WFH Possitivity Dossier

DAY 3

Hi Folks!

Here we are with day 3 challenge! Before we begin with our yoga pose for today, let me remind you that it is always advisable to start your yoga practise or any exercise regime for that matter with some basic stretching. Now we understand, we all are working from home and we tend to make ourselves a little more comfortable in that setting. Sitting for too long in one posture isn’t very ideal for our body. Standing up, walking a little, slowly moving your neck from the left to the right, moving your wrists, stretching your hands and legs can give you a much needed relief.

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

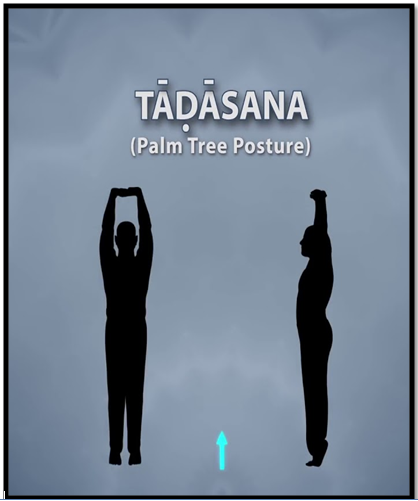

Tadasana – The Palm Tree Pose

Fun Fact to Note: The major difference between yoga and exercise is using the ‘breath’. In yoga we focus on the breath (practise breath awareness) and keep our attention on our body for maximum benefits.

Steps to perform Tadasana:

1.Stand Straight. Feet together, heels together, and knees together. Distribute your body weight evenly on both the legs.

2. As you breathe in start taking your hands towards your head slowly.

3. As your hands completely reach above your head, slowly bring your body weight on your toes and come on your heels. Give a good stretch to your spine with every breath.

4. If you want, you can interlock your fingers or keep your hands separate.

5. Maintain this posture for 3 to 5 breaths or as per your capacity.

6. To come out: Slowly put down your heels and start relaxing your hands. Come back to the initial positions. Repeat for 2 to 5 times as per your comfort.

People with acute trouble in the spinal column, a hunched back, extreme pain the shoulder, elbow or knees must avoid. A person who has undergone any recent surgery especially in the spine must avoid.

Benefits:

• With consistent practise of Tadasana one gets rid of heaviness, lethargy and feels fresh and energetic.

• Improves body posture.

• Improves the functioning of the veins of the legs.

• Improves our balancing capacity and improves the gait.

• Due to the stretch, the health of the discs between the vertebrae of the spine improves.

• Improves flexibility of the spine and resolves minor pain that arises in the back due to prolonged sitting or wrong posture.

• This is a great asana for kids between the age group of 14 to 18 as daily practise of this asana helps to increase one’s height.

• Avoid the tendency to lean forward or backwards while performing this asana.

GST Dossier

Latest GST Updates – Current forms

Today, we are covering all the Latest Updates in the GST regime. Most of the updates have been around E-Invoice, New Returns and EWB. The updates cover announcements in 39th Council meeting and other Notifications and updates issued by the government in last 1 month.

A. Updates on E-Invoice

Covers: 39th GST Council meeting announcements, API Specifications and E-Invoice standards released by IRP

PFA all the updates on E-invoicing with respect to various announcements in Council Meet and other releases, summarized at one place for easy assimilation.

“We discover our greatness when we find ourselves in a situation bigger than we are and we manage to grow and become bigger than situation”

By Luigiana Saggarro

1. E-invoicing applicable to companies having turnover above Rs. 100Cr. and the QR code applicable to companies having turnover above Rs. 500 Cr. has been deferred to 1st October 2020.

2. Certain class of registered persons (insurance company, banking company,financial institution, non-banking financial institution, GTA, passenger transportation service etc.) to be exempted from issuing e-invoices or capturing dynamic QR code.

3. E-invoice New API Specification has been released on 5th March 2020 in line with the updated e-Invoice standard fields released early Feb 2020

4. EWB can be auto-generated. If transporter id is provided then Part A will be auto generated and if vehicle details and transport document number is also provided then active EWB will be auto-generated

5. Additional API for generating EWB using IRN has also been provided. If E-way bill details are not provided during generating IRN, then this new API can be used.

