WFH Positivity Dossier

DAY 9

Here’s our positivity dossier – Day 9!

What’s in here?

A very simple yet super effective sitting posture ‘BaddhaKonasana’ followed by GST Updates that cover all about exemptions in utmost detail starting right from the basics.

We also have our book of the day ‘Wings of Fire’ in which we share wisdom from our beloved APJ Abdul Kalam Sir’s biography – all this just to cheer you up!

Smiling already?

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

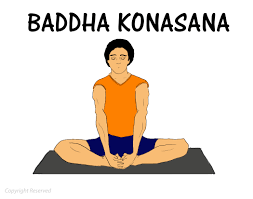

BaddhaKonasana – The Butterfly Pose

Steps to perform this aasana:

Step 1: Sit straight with your back and neck straight. Legs stretched out separated.

Step 2: Fold your legs from the knee and join both the heels. Bring your feet close to your pelvic region. Ensure, your spine is erect (natural curve), neck is straight and shoulders are not stooped.

Step 3: Hold the front of your feet with your hands. Close your eyes and relax.

Step 4: Maintain the posture for 5 to 10 breaths or as per your capacity. Come out of the asana slowly in reverse order.

Benefits:

Consistent practise of this BaddhaKonasana can help to:

- Open up the hips

- Gives a good stretch to the inner thighs, groins, and knees

- Improve the functioning of the abdominal organs

- Very good for the ovaries and prostate gland, bladder, and kidneys

- It is good for diabetes patients

- Soothes menstrual discomfort

- Gives a good stretch to the spinal column

- Helps to release stress and calms the mind

GST Dossier

Exemptions from GST Applicability

Here’s the list of persons who are not required to register under GST:

- Person who fall in the threshold exemption limit of turnover for supply of goods worth INR 40 lakhs and for supply of services worth INR 20 lakhs and for specified category – INR 20 lakh and INR 10 lakh.

- Specified category here includes people living in hilly and north-eastern states like Arunachal Pradesh, Jammu and Kashmir, Himachal Pradesh, Uttarakhand, Tripura, Nagaland, Sikkim, Meghalaya, Mizoram, Assam and Manipur.

“A crisis often brings out the best in you and you discover qualities that you never knew existed within.”

By Rajeev Siddhartha

- Person making activities which are not covered under the supply of goods and services such as funeral services, petroleum products etc.

- Person who are completely involved in manufacturing or sale of Nil-Rated, Non-GST and Exempted supplies are not required to get registered under GST.

- Person making supplies those are covered under reverse charge such as tobacco leafs, cashew nut (not shelled and peeled) etc.

GST exemptions on Goods:

Following is the list of certain goods which are exempted from GST

| Types of goods | Examples |

| Live animals | Asses, cows, sheep, goat, poultry, etc. |

| Meat | Fresh and frozen meat of sheep, cows, goats, pigs, horses, etc. |

| Fish | Fresh or frozen fish |

| Natural products | Honey, fresh and pasteurized milk, cheese, eggs, etc. |

| Live trees and plants | Bulbs, roots, flowers, foliage, etc. |

| Vegetables | Tomatoes, potatoes, onions, etc. |

| Fruits | Bananas, grapes, apples, etc. |

| Dry fruits | Cashew nuts, walnuts, etc. |

| Tea, coffee and spices | Coffee beans, tea leaves, turmeric, ginger, etc. |

| Grains | Wheat, rice, oats, barley, etc. |

| Products of the milling industry | Flours of different types |

| Seeds | Flower seeds, oil seeds, cereal husks, etc. |

| Sugar | Sugar, jaggery, etc. |

| Water | Mineral water, tender coconut water, etc. |

| Baked goods | Bread, pizza base, puffed rice, etc. |

| Fossil fuels | Electrical energy |

| Drugs and pharmaceuticals | Human blood, contraceptives, etc. |

| Fertilizers | Goods and organic manure |

| Beauty products | Bindi, kajal, kumkum, etc. |

| Waste | Sewage sludge, municipal waste, etc. |

| Ornaments | Plastic and glass bangles bangles, etc. |

| Newsprint | Judicial stamp paper, envelopes, rupee notes, etc. |

| Printed items | Printed books, newspapers, maps, etc. |

| Fabrics | Raw silk, silkworm cocoon, khadi, etc. |

| Hand tools | Spade, hammer, etc. |

| Pottery | Earthen pots, clay lamps, etc. |

GST exemptions on Services:

