![]()

![]()

Over 5,00,000 Downloads

More Than 4600 Positive Reviews!

Bringing GST Management to your fingertips, literally!

What started as just a GSTIN search mobile application has now transformed into a tool for all things GST. IRIS Peridot is IRIS GST’s most loved product which has touched the lives of millions of taxpayers and businesses positively. With IRIS Peridot, our idea is to make GST compliance, easy and at your fingertips, literally.

Simplify your GST Compliance and ITC tracking with IRIS Peridot

Checkout all the things you can do with IRIS Peridot

IRIS Peridot Features |

Not Sign Up |

Signed Up |

| Search GSTIN | ||

| Scan GSTIN | ||

| Voice Search GSTIN | ||

| Search GSTIN by Name | ||

| Search GSTIN by PAN | ||

| Get details of all the returns filed | ||

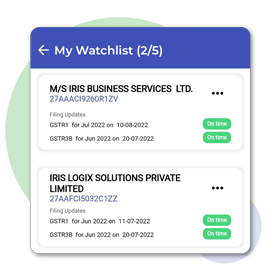

| Watchlist favourite GSTINs | ||

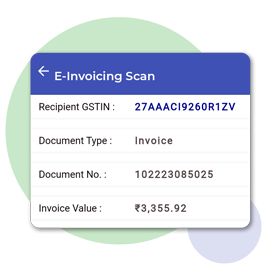

| Scan and Decode EInvoice and EWB QR Code | ||

| View compliance reports | ||

| Save Notifications | ||

| Ads free GSTIN search | ||

| Get Notifications | ||

| Multilingual | ||

| Share any page |

Run your small business with utmost efficiency

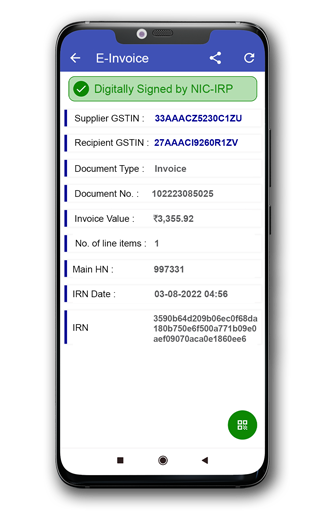

Check The E-Invoice Eligibility

of any GSTIN

Scan any GSTIN to check if the business is generating e-invoices or not. So if it’s your counter-party, vendors, or dealers, you can easily check the invoices you receive from them by scanning them in the app.

Likewise, you can also scan E-way Bill QR Codes to verify their correctness and get IRN information. The QR Codes are also verified for a digital signature to ensure it is generated from an authorised IRP.

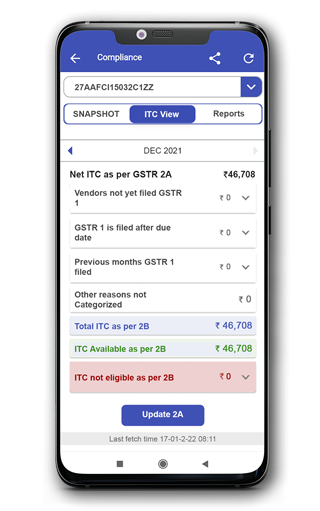

Better Control on Your ITC

With IRIS Peridot, we provide a high-level view of your ITC as per GSTR 2A and how it reconciles with your GSTR 2B.

You can drill down to know the vendors who are yet to file their returns affecting your ITC and which are the invoices where ITC is not eligible and so on.

Better Control

on your ITC

With IRIS Peridot, we provide a high-level view of your ITC as per GSTR 2A and how it reconciles with your GSTR 2B.

You can drill down to know the vendors who are yet to file their returns affecting your ITC and which are the invoices where ITC is not eligible and so on.

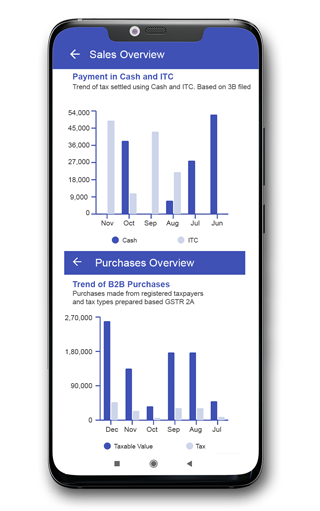

Your own GST Data with

meaningful insights

GST Returns are typically filed on a monthly basis and in some cases quarterly. We offer a consolidated view of your own sales and purchases for an extended period of 6 months.

This readily available data gives you a trend of your transactions over a period of time and thus helps you make crucial business decisions as well as get the pulse of your performance.

Want more? Here’s a sneak peek into the app!

Search GSTIN by Name/PAN

Scan E-invoices & E-way Bills to Check Validity

Voice Search

Watchlist favourite GSTINs

Testimonials

IRIS Peridot has been instrumental in making GST easy for its users. With changing times, we have ensured it gets better with every upgrade. Here are some of our happy users!

IRIS Peridot is the safest place for your GST data

We do not collect your GST portal passwords, nor do we connect to the portal to receive your data without your knowledge or consent. Any process related to GST Compliance starts only after your consent.

Your portal password is yours to keep,

we don’t store them

Your data is only visible to you