Opposed to a popular belief, the new e-Invoicing mandate will actually simplify a taxpayer’s compliance journey, by automating the invoice management, and auto-populate details for GST returns and EWB.

The Last Lap The Penal Proviso for GSTR 9 and 9C is Rs.200 per day After a series of extensions and filing complexities, the GSTR 9 and GSTR 9C filings

Still awaiting your #Christmas present, wondering what could’ve delayed #Santa? Maybe this could help!To know more about NIL GST returns, read here.

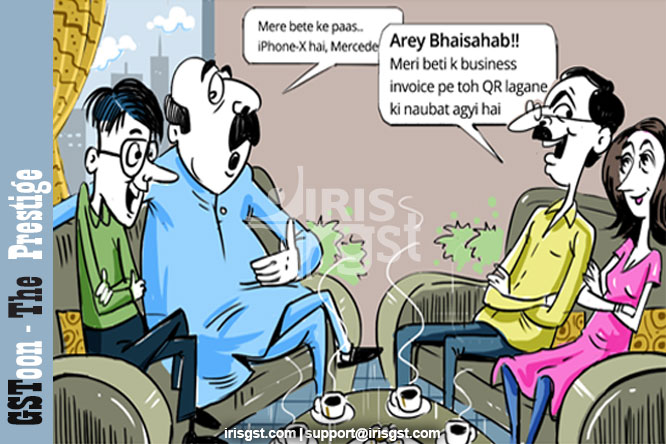

Under #e-Invoicing system, every #B2C invoice issued by taxpayer with an aggregate turnover of >500 crores has to have #QRcode on it.

38th GST Council meeting Will Smt. #NirmalaSitharaman increase the #GST tax rate, or will there be a rate cut to balance the #economy? Is there a room for any other possibility? Stay tuned …Read the highlights #GSToon #Comic

Filing Due Date of GSTR9-9C Before the 38th GST Council meet the industry anticipated that the GSTR -9 & 9C will be further postponed. Read here to know more

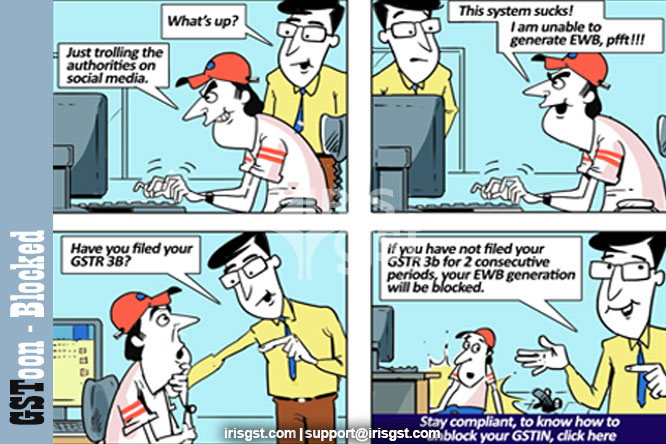

The #GSTN has already blocked around 3.5 lakh GSTIN from generating EWB, on account of non-filing of their #GSTR for the month of September and October.

E-Invoice generation is that it has to be generated through the #GST portal only !! In reality, any accounting software that can generate an invoice in the right format,can be used for eInvoicing.