WFH Positivity Dossier

DAY 18

Day 18 of the lockdown is here. We have been keeping our promise diligently and sharing these Positivity Doses with you daily! Hope you are following through them and enjoying them too! In today’s dossier we have a highly beneficial yoga posture – Pachimotanasana. In #EverythingGSTIN21Days we share all about advances and adjustments in detail. Our book of the day is Steve Job’s biography by Walter Isaacson.

Dive in!

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

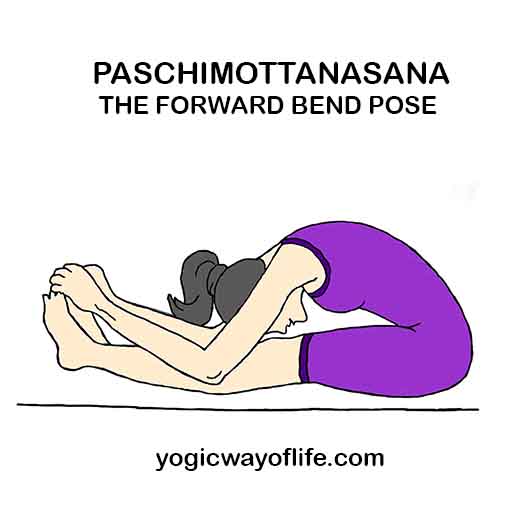

Pachimotanasana

Steps to perform the asana:

Step 1: Sit on your mat with your legs stretched out. Keep both your legs together and your spine erect, hands beside your body.

Step 2: Slowly take a deep breath in and stretch a little backwards and as you breathe out, start bending forward from your waist. Bend completely as much as you can.

*Ideally your forehead touches your knee and elbows touch the ground while you catch your respective toes with your fingers. However, this final posture may not be possible for many of us and that is okay. In this case, bend as much as you can and hold your legs (wherever your hands reach) and stay there.

Step 3: Maintain the final posture for 3 to 5 breaths or as per your capacity. Please do not hold your breath.

Step 4: Slowly come out of the posture in a reverse order. No jerks. Follow all the steps slowly. Repeat the asana for 2-4 times as per your capacity.

Any recent surgery in any part of the body especially –heart, spine, knee, leg must avoid, pregnant ladies must avoid. Any severe knee issue, hamstrings issue must avoid, any abdominal issue like hernia, appendix etc. must avoid. People with Asthama and Diarrhea must avoid.

Regular Practice for Pachimotanasana can give you the following benefits:

-

- Extremely good for the spine and hamstrings. Improves flexibility.

- Calms the mind and helps relieve stress and mild depression

- Stretches the all the muscles that are used thus toning them.

- Stimulates the liver, kidneys, ovaries, and uterus.

- Improves digestion.

- Helps to reduce belly fat.

- Helps relieve the symptoms of menopause and menstrual discomfort

- Helps in reducing headache and anxiety and also reduces fatigue

- Therapeutic for high blood pressure, infertility,

- Therapeutic for insomnia and sinusitis

GST Dossier

Advances and Adjustments

With respect to Sales:

It is a popular belief that GST is paid on supplies made in the month. However, this is not true. GST is not just paid on supplies but it is also paid on the amount which we receive in advance for future supplies. This future supplies could be in the same month in which advance is received or it could be in any other month after the current month.

If the supply is in the same month in which advance is received then we have a final invoice and tax paid on that final invoice. If the supply is in next month then for the current month there is no other invoice apart from the receipt voucher which we issue to the counterparty against the advances. Hence tax is to be paid against this receipt voucher.

Success is not final; failure is not fatal: It is the courage to continue that counts.

– Winston Churchill

For example: After 3 months we complete the task for which we received the advance and issue the final invoice. This final invoice will have the advance amount included in it. But since we have already paid the tax we will not pay it again instead we will show the invoice as it is in Regular Invoice section and show an adjustment to it in adjustments section giving reference of invoice and tax amount already paid when advances was received. Due to this the final liability which will get credited to liability ledger would be net off the tax amount already paid three months back.

The rules for the time of supply under GST play a very important role in determining when to pay tax for a transaction. The general rule for time of supply for services is earliest of the following –

- Date of issue of invoice

- Date of receipt of payment/advance*

- Date on which invoice should be issued

The second point above is receipt of advance. This means that if the advance is received before the issue of the invoice the time of supply would be the date of receipt of advance. Thus taxpayer receiving advance must pay GST on the money received.

Any advance received by a taxpayer for which invoice is not issued should be mentioned in Pt.11A of GSTR 1. Details of each advance need not be given; a cumulative figure of all the advances received has to be provided. The advance should be segregated into Interstate and intrastate advances.

This process would remain same in new returns too. Only difference is in current returns we show the details at Place of Supply level however, in new returns there would be just one value which would be shown in RET-1.

With respect to Purchases:

For advances paid to a registered supplier there is no need to show it anywhere in the returns. However, for advances paid to unregistered supplier as per law it needs to be shown and liability need to be paid. Also, when the transaction gets complete the purchaser need to show the adjustment details as well, the way registered supplier show in his returns.