Following is the list of certain services which are exempted from GST

| Types of services | Examples |

| Agricultural services | Cultivation, supplying farm labour, harvesting, warehouse related activities, renting or leading agricultural machinery, services provided by a commission agent or the Agricultural Produce Marketing Committee or Board for buying or selling agriculture produce, etc. |

| Government services | Postal service, transportation of people or goods, services by a foreign diplomat in India, services offered by the Reserve Bank of India, services offered to diplomats, etc. |

| Transportation services | Transportation of goods by road, rail, water, etc., payment of toll, transportation of passengers by air, transportation of goods where the cost of transport is less than INR 1500, etc. |

| Judicial services | Services offered by arbitral tribunal, partnership firm of advocates, senior advocates to an individual or business entity whose aggregate turnover is up to INR 40 lakhs |

| Educational services | Transportation of faculty or students, mid-day meal scheme, examination services, services offered by IIMs, etc. |

| Medical services | Services offered by ambulance, charities, veterinary doctors, medical professionals, etc. |

| Organizational services | Services offered by exhibition organisers for international business exhibitions, tour operators for foreign tourists, etc. |

| Other services | Services offered by GSTN to the Central or State Government or Union Territories, admission fee payable to theatres, circuses, sports events, etc. which charge a fee up to INR 250 |

One important point to note here is Input tax credit paid on these supplies will not be able for utilisation.

Exemptions from E-Invoice applicability

‘E-invoicing’ or ‘electronic invoicing’ is a system in which B2B invoices are authenticated and validated electronically by GSTN for further use of GST Compliances

E-Invoicing will be mandatorily required to be complied from 1st October 2020

- The taxpayers with annual aggregate turnover of over Rs. 500 Crore and

- The taxpayers with the turnover over Rs. 100 Crore

Note: Voluntary implementation has started from 1st Jan 2020 and 1st Feb 2020 for taxpayers above Rs. 500 Cr. and Rs. 100 Cr. respectively.

Following industries are exempted from e-invoicing requirements:

- Insurance companies

- Banking companies

- Financial Institutions

- NBFC

- GTA , Passenger Transportation Service

- In addition to above industry exemptions, SEZ suppliers are also excluded from e-invoice compliances

Exemptions from E-Way Bill

Applicability:

- Registered Person– Eway bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered person.

- Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

- Transporter– Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

Exemptions

In the following cases it is not necessary to generate e-Way Bil:

- The mode of transport is non-motor vehicle

- Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

- Goods transported under Customs supervision or under customs seal

- Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

- Transit cargo transported to or from Nepal or Bhutan

- Movement of goods caused by defence formation under Ministry of defence as a consignor or consignee

- Empty Cargo containers are being transported

- Consignor transporting goods to or from between place of business and a weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery challan.

- Goods being transported by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

- Goods specified as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

- Transport of certain specified goods- Includes the list of exempt supply of goods; Annexure to Rule 138(14), goods treated as no supply as per Schedule III, Certain schedule to Central tax Rate notifications. (PDF of List of Goods).

Note: Part B of e-Way Bill is not required to be filled where the distance between the consigner or consignee and the transporter is less than 50 Kms and transport is within the same state.

Book of the Day

Title: Wings of Fire

Author: Arun Tiwary

- You are in control of your growth: We always blame external circumstances and conditioning to justify our performances or actions. We act as victims and try to bypass a problem by declaring ‘there’s nothing we can do about it’. APJ Abdul Kalam explains – if a student really wants to learn, only he can be a hindrance to his progress. And in this day and age, with so much information at our finger tips, we really should audit the excuses we give. He says,‘a good student can extract more from a bad teacher than a bad student can from a good teacher.’

- Accept failures: In something as intense as rocket making, you can’t expect from yourself that you’ll never put your foot wrong. Nor can you go into a slumber and quit it. Failures should not only be considered as stepping stones for our successes, they should be considered essential to lead us to our growth. Approaching our failures constructively not only helps us make improvements, but bounce back stronger.

- Solve Key Problems: Dr.Vikram Sarabhai, a mentor to Mr. Kalam, believed in using failures to build opportunities. When there was a minor hiccup in an electronic system to fire up a mechanism in a rocket they were making, rather than questioning the insufficient knowledge and lack of skill on part of his people, he asked whether the work was possibly affected by something that was beneath the surface. He finally pointed out that they lacked a single roof under which all the development and assembly activities were carried out.This led to a decision to setup a separate Rocket Engineering Section.

- Single- Mindedness: Kalam says if we want success in our mission, we must have single-minded devotion to our goals. As also said in the PatanjaliYog Sutras, तीव्रसंवेगानामासन्नः meaning that which you give first priority to, the most importance to, is easier to achieve. We are more likely to achieve our goals and smash our To-Do Lists if remained focused on doing them, rather than allowing ourselves to attend to some ‘seemingly’ important, and urgent tasks.

- Team Work: The value of Team Work and Organised Management of our Teams is stressed over and over again in the book. For projects that run over the course of decades, and for doing things that have never ever been done in the country or in the world before, it surely takes more than two hands and one brain.

- Choosing right people for right jobs, involving everyone in the decision making, knowing where to take time and where to make quick decisions, are proven management practises, and we all can incorporate them to make everything we undertake better.

That’s all for today folks! We will again be back tomorrow with loads of new stuff to keep you updates! Till then you can visit our GST Blog to explore more!

If you have missed any of our previous positivity dossiers, just click here and enjoy!

Very useful article!! Understanding GST was always very tedious for me until I read this. So I finally found something productive for these 21 days. Thanks a ton!!

Thanks for appreciating. Please keep on viewing our articles