WFH Positivity Dossier

DAY 1

Hi folks!

Today is the very first day of our initiative – the #WFHPositivityDossiers and we are so excited to begin this journey with you! Today we start with a simple practise called as ‘Sukhasana’. There is a high possibility that most of us are already practising this, however, we will learn to link it with our breath. In #EverythingGSTIn21ays we cover everything about ‘Accounts and Records’ and our book of the day is ‘The Secret’. So let’s dive in…

Yoga Pose for the Day

By Meghana Pawar – Certified Yoga Trainer

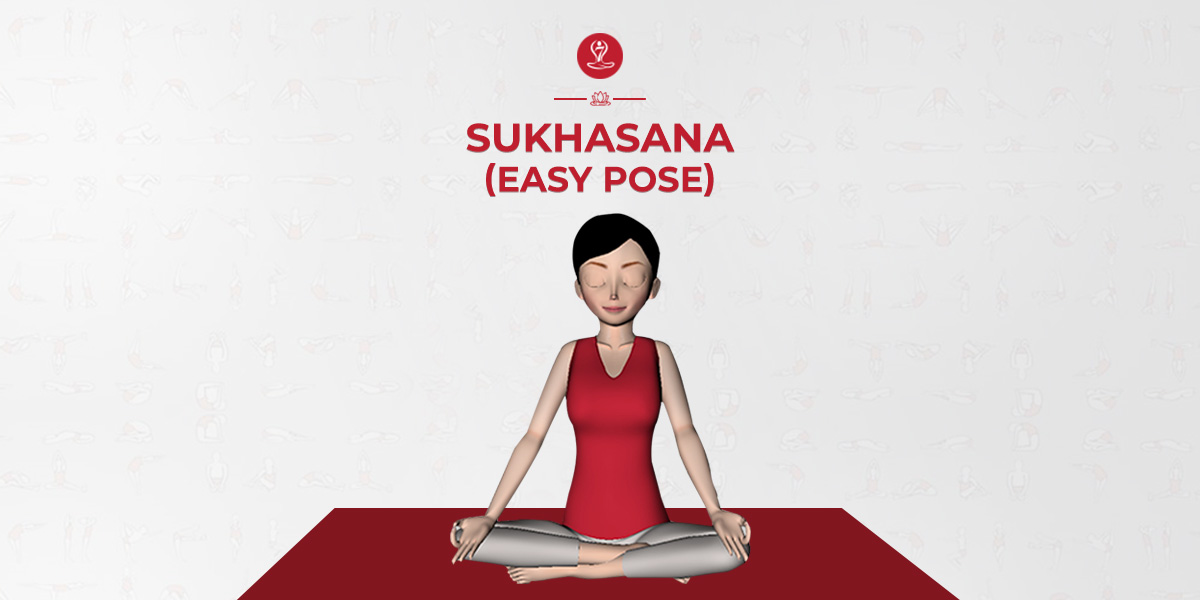

Sukhaasana – Simple Sitting Posture

Steps to perform the asana:

Sukhasana is nothing but the simple cross-leg posture. We begin with a simple practise and slowly we will increase the difficulty level as you continue with the daily practices.

- Sit comfortably on your mat with your legs spread out.

- Fold your right leg from the knee and bring it close to your pelvic area.

- Fold the left leg from the knee and bring it close to your groin/pelvic area crossing the right leg i.e. tug it inside the right thigh. Simple cross-leg posture.

- The only aspect to be taken care of is our spine and neck. It is very important to keep them erect. Also hand on your knees open to the sky. Eyes close and focus on your breath. You can start taking deep long inhalations and exhalations.

- Do this for around 10-15 breaths then you can relax.

If there are any complications or severe injuries or any recent surgery then avoid sitting in the cross leg posture. Practise deep breathing by sitting on a chair.