Below is the placement of details to be shown in old and new returns for advances paid to unregistered suppliers. Thereby getting covered under RCM:

| Purchases | |||||||

| Regular transactions | Advances and Adjustments | ||||||

| ANX-1 | Specification as per GSTR-2 | ANX-1 | RET-1 – Liability | RET-1 – ITC Auto from ANX-1 | RET-1 – ITC Downward/Upward -Manually | Specification as per GSTR-2 | |

| 3H. Inward supplies attracting reverse charge (to be reported by recipient, GSTIN wise, net of debit notes and credit notes and advances paid, if any) | B2B+RCM=Y & RCM | Table 3H | Table 3B.1 | Table 4A.5 | Reversal: Table 4B.5 | RV: O +R | |

| 3I. Import of services (net of debit/ credit notes and advances paid, if any) | IMS | Table 3I | Table 3B.2 | Table 4A.6 | Reversal: Table 4B.5 | RV: O +R | |

| 3J. Import of goods | IMG | Not Applicable | |||||

| 3K. Import of goods from SEZ units / developers on a Bill of Entry | IMG: SEZ | ||||||

| On receipt of invoice | |||||||

| 3H. Inward supplies attracting reverse charge (to be reported by recipient, GSTIN wise, net of debit notes and credit notes and advances paid, if any) | B2B+RCM=Y & RCM | Table 3H | Table 3B.1 | Table 4A.5 | Add Value: Table 4A.11 | TP:O+R | |

| 3I. Import of services (net of debit/ credit notes and advances paid, if any) | IMS | Table 3I | Table 3B.2 | Table 4A.6 | Add Value: Table 4A.11 | TP:O+R | |

| 3J. Import of goods | IMG | Not Applicable | |||||

| 3K. Import of goods from SEZ units / developers on a Bill of Entry | IMG: SEZ | ||||||

|

Below are few scenarios for advances paid to unregistered suppliers and invoice received later on |

|||||||

| Logic | Liability = Invoice Raised + Advance Paid – Tax Adjusted | ITC = Liability | ITC Reversal = RV | ITC Upward Adjustment = TP | |||

| Tables as per RET-1 | Table 3B.1 | Table 3B.1 | Table 3B.1 | Table 3B.1 | Table 4A.5 | Table 4B.5 | Table 4A.11 |

| Month | Invoice Raised | Advance Paid | Tax Adjusted | Liability | ITC | ITC Reversal | ITC Upward Adjustment |

| 1 | 100 | 100 | 100 | 100 | 0 | ||

| 2 | 100 | 100 | 0 | 0 | 0 | 100 | |

| 1 | 100 | 100 | 100 | 100 | 0 | ||

| 2 | 50 | 50 | 0 | 0 | 0 | 50 | |

| 3 | 50 | 50 | 0 | 0 | 0 | 50 | |

| 1 | 100 | 100 | 100 | 100 | 0 | ||

| 2 | 50 | 50 | 0 | 0 | 0 | 50 | |

| 3 | 80 | 50 | 30 | 30 | 0 | 50 | |

Book of the Day

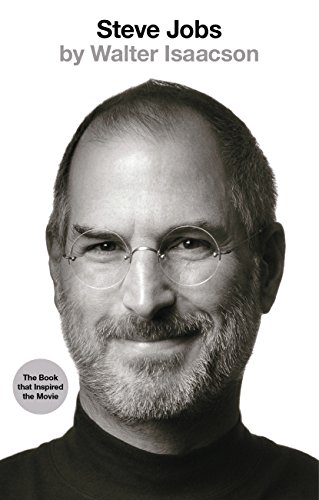

Title: Steve Jobs

Author: Walter Isaacson

After writing bestselling biographies of Benjamin Franklin and Albert Einstein, Walter Isaacson published Steve Jobs in 2011, less than three weeks after the death of Jobs. Things to learn from the book:

- Use your trust issues: Steve Jobs was ‘rejected’ by his parents and then ended up being adopted by the Jobs family. The rejection indeed left a huge impact on his life and led him to suffer from ‘Reality Distortion Field’. However, he did not let it be a hindrance in his professional life. He was extremely particular in choosing the people he was associated with.

- Bring out the best in yourself and your subordinates: Jobs was incredibly punctual and believed that as a computer company, Apple must always meet their deadlines. He pushed his engineers to their utmost potential and encouraged them to work harder.

- Imagine the future and coerce yourself to it: Jobs was undoubtedly a visionary and could fathom trends in and around the industry as futuristic opportunities. While he could imagine the vision amalgamating into the future, he was able to flawlessly convey it to his subordinates.

- Commitment: While Jobs was regarded to be a ruthless leader, the fact was he stayed committed to word and did not budge. He would willingly make a personal sacrifice for his company or even the people close to him if it meant their growth.

- Never Compromise: Steve Jobs believed in never compromising one’s goal if it seems out-of-reach. Work harder. For the same reason, he hired only “A-Players” to work at Apple.

The book flawlessly portrays the principles which helped Steve Jobs build Apple. Believed to have founded the elegant and strong fundamental base for the trillion-dollar company, Apple, there is a lot to learn from the business magnate.

Leave a comment