In addition to field level changes, there are some validation rules worth noting, for the impact it could have on the business processes –

| Validation Rule | Impact |

| The Document Date can be yesterday or today’s date | The maximum time gap between invoice generation and getting IRN can be at most 1 day. Back-dated or IRN for earlier dated invoices will not be allowed |

| Document number should not be starting with 0, / and -. Also, alphabets in document number should not have alphabets in lower cases. If so, then request is rejected. |

Revisit the invoice numbering sequence. GST Invoicing rules however do not have any such conditions. |

| ‘Reverse Charges’ can be set as ‘Y’ in case of B2B invoices only and tax is being paid in reverse manner as per rule. Even in the case of Reverse Charged invoices, the seller has to generate the IRN. |

Responsibility of Invoice and IRN generation in case of reverse charge transactions for B2B, is with the supplier of such goods and services.

|

| In case the supplier is SEZ unit, then he cannot generate e-Invoice. | Only suppliers can initiate IRN generation. Hence if SEZ cannot generate e-invoice, then from purchase side invoices received from SEZ will not have any IRN |

| e-invoice(IRN) cannot be re-generated for the cancelled e-invoice(IRN) also |

Revisions to invoice need to managed through Debit or Credit Note. Cancellation of IRN is equivalent to cancellation of invoice, which makes the invoice void for any further actions |

| IRN cannot be cancelled, if the Valid/Active E-way Bill exists for the same. | IRN and E-way Bill are tightly integrated and taxpayers need to accordingly align their systems. |

| IRN should not be passed as part of the request; it is generated by the e-Invoice system and sent as response. | IRN will be generated by IRP only. Taxpayers systems, if are generating IRN, should not be sent to IRP |

Separate validation rules for e-way bill generation are also provided.

B. Know your Supplier

‘Know Your Supplier’ scheme that will enable every registered person to have some basic information about the suppliers with whom they conduct or propose to conduct business was introduced in the 39th GST Council Meeting that happened on March 14th. IRIS Peridot does the same for you.

C. Updates on E-Way Bill

1.Integration with Vaahan system

E-Way Bill system is now integrated with Vaahan system of Transport Department in February 2020. Vehicle (RC) number entered in e-way bill will be verified with Vaahan data for its existence/correctness. If the vehicle number does not exist, then system will alert the user to check and correct, if required. If the vehicle (RC) number is correct as per the tax payer, then he can continue with generation of E-Way Bill. However, he needs to get the vehicle number updated in the vaahan database so that in future E-Way Bill generation will not be affected.

A pilot run has already begun in the state of Karnataka.

2. Blocking of E-Way Bill

- E-way bill generation is blocked for taxpayers who have not filed their GSTR 3B for the previous two consecutive months/quarters.

- Such taxpayers cannot generate e-way bills for dispatches and to receive goods, resulting in a standstill.

- On filing GSTR-3B, the e-way bills will get unblocked on the next day.

- The system of e-way bill blocking was implemented from the 2nd of December 2019.

C. Updates on New Returns

Covers: 39th GST Council meeting announcements and API Specifications released

- The new GST return system will be implemented from October 2020.

- The present return filing system (GSTR-1, 2A & 3B) will continue until September 2020.

- The New GST Return System has been launched on a trial basis from July 2019 onwards, with the full-fledged system proposed to be put in place from October 2020.

- API’s for New returns are also released in the month of January 2020

D. Updates on Current GST Returns

For current forms, we have prepared a compendium of all the latest updates and notifications here:

- Notification 26/2020-Central Tax, 25/2020-Central Tax, 24/2020-Central Tax, 23/2020-Central Tax, 22/2020-Central Tax, 21/2020-Central Tax, 20/2020-Central Tax:Extension of deadlines in filing of GST returns of companies whose principal place of business is in the erstwhile State of Jammu and Kashmir

- Notification 12/2020-Central Tax: Waived off the requirement for furnishing FORM GSTR-1 for 2019-20 for taxpayers who could not opt for availing the option of special composition scheme under notification No. 2/2019-Central Tax (Rate)

- Notification 10/2020-Central Tax: Special procedures have been announced for taxpayers in Dadra and Nagar Haveli and Daman and Diu consequent to merger of the two UTs

