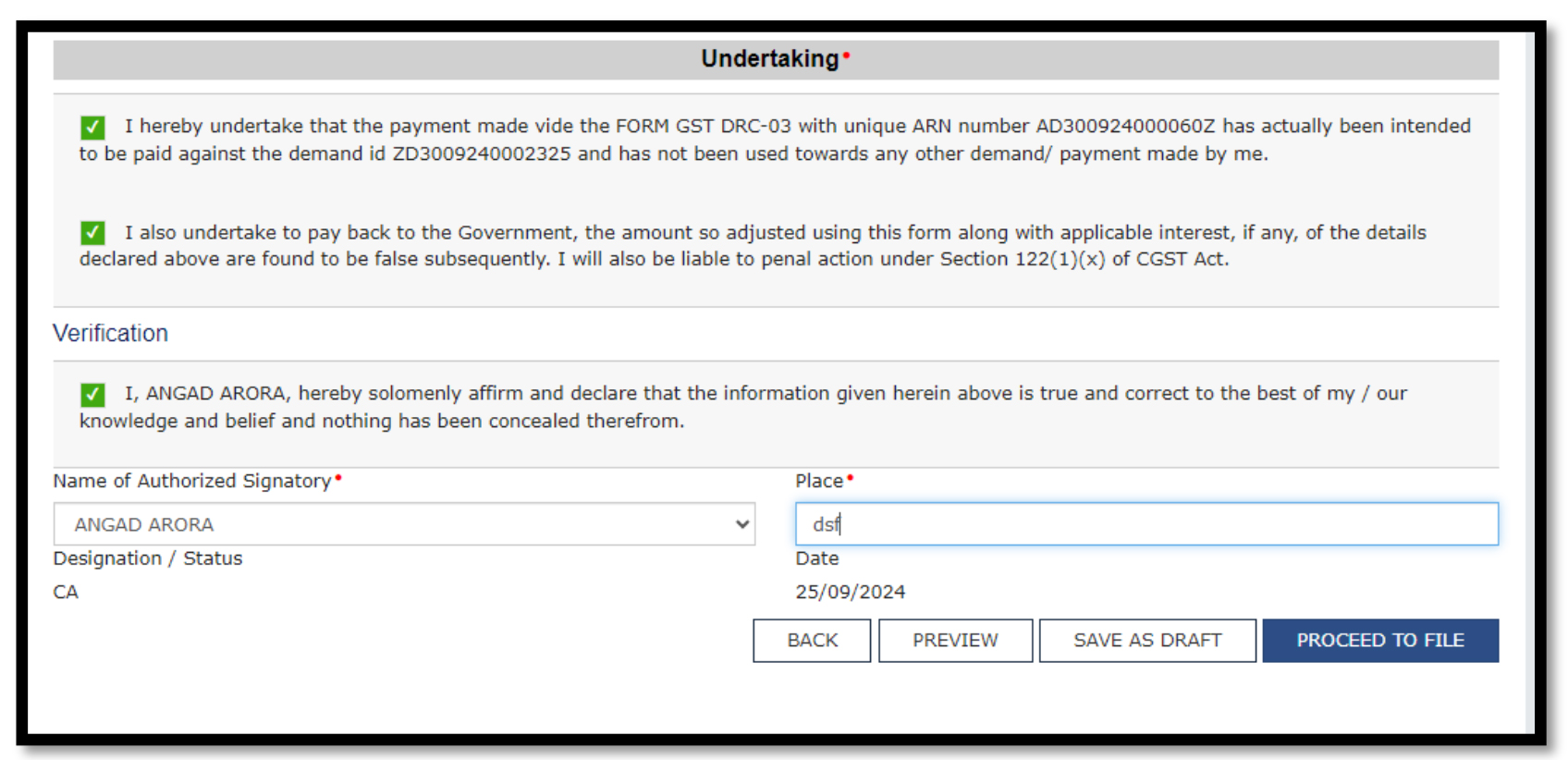

f. Taxpayer can also upload any supporting document (if required). Subsequent to that, the taxpayer has to sign the Undertaking & Verification as shown below.

