WFH Positivity Dossier

DAY 11

Here’s our positivity dossier – Day 11!

It’s a new day and here we come with our day 11 positivity dossier! This lockdown requires us to be strong mentally and physically. So, we bring you today’s yoga posture that will strengthen you inside out. Along with that, we aim to strengthen your GST knowledge too thus we share all about RCM transactions in all the phases of GST in today’s dossier. Also, we are so happy to share the book of the day – Elon Musk. The man who needs no introduction. While we work on acing our presentations, he works on colonising another planet! Yes, you are in for a treat today folks!

Dive right in!

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

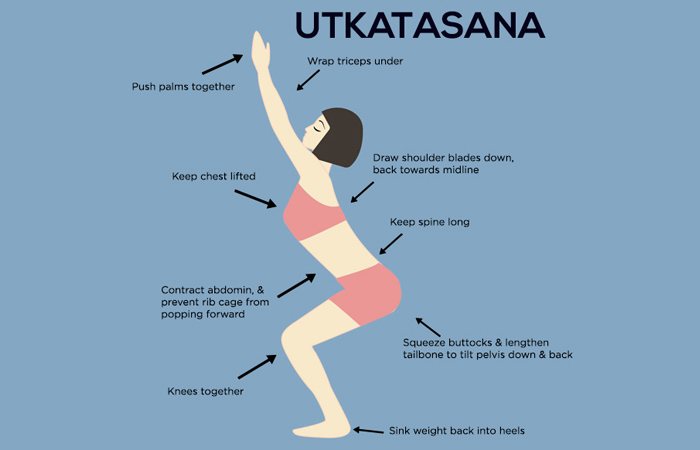

Utkatasana – The Chair Pose

It is advisable to do a little bit of stretching before this asana.

Steps to Perform Utkatasana:

Step 1: Stand straight with comfortable distance between the two legs, preferably shoulder level distance. Weight of the body is equally distributed between both the legs.

Step 2: Now, keeping your spine and neck straight bend from your knees. Hands spread out in the front or above your head as per your comfort.

Step 3: Imp Point to note: Your knees should not go ahead of your toes. Either you can fix your gaze ahead or close your eyes and focus on your breath. Maintain this posture for about 3 to 5 breaths or longer – as per your capacity.

Step 4: To come out, relax your hands and straighten up. Repeat the posture for 2-4 times as per your capacity. You can lie down to relax after this posture.

People suffering from severe knee pain or any leg issues must avoid. People with any recent surgery in the leg, abdomen, and spine must avoid. People suffering from arthritis, insomnia, headache or low blood pressure must avoid.

Benefits: Regular practise of Utkatasna can help to:

- Strengthen your back muscles, leg muscles, calves, and spine.

- Improve blood circulation throughout the body, especially in the lower body.

- Helps to tone abdominal muscles, back muscles, good for digestive organs, diaphragm, heart and leg muscles.

- Therapeutic for flat feet

GST Dossier

RCM transactions in all the phases of GST

There are certain things about reverse charge transactions which we all know like:

- RCM is applicable to specific type of services as notified by government

- In case of RCM transactions the purchaser is liable to pay tax and not the seller

- Government has suspended RCM payments for some period.

- Even where to report RCM transactions is known to everyone.

But in this article we would like to give the details of such reporting with respect to the current forms, new forms and E-Invoicing.

“A crisis often brings out the best in you and you discover qualities that you never knew existed within.”

By Rajeev Siddhartha

As per current forms:

Detail of RCM transactions is included in GSTR-1, GSTR-3B and GSTR-9.

In GSTR-1 the details of B2B sales made on RCM basis is included in Table 4(B)

In GSTR-3B RCM transactions are included twice

- Table 3.1 (d). Here we show the details of purchases made on reverse charge basis

- Table 4.3(a): Utilise the ITC on reverse charge purchases

The only difference is the value in table 3.1 (d) gets added to our liability and value in table 4.3 (a) gets added to our ITC.

The recipient has to discharge the liability on RCM Purchases through electronic cash ledger while filing his GSTR-3B

In GSTR-9 the details of RCM sales are included in 4G whereas RCM purchases are included in Table 6(C) and 6(D).

Under New Return Filing Mechanism:

Recipient has to record invoice wise details of inward supplies attracting tax on reverse charge basis in table 3H of GST ANX – 1 under new return system.

The details of inward supplies in ANX – 1 get auto populated in table 3B of GST RET – 1.