- Notification 09/2020-Central Tax: Foreign airlines exempted from furnishing reconciliation Statement in FORM GSTR-9C provided statement of Receipts and Payments account duly authenticated by CA shall be submitted to GSTIN

These were the major updates that you should be aware in the GST regime. We will be covering important due dates in tomorrow’s GST dossier. Follow us on Twitter and Linkedin to get regular updates on #EverythingGSTin21Days

Press release of announcements made by Finance Minister as relief measures relating to Statutory and Regulatory compliance matters across Sectors in view of COVID-19 outbreak

- Those having aggregate annual turnover less than Rs. 5 Crore Last date can file GSTR-3B due in March, April and May 2020 by the last week of June, 2020. No interest, late fee, and penalty to be charged.

- Others can file returns due in March, April and May 2020 by last week of June 2020 but the same would attract reduced rate of interest @9 % per annum from 15 days after due date (current interest rate is 18 % per annum). No late fee and penalty to be charged, if complied before till 30th June 2020.

- Date for opting for composition scheme is extended till the last week of June, 2020. Further, the last date for making payments for the quarter ending 31st March, 2020 and filing of return for 2019-20 by the composition dealers will be extended till the last week of June, 2020.

- Date for filing GST annual returns of FY 18-19, which is due on 31st March, 2020 is extended till the last week of June 2020.

- Due date for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents, time limit for any compliance under the GST laws where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June 2020.

Book of the Day

Title: 7 habits of Highly Effective People

Author: Stephen R. Covey

Key Takeaways from the 7 Habits that the author mentions:

Habit 1: Be proactive.We, humans, have the ability to control our effectiveness. We need not just keep reacting to the situations that life throws at us. We have the ability to pause, think and act. Our outer circumstances need not dictate our behaviour and affect our mental peace.

Habit 2 : Begin with the end in mind.Have crystal clear goals. Have the roadmap ready before you start anything. Plan your tasks; plan your journey to success. Be on the driver’s seat when it comes to decision making and not just be a passenger and do things others want you to do.

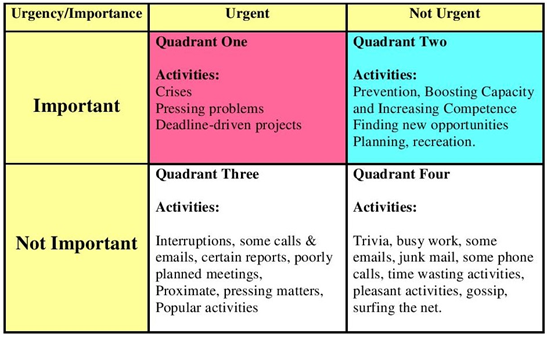

Habit 3 : First things first. Do the most important things first. Don’t start with tasks that have the lowest priority as it might lead to you underperforming with big tasks remaining unfinished. Identifying the time Quadrants:

Habit 4 : Think win-win. Establish effective interdependent in relationships.To achieve Win-Win, be solution-oriented, keep your focus on solutions, not methods; on problems, not people.

Win-Win – I win, you also win. Mutual Benefit.

Win-Lose – I win you lose.

Lose-Lose – We both lose.

Lose-Win – I lose, you win.

Habit 5 : Seek first to understand, then to be understood.“You have to build the skills of empathic listening on a base of character that inspires openness and trust.” -Stephen Covey. This explains it all.

Habit 6 : Synergize!Working together is working in synergy. The real essence of synergy is valuing the differences — the mental, emotional, and psychological differences between people.

Habit 7 : Sharpen the Saw.This habit focuses on ‘rejuvenating ourselves’. It shifts our focus on our greatest asset – ourselves. It involves taking care of our body, mind and soul! The spirit of what we plan to do with this new 21 day challenge!

So that’s it for today folks! Hope you enjoyed reading this positivity dossier. We sincerely wish it helps you get going and have some inspiration in this lockdown time! Feel free to share it with your colleagues, team members, family members and friends. You can comment below and let us know your thoughts! Let us all be together, grow together and face this challenge that our country and the world is facing with positivity!

This is a great initiative!

Also, a perfect book to start. Kudos.

Keep inspiring!

Thanks for the appreciation. Please keep on viewing for further updates.

Very informative & interesting too…

Thanks for the appreciation. Please keep on viewing for further updates.