WFH Positivity Dossier

DAY 8

Back with yet another positivity dose, it is lockdown day 8! Can you believe it? It has been more than a week we have been locked up in our homes, for our own good.

This WFH situation has left us with a little more time to ourselves and so this dossier brings you a posture that can ease your anxieties and help you look good without having to visit any salon!

Today’s GST update is about the amendments.We also have the learning points from our book of the day to add a lot of value to your life. So dive in, folks!

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

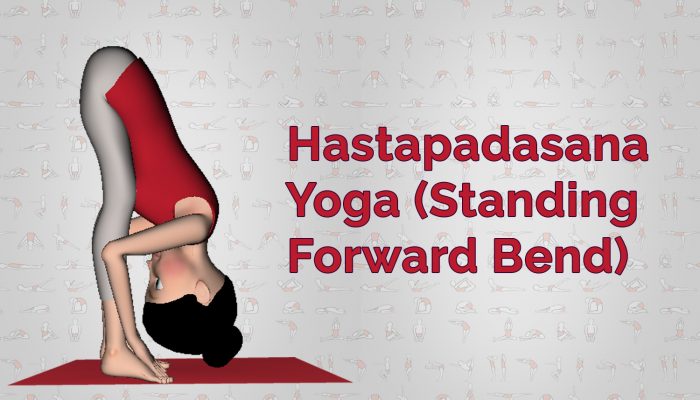

Hastapadasana (Hands to Feet)

Hastapadasana or Hands to Leg Posture is one of the easiest yet extremely effective yogic asana. Like every other asana, it is important to perform this on an empty stomach.

Steps to perform Hastapadasana:

Step 1: Stand straight with both your feet together. Distribute the weight of your body evenly between both the legs.

Step 2: Slowly take your hands above your head and tilt your body a little behind.

Step 3: Start coming down i.e. taking your hands towards your legs with your chin up. You have to bend from your waist, keeping your spine straight.

Step 4: As you reach down completely, drop your head and loosen up your hands. You can let your hands hang in the air, keep it beside your leg or keep them on your feet. Remember the goal isn’t to touch your toes, but to give a good stretch to your back and your calf muscles.

Step 5: As you maintain the position, shift the body weight ahead without bending your knees. Hold the posture for 3 to 5 breaths or as per your capacity. Repeat for 2 to 5 times as per your comfort.

Step 6: To come out, simply straighten up and relax.

People suffering from cervical spondylitis must avoid. Pregnant women must avoid. Those who are suffering from any spine injury, knee injury or has undergone any recent surgery must avoid. Severe migraine and hypertension patients must do it only under the guidance of a yoga teacher.

Benefits:

- Gives a good stretch to your posterior muscles resulting in their toning.

- Improves blood circulation.

- The blood rushes towards your face and your head. Thus brings a glow on your face and reduces hair fall and greying of hair.

- Brings flexibility in the spine and improves spine health.

- Extremely beneficial for the calf muscles.

- This is considered as a preparatory practise for advance asanas like pachimtanasana and halasana among others.

- Beneficial for back issues and also helps to tone the abdominal fat.

• Avoid the tendency to lean forward or backwards while performing this asana.

GST Dossier

Amendments

We upload invoice level details while filing GSTR-1, take a total of entire liability arise out of sales on a monthly basis and file GSTR-3B. Then total the monthly 3B and file GSTR-9. Since this process involves counting of each and every invoice there are chances that we skip an invoice/changes are to be made in an invoice after filing. But revised filing is not allowed in GST regime. What to do in such case?

The answer is to amend the return. Again the question arises how to do so? What will be the impact of it?

There are two ways in which this can be done:

- If filing of September month of next financial year is not done: Go to amendments section; select the month in which edit is required and make necessary edits. If this edit results in additional liability then pay the same via GSTR-3B along with interest.

- If filing of September month of next financial year is done but GSTR-9 not yet filed: Show correct value while filing GSTR-9. Pay the difference between previously shown value and revised value along with interest via DRC-03

“As mush as we want to keep ourselves safe, we can’t protect ourselves from everything. If we want to embrace life, we also have to embrace chaos.”

By Susan Elizabeth Phillips

If any revisions are required in GSTR-3B then the taxpayer can pay the additional liability/reverse the ITC along with interest in future months.

For amending GSTR-5, GSTR-7 and GSTR-8 the taxpayer can edit the details in future months by going to amendment section, selecting the month in which edit is required and make necessary edits. Payment can be made in the same return with interest.

For GSTR-6 the process is little different, ISD will edit the details of credit distributed in the similar way as taxpayers can do in other returns. But he does not make any payments, instead the branches reverse the ITC and pay interest on reversal.

Amendments in New Return:

To edit the filed returns, GSTN has given an option called amendment. There is a specific procedure mentioned for amendments which one has to follow to edit previous filed data.

Currently there is only one single facility to amend any data that is reported. Taxpayer can revise the data by selecting the previously filed invoice (in case of invoice level information) or value (in case of aggregated information) and report the change in subsequent return.

In new forms the scenario is quite different. There are various ways in which information can be amended.

Wondering How Simplified Returns can be amended? Click Here!

Book of the Day

Title: Crushing It!

Author: Gary Vaynerchuk

Key learning pointers from the book:

- No matter what, always do the right thing.

- Don’t expect people around you to hustle as hard as you. Don’t even expect your employees to work as hard as you! Because, it’s your company and not theirs for them to care as much as you do. No point in getting pissed and losing your cool.

- Always remember that there are more important things than money. Don’t be super materialistic. Value humanness first.

- There is hardly any problem that communication cannot solve. Communication can solve 99% of the problems so use it well.

- Don’t just sit with all the good advice implement them. Experience everything yourself.

- It is not a good idea to take your work problems home! It will not just ruin your relationships but screw your mind.

- Always remember that we all just have 24 hours. Even the rich of the richest and the poor of the poorest people have 24 hours. What they make of it is the real deal. How you spend your time and on what matters.

- Create content, use social media to build your personal brand. This can be done irrespective of whether you have a product to sell or not.

- Don’t define success with material things. Real success doesn’t lie in material things but in the contentment you receive from doing the work that you do in the world.

So this brings us to the end of our day 8 positivity dossier! We will be back tomorrow with some more interesting yoga postures, latest GST updates and wisdom from a best-selling book.

So stay tuned…

Leave a comment