Further, the credit for these purchases made on reverse charge basis gets auto populated in table 4A, part 5 namely ‘Inward Supplies Attracting Reverse Charge’

The supplier, however, while filing GST RET -1, furnishes the sales summary of outward supplies liable to reverse charge in section D titled ‘Details of Supplies Having no Liability’ of table 3 in GST RET – 1.

If supplier is filing RET- 2 or RET – 3, RCM Sales are not required to be reported

Under E-Invoicing

Only B2B RCM transactions are covered under E-Invoicing compliance. Although liability has to be paid by the recipient, invoice has to be registered with IRP by the Supplier.

Book of the Day

Title: Elon Musk

Author: Ashlee Vance

- Failure is Good: ‘If you worked really hard, and it did not go well, you know, it’s okay.’ Elon Musk believes in Failing Fast, and making Rapid Improvement. It gives impetus to creative and innovate solutions.

- Think Big: One of the things which make Elon Musk, well, Elon Musk, is the magnanimity of his Goals. He chooses bigger problems to work on. While we work on acing our presentations, he works on colonising another planet. While we aim to get to 1 Million Followers, he aims to make Reusable rockets, a feat not achieved even by national space agencies like NASA, and which was deemed the practically impossible by scientists, until that point.

- Never say it’s impossible: One thing that’s forbidden around Elon is saying something is impossible. He believes that every problem can be worked out and every obstacle can be overcome, if one stays persistent and creative enough.

- Work more: If you work 100 hours a week and your competition works 40 hours a week, even if you do the exact same thing, you’ll achieve in 4 months what they require a year to achieve. Elon would stay up all night working on the website of his first start-up, just so that it is up during the day. He suggests working, ‘basically every waking hour’ which is not a good idea for a regular person though! But yes, work more and give your 100% for sure.

- Never give up: He says, “I don’t ever give up. I mean I would have to be dead or completely incapacitated (to do it)”. Elon Musk never gives up. If there’s one thing that can guarantee our success at something, it is this.

- Seeing opportunities: Elon, with his roommate, would transform their house into a club like setting, and throw parties on weekends, and would generate enough revenue in one night, that’ll cover their one month’s rent. Often opportunities are there around; we just need to develop an eye for them.

- Implement Faster: Everyone gets ideas. The one who implements over them, wins. Speed of Implementation is one of the things which separate the dreamers and the achievers.

Do what you love: “When you do what you love, you think about it even when you’re not working.” and that gives a person an extra edge. Also it’s easier to be persistent on something when you love it. Your love for the work will help you hold on through the difficult times.

As we come to an end with today’s dossier, we wish all our readers lot of strength and positivity. Stay tuned for tomorrow!

Nice article

Maam can you please guide me RCM liability on director salary

Thanks for appreciating.

As per Section 9(3) of CGST Act, “The company or a body corporate located in the taxable territory shall pay GST under reverse charge on receiving service from a director of a company or a body corporate”. Hence when you pay salary to a director, you will have to pay GST on RCM basis.

Maam did you mean salary is also cover in gst?

No, GST will not be deducted from Salary because as per Schedule III specified in Section 7(2) of CGST Act,

Services by an employee to the employer in the course of or in relation to his employment.

Hence, Services given by an employee to the employer will not be considered as supply of goods or services in GST . Thus, GST will not be levied or deducted from Salary.

Maam thanks for your comments

We have not paid RCM on director salary as of now

Do we have to paid RCM along with interest

Pls guide US.

Yes, it is covered u/s 9(3) of CGST Act, 2017, so RCM is applicable on service supplied by directors to a company. But if the director is working as full time director then it will be relation of employer and employee and no GST will be applicable.

Kindly note if the liability is not paid till date. same will have to be paid along with interest in current month

Maam

Our consultant say there is no requirement to pay gst on director salary. As director is a employee of the companies as per companies act.

Even I checked some other companies they also not pay any RCM on director salary.

I am totally confused.

Pls let me know are your sure bcz we have to pay RCM since July 2017.

maam our consultant says there is no requirement to pay GST RCM on director salary.

but you suggest we have to pay RCM along with interest , can you please give us any notification or something so we can show to this our consultant.

we have not paid RCM on director salary since July 2017 and it will impact huge cash outflow.

Dear Sir,

Please refer the below notification

https://www.cbic.gov.in/resources//htdocs-cbec/gst/Notification13-CGST.pdf

check serial 6

Or you can tell him to check ‘Notification 13/2017

Kindly note as mentioned in my earlier response as well

If the director is working as full time director then it will be relation of employer and employee and no GST will be applicable.