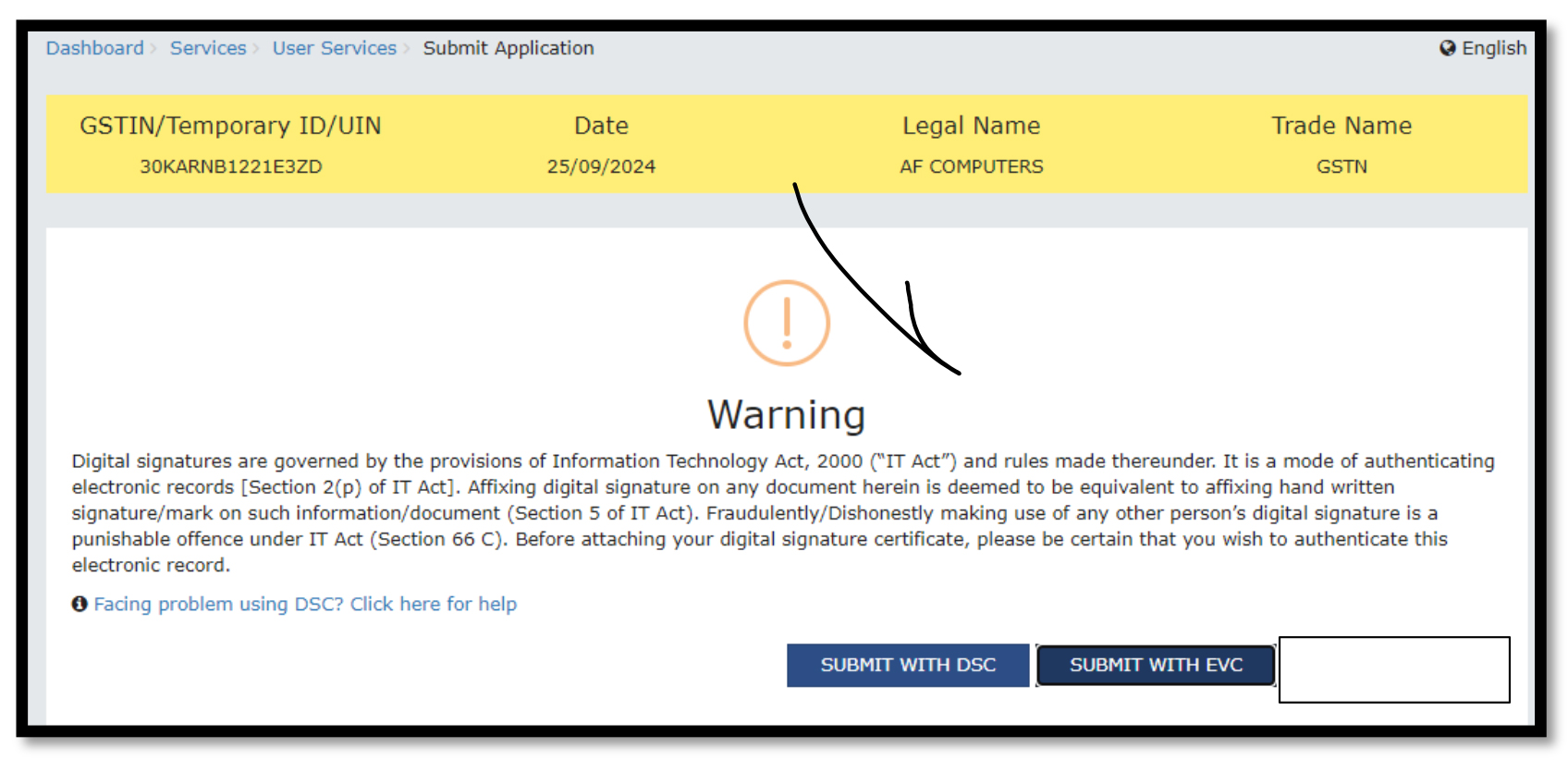

g. The taxpayer can then Preview or Save Draft or Proceed to file. After clicking on Proceed to File button, the following page will be displayed and taxpayer can submit the form using DSC/EVC.

