WFH Positivity Dossier

DAY 12

Hi Folks!

Today is Sunday – Day 12 of the lockdown and we are back with our positivity dossier! Since it is a complete holiday for even the work-from-home lot we decided to share an intense yoga practice for today. Also we talk about SEZ in todays’ GST updates under #21DayEverythingGST and our book of the day is one of the most loved business/self- help books – ‘who moved my cheese’ so you are in for a delight!

Dive in…

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

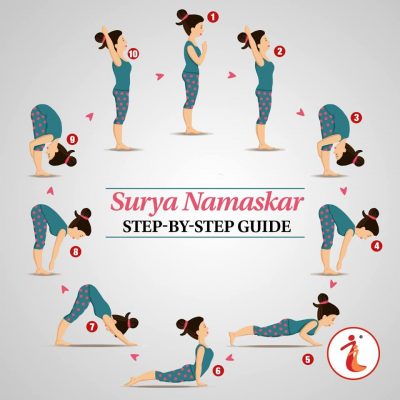

Surya Namaskars – Sun Salutations

It is advisable to do a little bit of stretching before this asana.

Follow the steps in the image below to perform Suryanamaskars correctly. Ensure you do it slowly and have breath awareness. Focus on your breath and do not compete with anyone while in your flow. If you are a beginner, just start with 2 suryanamaskars and gradually increase every day. If you are doing more than two, please warm up for 10 minutes before you start so as to adjust your body.

People with – bodily weakness, bad back, women in their monthly cycle, pregnant women, high blood pressure heart problem, arthritis, wrist injury must avoid.

Benefits: Regular practice of Utkatasna can help to:

- Tones the entire body properly.

- Improves blood circulation throughout the body.

- Good for skin and hair health.

- Improves digestion and ensures proper functioning of all the organs and body systems.

- Regular practice can help in weight management.

- Regulates monthly cycle – women

- Improves energy and awareness levels

- Improves bone health

- Detoxifies your body

GST Dossier

SEZ and GST

SEZ (Special Economic Zone) units have always played a special role in the development of the economy. So there is special treatment of purchases from and sales to SEZ units.

Sales to SEZ

Whenever we sale to SEZ unit it could be with/without payment of duty. Based on the category of the details can be reported in various returns:

GSTR-1: Whether it is with/without payment of duty it needs to be reported in Table 6(B). While calculating summary the value of this table gets added to B2B transactions reported in Table 4.

GSTR-3B: The value of both with/without payment of duty gets reported in Table 3.1(b) along with the all zero-rated supplies

GSTR-9: Here the value gets bifurcated among various tables. The value of SEZ supplies with payment of duty gets reported in Table 4D and without payment of duty gets reported in Table 5B.

“It is in times of crisis that good leaders emerge.”

By Rudolph Giuliani

In new returns GSTN has followed this approach of showing value of supplies with payment and without payment of duty separately. Supplies with payment of duty gets reported in Table 3E of ANX-1 and Table 3.A.5 of RET-1 relates to exports with payment of duty and Table 3F of ANX-1 and Table 3.A.6 of RET-1 relates to exports without payment of duty.

Please check our blog on SEZ transactions for more details (https://irisgst.com/understanding-the-supply-to-from-sez-in-gst).

Purchases to SEZ

With respect to purchases from SEZ in most of the cases there is no liability payment by SEZ. This is because SEZ unit sales with bill of entry hence it becomes an import for the non-SEZ taxpayer. So the treatment which import transactions have follows. If it is without bill of entry then it becomes a normal purchase and the taxpayer can take ITC of such tax payments.

SEZ and EWB

- SEZ supplies are treated how the other inter-state supplies are treated.

- The SEZ units or developers will have to follow the same EWB procedures as the others in the same industry follow.

- In case of supplies from SEZ to a DTA or any other place, the registered person who facilitates the movement of goods shall be responsible for the generation of e-Way bill.

- Since the movement of goods from and to SEZ is considered as inter-state supply of goods and the value of this supply is more than Rs. 50,000, EWB will have to be generated. SEZ is required to generate an EWB. The transporter may choose to generate the EWB if SEZ does not generate it.

- Further, it is important to note that, if SEZ is an unregistered dealer under GST, and Recipient who is a registered dealer will have to generate the EWB.

SEZ and E-Invoicing

Currently for supply from SEZ, E-Invoice is not required to be generated whereas Supply to SEZ is carried out in two ways:

1) Against Bond or LUT – In that case mention document type as SEWOP for e-invoicing

2) With Payment of tax – In that case mention document type as SEWP for e-invoicing.

Book of the Day

Title: Who moved my Cheese?

Author: Dr. Spencer Johnson

- Not associating our Jobs and Money with Happiness: It is easier to fall into the trap and assume they’re the same, but it is important to know that one is just the means to get to the other, and not the end destination.

- Adapt to change quick: The underlining principle of the book. The faster you accept that the cheese is gone start looking for the new one, the faster you’ll find it. The faster you accept there’s a change (or a problem) and start to act on it, the faster you’ll be able to deal with it.

- Change is inevitable: It is the nature if the Universe to change. Things are not going to remain the same the entire time. Acknowledging this very fact helps us in not getting too comfortable with how things are, and makes things easier in moving on and taking actions, when things eventually do change.

- Being dispassionate: Being attached to our ‘Cheese’ is what makes us resist change, says the author. As one of the characters say, “The more important your cheese is to you, the more you want to hold onto it.” This is so true. Being dispassionate to our work, the things that we undertake not help us to deal with the challenges efficiently and with a stable intellect, but also enables us to adapt when sudden and drastic changes are required.

- Doing same things over and over and expecting different results: Until it’s spin wheel or throwing a dice, doing the same things repeatedly don’t usually give better results. We need to be creative in our approaches, and keep finding innovative solutions, until we find the one which works best for us.

- Being Brave: Sure, dealing with change requires courage. But understanding that the current situation doesn’t serve us anymore, and that things have changed, you too should move on. Author suggests thinking about the prospects of what the new change would bring, rather than dwelling on the things lost. Get over your fear! Invoke the courage that’s deep inside you. As one of the characters asks us, “What would you do if you weren’t afraid?”

- Once you stop being afraid, you feel good: Change feels scary only when we are yet to act on it. Once we start acting, we understand that it’s not as hard as you imagined it to be. Things are worse in our brains. Things aren’t as bad as we fear.

Leave a comment