Benefits:

- Opens up the hips

- Flexibility to the neck and spine

- Improves posture

- The breathing helps to relax and calm the mind

- Helps to get rid of anxiety

- Good for practice of meditation and pranayama

GST Dossier

Accounts and Records:

GST has replaced many taxes. Hence the books of accounts should also be modified. Please check out blog on “Accounts and Ledgers under GST” to know the details of accounts and records to be maintained in GST regime.

Apart from maintaining records there are certain other points too which we need to consider while preparing e-invoices. From 1st October, electronic invoicing (e-invoicing) will be mandatory for businesses with a turnover of Rs 100 crore.

1) E-Invoice request JSON data has to be validated as per the e-Invoice JSON Schema given on the portal.

2) Document number should not be starting with 0, / and -. Also, document number should not have alphabets in lower cases. If so, then request is rejected

3) Supplier should ensure that the unique invoice number is being generated for the financial year for each invoice, in his ERP/manual system. For the purpose of the financial year, the date of invoice is considered. The financial year starts from 1st April and ends on 31st March.

4) The Document Date can be yesterday or today’s date

5) Recipient GSTIN should be registered and active. In case of transaction of direct export, recipient GSTIN has to be URP and state code has to be 96

6) If ‘Shipping party’ is provided, then the transaction is considered as ‘Bill To-Ship To’.

7) If ‘Dispatching party’ is provided, then the transaction is considered as ‘Bill From – Dispatch From’.

8) If Shipping and Dispatching parties are provided, then the transaction is considered as ‘Combination of Both’.

9) In case of export transactions, the ‘Ship-To’ address should be of the place/port from where the goods are being exported.

10) Sl.no of the item should not be duplicate.

11) Each item needs to have valid HSN code with at least 4 digits. That is, items of goods type should be 4 or 6 or 8 digits and items of service type should be 4 or 5 or 6 digits. HSN Code should be valid as per the GST master.

12) In case of Service invoice, then the HSN codes must belong to services.

13) Each item should have valid Unit Quantity Code (UQC) as per the master codes, in case of goods.

14) Quantity and Unit Quantity Code are mandatory for Goods and optional for Services.

15) In case of intra-state transaction, the sum of SGST and CGST tax rates should be entered as GST Rate.

16) In case of inter-state/ export transaction, the IGST tax rate and value has to be passed.

17) In case the buyer is SEZ unit, then IGST tax rate and value has to be passed irrespective of state of the buyer.

18) Maximum number of items in each invoice should not exceed more than 1000 items.

19) Additionally, companies having turnover above 500 Crores are required to include QR Code in their invoice. Content of QR Code is not notified by GSTIN it is open to taxpayer to determine the content.

Book of the Day

Title: The Secret

Author: Ronda Byrne

The Law of Attraction: What you can believe you can achieve, you can actually achieve. Our mind is a very powerful tool. You must believe in the power of your mind and believe in the universe.

Intention: To receive what we please, it is important to intend the same. We must have an intention i.e. a clear picture of what we desire in our head. We can write it down, draw a picture of it or write a song around it. You need to have complete faith that you are sure to receive it.

Attention: Now after you get 100% sure of what it is that you desire, say for example, a home, a car, your dream job or so on then you have to put attention on it. Attention is not just the dreaming phase. Many people mistake it as mere visualization and do nothing. However, after the intention, action steps must follow. Work towards your desires, do all that you can to have it while having the faith and not getting anxious.

Manifestation: This is the last phase of the process where you need to be in the receiving mode. At any point, never feel discouraged or demotivated or doubt the process. The book has multiple examples revolving around the same.

Visualisation: In all the three phases, one common thing is visualisation along with other action steps. You need to visualise yourself in that situation that you want to be in. Feel the feelings of already having it and be happy. Keep your mind happy and away from negativity.

Importance of being happy and positive thoughts: The book teaches the importance of being happy and getting out of the lack mentality. It teaches us how powerful our thoughts and feelings are. Thus having a positive state of mind do wonders for our growth and prosperity.

So this was Day 1 of our #WFHPositivityDossier! Thank you so much for reading it…stay tuned as we have lots more to come!!

Leave a comment