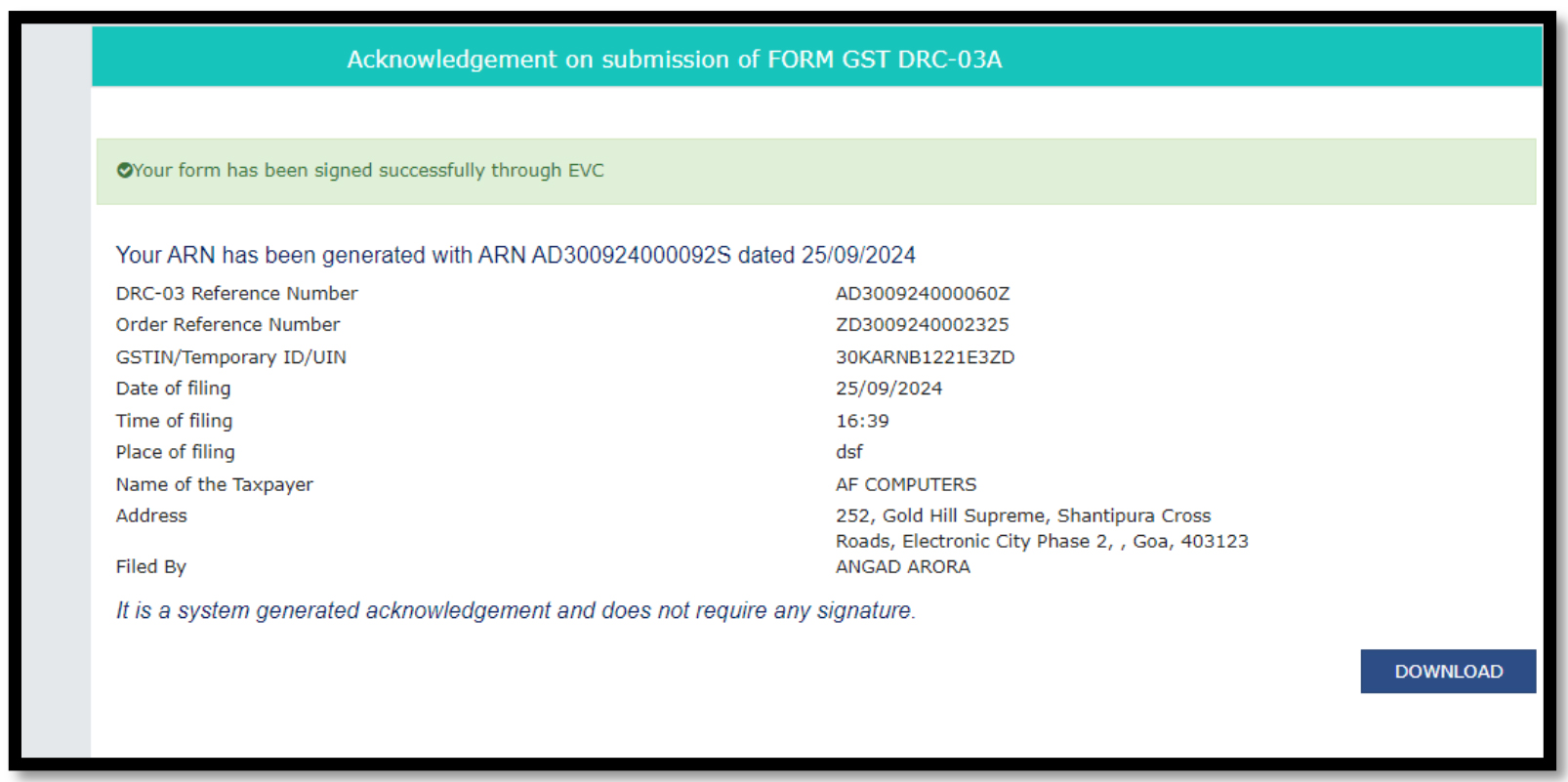

h. On successful submission, Acknowledgment will be issued.

Filing Form DRC-03A on the GST portal is designed to be simple and user-friendly. Here is a detailed look at the steps involved in filing the form:

- Accessing the Form

Taxpayers can access Form GST DRC-03A through the GST portal. The form is readily available under the “Payments” section, making it easy for users to locate. - Providing ARN

The Application Reference Number (ARN) from the original Form GST DRC-03 is a key input when filing Form DRC-03A. This number links the payment made through DRC-03 to the new form, allowing the system to accurately track and allocate the payment. - Auto-Population of Details

Upon entering the ARN, the system automatically populates the relevant details from Form GST DRC-03 into Form DRC-03A. This includes the amount paid, the type of liability, and the demand to which the payment was applied. This automation reduces the risk of manual errors and ensures that the correct information is carried forward. - Reference Number of Order

Taxpayers are required to provide the reference number of the order of demand, or any rectification/appeal order related to the payment. This ensures that the payment is properly matched with the specific tax demand.

By following these steps, taxpayers can efficiently file Form DRC-03A, ensuring that their payments are correctly appropriated and that their tax liabilities are settled.

Conclusion

Form DRC-03A brings significant improvements to GST compliance by simplifying payment appropriations and improving transparency. As part of the broader effort to streamline the GST system, this form is a welcome step for businesses looking to manage their tax liabilities with ease and accuracy. Taxpayers should stay informed on evolving guidelines to fully leverage this compliance tool.

*****

Need help in being prepared for GST audits and litigations? IRIS GST can help!

IRIS LMS – Litigation Management Solution helps users keep track of due dates, manage notices and cases, and store documents and precedence along with their legal positions at one location digitally. The solution is designed to assist you in facing GST audits efficiently and managing GST litigations effectively.

We highly recommend you schedule a free demo of IRIS LMS to understand what it can do for you. Click the link below!

Ready to Get Started?

We highly recommend you schedule a free demo of IRIS LMS to understand what it can do for you.

Click the link below!

IRIS is a listed reg-tech solution provider and an authorized GSP for the past 5 years. IRIS GST has helped businesses like L&T, Bajaj, Thermax, and Forbes meet their GST compliance efficiently and effectively with no missed due dates and 100 % ITC claims.

Please feel free to revert with any queries regarding GST litigation and departmental audits. Our team of experts can certainly take on your specific questions, if any, and look at resolving the issues efficiently. Email: support@irisgst.com.