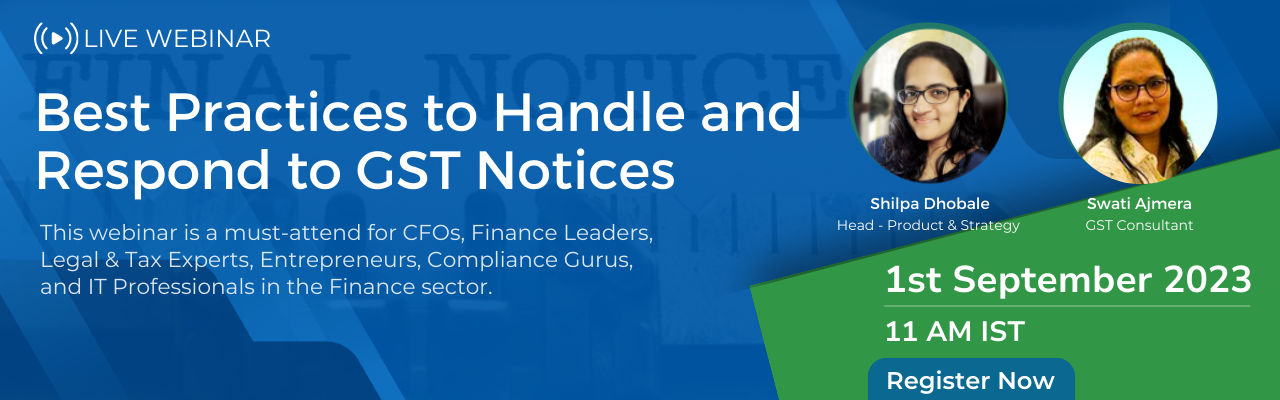

The IRISGST Times

Volume 68 | August, 2023

What’s Inside

Hello Readers!

September in India marks the completion of half fiscal year for businesses and a lively transition into a month brimming with festivities. In the realm of GST, the preceding month was notably eventful. We have touched upon it all here!

In this newsletter, there are interesting articles on mutiple topics related to GST, GST data based lending and also latest news updates about the new GST council meeting and more.

Here, you will also get details about IRIS Credixo, best software for GST data-based lending. And, yes, we have the most popular section – the GST Compliance Calendar for September 2023 so that you never miss a GST due date.

Happy Reading!

Regards,

Meghana Pawar,

Editor, IRISGST Times

Latest GST News Updates

In August, the government released a bunch of new GST Notifications and the Mera Bill Mera Adhikar Scheme. Read all the new updates from the month here: Top GST News

Reader’s Choice of the Month

Our most popular article for the month is – 51st GST Council Meeting. The council met again to discuss the issue of GST rates for online gaming. Click the link to know the details!

Top Finance News of the Month

The Income Tax Department has upgraded its national website, ‘www.incometaxindia.gov.in’, with a user-friendly interface, added features, and new modules to enhance the taxpayer experience and keep up with technology.

GST Updates

Product Highlight

IRIS Credixo: Supercharge your lending capabilities using real-time GST data!

Who is IRIS Credixo for?

IRIS Credixo helps financial institutions to extend lending opportunities to the SME and MSME sectors, breaking barriers that traditional lending models struggled to overcome.

Banks and Non-Banking Financial Companies (NBFCs)

- Upgrade legacy lending systems

- Enhance lending capabilities

- Leverage real-time invoice data

- Take informed credit decisions

- Streamline credit assessment and approval processes

- Build cleaner credit portfolios

FinTech’s and Neo-banks

- Build innovative credit products

- Move beyond traditional limiting data sources

- Crunch credit lending cycles

- Explore AI-based advanced data analytics

- Enable faster, low-risk credit approvals

- Construct leaner and agile platforms

With IRIS Credixo, you get

- Cloud/SaaS Architecture: Enjoy the flexibility and scalability of cloud-based architecture that enables you to access IRIS Credixo from anywhere, at any time.

- Available as APIs: Considering the set systems of FIs and agility of fintechs’, IRIS Credixo is also available as APIs to easily integrated with your systems.

- Real-Time Data: Access real-time e-invoice data along with GST data to make informed decisions quickly and confidently.

- Alternate Credit Scoring Model: Triangulate GST data with bank statements to make faster credit decisions. Expand the scoring dimensions by including GRRAS* e-invoice and e-way bills data.

- Early Warning System: Stay ahead of potential defaults with our early warning system that alerts you to potential risks before they become a problem.

- Collection Analytics: Analyze your collection processes and make data-driven decisions to increase efficiency and improve results.

*G=Granular R=Recent R= Relevant A=Accurate S=Standard

#Built in association with Metis Technologies

Want to know more about IRIS Credixo? Write to us at support@irisgst.com

Testimonial

“We are able to maximize our ITC and the recon process has been seamless.”

“Choosing a solution that does both GST’s regular monthly Compliance and E-invoicing wasn’t easy for us. We needed a hassle-free and quick solution and glad we selected IRIS GST. It’s been 4 years and the team has been offering prompt support for all our requirements. The ease of operating the software and easily connecting to our ERP solution is the key strength of IRIS, the changes that are coming for GST compliances & filings, can be easily incorporated without changing the framework of our ERP system.

IRIS GST helped us address the issue on a real-time bases. At the time of actual implementation, addressing the issue on a real-time basis and thus the quality of our GST filing improved and we were able to manage the liabilities timely and properly. Apart from this, the team has been diligently helping us with GSTR 2A/ 2B reconciliation with our purchase data to monitor our vendor compliance. With this, we are able to maximize our ITC and the process has been seamless.”

– PARAG PAREKH,

General Manager Accounts & Finance, Parekh Group

GST Compliance Calendar

Here is a comprehensive image of the GST Compliance Calendar that helps you be GST compliant. It has all the GST Compliance Due dates for September 2023 so that you never miss a GST due date!

Click here to read: GST Due Dates – September 2023 Calendar

By C.A. Samaira Tolani

We hope you enjoyed reading this issue of IRIS GST Times and found it informative! Do write us back and let us know what was a hit or miss for you from this issue. Our email id is: support@irisgst.com

Every feedback, be it via comments, replies on Social platforms or emails is always welcome. Thank you for appreciating our efforts and staying connected.

CONTACT US

Have feedback for us? Want to request for our product demos? Please reach out to us at