WFH Positivity Dossier

DAY 15

It’s day 15 of the lockdown today!

Days are just passing by and we are getting closer to the 21st day! Staying home is our contribution to the battle that our country is fighting against COVID-19.

In todays’ #WFH Positivity Dossier we have one of the most popular yoga asana- Vrikshasana or the tree pose. In #EverythingGSTin21Days section we have all about Cancellation, Amalgamation and Merger. Plus our book of the day is pure delight! The title ‘Everything is Figureoutable’ itself gives a lot of relief and freedom! So dive right in!

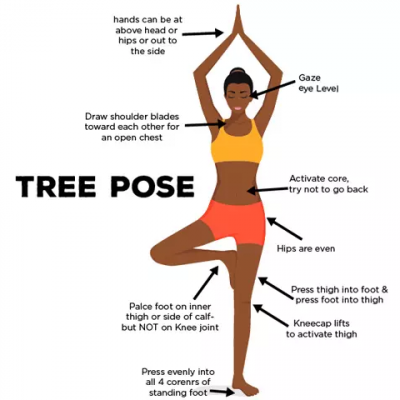

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

Vrikshasana – The Tree Pose

Steps to perform the asana:

Step 1: Stand firmly on your yoga mat, legs together, neck straight, back straight. Make sure you are not using and slippery mat. The mat needs to be firm for this posture.

Step 2: Place your left feet on your right inner thigh by bending the left knee. Right leg firmly on the ground. You will need to balance your body in this position.

Step 3: Take your hands up above the head and join the palms making a namaste posture. Stretch yourself up. Breaths normally, don’t hold your breath. Maintain for 3 to 5 breaths or as per your comfort.

Step 4: To come out, first relax your hands and then relax your legs slowly. Repeat with the other leg. Do this asana after a light warm up.

Any spine or leg injury, severe knee pain, low or high blood pressure patients must avoid, headache, severe migraine or insomnia.

Benefits:

- Helps to give relief from sciatica.

- It helps improve concentration.

- Improves body balance.

- Balances the mind.

- It strengthens the legs and opens the hips.

- Increases flexibility in the spine.

GST Dossier

Cancellation, Amalgamation and Merger

Cancellation in case of E-Invoice

- An e-Invoice cannot be partially cancelled; it has to be cancelled fully.

- Once cancelled, it will need to be reported into the IRN within 24 hours. A cancellation done after 24 hours cannot be done on the IRN and needs to be manually cancelled on the GST portal before the returns are filed.

- E-invoice (IRN) cannot be re-generated for the cancelled e-invoice (IRN) also.

- IRN cannot be cancelled, if the Valid/Active E-way Bill exists for the same

- And E-way Bill cannot be generated for cancelled IRN.

Cancellation in case of EWB

If the goods were never transported or are not transported as per the details furnished in the E-Way Bill, then the generator of such e-way bills can cancel the e-way bill by following these steps.

Note:

- Only generator can cancel such e-way bills only.

- The time-limit to cancel is within 24 hours of generating the e-way bill.

- Once cancelled, such E-Way Bill cannot be used

- If the e-Way Bill verified by any empowered officer same cannot be cancelled.

“Crisis are often resolved only through a new identity and new purpose, whether it’s that of a nation or a single human being.”

By Rebecca Solnit

Cancellation in case of GST returns

The way we cancel E-Invoice and EWB there is no provision to cancel GST Returns. In case of GST returns entire GSTIN is cancelled. Following is an example in which cancellation of GSTIN takes place:

Amalgamation and Merger

Amalgamation and Merger are not just commonly used terms; they are also commonly found scenarios.

What happens with existing registration in case of Amalgamation or Merger?

The answer is if newly formed company is registered with a separate PAN then all existing GSTINs should be cancelled. For example say there are two companies, Company A and Company B, a new Company AB is formed with a new PAN then all registrations of both companies A and B should get cancelled. But if say PAN of Company B is cancelled and is merged with Company A then existing registrations of Company B should get cancelled.

For cancellation of registration, GSTR-10 should be filed (To know more about filing process of GSTR-10 please check our WFH positivity dossier of Day 7 (https://irisgst.com/wfh-positivity-dossier-day-7/). GSTR-10 can be filed only if GSTR-9 of previous financial year is filed. So if your registration is cancelled in say May 2019 then you are supposed to file GSTR-10 in the month of June 2019. But since the window to file to GSTR-9 of previous financial year 2018-19 was not open, instead of filing GSTR-10 companies filed NIL return in June 2019.

Book of the Day

Title: Everything is Figureoutable

Author: Marie Forleo

Key Learning Points from the Book:

- Fear is good: All our lives we fear from ‘fear’. In the book (which is a gem) the author talks about how to deal with fear without trying to get rid of it. Fear is good as it drives us to the right direction. Too much fear can cause problems but little fear is good. It helps us be alive and even succeed! For example: Fear of failing makes students study; Fear of penalty makes us file our returns on time!

- Train your mind for success: Like everything else, it is important that we train our mind for success and direct it towards the right things. Train your mind for growth and always look for opportunities for growth. For example: Ask helpful, productive questions to yourself like instead of saying ‘I know this already’ say ‘what can I learn from this?’.

- Don’t run after Perfection: The author says, start before you’re ready and don’t strive for perfection. Because not everything can be planned. However, it is indeed good to plan and execute but some things must be started before we feel ready for them else they never get started at all. Don’t run for perfection but look for progress.

- Increase your odds of success by 42%: A goal not written is only a wish. According to a study by Dr. Gail Matthews you are 42% more likely to achieve your goals if you write them down.

Everything is Figureoutable: This concept is emphasised at every stage, every chapter in the book. Everything is figureoutable i.e. we can figure out anything and everything provided it is against the rules of nature like death. The book gives the readers hope and faith to sail through any situations without getting bogged down. There are multiple stories in the book that prove it right. Indeed a very beautiful book.

Leave a comment