WFH Possitivity Dossier

DAY 5

The anxiety that one gets after watching 15 minutes of news these days is huge! In such a delicate time, it is significant that we keep our mind sane and our body healthy. This is why we have included a very effective breathing technique in today’s positivity dossier!

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

Anuloma-Viloma Pranayama – Alternate Nostril Breathing

So after a light warm up and a little bit of stretching, you can get ready for today’s practice which is Anuloma-Viloma or alternate breathing technique. Pranayamas are super powerful. They directly affect our central nervous system thus help us regulating our thoughts making us calmer and bring us peace. Thus it is important to do it correctly.

Steps to perform Anuloma-Viloma (NadiShodhan Pranayama) :

Step 1: Sit in any comfortable posture. You can sit in sukhasana, padmasana, ardhapadmasana or even comfortably on a chair. I would suggest take back rest.

Step 2: Left hand in chin mudra i.e. join the thumb and first finger and rest of the fingers straight. Place your left hand on your knee. We will use our right hand to regulate our breath.

Step 3: Now, position of your right hand – place your first and middle finger in between your eyebrows (Agya chakra), thumb is to block the right nostril and the rest two fingers are for the left nostril.

Step 4: Breath out fully. Now breathe in from the left nostril (blocking right) – full – deep – long breath and slowly breathe-out from the right nostril (Blocking the left). Again breathe in from the right and breathe out from the left. Continue…breathe in from the left, breathe out from the right. This is alternative nostril breathing. We need to take deep, long and controlled breaths. Ideally breathing out is slower than breathing in.

People who have infection in the lungs, severe abdominal issues, growth in the nose (polypus), enlargement of liver, severe throat infection, blockage of the nasal passage, appendicitis, or have undergone any recent nose surgery must avoid.

- Cleans the respiratory track/passage

- Helps to reduce arthritis problems

- Proves beneficial inchronic sinus problems and snoring

- Mind becomes calm, heart beats are regulated i.e. natural rhythm is restored.

- It is a very good practise to maintain your mental health. Helps in reducing baseless fears and anxiety issues, acts as a preventive/remedial practise for depression and sadness.

- Improves blood circulation.

- It has a positive impact on all the organs of our body.

Keep you neck, back and spine erect – This is crucial. Any pranayama is done for minimum of 5 minutes to achieve its benefits. Don’t make any noise while breathing. The breaths are slow, conscious and normal.

GST Dossier

How to Comply – Part 1

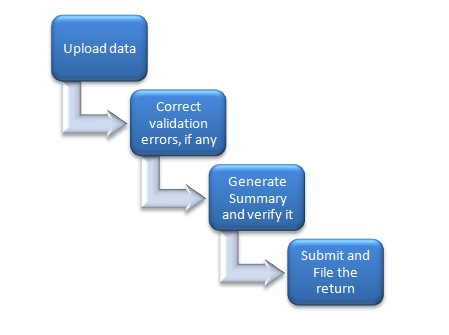

Various returns need to be filed by various taxpayers to comply with GST mandates.

The filing procedure of the returns GSTR-1, GSTR-5, GSTR-6, GSTR-7, GSTR-8 and GSTR-11 is same.

Filing process:

What differs is the taxpayer type, due dates (already covered in yesterday’s WFH Dossier) and details to be uploaded by the taxpayer.

GSTR-1: GSTR-1 is filed by a normal taxpayer.

In GSTR-1 the taxpayer uploads his daily sales to registered and unregistered persons, his exports and amendments made to such sales. GSTR-1 also includes other supplies like Nil-rated, Non-GST and Exempted supplies. This is something which all of us know. But below are just some facts about GSTR-1 which is not known to all:

Nil-rated, Non-GST and Exempted supplies are shown just to depict the turnover for the month. They don’t have any impact on the tax payment under GST. Hence there is no separate table to show amendments to Nil-rated, Non-GST and Exempted Supplies.

B2B RCM sales reported in GSTR-1 Table 4(B) have no impact on tax liability of taxpayer hence it is not considered while matching GSTR-1 and GSTR-3B of the taxpayer. The details of invoices shown in this section get auto-populated in GSTR-2A of the counterparty.

Export refunds of the taxpayer are not just completely related to the liability paid by the taxpayer in GSTR-3B it is also related to the details of invoices shown in Table 6 (A) of GSTR-1. (You can visit our blog on export refunds for further details https://irisgst.com/non-transmission-of-export-refunds-in-icegate/)

B2CS is the only section in GSTR-1 where invoices are reported net of credit/debit notes.

Document Details is the only section where serial number is mandatory.

Please read our tomorrow’s segment to know such facts about GSTR-5, GSTR-6, GSTR-7 and GSTR-8.

*** *** *** *** *** ***

Here’s all you want to know about SUGAM (RET-3): Quarterly Return for B2B+B2C Transactions!

In the blog, we cover:

- What is Sugam (RET-3)?

- Who can file Sugam?

- What details are allowed to be declared in Sugam?

- List of documents to be filed by Quarterly return filers opting for Sugam and when?

- How to file RET 3 – Sugam?

- How to upload ANX-1?

- How to file ANX-2?

Read the full Blog on Sugam : New Returns for small tax payers here.

“Successful people recognise crisis as a time for change – from lesser to greater, smaller to bigger.”

By Edwin Louis Cole

Book of the Day

Title: IKIGAI – The Japanese Secret of Living a Happy Life

Author: Hector Gracia & Francesc Miralles

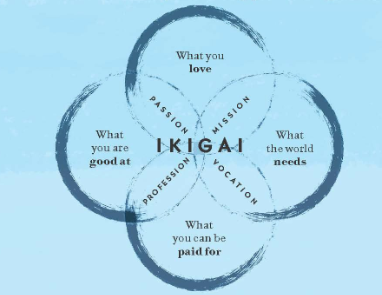

- The book touches upon various aspects of life which can help us achieve a long happy life. It is based on ancient Japanese technique named — IKIGAI.

- The Book talks about how we can stay young while growing old. The narrative explains multiple concepts that help us stay young at heart, lively and energetic. We all have our IKIGAI. Don’t worry too much if you don’t find it easily; just keep doing what you love.

- Although, following our IKIGAI can give us a lot of joy and fulfilment! The following image will help you understand how you can find yours!

- The book also talks about ‘finding the flow’ i.e. if you have found your meaning of life, completely immerse yourself into it. It has mentioned a few techniques to achieve the ‘flow’. All of the techniques are not originated in Japan. Techniques like yoga, meditation, suryanamaskars are all Indian.

- The book suggests the practise of slow and conscious living. It suggests the concept of eating healthy and living an unhurried life to sustain longer. It also suggests the practise of awareness and mindfulness.

Rules/Guidelines of IKIGAI:

- Always be active, don’t live to retire.

- Take it slow

- Don’t fill your stomach (only eat till 80% full)

- Have good friends

- Get in shape

- Smile more

- Reconnect with nature

- Give thanks

- Live in the moment

- Follow your IKIGAI

Wouldn’t it be so beautiful if we live our lives like this?

Conclusion:

So this was day 5 of the #WFH Positivity challenge! Hope you had a great time reading and practising it! Do keep us posted about how you are spending your #Quarantine days in the comments below! We would love to know and learn! Check out our Blog for more updates on the GST front!

Leave a comment